In a surprise move, the United Auto Workers (UAW) union expanded their strike action against Ford yesterday evening, now picketing the automaker's Kentucky Truck Plant, where Super Duty pickups as well as the Ford Expedition and the Lincoln Navigator SUVs are produced. This is a significant escalation, as Ford's Kentucky truck plant is the company's single largest and most profitable operation, generating $25 billion in annual revenue, or about a sixth of the company's global automotive revenue. That will see another 8,700 UAW members walk off the job, bringing the total amount of workers on strike at Detroit's "Big Three" to 34,000 — equivalent to roughly 22.7% of the UAW's 150,000 members.

Strikes have been ongoing for nearly a month now, beginning on September 14. In just the first two weeks of UAW work stoppages, a total of nearly $4 billion in economic losses were racked up. Declines in new vehicle output, as well as sales, are significant for the economy, as auto production is the largest American manufacturing segment and responsible for 3.0% of GDP. Ford, GM, and Chrysler (owned by Stellantis), known as Detroit's ‘Big Three", are countering work stoppages by laying off and furloughing upwards of 5,000 workers and draining inventories.

The Bureau of Economic Analysis pegged domestic auto inventories at roughly 181,000 units in August. That's up more than 120% from a series low of just under 82,000 in July of last year, but still very thin by historical standards. From August 2012 to September 2017, auto inventories never dropped below the 1-million-unit mark. Since then, stockpiles have diminished severely. As these inventories are thinned out by new vehicle demand, prices will have to rise. CBS News reports that hikes in vehicle prices could be anywhere from 10.0% to 20.0%, compounding prohibitive financing pressure already dampening auto sales. The prospect of a decline in car sales could be a much more consequential factor for economic growth than the auto strike itself. In the 50-plus years of available data from the Commerce Department, The Wall Street Journal notes that there has never been a recession in the US without a decline in new vehicle sales.

The UAW entered the dispute with $825 million in its strike fund to help workers make do without pay should they walk off the job. The Washington Post notes that full-time employees at the Big Three make an average of $18 to $32 per hour, or $720 to $1,280 per week. However, strikers are getting just $500 per week from the strike fund. Ignoring temporary benefits payments, the union may also be doling out; striker compensation payments suggest that the UAW has paid out roughly $40.8 million throughout the past four weeks (an average of just over $10.0 million). By adding a further 8,700 workers to the strike, the weekly expenditure will increase to $17.0 million. At that pace, the UAW has funds available to sustain payments to the current number of striking workers for at least 46 weeks (322 days) further. Immensely longer than the most protracted UAW strike in US history at just over 16 weeks (113 days) back in the 1940s. The glut of cash suggests that the UAW has significant capacity to scale up its action against the automakers if common ground cannot be found soon.

UAW President Shawn Fain will give bargaining updates and potentially announce further strikes on Friday morning. Though the Big Three are the UAW's primary disputants, Mack Trucks has also been pulled into the fray this week, as the Volvo-owned heavy truck manufacturer also failed to agree to new contract terms with its union workforce, sending 4,000 to the picket lines. Assuming those UAW members are also entitled to the strike fund, that would put a further $2 million weekly drain on the union's surplus, slightly contracting the potential length of their strike.

One of the key sticking points in these negotiations has been a focus on the future of America's automakers in their quest to source in-house EV components, more specifically, batteries. MRP previously highlighted the already high costs the Big Three pay for labor and their struggle to match EV brands like Tesla on the bottom line. For example, Ford estimates that its labor costs are already 25% higher than Tesla's when accounting for wages and benefits. If the UAW were to get close to what they want at the bargaining table, Wedbush Securities has estimated that the average EV vehicle would go up in price by $3,000 – $5,000 to pass rising labor costs onto the consumer.

In the midst of the strike, at least one of Ford's electrification projects has been idled: a $3.5 billion battery plant in Michigan that is slated to use technology licensed from Chinese battery maker Contemporary Amperex Technology Co. Ltd (CATL). The UAW wants these sorts of battery facilities to eventually fall under an eventual "master contract" agreement, which would make all employees in the plant subject to the union. Ford has said the construction halt on the battery facility is temporary, but it remains to be seen how negotiations with the UAW may ultimately impact its future.

GM has already given in on this front in a bid to avoid more strikes at its auto assembly plants, which will not only make its existing joint venture with LG a union facility but all of its future capacity as well. Under current plans, GM will partner with South Korea's Samsung SDI to build new factories and raise its US battery cell capacity to about 160 gigawatt hours (GWh) at full production. That is the equivalent of nearly four Tesla Gigafactories. Stellantis announced their own joint plan with Samsung SDI to invest $3.2 billion into a new EV battery plant in Indiana just yesterday. It would be Stellantis' sixth battery plant globally and its second in the United States.

GM's concession will now put pressure on its Big Three counterparts to put their own battery plants under the UAW's master contract. So far, Ford and Stellantis have not matched GM's proposal on battery plants, but it's hard to see how they escape this demand now that GM is on board and will likely see less targeting by the union's strikes than Ford or Stellantis. The aforementioned action on Ford's Kentucky plant may have been a direct result of its ongoing refusal to subject its battery plants to union labor demands.

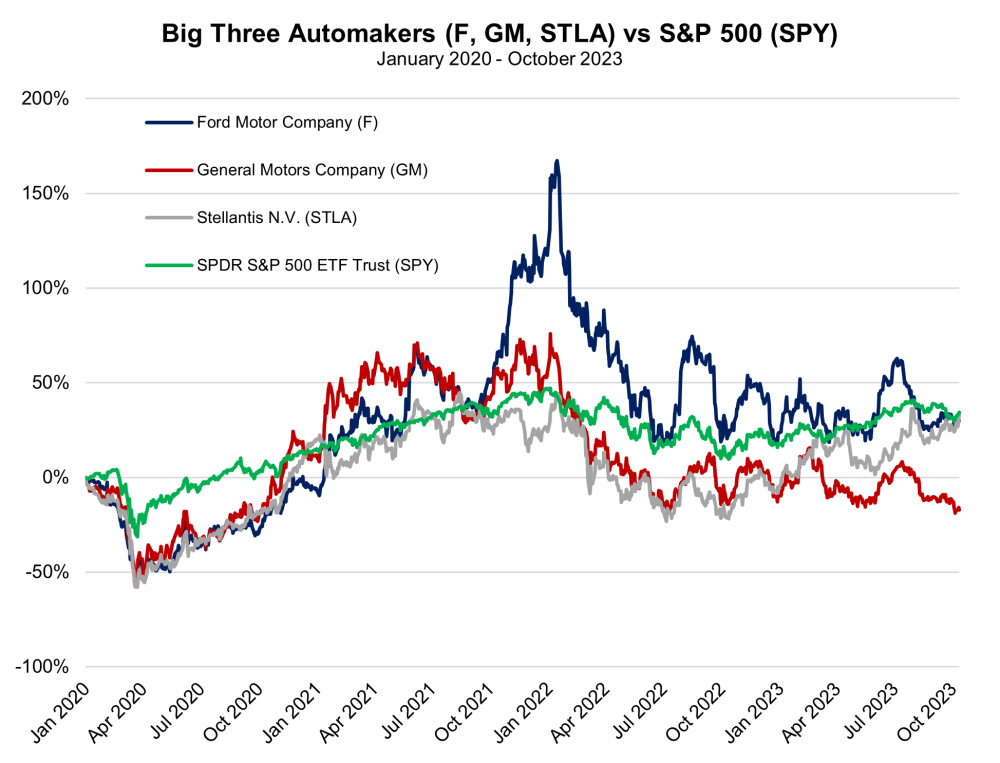

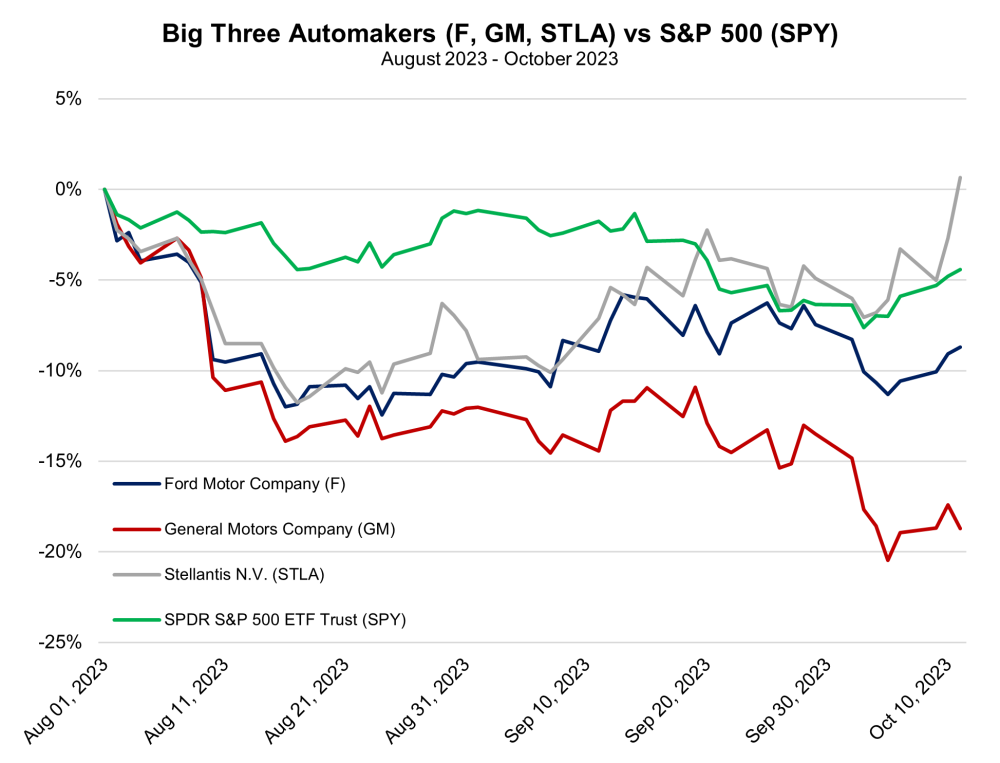

Charts

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.