Following a sudden and wide-reaching incursion into Israeli territory on Saturday, targeting civilians and military personnel, Israel's government declared war on the paramilitary organization Hamas — the first such declaration by Tel Aviv in 50 years. Hamas, which is the de facto governing authority in the Palestinian exclave known as the Gaza Strip, situated on Egypt's northeastern border and adjacent to Israel's southwestern territories, began "Operation al-Aqsa Flood" by launching as many as 5,000 missiles into Israel in the course of just 20 minutes. This mass of projectiles overwhelmed Israel's world-renowned Iron Dome air defense system, allowing about 650 to hit targets on the ground. Simultaneously, militants acting as Hamas's mobile infantry began dismantling Israeli border defenses and infiltrating Israeli Defense Forces (IDF) installations. Rocket fire out of Gaza continued into Monday.

Though Hamas has no regular military structure and lacks large amounts of traditional military equipment, they were able to launch a full land, sea, and air attack on multiple Israeli cities, as makeshift paratroopers deployed into Israeli proper and naval operations took place with the use of motorboats on Israel's western shores. As many as 22 locations reported strikes on Israelis and infantry clashes with the IDF as the conflict zone reached as far east as the city of Ofakim and as far north as Ashkelon, more than 20km and 8km from Gaza, respectively.

Visually-confirmed losses indicate several Israeli Merkava tanks were destroyed or damaged in the fighting with the use of artillery and small drone copters — a very common tactic in the ongoing Russo-Ukrainian war. Despite a wide area of attack, OSINT mapping shows only a small number of Israeli settlements may have been formally occupied by Hamas forces on Saturday and Sunday, including the Kibbitzum of Mefasim, Kisufim, Ein Hashlosha, and Mefalsim. On Monday morning, the IDF claimed it had regained "full control" of villages that were overrun by Hamas, but this has yet to be confirmed.

Thousands have been killed by Hamas's incursion, and hundreds more were abducted and moved to Gaza as hostages. The detaining of these hostages within the densely populated network of 25 municipalities complicates Israel's imminent counteroffensive against Hamas militants, hindering Tel Aviv's ability to strike the strip indiscriminately.

Though Israeli Prime Minister Benjamin Netanyahu seeks a devastating and terminal confrontation with Hamas, stating, "We will turn all the places in which Hamas is based . . . all the places Hamas is hiding in, acting from into rubble," this becomes a difficult prospect with the lives of many Israeli hostages, as well as foreign nationals also taken prisoner, now hanging in the balance.

Gaza is also home to millions of civilians, being one of the most densely populated areas on earth, but it is hard to tell how much consideration will be given to this fact, as Israeli Defense Minister Yoav Gallant has "ordered a complete siege on the Gaza Strip. There will be no electricity, no food, no fuel, everything is closed," indicating a blockade of Gaza will begin immediately. "We are fighting human animals, and we are acting accordingly," he stated. Air strikes from Saturday to Monday have killed hundreds of Palestinians in the strip. Israel's standing army is already comprised of 200,000 troops, but the country is now mobilizing a further 300,000 reservists – the largest mobilization in Israel's history.

Israel must also balance the potential provocation of Palestinian-allied Muslim nations throughout the Middle East. Israel is already entrenched in an informal conflict with Syria, launching airstrikes against the Syrian Arab Army (SAA) as recently as last week. A ground invasion of Gaza risks Israel entering a two-front war with Lebanon-based paramilitary organization Hezbollah, which has up to 100,000 fighters and is threatening action against Israel if they are to begin a ground invasion of Gaza. Hezbollah and the IDF have already begun exchanging fire on Israel's northern border in the past 24 hours. The Wall Street Journal has reported that, not only did Hezbollah help Hamas plan Operation al-Aqsa Flood, but Iran had a hand in it as well.

That could be a major flashpoint in this developing conflict. If Iran is involved, this is not a re-hashing of a longstanding Israeli-Palestinian dispute but an international incident that will likely attract the attention of the United States. U.S. Central Command announced yesterday that the Navy would move the aircraft carrier USS Gerald R. Ford, along with other ships in its Carrier Strike Group, to the Eastern Mediterranean. Those ships will support U.S. fighter jets, including F-35s and F-15s, that will patrol the region in a peacekeeping capacity. The U.S. is closely allied with Israel, an international rival of Iran, which is subject to heavy sanctions from America and its allies. Iran's Islamic Revolutionary Guard Corps (IRGC) has conducted operations in countries surrounding Israel many times over the last decade, and while U.S. Secretary of State Antony Blinken has thus far denied evidence of Iranian involvement in Hamas's recent attack on Israel, Tehran is a known international sponsor of Hezbollah and other militant groups like the Houthi rebels in Yemen.

Iran maintains that they had nothing to do with Operation al-Aqsa Flood. The country occupies a critical geographic and economic chokepoint on the Strait of Hormuz, a shipping route for 20% - 30% of global oil supplies. Already elevated crude futures spiked at the week's open, with international benchmark Brent jumping back above $87.50 on Monday morning. Though it has been confrontational in the past, Tehran has shifted its diplomatic strategy in recent months, shoring up relations with other Muslim nations in the Middle East. Key among those improving relationships has been Saudi Arabia, which put an end to a seven-year diplomatic freeze and proxy conflict with Iran, brokered by China in March. As part of the newly formed agreement with Riyadh, Iran agreed to halt their covert weapons shipments to the Houthis.

Saudi Arabia also sought to normalize relations with Israel recently and was closing in on a deal to formally recognize the country for the first time. If Saudi Arabia agreed to recognize Israel, it could lead other Arab states to do so. Those prospects were likely torpedoed (at least temporarily) by Hamas's attack, as Saudi Arabia appeared to blame Israel's government for Hamas's violence, with the Kingdom recalling its "repeated warnings of the dangers of the explosion of the situation as a result of the continued occupation, and deprivation of the Palestinian people of their legitimate rights, and the repetition of systematic provocations against its sanctities." It's likely that the timing of Operation al-Aqsa Flood was predicated on cutting any formation of an Israeli-Saudi normalization, as Hamas partially relies on an anti-Israel Islamic front abroad to bolster its legitimacy.

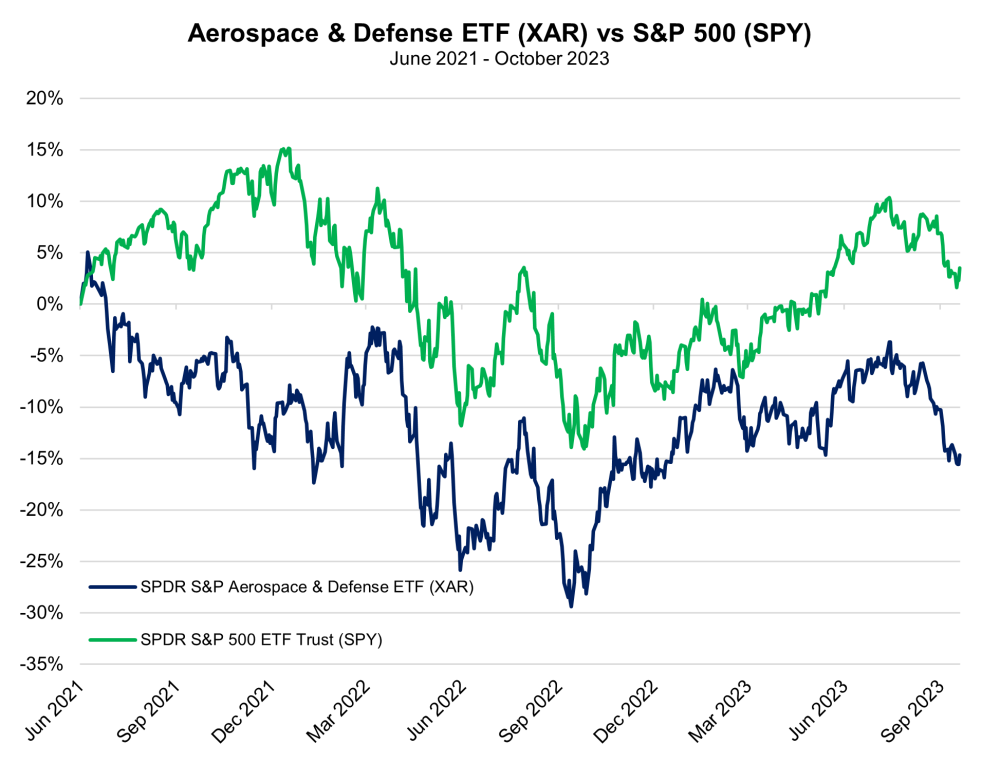

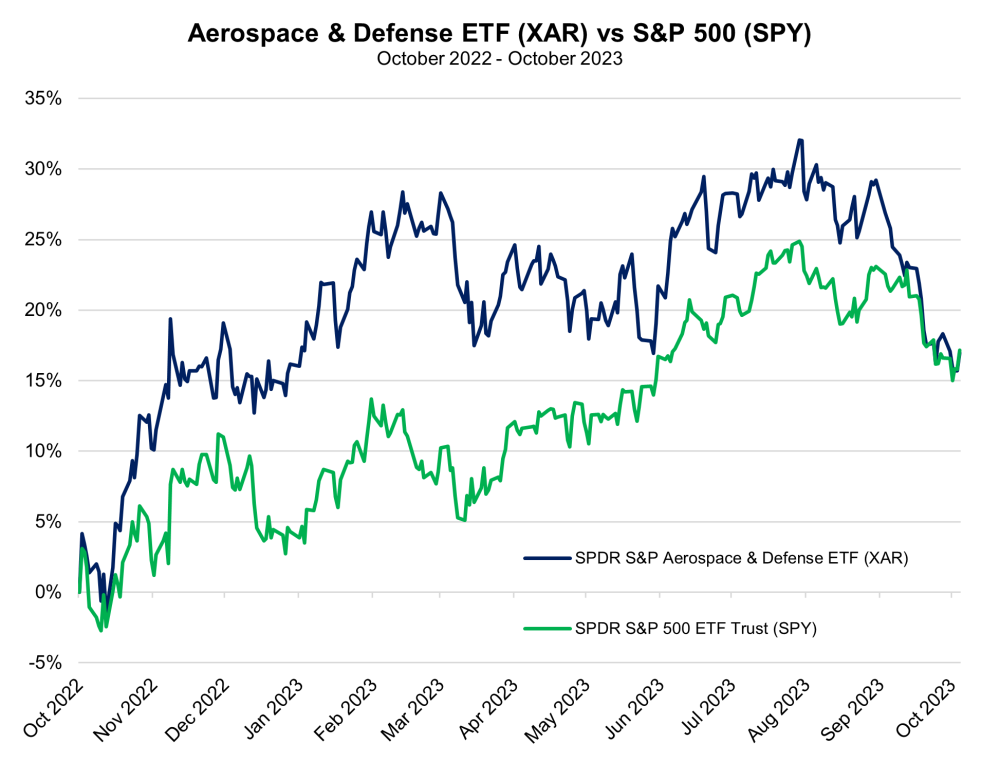

Charts

Originally released in McAlinden Research Partners' newsletter on October 9, 2023

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.