Most of the introductory part of the parallel Gold Market update applies equally to silver, so it will not be repeated here, and we will move straight to looking at the charts.

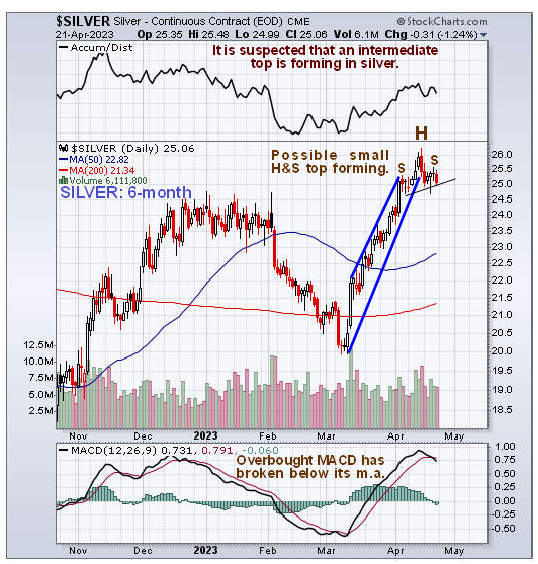

Recent action in silver looks very similar to that of GDX, which we looked at last week. On the 6-month chart, we can see that both have broken down from rather steep uptrends in force from early March by virtue of moving sideways, and silver looks like it is completing a small Head-and-Shoulders top that will lead to a period of retreat, which would be exacerbated by a drop in the broad stockmarket and temporary dollar rally, as discussed in the Gold Market update.

Two further points on this chart worth mentioning are that the MACD indicator has broken below its moving average, which increases the risk of a drop, and the overall trend at this point is gently higher, as shown by the positive alignment of the moving averages.

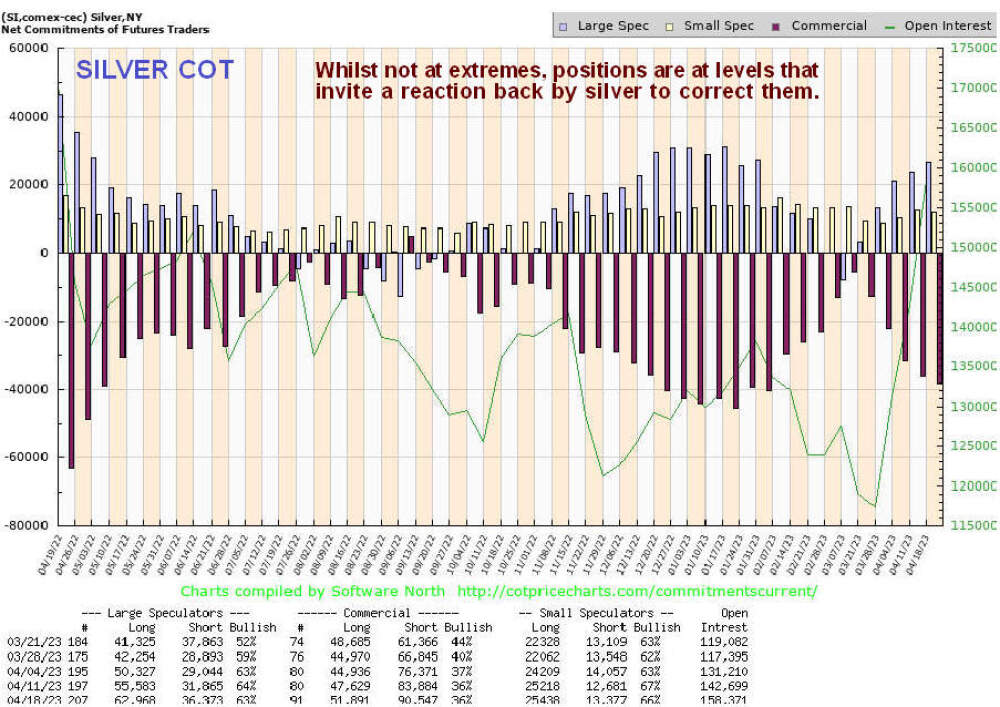

Silver's latest COT chart shows that, while there is room for further gains, it looks more likely to react than to advance over the short to medium-term.

Moving on to the 5-year chart, we see that, following the steep rally out of the Covid crash low of Spring 2020, silver has basically been stuck in a giant trading range ever since, hardly an impressive performance, especially when you factor in inflation during this period, and it is worth repeating here this paragraph from the Gold Market update.

Taking all this into consideration, especially the recent ramping up of inflation, it may seem strange that gold and silver's paper price has still not risen above their highs of mid-2020, almost three years later. Here we should factor in that the paper price of gold and especially silver is rigged — you go try and buy a quantity of physical gold and silver at the paper price and see how far you get.

Apparently, J.P. Morgan controls more than 50% of the paper silver market, and demand for physical silver is now at record levels, although you wouldn't think so looking at the paper price, and demand is set to continue to grow rapidly. If there was true price discovery in these markets, the prices would be much higher, and there wouldn't be shortages; it's that simple.

What this means is that we are effectively seeing "price fixing" of the sort you see in communist-style command economies, which creates shortages and a black market. Unless they stop rigging these markets, we can expect to see a thriving black market start to flourish in gold and silver as demand pressures build, regulation or not, that will eventually render those attempting to rig their price as impotent and sidelined.

Although a temporary dollar rally is looking increasingly likely, the longer-term outlook for the dollar is grim. Thus, even though a short-term retreat by silver looks likely, longer-term, it is expected to soar.

This being we will be looking to buy any significant near-term reaction, and a breakout above the resistance at the upper boundary of the big trading range shown on our 5-year chart will be viewed as a major buy signal.

Originally published on clivemaund.com on April 24, 2023.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures:

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.