We are now entering a long period of hyperinflationary depression which will mark the ignominious end of the latest and most catastrophic fiat experiment in the history of the world.

The seeds of the impending catastrophe were sown with the creation of the Federal Reserve in 1913, a private bank whose power grew and grew over the years until it became the effective government of the U.S. and, some would say, by extension, the world.

Its power was magnified further when in 1971, it eliminated the necessity to have any gold backing for the dollar and with the establishment of the petrodollar. The global dollar Ponzi scheme expanded exponentially to arrive at the point we are at now, where the dollar is intrinsically worthless; it's just that most of the world hasn't figured that out yet.

The Dollar Losing Value, Gold Steps In

By the end of 2019, a year characterized by mounting discontent and demonstrations around the world, it was apparent that this Ponzi scheme had almost hit the buffers with the appearance of the repo crisis in the Fall of that year. Something drastic had to be done to provide the excuse to create trillions more dollars so that they could be kicked a few more years down the road. Enter Covid, which made it politically possible to indulge in "emergency funding" on a grand scale.

It's important also to understand that, in addition to the enormous inflationary pressures resulting from profligate money creation, there are powerful deflationary forces at work at the same time — hardly surprising considering that the world economy is collapsing with sagging consumer demand as a result of inflation and rising rates and massive supply chain disruptions and sabotage of vital infrastructure and the food supply, etc.

It is imperative that investors and citizens generally striving to conserve the purchasing power of whatever wealth they have moved their capital to something that will maintain its value, and with respect to this there is no better store of value than gold and silver.

However, these deflationary pressures are being masked by the massive money creation, not just by the Fed but by Central Banks all over the world. This is why, in its quest to achieve zero purchasing power, the dollar has some serious competition from other currencies vying for the coveted prize of the currency that can get to being worthless first.

So although the dollar is heading in the direction of worthlessness, the dollar index, which is a measure of the dollar relative to other currencies, can actually rise, and a supporting factor for the dollar that we should keep in mind is the need for other countries around the world that are grappling with mountains of dollar-denominated debt, often courtesy of the IMF, to pay back or at least service these debts.

In the face of this accelerating race to the bottom by most global fiat that will end up worthless, it is imperative that investors and citizens generally striving to conserve the purchasing power of whatever wealth they have moved their capital to something that will maintain its value, and with respect to this there is no better store of value than gold and silver.

Silver

Gold always retains its intrinsic value, no matter what, so in a sense, its price in fiat is irrelevant — it only matters to the extent that if you time your purchases well, you can swap more fiat garbage money into it. Silver's advantage, meanwhile, is that in a situation where paper money is worthless or close to worthless, you can use it for relatively modest transactions. If you try to use gold, you might be shot or clubbed and have the gold stolen, especially in the Mad Max world that is now emerging; that's less likely with a silver coin.

Taking all this into consideration, especially the recent ramping up of inflation, it may seem strange that gold and silver's paper price has still not risen above their highs of mid-2020, almost three years later. Here we should factor in that the paper price of gold and especially silver is rigged — you go try and buy a quantity of physical gold and silver at the paper price and see how far you get.

Unless they stop rigging these markets, we can expect to see a thriving black market start to flourish in gold and silver as demand pressures build, regulation or not, that will eventually render those attempting to rig their price as impotent and sidelined.

Apparently, J.P. Morgan controls more than 50% of the paper silver market, and demand for physical silver is now at record levels although you wouldn't think so looking at the paper price and demand is set to continue to grow rapidly. If there was true price discovery in these markets, the prices would be much higher, and there wouldn't be shortages; it's that simple. What this means is that we are effectively seeing "price fixing" of the sort you see in communist-style command economies, which creates shortages and a black market.

Unless they stop rigging these markets, we can expect to see a thriving black market start to flourish in gold and silver as demand pressures build, regulation or not, that will eventually render those attempting to rig their price as impotent and sidelined.

Now we will proceed to "play the paper game" like most others and see if we can figure out what is likely to happen to gold priced in dollars over the medium and long term especially. As far as gold itself is concerned, we aren't minded to sell, except on a trading basis, as the emphasis is more on adding to positions on dips. The paper price fluctuations of gold and silver, of course, become much more important when it comes to timing decisions with respect to trading gold and silver stocks if we can reduce positions at peaks and add to positions on dips, we can greatly improve our performance.

Gold

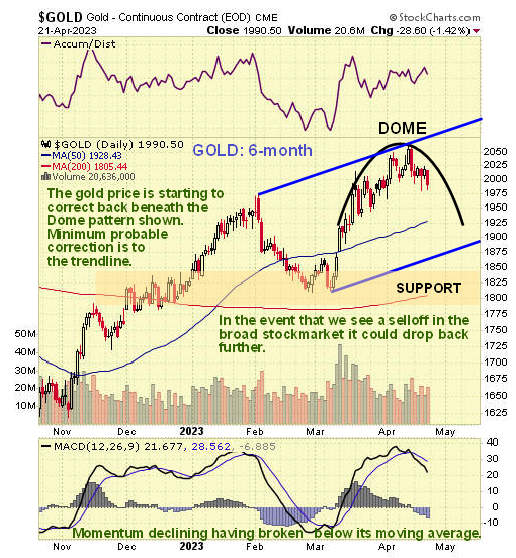

On the 6-month gold chart, we can see that, following a wave up during March and into April that resulted in a substantially overbought condition on its MACD, gold has rolled over beneath a Dome pattern and is starting to correct back.

There are various targets for this correction depending on what the broad stock market does, but at the least, it looks likely to drop back to the lower boundary of the prospective channel shown, whose boundaries are at this point not definite, and it could fall further to the support level beneath.

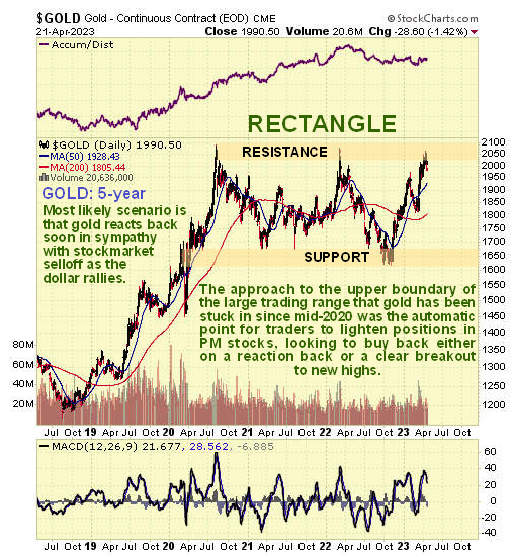

On gold's 5-year chart, we see at once why it would correct back from this level since it had arrived at resistance at the top of the large Rectangular trading range that formed from mid-2020 to the present.

Gold's performance from mid-2020 is unimpressive since taking inflation into account, which is now robust, it is, of course, down. Tactics here are to reduce holdings with the aim of building them back on a significant correction, or hedge them, which we have already done, or alternatively, to add to positions on a clear breakout above the resistance, should that happen, which at this point doesn't look likely.

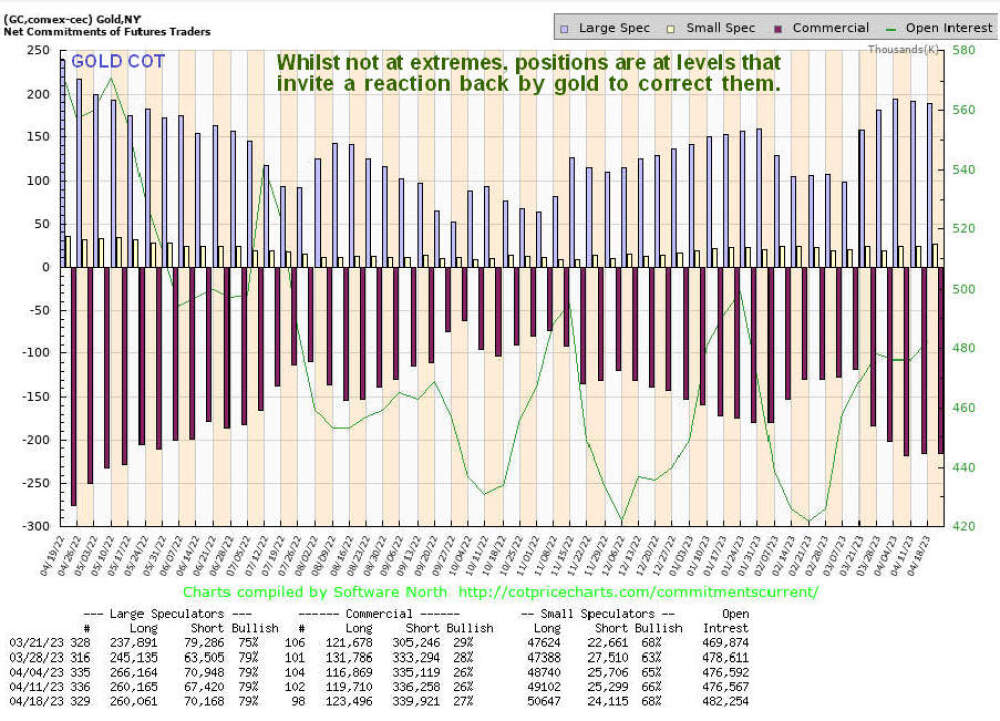

Gold's latest COT chart shows that, while there is room for further gains, it looks more likely to react than to advance over the short to medium-term.

On the 5-year chart for GDX we can see that, unlike gold, it hasn't gotten up to the resistance at its 2020 and 2022 highs, showing a lack of conviction and skepticism that is actually bullish, although that said, if gold drops away here, as it looks like it's going to, it will take the stocks down with it.

Now we come to a useful chart that plots the performance of precious metals stocks relative to the S&P500 index. It shows us that PM stocks have outperformed the broad market on the recent rally from early March, but more importantly, this chart reveals that PM stocks have been slavishly moving with the broad market for much of this year.

The conclusion from this is that if the broad market takes a hit soon — and we are talking about a drop, not a crash — it will take the PM sector down with it. So the next question is, "How does the broad stock market look?"

The Broad Stock Market

On the 1-year chart for the S&P500 index, we can see that its broad trend is sideways at this point, and it is suspected that the rally from the October lows through early February may have been nothing more than a bear market rally, although what happens next probably depends on how much new money the Fed is prepared to create and its stance on rates.

A retreat from here does look likely because the market is close to resistance at the February highs and somewhat overbought on its MACD, and if it does retreat, going on past behavior, it looks likely that the PM sector will drop with it.

The U.S. Dollar Index

Lastly, it is important that we look at the U.S. dollar index, especially as it is right now at a critical juncture. On the 2-year chart, we see that, following a strong bullmarket phase during the last half of 2021, which lasted well into 2022, it has reacted back quite hard, which at this stage may be nothing more than a heavy correction.

Over the past month or two there has been no shortage of people reading the dollar its last rites on account of BRICS members declaring their intention to move away from using the dollar, with a bombshell development being Saudi Arabia accepting Yuan payments for oil, and all this doubtless accounts for a large part of recent dollar weakness, but the international dollar market is vast, and it is not going to fall into disuse overnight, it will take time, kind of like a slow-motion train wreck.

What could happen here as a result of painfully high-interest rates (by recent standards) is that dollar debtors scramble to buy dollars to pay back / pay down debt, thus triggering a dollar rally feedback loop, and we can see on our chart that the dollar index looks like it might be at the second low of a Double Bottom and if it is, a big rally could be in the offing that would clobber commodity prices, gold, and silver included.

So clearly, what the dollar does next is of key importance.

Originally published on clivemaund.com on April 23, 2023.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures:

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.