As most Western governments are on the path of the energy transition, technology that saves or reduces energy consumption is just as important. I don't agree with how governments here in North America are proceeding with the transition as they are putting that first ahead of energy security. I am afraid their policies will cause an energy shortage, but in that case, companies that can help save energy will be even more attractive.

After adjusting for inflation, costs for major U.S. utilities to produce electricity rose 6% in 2021 as a result of rising fuel costs. For a number of years, electricity production costs had declined as natural gas prices fell and new low-cost renewable generators came online.

The cost to deliver electricity across transmission and distribution lines increased by 12% in 2020 and remained steady in 2021. The latest data I found, according to choseenergy.com, electricity prices were up 11.2% in the U.S. from November 2021 to November 2022.

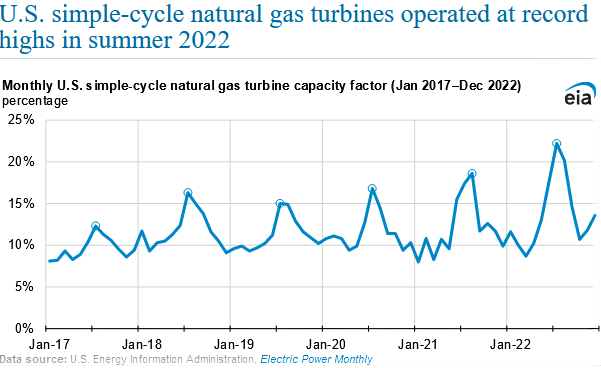

Many people do not realize that electricity demand is around twice as high during the day (work hours) compared to at night, so natural gas power plants are used as the swing producer because they are the easiest to turn on and off.

The summer demand has been increasing. The average monthly capacity factor for simple-cycle, natural gas turbine (SCGT) power plants in the United States has grown annually since 2020. Average capacity factors surpassed 20% for two consecutive summer months in 2022 — the first time on record — to meet peak electricity demand, based on data from our Electric Power Monthly.

With rising electricity demand for going green and charging EVs, along with higher electricity prices, companies that have the technology to save electricity will be in big demand.

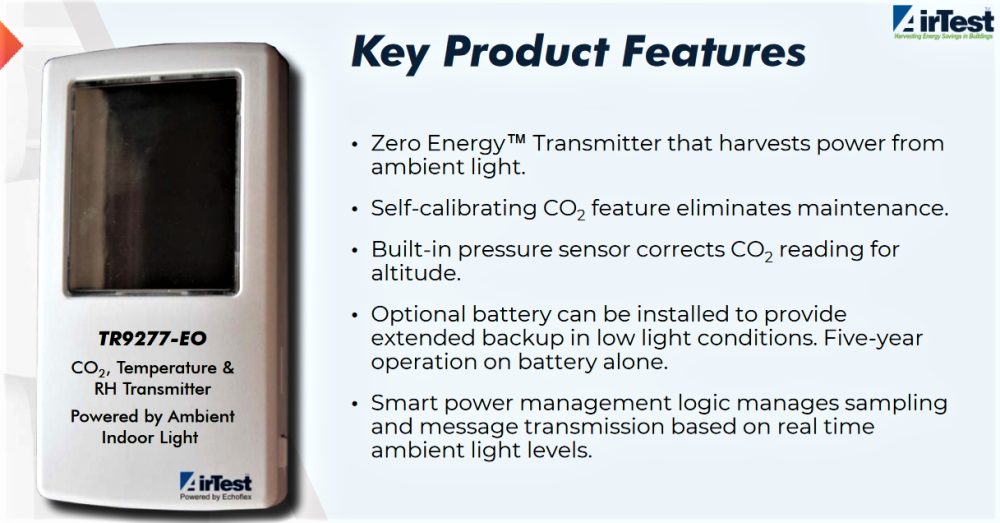

I have mentioned many times about junior tech companies that have the best technology are great but you need great salespeople too or some kind of sales advantage or angle. For example, my last tech pick, Clip Money already have the customer base from their last endeavor into ATMs. I believe Airtest has great technology to save on electricity costs, but they were lacking on the sales side until now.

Airtest

Lorne Stewart took over control as President of ATI AirTest Technologies Inc. (AAT:TSX.V; AATGF:OTC) at the start of the year. He has been employed for the last four years as a sales representative and more recently sales manager for Camfil Canada.

Camfill is a 60-year-old air filtration company so a very similar industry to Airtest being basically air quality and measurement. He has continually exceeded sales targets, growing his sales territory by 400% during the last four years. This has given him an opportunity to understand the industry and the potential that exists for Airtest. I believe that this addition to the Airtest team is a significant step toward strategic growth.

Mr. Stewart commented: "Airtest has generated business over the last 20 years with over 1,600 customers. This existing base of customers represents a database that can be introduced to the company's latest offerings with tremendous potential. In addition to this existing database of clients, a large number of prospective customers are also reaching out to the company driven by our quality, value proposition, and industry expertise. I'm looking forward to leading Airtest to significant sales growth and profitability."

Proven Technology with big savings:

-

Airtest CO2 transmitters installed in 600 Lowes stores. Installation was 100% funded by rebates from energy and payback was less than two years:

-

1,140 Shoppers Drug Mart stores retrofitted resulted in an 18% total energy reduction with a payback of fewer than two years:

-

Installed 65 Canadian Tire stores in Ontario Canada. Delivered over CA$240,000 in natural gas savings alone and payback less than two years:

-

Installed 12 new IKEA stores with a greater than 50% reduction in ventilation costs and payback of less than two years.

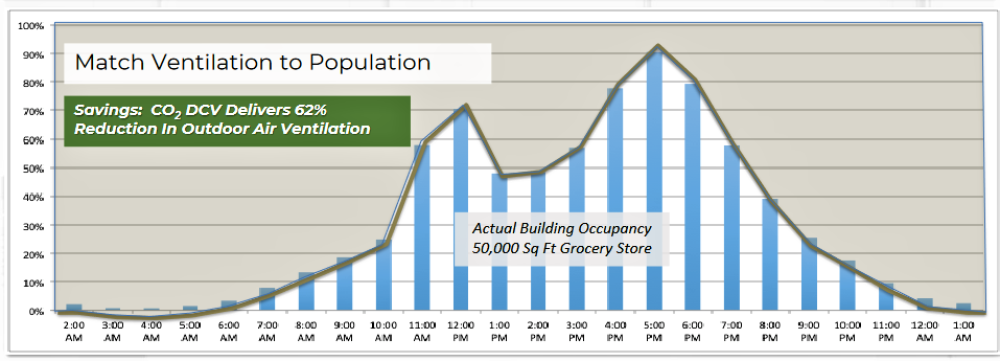

Basically, by measuring CO2 levels, ventilation can be provided as needed.

You don't need much ventilation at night if a store is empty and closed. This saves on the amount of air you have to heat or cool. This data from a grocery store shows a good graphic picture.

Building codes require fresh air ventilation in all public buildings based on maximum possible occupancy. There has not been much in the way of controlling these units, they just run at maximum. Previously it has been too expensive to hard wire in CO2 sensors, but Airtest breaks this cost barrier with wireless sensors.

The market is huge with around 20 million Roof Top Units for heating and cooling with about 80% of them not measuring CO2. Companies need to reduce operating costs and carbon emissions. Airtest's next target market is grocery stores and retail store chains.

In the first three quarters of 2022, sales were just over US$1.8 million and you can see from above, the potential is in the billions. It should not be too difficult to get into the tens of millions run rate.

On March 1st Airtest announced that their IAQEye demand control ventilation (DCV) solution has been approved by Save On Energy for a 50% subsidy.

The DCV solution is intended to be installed at numerous shopping malls in Ontario. This will bring the cost break-even point down to about one year. Airtest has also submitted its technology to Alternative Energy Systems Consulting (AESC) to evaluate with the goal to garner incentives or rebates in California.

It seems the stars just recently aligned for Airtest.

-

Rising electricity demand in the push to green and electrification:

-

Rising electricity prices with that strong demand:

-

ESG means companies need to reduce costs and carbon emissions:

-

Airtest beginning to qualify for 50% subsidies:

-

New leadership with stronger sales background:

-

And for investors, a low entry-level stock price.

This is just a small company with 223 million shares out and CA$0.03 has a valuation of just CA$6.7 million. It is a stock you can throw a few 1000 at.

On the chart, it looks like a bottom is in and is breaking out above the downtrend channel. A close above the 200-day MA would be confirmation. I see resistance levels around CA$0.06 and CA$0.12.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Struthers Stock Report Disclaimers:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate.

The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information.

Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Disclosures:

Charts and images provided by the author.

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: ATI AirTest Technologies Inc. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None.

I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: ATI AirTest Technologies Inc. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ATI AirTest Technologies Inc., a company mentioned in this article.