During the post-WWII period and, more specifically, the 1950s, there was a movement that emanated from Europe called "théâtre de l'absurde" where plays would focus largely on ideas of existentialism and express what happens "when human existence lacks meaning or purpose and communication breaks down," which is essentially what is happening in Congress this week.

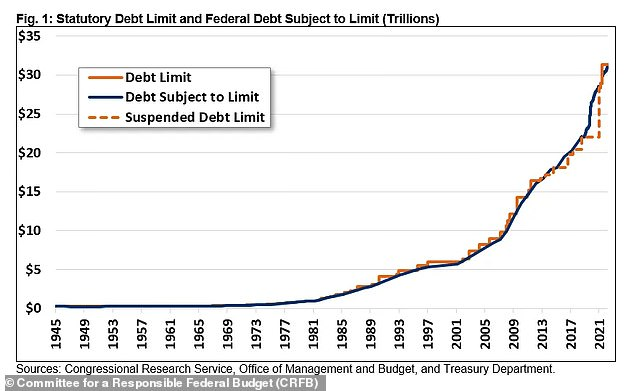

With the month of January being a slow news month, the MSM is conjuring up story after story designed to grab public attention while stirring a pot of totally unfounded fears that, in some infinitesimal manner, the American government apparatus was soon to be shut down due to the insolvency that occurs when they exceed "the debt limit."

Debt Limit Debate

In my career as a follower of markets and lover of all things "non-paper," I cannot recall how many times I have had to listen to politicians and MSM commentators drum up all sorts of angst and anger over "profligate government spending" or "bureaucratic largesse" soon to find their vanquishers mired in "fiscal responsibility" and "administrative accountability."

In the end, the noise reverberating out of the halls of the legislatures in Washington (and Ottawa) and around the planet for that matter (Think Tokyo) is just that — NOISE.

The new term for it these days is "gaslighting," which is a form of psychological manipulation that seeks to sow seeds of doubt in a targeted individual or group. Call it noise or call it gaslighting; it has been going on for years, but ever since those that were in charge of delivering "the news" decided to refrain from delivering facts and instead insert opinions, the term "fake news" has been escalating in frequency and topicality at a frightening pace.

That is because debt ceilings always get raised, and checks always get written because the civil service can never go without.

To the members of the media that would serve to spotlight political ascenders hell-bent upon frightening us with premonitions of empty buildings in Washington and Ottawa due to funding deficiencies, I would ask that they instead encourage the viewers to recall past debt ceiling debates making strong note of their outcomes which are never, EVER, bad. That is because debt ceilings always get raised, and checks always get written because the civil service can never go without.

So please spare me the drama and save the ink and electricity required to manufacture paragraph after paragraph, sound bite after sound bite of moral indignation and outrage because the national debt is approaching levels where solvency trumps liquidity. We all know that sovereign debt levels are approaching the critical stage with no better place to observe its outcome than in Tokyo, where the Bank of Japan is spending tens of billions of dollars per day to defend the yield curve. What I am watching in Japan is at the heart and soul of the "théâtre de l'absurde" as BoJ officials unabashedly print billions upon billions of dollars to stave off the deflation monster that actually arrived some forty years ago.

You see, the difference between the United States Fed and Japan’s central bank is that a number of years ago, in testimony before Congress, Ben Bernanke told the world that they never "print money" and sat straight-faced as Representatives in the House nodded their heads and winked at each other, carefully ensuring that no hot mics or probing cameras could reveal the ruse.

Contrast that with Japan, where when asked how they have been able to keep their bond and stock markets together while defending the Yen, they jump out of their chairs, megaphones in hand, and scream, "WE PRINT MONEY!" and then laugh hysterically as the cameras whirred away, and the audience applauds.

What has been happening to Japanese capital markets since 2001 is truly a theater of the most absurd as their central bank has proceeded to inhale literally every government and corporate bond in existence while owning massive amounts of REITs, ETFs, and stocks. The figure used in the Japanese sovereign bond arena is 55% as in that is the percentage of Japanese government bonds currently owned by the BoJ and, I should add, bought with printed yen conjured up at the whim and wish of an out-of-control central bank.

To put this in perspective, when the Bank of England was forced to bail out its pension funds with purchases of British 10-year gilts, they spent an estimated USD $5 billion. By contrast, the Bank of Japan spends that amount morning and afternoon every day in order to suppress yield curve interest rates and cap domestic borrowing costs. The outcome of such absurdity has been seen before in different locales and at different times with names like Weimar Republic circa 1922 and Venezuela circa 2000. Zimbabwe and Argentina in the prior century come to mind, but one phenomenon that always occurs when all respect for money is thrown into the dung heap of monetary policy is that the currency collapses and domestic equities explode higher.

In Japan’s case, they are the eighth largest holder of gold bullion with an estimated 846 metric tonnes held by the BoJ, so perhaps the need to reprice gold is heightened.

The contrast between the way the Japanese media and the American media cover debt ceiling debates is not only stark but also revealing. It is revealing in the sense that the situation in Japan is not a great deal different than the rest of the world; it is just that Japan started the process of quantitative easing decades before the U.S. did, and therefore developments in Tokyo are a crystal ball snapshot into what is in store for the rest of the West.

The external debt for Japan is fifth largest behind (astonishingly) Germany, France, the U.K., and the largest deadbeat of them all, the United States while per capita debt shows Switzerland as carrying more debt per citizen than any other nation on the planet. I find it hard to believe that those same ultra-conservative investors I used to meet in Geneva and Zurich pitching Canadian resource deals back in the 1990s have stood by and idly watched their children loading up the Swiss national pension funds with Tesla and crypto and earnings-less technology zombies in place of bills and bonds.

Very soon, I think Japan is going to hit an iceberg, and it will arrive in the form of a currency crisis or a bond default.

In fact, rather than singling out Japan for its irresponsible largesse, the Swiss National Bank recently reported a US$143 billion loss for fiscal 2022 citing drawdowns in their bond and stock portfolios. The reason these typically-conservative bankers are being drawn into highly-speculative transactions lies directly in the laps of the central banks led by the U.S. Fed and perfected by the Bank of Japan, whereby they suppress interest rates on sovereign debt instruments to the point where yields can no longer satisfy the income requirements of pension funds and insurance portfolios forcing the managers down the "risk curve" in search of higher yields.

With higher yields always comes higher risk, so it is no surprise that these massive losses are not relegated to just the gnomes of Zurich. The bodies floating to the surface are going to be wrapped in flags of all major G20 nations because, as I have written for decades, they all feed at the same trough. We have seen stress in the U.K. last September with their pension funds, the Swiss, and very soon, I think Japan is going to hit an iceberg, and it will arrive in the form of a currency crisis or a bond default.

There is a large degree of irony in the translated meaning behind the flag of Japan, which mean "impact zone." While it is difficult to gauge the impact of Japanese monetary policy on the rest of the global economy, it is a veritable certainty that "things" are not going to be calm in the Land of the Rising Sun" as 2023 unfolds. However, every time you read a Japanese headline citing problems, you might elect to refrain from excessive finger-wagging and instead remember that the U.S. Fed and the Bank of Canada are going to be up against the very same wall in due course.

There is a myriad of possible outcomes for the capital markets when the day of debt reckoning arrives, but there is only one that I can take to the bank, and that is that gold and silver, free of counterparty shackles, will protect wealth. If you are a Japanese resident, the best protection from a currency crisis is to have one’s savings in non-yen denominations. I find it somewhat laughable when financial forecasters are quoted as predicting that "Gold and silver will soar!" when in reality, what will happen is that the currency one used to buy the precious metals "will crash!"

Gold

This is the primary reason that the U.S. treasury, central bank, and National Security Agency are so vehemently anti-gold. When the Bretton Woods Accord was signed in 1948, the unwritten rule was that Americans would patrol the sea lanes to keep global trade flowing freely (especially the oil tankers from the Gulf States) in return for adherence to the petrodollar.

Since most of the world’s nations were oil importers, they had to have U.S. dollars to pay for it, and since dollar strength had to be maintained vis-à-vis oil, any set of circumstances threatening dollar strength had to be checkmate, and that included gold (and to a lesser degree silver). Strong gold prices have always been the antithesis of dollar hegemony, so any time gold caught a bid, the "invisible hand" would appear out of nowhere and bludgeon prices back downward.

As I predicted last week, the "Golden Cross" was completed, and once minor resistance at US$1,950-1,960 is overcome, I see some real fireworks developing.

By suppressing gold, they buttressed the U.S. dollar, and by doing so, they securitized the military. Now, with OPEC members agreeing to accept currencies other than dollars for oil, that cozy little arrangement has been supplanted by a laisser-faire, every-man-for-himself free-for-all where it has become "Let the best currency win!". Patriot Battery Metals Inc. (PMET:CA)

I think that this is why gold is now achieving escape velocity above US$1,900/ounce despite declining real interest rates and hostile monetary policies the world over.

Gold is anticipating stress to the financial system, and it is no longer a matter of navigating around the bullion banks or monetary policy hostility.

It is more about the fiscal messes popping up around the globe, with the main event in Washington, D.C., and debt serviceability.

Gold closes out the week in a clearly-defined breakout of that massive congestion zone between US$1,825 and US$1,875 and appears to be on a clear path to the magic US$2,000/ounce level. As I predicted last week, the "Golden Cross" was completed, and once minor resistance at US$1,950-1,960 is overcome, I see some real fireworks developing. Once again, I would like to see silver lead the way above US$26.50 and have the miners led by the GDX/GDXJ "dynamic duo" kicking into gear as well.

Lithium

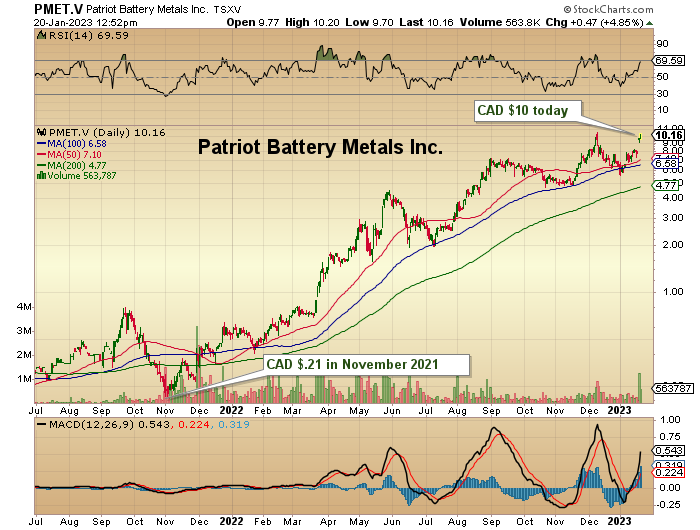

I have been of the opinion that I had largely missed the move in lithium, having remained focused on copper as my choice for the electrification movement since 2020. Here is the chart of lithium resource owner Patriot Battery Metals Inc. (PMET:CA), whose James Bay Lowlands project has enriched more than a few investors since November 2020, when the stock traded as low a CA$0.21.

I have never owned this company, nor have I ever written about it, and as much as this appears as "full disclosure," it is also an admission of inadequacy in that I could not find the mental space to try to understand "brines" and "cycles" and a plethora of other technical terms. NX)

In the past, I have avoided the lithium market largely because it is difficult to follow the trend of the lithium price as it is usually held captive by the end users in much the same fashion as the molybdenum or vanadium markets.

As a trader/investor, my focus is on the opportunity lithium represents and whether or not I am coming into this space far too late in the cycle.

As such, Chile and Australia are the two biggest producers of lithium, with Argentina holding a sizeable resource tonnage as well.

What has captured the imagination of the younger generations are the "green-friendly" qualities of the lithium stocks, and as such, they are absolutely piling into this alkali metal as if it were the solution to all carbon footprint ailments.

While there is no question of the demand side looking out to a world in full electrification mode, as a trader/investor, my focus is on the opportunity lithium represents and whether or not I am coming into this space far too late in the cycle.

The method I use to offset that is obviously the market cap of the deal under scrutiny, so while Patriot may be the poster child for capital gains in the lithium space, I want to compare my lithium selection with other deals by looking at valuations.

Allied Copper and Volt Lithium

One of the copper deals I took down in 2021 was Allied Copper Corp. (CPR:TSX.V; CPRRF:OTCQB)as one of the proxies I used for the increase in copper usage and demand coming from the global move to electrification. After a couple of financings in early 2021, the company hit a snag with some regulatory entanglements and was halted for six months which is never a positive event for any junior.

After hitting a 52-week low date in August at CA$0.06, the company appointed a new interim CEO, Kyle Hookey, to right the ship, and then in October, they announced intentions to acquire a lithium deal (Volt Lithium Corp.) a privately-held, Alberta-based company that holds 400,000 acres of mines and mineral permits in the Rainbow Lake area of Alberta, specifically targeting the brines of the Keg River formation.

With this deal (and subsequent shareholder approval), Allied Copper became Volt Lithium Corp., and while they will retain the copper exploration properties, I suspect they will eventually spin those out in order to focus 100% on Rainbow Lake. More importantly, the listed company most similar to Volt is an E3 Lithium Ltd. (ETL:TSXV;EEMMF:US), where the resource is similar in size and where the jurisdiction is the same (Alberta).

Volt E3 Lithium

Shares issued 118.8m 61.03m

Recent Price CA$0.14 CA$2.14

Market cap CA$16.63m CA$130.60m

(valuation gap) 7.85 0.127

The market is perfectly fine with assigning a market cap of CA$130.6 million for E3 Lithium while valuing Volt at just CA$16.5 million, suggesting that a possible 7.85 times lift could be in the cards for Volt. The Volt share count was calculated using the most recent SEDAR data plus the news release detailing the additional 39,840,000 shares issued to Volt as payment by Allied for the asset.

The Volt story is an evolving one with many moving parts and absolutely enormous upside, from what I am hearing. While acknowledging that I might be late in the lithium trade as a sector, Volt as a valuation story cannot be denied if the resource presented compares favorably with those of other generously-valued deals.

My hat is off to the team at Allied Copper for their tenacity and to the new Volt management team led by Alex Wylie, CEO, whose capital markets experience and knowledge of the Rainbow Lake Project are extensive. It just goes to show you that when reputations are on the line, quality managers find a way to create value, and while it is not quite there yet with the Allied/Volt share price, I have added to my holdings this week in advance of accelerated news flow anticipated as the year moves along.

Last point: I am not at liberty to discuss the identity of one of the major shareholders in this deal, but I assure you that when it is divulged, there will be a torrent of buy-side volume coming into the stock. The question is how and when the "mystery man" appears; that is above my pay grade.

Buy Allied Copper Corp. (soon to be renamed Volt Lithium Corp.).

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosures:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: All. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: My company, Bonaventure Explorations Ltd., has a consulting relationship with: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Allied Copper Corp., a company mentioned in this article.