It was only a few months ago that the world witnessed an event in the Middle East that can only be classified as a “watershed event.” For the first time since Chevron first discovered oil in the Dhahran, Saudi Arabia, a world leader not belonging to the U.S.-dominated NATO alliance, was greeted with all of the pomp and circumstance usually reserved for the United States.

When Chinese President Xi Jinping stepped off the aircraft back in December, he was greeted with such respect by Saudi leader Mohammed bin Salman that the international media made great fanfare out of it while the U.S. MSM downplayed it as if it were an inconsequential state visit.

As we move into the New Year, one of the forecasts about which I am constantly reading is the imminent arrival of the “New World Order” in which the World Economic Forum (“WEF”) led by Klaus Schwab rearranges global priorities by way of seismic changes in politics, economics, and medicine.

The spin doctors conger up images of Dr. Evil-type characters holed up in a luxurious retreat in the Swiss Alps, hovering over a map of the world as they divide up the regions like Monopoly pieces. Unfortunately, there actually is a shift occurring in the way the world works, but it lacks the theatrics of an Ian Fleming novel or a movie by James Cameron. The shift that is occurring at Hemingway-esque speed (first slowly, then suddenly in reference to his bankruptcy) is the demise of the not-so-mighty U.S. dollar.

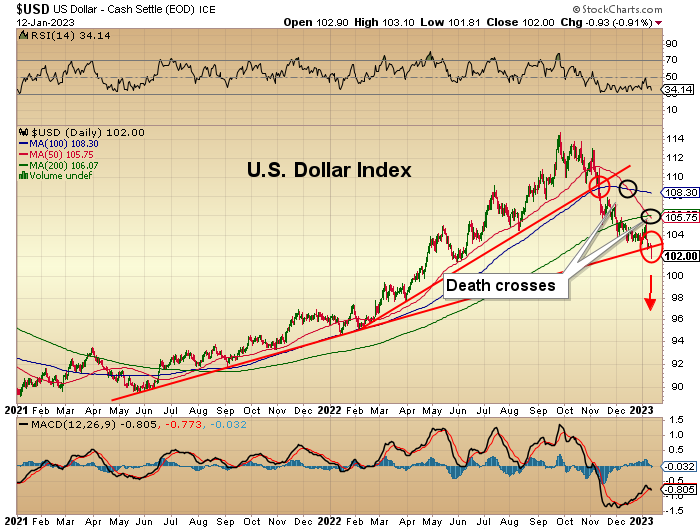

From a technical perspective, the dollar index is comprised of a basket of currencies (more appropriately referred to as a “basket-case of currencies” like the energy-starved Yen and Euro), but it generally represents the major influence on the commodity prices or as the CPI-watchers like to say “input prices.” I am focused on this because the greenback’s raging ascent, which began in the summer of 2021, put in a major top in late September of last year on the exact day that I marked the turn, which was when the Bank of England did a ferocious one-eighty and instead of selling 10-year gilts to reduce the balance sheet, they were forced to buy gilts in order to rescue their insolvent pension funds.

Since then, two uptrend lines have been vanquished at around 109 and 103, with the first of the greatly-revered “death crosses” occurring last December at around 108 and the second this week around 106. The “death cross” occurs when the one moving average crosses below the second. In this case, the 50-DMA crossed below the 100-DMA in December, with the 50-DMA crossing below the 200-DMA this week.

Historically, these are very powerful signals that speak to the longer-term trend of markets, and the reason I am focused on the dollar is that its behavior can be a predictive tool for monetary and foreign policies.

2022 was a year in which the U.S. financial press was preoccupied with inflation, and it was the CPI bogeyman that hit 9% in the third quarter that was on the minds and lips of all of the Fed governors led by numero uno inflationista Jerome Powell. In order to eliminate the embedding of the dreaded “inflationary psychology,” Powell allowed the Fed Funds rate to advance more in nine months than had ever been experienced in all the years of Federal Reserve Board's “management” of monetary policy.

What troubles me greatly as we head into 2023 is that the inflation rate in the United States (and Canada) skyrocketed during a period in which the American currency experienced the biggest rise since 1980 and 1994. The past sixteen years have seen the USD move from the low 70’s to the recent 114-plus level allowing the strength of the dollar to negate the effect of rising input prices.

From the summer of 2021 and all through 2022, as CPI began to soar, the strong dollar should have had a moderating impact on input prices, but due to supply chain shocks and fiscal handouts in the form of “stimmy cheques,” input prices were not dulled by the strong dollar.

When I see the chart of the dollar index and ponder the ramifications of its effect upon input prices within an extended period of weakness, I have to wonder how on earth the Fed is going to launch into “pivot” mode during a period of dollar weakness. One also has to wonder how the dollar can be retreating given the typically bullish effect of rising yields on the domestic currency.

The answer lies in the ability of markets to discount future events and what I think the dollar weakness is telling us is that the American economy may no longer be the aphrodisiac for global investment flows. It may just be that the debt monster plaguing the world’s largest deadbeat nation may be the proverbial chickens coming home to roost. Foreign investors typically favor the U.S. dollar during periods when they get a preferential return on their principal; what if the new focus has morphed into a concern of the return OF their principal? Solvency is never a concern until it is one, and with the US$32 trillion debt load, there is going to be a need to refinance that debt at rates far higher than a year ago.

I turned positive on stocks in late September with the Bank of England now forever in my servitude as their move to save their pension funds set the theme for the balance of 2022. I wrote back in December that I was not going to call the October 13th low for the S&P at 3,491.58 as “THE” low until I watched the late December-early January tape action. Now that the Santa Claus Rally and the First Five Days indicators registered positive outcomes, I am confident that the October low was indeed the low for the bear market and that we could see an extended rally into at least the second quarter.

However, there is an indicator called the “December low indicator” that says that if the market takes out its prior December low in the first quarter of the year, then all “BUY” signals are negated, and new lows are on the horizon. The levels that I will use as a stop-loss range is between 3,783 and 3,764 (closing low and intraday low for December).

The first week of trading allowed gold to break out of an oppressive band of resistance between US$1,825 and US$1,875 after which it touched US$1,912 before succumbing to profit-taking.

Also, the relative strength indicator just poked its head above 70 and now resides in overbought territory. That does not mean gold should be sold because it can stay overbought for weeks before reversing. It does mean that one should defer new purchases until the overbought conditions get worked off.

Now, despite the elevated RSI reading, the 50-DMA is about to surpass the 200-DMA, constituting a “Golden Cross” (the opposite of the “Death Cross”), and that could serve as an offset to the RSI reading. If gold can get comfortably above the US$1,900 level and stay there, we will get the cross next week, which is a powerful longer-term signal for the gold market. The next major resistance for the spot is around US$2,000, and then the all-time highs of around US$2,087.

The only problem I have right now with the entire precious metals complex is that this week, unlike the period of September 27th until New Year’s, silver is underperforming gold, which is a big non-confirmation and a near-term negative. Silver usually acts as an early warning device, and when it starts to lag gold, a near-term top usually arrives for the entire complex.

There was a bearish MACD crossover (“sell signal”) just before Christmas, and since then, silver has been in a range between US$23.25 and US$24.75, with resistance sitting in the US$26.00-26.50 range. I think it resolves to the upside in Q1/2023, but it may need a retest back to the 50-DMA around US$22.70 first.

Top-rated Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) reported more positive drill results from Fondaway Canyon, where they have recently upgraded their resource estimate to 2,059,900 ounces of in-ground gold with all zones open along strike and to depth. I get bombarded with emails asking why the stock price continues to languish, and while it is terribly frustrating, it is perfectly understandable.

The answer lies in the recently-reported sentiment numbers for the American Association of Individual Investors (“AAII”), which came in at 20.5% bulls, one of three record-low readings for the month of December, which represented the first time it has occurred since the survey began in 1987!

The AAII is a broad representation of the average retail investor which is typically the type of investor that buys junior resource stocks. With the brutal performance of the small-cap stocks last year, the average investor is licking his/her wounds with portfolio values down savagely in many sectors.

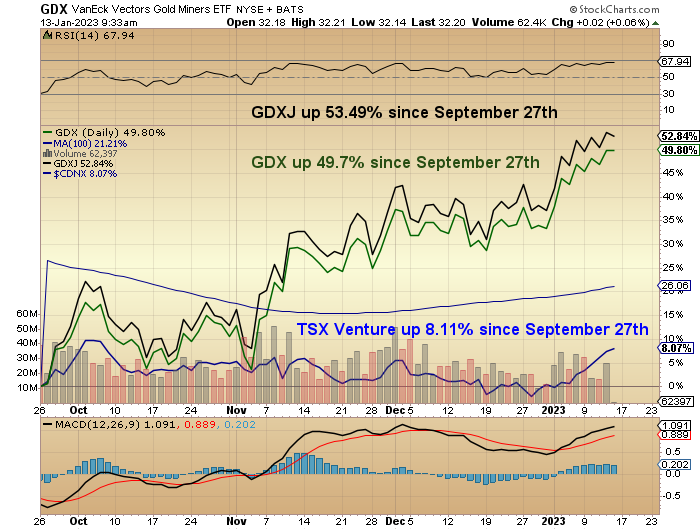

Those investors holding or buying the senior and intermediate miners (GDX/GDXJ) are ahead 49.7% and 53.49%, respectively, in those two ETF’s while the poor TSX Venture Exchange, which houses the junior developers and explorers is up a paltry 8.11% despite raging precious metals prices and copper at $4.15/pound. The microcap juniors are simply lagging behind their bigger brethren, and in time, the inevitable rotation will occur as fund flows begin to favor the little guys.

When sentiment amongst the resource investors (and the AAII) begins to heal, investment flows will move initially to those developers with a resource (such as Getchell) and then ultimately to the explorers. If one is looking for leverage, buying in-ground ounces at US$15.65 per ounce in the State of Nevada is a no-brainer which means Getchell Gold is just that.

Next week I will take the reading of the S&P on the sixteenth (Monday) which is the third of the December-January early warning numbers that I monitor. It will show a decent advance for the month (Approx. 2%) which leaves month-end as the last reading. If I get an up January, then all components of the January Barometer will have passed the test, and from at least a statistically-historical perspective, 2023 should be a bull market year. I think that 2023 will actually turn out to be a stock-picker’s market where fundamentals and valuation will be far more important than momentum or “the story.” I would welcome that with open arms.

I get frequently asked how I can be a bull when earnings are decelerating so rapidly amidst an inflationary backdrop and a hostile Fed. The only answer I have lies in a phrase that I have used for years and that is “Never underestimate the replacement power of equities (stocks) within an inflationary spiral.” From what I read and hear, there is an absolute mountain of cash on the sidelines from either real estate sales of stock market profits taken in 2021, but it is definitely out there, and I suspect that at the first sign of monetary policy relief, there will be a tsunami of buy-side volume piling into the quality names.

Want to be the first to know about interesting Special Situations, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosures:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: All. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: My company, Bonaventure Explorations Ltd., has a consulting relationship with: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., a company mentioned in this article.