Goldshore Resources Inc. (GSHR:TSX; GSHRF:OTC; 8X00:FSE) has had a plethora of news in the past couple of months, including the announcement of a CA$5 million public offering, the official filing of a technical report for its Moss Lake Project, and the revelation that the company had intersected even more high-grade shears in the QES Zone at Moss Lake.

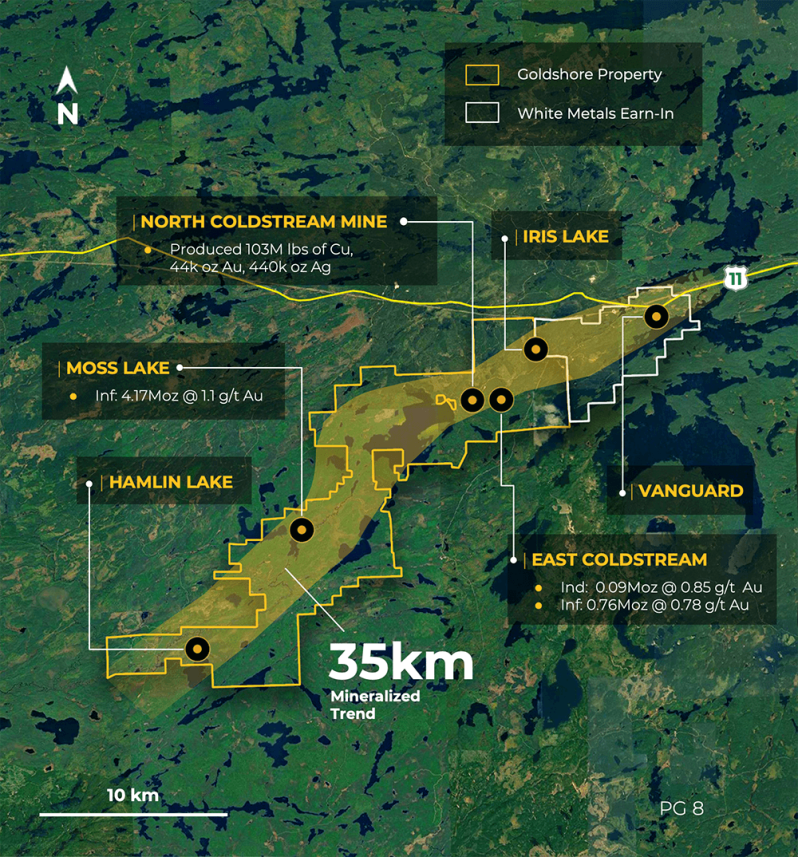

Goldshore Resources is a gold mining junior focusing on the previously mentioned 100%-owned Ontario Moss Lake Property.

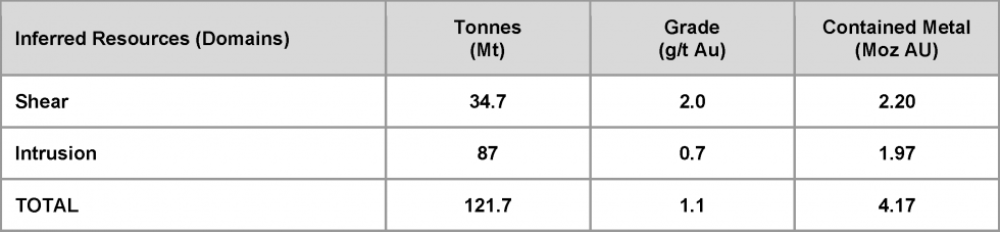

The current project is a 100,000-meter drill program on Moss Lake, a property that, as of November, has a resource estimate of 4.17 million ounces gold (4.17Moz Au) inferred and multiple targets. The property also has all the infrastructure needed to move forward with a district-scale mining camp.

Rick Mills of Ahead of the Heard shared his optimism about the company earlier this year, saying, "the Moss Lake project could easily help the company attain a higher value than most projects that have been targeted by the majors in the area, given the project's economics (were) last updated in 2013."

High-Grade Shears in the QES Zone

Goldshore Resources November results came from seven holes, originally drilled to expand the coverage of the high-grade shears in the QES Zone. This established a massive volume of well-mineralized diorites hosting higher-grade shear-hosted gold mineralization.

Highlights included:

- 1.47 grams per tonne (1.47 g/t) Au over 30.1m from 530.0m

- 8.45 g/t Au over 5.0m from 576m depth in MQD-22-076, including 36.9 g/t Au over 1.0m from 577m

- 1.07 g/t Au over 24.7m from 369.0m depth in MQD-22-087

- 2.11 g/t Au over 30.75m from 536.9m, including 11.5 g/t Au over 3.1m from 555.2m

- 1.31 g/t Au over 63.6m from 427.0m depth in MQD-22-090A, including 2.07 g/t Au over 32.0m from 439.0m

In light of these results, President and CEO Brett Richards said, "The results from these drill holes in the QES Zone . . . confirm our belief that there are additional high-grade shear zones within the deposit that will potentially add to the shear domain component of the mineral resource that we anticipate will be prioritized in the mining schedule when we move towards conducting a preliminary economic analysis next year."

Technical Report at Moss Lake

Maurice Jackson of Proven and Probable said, "I am a proud shareholder, and I'm looking to add to my position under these circumstances. The value proposition is extremely compelling, and I'm not discouraged by the price."

December 12, 2022, Goldshore Resources stated it had officially filed a pursuant to National Instrument 43-101 Standards of Disclosure for Mineral Projects a technical report titled “NI 43-101 Technical Report – Mineral Resource Estimate for the Moss Lake Project, Ontario, Canada."

This was brought together by Neal Reynolds and Matthew Field, Nat of CSA Global Consultants Canada Ltd, and was made effective on December 9, 2022.

You can view the report on Sedar.

Catalyst: US$5 Million Public Offering

Wednesday, December 14, Goldshore Resources published it had entered into an agreement with Research Capital Corporation as the lead agent on behalf of a syndicate of agents. This regards best-efforts public offering of securities of the company's offered securities for aggregate gross proceeds of up to CA$5,000,000.

This offering is a combination of the following:

- Conventional units at a price of CA$0.25 per unit.

- Flow-through units at a price of CA$0.30 per unit

- Flow-through units sold to charitable purchasers at a price of CA$0.35.

Each warrant provides the holder one common share at an exercise price of CA$0.40 at any time up to 24 months from the closing of the offering. There is also an option for the agents to increase the offering up to equal 15% of the total number of issued securities to cover possible over-allotments and for market stabilization purposes, exercisable at any time and up to 30 days following the closing of the offering.

These net proceeds will be used toward working capital and general corporate purposes, while gross proceeds will be used for exploration expenses at Moss Lake. The expected closing of the offering is set for December 22, 2022.

Analysts and Expert Commentary

Goldshore Resources has caught the attention of Paul O'Brien of Velocity Trade Capital. On April 22, Velocity initiated coverage on the company with an Outperform rating and a target of CA$0.85 per share, saying there was acquisition potential.

The Critical Investor also has spoken about the company and marked Goldshore Resources as one of his top picks for 2022.

In reference to his confidence in the company, Maurice Jackson of Proven and Probable said, "I am a proud shareholder, and I'm looking to add to my position under these circumstances. The value proposition is extremely compelling, and I'm not discouraged by the price."

As previously mentioned, the company is also covered by Rick Mills of Ahead of the Heard. You can view more of what these experts are saying by clicking "See More Live Data" in the data box above.

Ownership and Share Structure

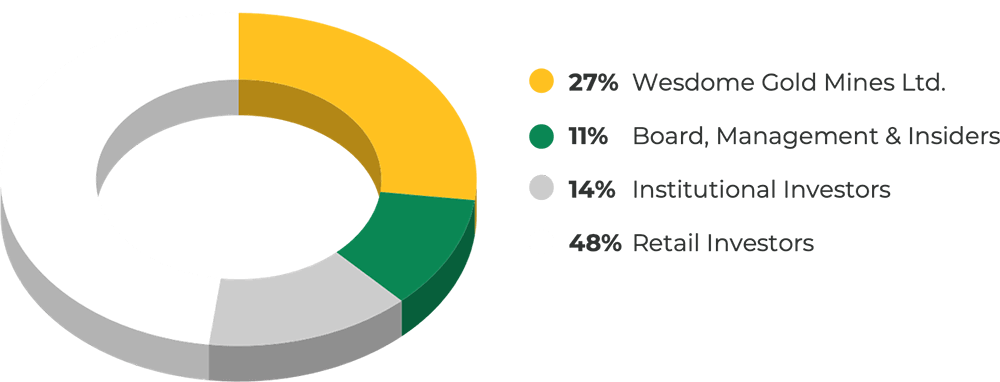

Approximately 11% of the company's shares are with management and insiders. Out of management, Chairman Galen McNamara holds the most shares at 2.81% with 4.01 million shares, according to Reuters.

CEO and Director Bretty Richards is next at 2.43%, with 3.47 million shares. Director Victor Cantore has 1.38% with 1.96 million. Director Doug Ramshaw is at 1.10% with 1.57 million shares. Director Shawn Khunkhun has 0.56%, with 0.8 million shares, and Director Brandon Macdonald has 0.25%, with 0.36 million shares.

Among the 14% of institutional investors, Wesdome Gold Mines Ltd. has the most stake in the company at 21.11%, with 30.09 million shares. Sprott Asset Management LP is at 8.65%, with 12.33 million shares. Commodity Capital AG is at 3.24%, with 4.62 million shares, and U.S. Global Investors Inc. has 0.26%, with 0.38 million shares.

Goldshore Resources Corp. has a market cap of CA$35.2 million with 109.2 million shares outstanding. The company has 92.29 million shares in the public float and trades in the 52-week range between CA$0.16 and CA$0.67.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Katherine DeGilio wrote this article for Streetwise Reports LLC. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Goldshore Resources Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc., a company mentioned in this article.