With the increase in environmental interests, a mining company's ESG has become quite important. This has led Troilus Gold Corp. (TLG:TSX; CHXMF:OTC; CM5R:FRA) to present a yearly sustainability report, and on December 12, 2022, the 2021 report was released.

Troilus Gold Corp. is a Quebec-focused, advanced-stage exploration and development company based in Toronto, Canada. The company focuses on the mineral expansion and potential mine-restarting of the former gold and copper Troilus mine.

Why Gold?

With inflation on the rise, investors are searching for sectors that can weather the storm, and in the investing world, gold is seen as a hedge against inflation. This could be one of the reasons gold demand has risen in 2022.

According to Reuters, "gold demand (excluding OTC) in Q3 was 28% higher y-o-y at 1,181t. Year-to-date (y-t-d) demand increased by 18% versus the same period in 2021, returning to pre-pandemic levels."

December 12, 2022, Adrian Day of Adrian Day Asset Management said, "We are, then, entering the sweet spot for gold," and the Troilus Gold Project is one of the largest undeveloped gold resources in Canada, and according to the company, positive PEA results show the potential for Troilus to rank among the top gold-producing Canadian mines.

Why is ESG Important?

ESG stands for environmental, social, and corporate governance. It is data collected to examine and explain the effects on the environment, society, and to corporate governance caused by a company. According to NASDAQ, "strong ESG practices can benefit companies and investors."

In a 2019 article, Wall Street veteran Vikram Gandhi pointed out that he recognizes "that ESG isn’t a fad — it’s part of a long-term trend."

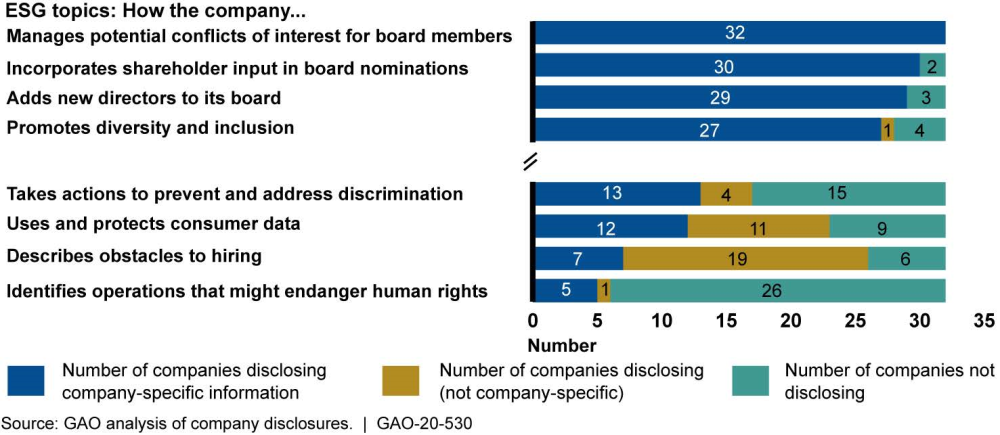

In 2020, the U.S. Government Accountability Office found that "most institutional investors GAO interviewed (12 of 14) said they seek information on environmental, social, and governance (ESG) issues to better understand risks that could affect company financial performance over time."

Now over 120 companies are currently using ESG. Because of this, Troilus Gold Corp. implemented an annual sustainability report in 2020, and has continued to strive for ESG.

2021 Sustainability Report

December 12, Troilus Gold Corp. officially released its 2021 Sustainability report.

Highlights of this report included:

- ~36% of full-time employees and 40% of the senior management team at Troilus were women.

According to Forbes, women currently only make up 15.7% of the mining industry workforce. This makes Troilus 129.299% above the average.

- 71% of the energy used at the Troilus site is derived from renewable hydroelectricity with the existing infrastructure to help power contemplated future production while minimizing GHG emissions and carbon footprint.

- 65% of Troilus’ total procurement spending went to suppliers from the local economy in Northern Quebec.

- Zero fatalities and zero work-related injuries resulted in lost time among employees and contractors at the site.

- Troilus had zero instances of non-compliance with environmental regulations.

CEO and Director of Troilus Justin Reid, commented, “We are pleased to share the positive progress of our ESG program as we continued to advance the Troilus project responsibly and upholding the highest standards when it comes to our corporate governance, our people, our communities, and the environment."

Catalyst

Analyst Coverage

On October 11, 2022, Stifel analyst Ian Parkinson said, "Troilus Gold remains the cheapest company in our coverage universe. We rate it as a Buy." Parkinson went on to reiterate his Buy rating on November 16 after Troilus sold 1,824 noncore land claims in Northern Quebec to lithium miner Sayona Mining. Then Parkinson said he views "the transaction as a strong positive for Troilus as it gives them a significant cash injection and significantly reduces share dilution as they continue to explore and work towards a final feasibility study for the Troilus project expected in H2/23."

November 18, 2022, Jacques Wortman of Laurentian Bank gave the company a Buy rating and a target price of CA$2.50, which was significantly higher than its CA$0.56 price at the time.

Troilus is also covered by analysts Brock Salier of Sprott Equity Research and Pierre Vaillancourt of Haywood Securities. Click "See More Live Data" in the data box above to read more of what they are saying.