Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) is a Canadian-based exploration company. The company is focused on acquiring uranium exploration projects in Canada's Athabasca Basin. Recently Skyharbour announced that it had received US$895,000 from warrant exercises with a strike price of US$0.22 since June 29, 2022. According to the company, "a total of 4,068,306 warrants have been exercised with this batch of warrants expiring Nov. 29, 2022."

Why Uranium?

Uranium is an element that is mainly used to provide nuclear energy. Because of its radioactive properties, it can manufacture a tremendous amount of emissions-free energy. It is also considered more reliable than other emissions-free energy sources such as wind and solar.

While uranium has taken a dip in the past, recent news has led to its rise with the worldwide push to green energy, inflated energy costs, and the war in Ukraine. This August, Japan's prime minister announced they would restart more idled nuclear plants and look at developing next-generation reactors. At this announcement, Forbes reported, "The Global X Uranium ETF surged 11.5%."

The United States also has leaned into green energy. Currently, 20% of the electricity and 50% of the clean energy in the United States is nuclear, and this number seems to be on a path to only getting bigger.

On July 5, 2022, The New York Times reported that "the Biden administration has established a US$6 billion fund to help troubled nuclear plant operators keep their reactors running and make them more economically competitive against cheaper resources like solar and wind power." The administration also is alluding US$2.5 million to fund two projects intended to showcase new nuclear technology.

This October 2022, the Biden administration also announced they would be providing US$150 million to improve nuclear research and development infrastructure at Idaho National Laboratory as a part of President Biden’s Inflation Reduction Act.

U.S. Secretary of Energy Jennifer M. Granholm commented that the Department of Energy "is taking critical steps to strengthen domestic nuclear development and deployment — helping ensure the United States is on track to reach a clean energy future.”

This, of course, leads to more uranium demand, or as Forbes said, "with many major nations rethinking their approach to clean, affordable energy, nuclear power plants are an obvious option. That’s good news for uranium investors, as more nuclear power means more demand for the radioactive metal."

Skyharbour's Plethora of Projects

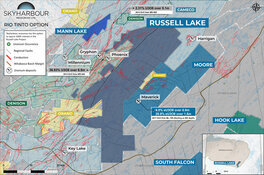

Skyharbour Resources has been around since 1970 and has a myriad of projects, including Moore, Russell Lake, South Falcon Point, South Falcon East, Preston, East Preston, Hook Lake, Mann Lake, Yurchison, Riou River, Pluto Bay, Wallee, Usam Island, Foster River, West Dufferin, And South Dufferin.

The company noted that "Skyharbour holds an extensive portfolio of uranium exploration projects in Canada's Athabasca basin and is well positioned to benefit from improving uranium market fundamentals with 15 projects, 10 of which are drill ready, covering over 450,000 hectares of land."

Skyharbour estimates that approximately 30,000 meters of exploratory drilling will take place between all of its Athabasca Basin projects — including its two core sites and its multiple joint ventures —over the course of the next year. The company plans to dedicate a third of this work toward its flagship projects in Russell Lake and Moore Lake and is independently funded to conduct this work.

Russell Lake

Rio Tinto Plc. (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK), whose asset focus lies primarily in iron and copper, temporarily shelved the Russell Lake project. Rio has since optioned the project to Skyharbour, which plans to engage in advanced-stage exploration by drill testing “a number of these prospective targets [that] weren’t fully tested,” according to CEO Jordan Trimble. It wasn’t until a recent “resurgence in uranium and the nuclear industry” Trimble suggested that the industrial metals giant option the project to Skyharbour.

In resuming operations on the Russell Lake project, Skyharbour assumes the 40-person exploration camp previously used by Roughrider Uranium, the site’s previous tenant. Trimble believes that the inheritance and use of this asset for staging purposes “will bring [its] drill costs down quite a bit, not just at Russell Lake, but also at the adjacent Moore Lake.”

On November 23, the company announced it will carry out multiple phases of diamond drilling totaling 10,000 meters at Russell Lake.

Making Skyharbour’s operation in Russell Lake particularly efficient is the project’s positioning to the Athabasca Basin’s southeast. Rajeev notes that Russell Lake “is strategically located between Cameco’s Key Lake mill and MacArthur uranium mine,” such that Skyharbour has a direct and rapid processing line between “the world’s largest uranium mill and the largest high-grade uranium mine.”

2022 Drilling Complete at Mann Lake

At the end of last month, the company announced they had completed drilling at Mann Lake for 2022. 6,279 meters were drilled. Core samples have been submitted for analysis to the Saskatchewan Research Council (SRC).

As they hold steady for the assay results, Skyharbour plans to continue its exploration programs at it Mann Lake project in the Athabasca basin and its Wray Mesa project in Utah in 2023.

Analyst Sid Rajeev of Fundamental Research identified “the ongoing/planned exploration programs by Skyharbour and its partners” as major catalysts toward the company’s impending growth” and said that “as a result, Fundamental Research maintains its Buy recommendations for Skyharbour.”

Catalyst: Skyharbour Receives US$895 Million

Friday, Skyharbour announced it had received US$895,027.32 from the exercise of share purchase warrants with a strike price of US$0.22 since June 29, 2022. 4,068,306 of the warrants have been exercised, with this batch of warrants expiring on Nov. 29, 2022.

The company noted that "collectively, Skyharbour has now signed option agreements with partners that total over US$34 million in partner-financed exploration expenditures, over US$23 million in stock being issued and just under US$15 million in cash payments coming into Skyharbour, assuming that these partner companies earn in the full amount at their respective projects."