DroneShield Ltd. (DRO:ASX; DRSHF:OTC) is an Australian and U.S.-based tech company. The company offers what is known as counter-drone systems, which can interfere with or disable remote-controlled ground surveillance drones during operation and while in flight.

Due to the practical application of drones in modern warfare, the counter-drone technology marketed by DroneShield has attracted the attention of major military electronic warfare organizations, such as the ISREW branch of the Australian Joint Systems Division, The United States Department of Defense, and the Department of Homeland Security.

Why Is Counter-Drone Technology Important?

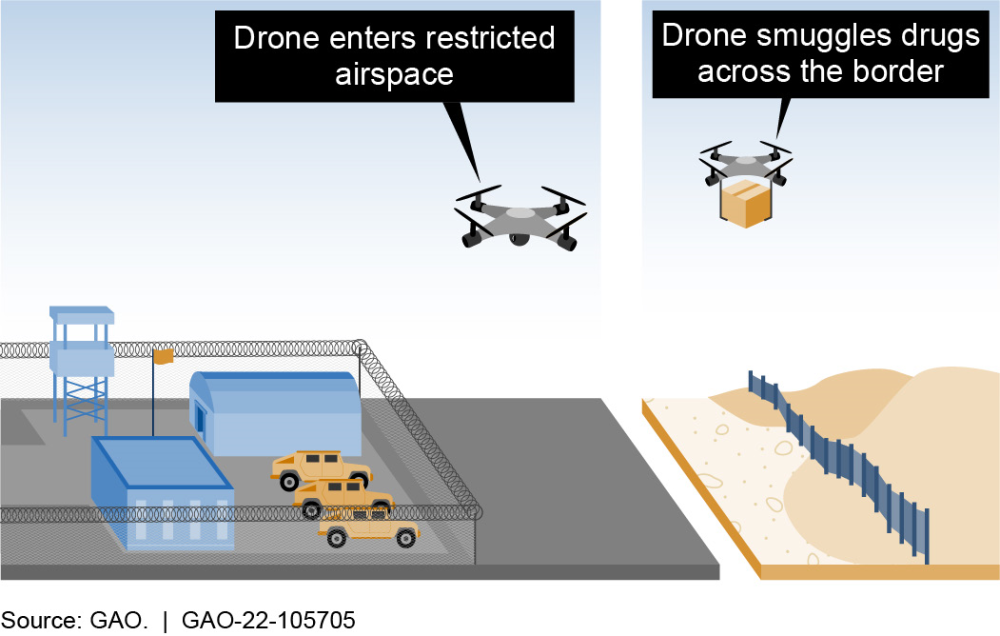

While drones can be extremely useful, they can also pose serious threats. They can be used for drug smuggling, interfere with planes if they are used in airspace near airports, or uncover secure data that should not be released. Because of this, it is imperative we have the technology to counter them by jamming their signal or taking them down completely, and this has become more important now than ever.

As the U.S. Government Accountability Office says, "With over 2 million drones projected in the U.S. by 2024, these risks are likely to grow."

National Defense Business and Technology Magazine reported that Meni Deutsch, the regional director for Europe at Skylock Anti-Drone Technologies, said, "We have been witnessing the growing demand for anti-drone systems and technologies."

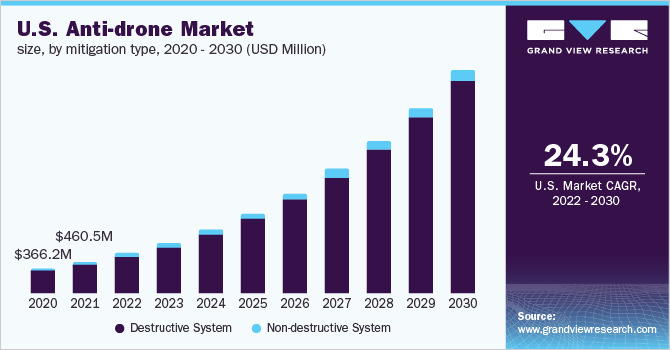

This demand has led to massive projected growth. The counter-drone market was already at "US$1.1 billion in 2021 and is anticipated to register a CAGR [compound annual growth rate] of 28.3% from 2022 to 2030," which could provide ample opportunity to investors.

As for DroneShield, the company "differentiates itself from the rest of the market by offering an end-to-end counter-drone solution with largely in-house technology," Laing of Bell Potter Securities wrote.

A Plethora of Orders

DroneShield has also identified critical markets for its counter-drone technology in airport security, correctional facilities, and government offices. Within these sectors, the company has secured four development contracts worth around AU$750,000 to close out 2022, an AU$1.8 million contract with the Department of Defense, and an anticipated AU$230 million in potential sales through 2023 and beyond.

Airports have been on the watch for technology to counter drones after several incidents, one being the 2018 Gatwick affair, where one of the U.K.'s most popular airports had to suspend all travel after multiple drones were sighted along its airfield.

Since then, "stakeholders at airports all over the world have called for a solution that can identify unauthorized drones — while complying with laws that generally prohibit interference with aircraft," reported DroneLife.

This led to Dronshield's August 2022 announcement of its first permanent deployment of DroneSentry at a U.S. airport. You can see a video demonstration of how the Sentry works here.

Then on October 25, 2022, the company received a AU$900,000 order contract for portable counter-drone systems for an undisclosed Asian country. This led to the company trading 2.56% higher on the announcement day.

Last month, Dronesheild also announced it would receive AU$1 million from an unnamed international government agency. In this order, the company would provide several of its DroneSentry-X units. DroneSentry-X is vehicle compatible counter-drone device. You can read more details about it here and see a video demonstration of the product through this link.

Payment and shipment are expected before the end of the quarter. The company reported that "for this customer, it is an initial purchase that follows trials, and is expected to follow up with a number of additional systems, to be acquired in 2023."

Private Placement With Epirus

DroneShield Ltd. has been on the move. The company organized the private placement of AU$18.5 million shares with technology investment firm Epirus Inc. According to Peloton Capital, the market volume saturation resulting from this deal “represents a discount of 2.4% to the last closing price of AU$0.21 per share.”

At around AU$0.20 per share, Epirus’s placement has provided DroneShield an additional AU$3.6 million in operating capital. Peloton reports that this deal grants Epirus a 4.1% shareholder stake in the upstart Australian counter-drone company.

Analysts and Newsletter Commentary

Shane Gavegan of Peloton Capital insisted that DroneShield plans to direct this incoming investment capital toward “the scaling up of ready inventory and long lead items to rapidly fulfill anticipated orders.”

Laing suggested an estimated “AU$50 million worth of projects for 2022 and about AU$180 million worth for next year and further out” to be fulfilled by DroneShield — a matter of bolstering its supply to meet steady demand. The company is well positioned to "capitalize on favorable macroeconomic conditions accelerating structural growth in the market," Laing pointed out.

There is also evidence to suggest that this demand for DroneShield’s military technology will grow considerably in the coming quarters, where Gavegan projects that the funding received from Epirus will contribute toward “the scaling up of engineering and operations in support of current momentum.”

This momentum is echoed in the words of Peloton analyst Darren Odell, who notes that the counter-drone company is “currently selling its systems in the Five Eyes countries, the Middle East, and Ukraine.”

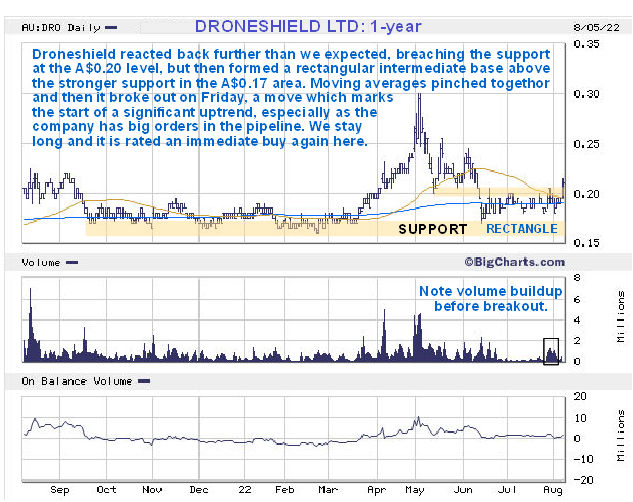

Technical analysts Clive Maund also commented on the stock in an August 9, 2022, post.

There Maund said, "the fundamentals of the company have continued to improve at an ever more rapid rate."

He rated the company an Immediate Buy and said, "with the outlook for orders and earnings improving dramatically, it is clear that there is everything to go for here."

Both Peloton and Bell Potter also maintain their Buy recommendations on DroneShield.

Catalyst: U.S. DOD Recommendation

October 18, 2022, the company happily unveiled it "had been recommended by the U.S. DoD’s Joint Counter-small Unmanned Aircraft Systems Office (JCO) as part of the Science Applications International Corporation (SAIC) joint solution for Counter-UAS as a Service (CaaS)."

Daniel Laing of Bell Potter Securities identifies “the deployment of its technology at U.S. military bases following the U.S. DOD recommendation” as a key catalyst for DroneShield’s projected growth.

These inroads maintained with major government organizations have established the “validation of the sales pipeline through consistent contract wins,” which Laing claims to be an additional, concurrent catalyst for DroneShield’s sustained growth in other sectors.

Ownership, Coverage, and Share Structure

Approximately 11% of DroneShield’s stock is owned by management, with CEO Oleg Vornik claiming 15.3 million shares at a majority stake of 3.39%. Other internal stakes are maintained by CFO Carla Balanco at 3.2 million shares, as well as board member Peter James with 9.3 million.

Without any institutional shareholders, the remaining 89% of DroneShield’s outstanding shares are retail.

The company is covered by a surfeit of analysts, including Finola Burke of RaaS Advisory Pty Ltd., Daniel Laing of Bell Potter Securities Ltd., and Shane Gavegan of Peloton Capital. Newsletter writer of Clivemaund.com also follows the stock. Click "See More Live Data" in the data box above to view more of what they are saying.

A micro-cap, DroneShield currently boasts an approximate AU$90 million market cap on 432 million outstanding shares spread across more than 8,000 investors. Approximately 378 million shares are free-floating. In addition, as noted by analyst Daniel Laing of Bell Potter Securities, DroneShield operates without bank debt and has an estimated AU$7 million in cash available as capital expenditure.

It currently has 451.04 million shares outstanding and trades in the 52-week range between AU$0.188 and AU$0.20.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Katherine DeGilio and Tom Griffin wrote this article for Streetwise Reports LLC and Tom Griffin provides services to Streetwise Reports as an independent contractor. They members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with DroneShield Ltd. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Droneshield Ltd., a company mentioned in this article.