Gold stocks have started a new bull market. The question is, will the gold price confirm it? The HUI index ran from a low 180.41 on November 3rd to a high of 224.88 on November 10th and that is a +24.6% move. The gold stocks often lead a move in gold and the gold price did move from $1631 to $1775 in the same time frame. Gold broke out with a strong bullish engulfing candle stick on November 4th. I commented and went into more detail in my November 3rd update that I put out about 11AM on the 4th.

Right now I am watching support around $1730 which was the break out to a higher high. Ideally in a bullish scenario, this holds and we see a bounce up higher from it. Next important resistance is around $1830. While I believe there are strong odds a gold bottom is in, the jury is still out how and whether a bull market develops. I am much more confident on a strong bull move with oil&gas.

The Biden Administration and Environmental Social Governance (ESG) guarantee a huge bull market in oil. I have commented plenty about Biden ending pipelines and oil&gas leases and incentives. ESG is really about not investing in oil&gas but green energy only. Ironically the big oil companies are investing in solar and wind to meet ESG rhetoric. BP even changed their branding name to Beyond Petroleum “We need to reinvent the energy business,” declared BP’s chief executive in a speech at Stanford University in March 2002. “We need to go beyond petroleum.” In recent years this ESG focus has intensified.

You probably heard plenty in the news with the recent climate summit (COP27), but I would like to make a point how phony this is. The U.S. accounts for about 25% of the world's carbon output and they still get almost 50% of their electricity from burning coal. The U.S. needs to clean up their act before telling the rest of the world what to do. The Biden administration has given incentives for green energy but they always seem to avoid this coal burning issue.

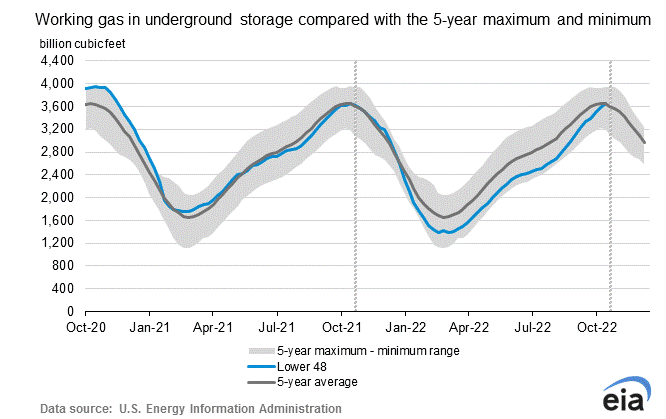

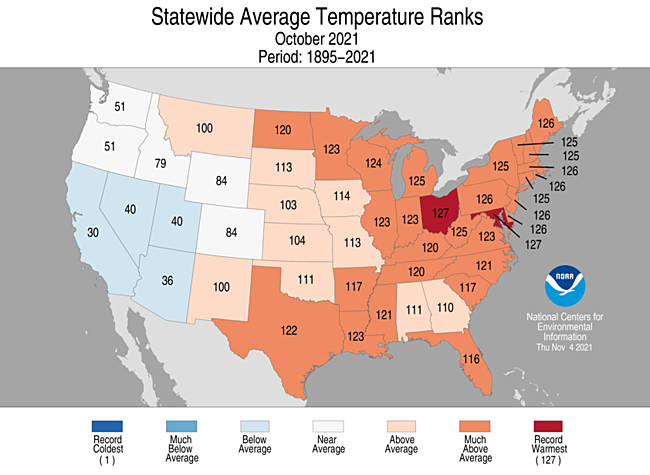

Natural Gas storage in the U.S. bounced back to the 5 year average and I believe we got a lucky break. Usually October is the early days of the heating season and gas inventories start their seasonal decline. However, for October, the average contiguous U.S. temperature was 57.0°F, 2.9°F above the 20th century average. This ranked sixth warmest in the 127-year record. Notice on the map the largest users of heating fuel in the NE U.S. had abnormal warm weather. It was much the same in Ontario Canada.

That was perhaps the good news but as I warned with another La Nina winter and the lowest sun spot activity in 100 years, a cold winter is likely. It arrived with vengeance last week with record snow falls in the US and Canada. I usually watch some Sunday football and this year the Buffalo Bills had to reschedule their home game to Detroit. Buffalo got 77 inches of snow and it was the first time in history that a game was moved because of snow.

There is a long line of well-developed storms stretching across the Pacific Ocean. Eventually, this means Michigan and the Great Lakes region will get into significant moisture. The first two of these storms will cross the U.S. around the Thanksgiving. the parade of storms will then send a full-scale storm system toward the Great Lakes about every three to five days. Depending how they track, there can be warmer weather that is usually to the south side of the storm track. It's up to Mother Nature.

Although natural gas inventories rose, it appears gas prices are not agreeing and going higher. Perhaps the market is starting to price in winter weather, just a little late this year. On the chart we see a strong move up on Monday and I expect a test of resistance just over $7 next. As I mentioned before, the down trend channel has been broken and we have a double bottom in around $5.

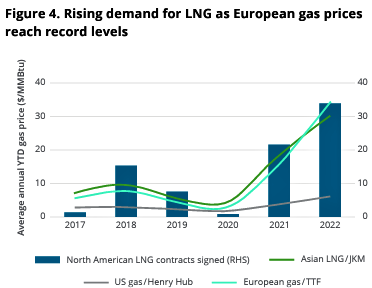

There is not much confidence to invest on the oil&gas side. According to a recent Deloitte outlook report, in the first 9 months of 2022 oil&gas merger and acquisition activity dropped -27% year over year despite oil prices averaging above $100/bbl and the upstream industry's financial health reaching an all time best. They also indicate strong demand on US LNG that is eventually going to positively effect US Natural Gas prices.

I expect this winter we will see that huge gap between US Henry Hub prices and European gas prices close significantly. I expect US prices of $10 to $15.

I am not going to get into much detail on the oil side other than an obvious reversal on the chart. Today and the last couple days was a good washout bottom in the oil price. The selling in the last 3 days has been on high volume and we got a hammer candle stick that hammered a bottom just above $75 on Monday. That was also a retest of the bottom from late September so to me it appears a double bottom has just been made.

My favourite Natural Gas stock is still Birchcliif Energy TSX:BIR. They are now paying a C$0.20 quarterly dividend so at the current $10.60 share price, that is a yield of 7.5%

In 2023, Birchcliff is expected to deliver annual average production of 81,000 to 83,000 barrels of oil equivalent per day, a 5-per-cent increase over 2022. Although the dividend was called a special dividend, according to their Oct. 13th press release it will continue. “Birchcliff is currently forecasting that it will generate adjusted funds flow of approximately $855-million and free funds flow of approximately $585-million to $615-million in 2023, based on current strip pricing. This anticipated significant free funds flow provides the corporation with the ability to sustainably increase shareholder returns. As previously disclosed, Birchcliff is currently targeting an annual common share dividend of 80 cents per share in 2023 (approximately $213-million annually), subject to commodity prices and the approval of the corporation's board of directors.”

"Birchcliff continued to deliver exceptional results in the third quarter, highlighted by quarterly average production of 78,079 barrels of oil equivalent per day, which resulted in record Q3 adjusted funds flow of $267.4-million ($1.01 per basic common share), record Q3 free funds flow of $182-million (69 cents per basic common share) and record quarterly net income to common shareholders of $244.6-million (92 cents per basic common share)," commented Jeff Tonken, chief executive officer of Birchcliff.

Birchcliff announced record quarterly results on November 9th. "Birchcliff continued to deliver exceptional results in the third quarter, highlighted by quarterly average production of 78,079 barrels of oil equivalent per day, which resulted in record Q3 adjusted funds flow of $267.4-million ($1.01 per basic common share), record Q3 free funds flow of $182-million (69 cents per basic common share) and record quarterly net income to common shareholders of $244.6-million (92 cents per basic common share)," commented Jeff Tonken, chief executive officer of Birchcliff. Mr. Tonken continued: "As previously announced on Oct. 13, 2022, Birchcliff paid a special cash dividend of 20 cents per share to our common shareholders on Oct. 28, 2022. Additionally, we have commenced the execution of our 2023 capital program, which we expect will result in annual average production of 81,000 to 83,000 barrels of oil equivalent per day in 2023, a 5-per-cent increase over 2022. After the payment of Birchcliff's targeted 2023 annual common share dividend of 80 cents per share (20 cents per share quarterly), we are forecasting that we will have a cash surplus of approximately $295-million to $325-million at Dec. 31, 2023. We are maintaining our 2022 guidance and preliminary 2023 guidance that we provided on Oct. 13, 2022, and we expect to announce the details of our 2023 capital program and updated five-year plan for 2023 to 2027 on Jan. 18, 2023."

The Birchcliff chart shows a rising up tren of higher lows and it appears a wedge pattern is developing. I expect the break out to the upside. My favourite oil plays are Callon Petroleum NY:CPE and Earthstone Energy NY:ESTE

Callon is trading at just 1.5 times book value and just over 1.8 times CFFO. For unknown reasons the stock has been under performing the market. I think it will play catch up now and in 2023.

With Earthstone, since my last coverage on September 27th, the news has been all great. Q3 results announced November 2nd were awesome.

Third Quarter 2022 and Other Recent Highlights

-

Repurchase of 3 million shares of Class A Common Stock for $43.7 million

-

Closed the Titus Acquisition on August 10, 2022

-

Net income attributable to Earthstone Energy, Inc. of $211.5 million, or $1.94 per Diluted Share

-

Net income of $299.3 million, or $2.09 per Adjusted Diluted Share(1)

-

Adjusted net income(1) of $186.9 million, or $1.30 per Adjusted Diluted Share(1)

-

Adjusted EBITDAX(1) of $345.8 million, up 15% compared to 2Q 2022

-

Net cash provided by operating activities of $365.5 million

-

Free Cash Flow(1) of $174.2 million, up 6% compared to 2Q 2022

-

Average net production of 94,329 Boepd(2), up 22% compared to 2Q 2022 and 7% above the midpoint of 3Q 2022 guidance

-

Capital expenditures of $147.2 million

Their production increased to over 100,000 Boepd in September. On the strength of production from new wells and continued operational improvements which resulted in exceeding their third quarter production guidance, Earthstone is increasing its fourth quarter production guidance to a new range of 98,000 -102,000 Boepd. Earthstone is trading about even to book value and just over 2 times cash flow. The company has been on a growth spurt on steroids going from around 24 Boepd a year ago to 100 Boepd now. Using current cash flow the stock is trading at just 1.5 times. These oil&gas stocks would normally trade at 5 to 10 times cash flow. I expect these days will return, once the market figures out the current energy crisis will be around much longer than is expected now.

ESTE was breaking resistance around $17, but the recent pull back in oil has only delayed this short term.