Streetwise Articles

Are You Protected from Oil Price Downside? Chen Lin Shares His Strategy

Source: Zig Lambo of The Energy Report (6/25/13)

Remember when oil shot up to $148 a barrel? Chen Lin does, and he sees potential for Wall Street market manipulation to push the oil price in the opposite direction—as low as $47 a barrel. Plus, he's bearish on China now. The good news is that Lin, publisher of What Is Chen Buying/Selling?, was willing to share his personal investment strategy in his interview with The Energy Report. Find out where Lin booked profits this year and get the names he's turning to for protection against oil price downside.

More >

After Labor Strikes, What's Next for Platinum?

Source: Brian Sylvester of The Metals Report (6/25/13)

Violent South African mining labor strikes shocked the globe in 2012, but the resulting negotiations underway could create more stable supply flows in the long term—that's how CPM Commodity Analyst Erica Rannestad sees it. In this interview with The Metals Report, Rannestad discusses the key developments that could signal a price rise and which producers could clean up big on high-priced PGMs.

More >

Roger Wiegand Predicts a Brand New World for Gold

Source: Peter Byrne of The Gold Report (6/24/13)

The quant who produces Trader Tracks newsletter tells The Gold Report that the technical charts project a brightening future for precious metals. Technical market analyst Roger Wiegand tracks annual trading cycles while keeping an expert eye on potentially disruptive world events. He is a stickler for fundamentals, though, when it comes to picking out the best juniors for safe bets in a cash-poor industry.

More >

Ben Bernanke's Real Message for Gold Investors, Translated by John Williams

Source: JT Long of The Gold Report (6/24/13)

Don't fall for propaganda from the Federal Reserve about tapering quantitative easing, says ShadowStats editor John Williams in this interview with The Gold Report. His corrected economic indicators show the U.S. is nowhere near a recovery and the Fed will have to increase rather than decrease bond buying to prop up the banks and push off inevitable dollar debasement. That could be very bad for savers, but good for gold.

More >

African Shale Gas Production Could Break Out

Source: Justin Williams, Energy & Capital (6/24/13)

"South Africa (which holds the fifth-largest reserve in the world), Morocco, Algeria, Tunisia, Libya, and Egypt are among the small group of countries that have the potential and are exploring for gas on the continent, according to the U.S. Energy Information Administration."

More >

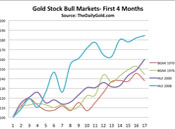

Final Capitulation Coming in Precious Metals

Source: Jordan Roy-Byrne, The Daily Gold (6/21/13)

"A close examination of history tells us that this could be the final capitulation that would lead directly to a huge rebound in the ensuing months."

More >

Five Miners Chen Lin Expects to Buck the Trend

Source: Zig Lambo of The Gold Report (6/21/13)

For most investors, the market for gold and silver stocks resembles a battlefield littered with the dead and dying, especially after the last day or two. The key for investors is picking those stocks that have the best chance for survival, and sticking with them until they are able to recover. In this interview with The Gold Report, Chen Lin tells us what he looks for to make that critical decision and why he believes that platinum and palladium should do well regardless of what is happening with gold and silver.

More >

Deadly Bacteria Are a Global Crisis: Brad Spellberg

Source: George S. Mack of The Life Sciences Report (6/20/13)

Antibiotic-resistant bacteria, like the proverbial time bomb, are poised to wreak infectious havoc on a worldwide scale. Brad Spellberg, associate professor of medicine at the Los Angeles Biomedical Research Institute and the Harbor-UCLA Medical Center, is committed to defusing the bomb with the development of new antibiotics and creative platforms. He believes investigators must look at alternative ways to deal with bad bugs, perhaps by neutralizing their toxic effects rather than killing them. In this interview with

The Life Sciences Report, Spellberg explores this critical issue and names four companies with novel technologies that address this looming global crisis.

More >

Profit from Seasonal Energy Cycles: Roger Wiegand

Source: Peter Byrne of The Energy Report (6/20/13)

For short-term traders, understanding cyclical markets is the key to profits. And with the hottest summer months ahead, natural gas could get a price boost when air conditioners start to hum, says Roger Wiegand, publisher of the Trader Tracks investment newsletter. In this interview with The Energy Report, Wiegand shares some promising names for investors who are ready to read the technical charts—and mark their calendars.

More >

Who Is Manipulating the Gold Price?

Source: Anthony Harrington, Economy Watch (6/20/13)

"Gold suffers from wild price gyrations when the markets become too disruptive, and data suggests that gold prices are regularly manipulated for the benefit of large banks and to the detriment of any retail investor trying to protect their wealth by investing in gold."

More >

What China's Crackdown on 'Midnight Mining' Means for REE Projects

Source: Jack Lifton, Technology Metals Research (6/20/13)

"The rare earth mining industry will be saddled with permanent increased operation costs."

More >

Get Ready for Stupid Cheap Silver Prices:

David H. Smith

Source: Brian Sylvester of The Gold Report (6/19/13)

It's a jungle out in the silver markets. Investors are holding on for their lives as the price of metals swings to higher highs and lower lows and junior equities bounce along the bottom. In this interview with The Gold Report, David H. Smith, senior analyst at silver-investor.com's The Morgan Report, navigates the jungle by advising which explorers, midtiers, stalwarts and royalties to consider buying in tranches on the way down and selling on the inevitable way up.

More >

Fadel Gheit: Avoid the Middle East, Invest in US Refineries

Source: Tom Armistead of The Energy Report (6/18/13)

Shifting commodity prices are a given in the oil and gas industry, but sometimes the industry landscape changes in unexpected ways. In this interview with The Energy Report, Oppenheimer & Co. Managing Director and Senior Energy Analyst Fadel Gheit discusses the effect of Middle Eastern geopolitical issues on oil production, dissects the changing oil and gas production situation in the U.S. and explains how the shift in natural gas prices has turned the refinery business from the industry's perennial ugly duckling into a beautiful swan.

More >

Seven Australian Companies to Survive a Metals Market Correction

Source: Kevin Michael Grace of The Metals Report (6/18/13)

Australian mining companies have been hard hit by falling commodities prices and rising costs. But Petra Capital Analyst Andrew Richards believes his country's resource sector has turned a corner. In this interview with The Metals Report, Richards says that costs are falling and China's need for Australian metals will continue to grow. He also names companies that are well positioned to flourish in the near future.

More >

Are the 'Special Few' Manipulating Oil Prices?

Source: Kent Moors, Money Morning (6/18/13)

"With an ability to know the inventory figures up to five seconds before the market does, major market makers can swing entire portions of the energy curve."

More >

Jay Taylor: In Precious Metals, Cash Flow Is King

Source: Kevin Michael Grace of The Gold Report (6/17/13)

The price of gold remains in the doldrums, but Jay Taylor, host of the radio show "Turning Hard Times into Good Times," expects the bull market to come roaring back. In this interview with The Gold Report, Taylor cautions that not all miners are equal and advises investors to look for companies with cash flow and the potential for organic growth.

More >

FOMC Is the Big Driver for Precious Metals this Week

Source: Ben Traynor, BullionVault (6/17/13)

"On the New York Comex, the so-called speculative net long position in gold futures and options—calculated as the number of 'bullish' long minus 'bearish' short contracts held by traders classed as speculators—fell in the week ended last Tuesday."

More >

The Hidden Costs of Precious-Metals Miners' Optimism

Source: Andrey Dashkov, Casey Research (6/17/13)

"We believe gold will rebound and head higher, as you know, but that hasn't happened yet, and some mines that went into construction or production based on unrealistic assumptions are facing greater costs and lower revenues, resulting in net incomes far below investors' expectations."

More >

Three Rules of Thumb for Watching Insider Trading: Ted Dixon

Source: Brian Sylvester of The Gold Report (6/14/13)

Data on trades made by company insiders—key executives and directors—demonstrates to Ted Dixon, co-founder and CEO of INK Research, that most of them are contrarian in their approaches. Lately, Dixon finds that insider indicators in the gold and junior gold miner sectors are "off the charts." In this interview with The Gold Report, Dixon shares the names of frequent traders in recent months, along with insights into why, when and how insiders are trading.

More >

George Soros Joins Michael Ballanger on the Goldbug Side of the Market

Source: Brian Sylvester of The Gold Report (6/14/13)

In his 36-year career, Michael Ballanger, director of wealth management at Richardson GMP, has seen good markets and bad. As a true contrarian, he sees opportunity in undervalued precious metals assets and lauds George Soros' recently reported large gold-related positions. In this interview with The Gold Report, Ballanger discusses market sentiment and some companies that he expects to take off when the market turns.

More >

New Biotech Names with Excellent Prospects: Michael Aitkenhead

Source: George S. Mack of The Life Sciences Report (6/13/13)

In a marketplace as diverse as biotech, picking the best and brightest can stymie even the savviest investor. Senior biotechnology analyst and physician Michael Aitkenhead of Edison Investment Research has done meticulous research on both the science and unmet needs to reveal the growth potential of biotechs with vastly different stories, disease indications and markets. In this interview with The Life Sciences Report, Aitkenhead details his thesis on three names, each with the ability to return large multiples on original investment.

More >

For Love and Money: Three Growth Stocks from Casey's Alex Daley

Source: George S. Mack of The Life Sciences Report (6/13/13)

Alex Daley, senior editor of Casey Extraordinary Technology, seeks out undiscovered names because that's where he finds the big upside. In this interview with The Life Sciences Report, Daley brings his best ideas to investors who won't shy away from unloved biotech and medtech names. Sharpen your pencils, steel your nerves and take note of these three growth stories.

More >

Transformative Energy Technologies: Michael and Chris Berry

Source: George S. Mack of The Energy Report (6/13/13)

The synergy of temperament and intellect has fostered much success for the father-son team of Michael Berry, editor of Morning Notes, and Chris Berry, founder of House Mountain Partners LLC. In this Father's Day interview with The Energy Report, the Berrys reveal what they've learned from each other's investment strategies over the years, and mull energy metals and emerging green technologies that could be "compelling investment opportunities." They also reveal that, for all the familial camaraderie, there are energy issues about which they strongly disagree.

More >

Mixed News for Biotech Industry: Supreme Court Upends Gene Patents

Source: Genetic Engineering and Biotechnology News (6/13/13)

" 'A naturally occurring DNA segment is a product of nature and not patent eligible merely because it has been isolated, but cDNA is patent eligible because it is not naturally occurring,' the court stated in an opinion written by Justice Clarence Thomas."

More >

Gold Has Stood the Test of Time: Michael and Chris Berry

Source: George S. Mack of The Gold Report (6/13/13)

The synergy of temperament and intellect has fostered much success for the father-son team of Michael Berry, editor of Morning Notes, and Chris Berry, founder of House Mountain Partners LLC. In this Father's Day interview, the Berrys reveal what they've learned from each other's investment strategies over the years and why they are still bullish on gold.

More >