Streetwise Articles

Promising Biotechs Target New Ways to Kill Bad Bugs: Venture Capitalist Dennis Purcell

Source: George S. Mack of The Life Sciences Report (3/18/14)

Dennis Purcell, senior managing partner of Aisling Capital, has seen the biotechnology industry morph from exciting science project to a full-blown, multibillion-dollar industry producing blockbuster products that routinely save lives. Now a new crisis is looming, as drug-resistant bacteria evolve, proliferate and wreak havoc. With this dire need driving interest, Purcell believes a change of focus, from oncology and orphan drug indications to anti-infectives, will develop in 2014 and beyond. In this interview with The Life Sciences Report, Purcell shares ideas that could offer a definitive cure for your portfolio.

More >

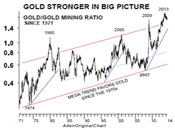

Feelin’ the Fire, Investors are Hot for Gold

Source: Frank Holmes, U.S. Global Investors (3/18/14)

"When real interest rates go above the positive 2% mark, you can expect the gold price to drop."

More >

2014: The Year Gene Editing Shocks the World

Source: Ray Blanco, The Daily Reckoning (3/18/14)

"In labs, researchers can go in and they can basically rewrite the code of life, the genome encoded on the DNA molecule."

More >

Rick Rule: Which Companies Will Bring in the Green?

Source: Karen Roche of The Gold Report (3/17/14)

Thoughts turn to green on St. Patrick's Day. Rick Rule of Sprott US Holdings believes the resources bull market is about 18 months from arriving and there could be multiple promising entry points in the market this summer. But in this interview with The Gold Report, he says that this rebound may not look like the one investors are expecting and shares tips on how to spot companies that may have pots of gold at the end of the rainbow.

More >

In Need of Financial Safety? Here's Your Safe Haven

Source: Mary Anne and Pamela Aden, The Aden Forecast (3/14/14)

"Clearly, the world has plenty of uncertainty. From Russia, Ukraine, Venezuela, emerging currency devaluations, the sluggish U.S economy, as well as the slowdown in China, the world has hot spots. With this backdrop it's easy to understand why demand continues to grow. The world wants gold."

More >

Tom Varesh: If Canada Opens the Spigot on Drilling, These Oil Services Companies Could Climb

Source: Peter Byrne of The Energy Report (3/13/14)

One of Canada's top-ranked industrial investment analysts, Tom Varesh of M Partners, tells The Energy Report where to find the best-positioned oil services companies in the oil fields of western Canada. With many pipeline and E&P projects approved and still more seeking approval, western Canada looks primed for an energy renaissance. At this point, it's a case of "if you build it, they will come." Find out about the companies doing the building, and get exposure before share prices start sprinting.

More >

Exuberant, Yes: Michael King on How the Oncology Drug Development Machine Builds Biotech Wealth

Source: George S. Mack of The Life Sciences Report (3/13/14)

Veteran biotechnology analyst Michael King of JMP Securities has seen drug development evolve from hit-or-miss to the sophisticated, high-throughput discovery techniques in place today. He understands the sector, the entrepreneurs and the valuations as well as anyone on Wall Street. In this interview with The Life Sciences Report, King zeros in on the oncology space, his focus for nearly two decades. Never single-minded, King's stable of thoroughbred names includes a bonus pick he likes very much in the field of fertility.

More >

Derek Macpherson: Is It a Love Affair or a Tryst?

Source: Brian Sylvester of The Gold Report (3/12/14)

Investors have again begun flirting with the junior mining sector. Will it lead to a love affair or is it just a tryst? Derek Macpherson, a mining analyst with M Partners, believes it is still too early to be taking on high-risk, high-leverage names. In this interview with The Gold Report, he advises investors to carefully choose low-risk companies, even in this early stage of a rising gold price environment, and names a handful that investors could fall in love with.

More >

Paul Adams: Investor-Friendly Australian Projects Around the World

Source: Kevin Michael Grace of The Mining Report (3/11/14)

Rather than shoot for the stars, Paul Adams of DJ Carmichael argues that junior miners should focus on more modest projects best suited to maximizing shareholder value. This means projects with reasonable capex, good grades and short turnaround times. In this interview with The Mining Report, Adams suggests gold, copper, iron ore and rare earths projects that can weather the complete commodities cycle, as well as a fascinating gold-silver outlier in Peru.

More >

Mike Breard: Buy Small for Deep Profits

Source: Peter Byrne of The Energy Report (3/11/14)

The Street's eyes may be on North Dakota, but Mike Breard also keeps an expert eye focused on smaller oil and gas companies drilling elsewhere. In this interview with The Energy Report, the Hodges Capital analyst discusses several companies drilling excellent wells in Texas, Oklahoma and the Gulf of Mexico. Breard, a veteran oil and gas analyst, knows the first names of some of the sharpest managers in the industry. Stick with the winning teams, he advises, even when they change firms.

More >

More than 25,000 Investors and Mining Types Walked into PDAC. The Result Was. . .Realistic

Source: JT Long of The Gold Report (3/10/14)

PDAC curse or blessing? Fresh from the Letter Writer Presentations track at the Prospectors and Developers Association of Canada (PDAC) conference,

PDAC curse or blessing? Fresh from the Letter Writer Presentations track at the Prospectors and Developers Association of Canada (PDAC) conference,

The Gold Report

asked thought leaders to share their impressions from the annual minefest. Adrian Day Asset Management Founder Adrian Day, Exploration Insights Publisher Brent Cook, House Mountain Partners Founder Chris Berry and The Daily Gold Premium Publisher Jordan Roy-Byrne used terms such as "realistic" and "muted." Eric Coffin, editor of Hard Rock Analyst, posited that the lack of excitement might actually benefit the few companies that rose on good conference-timed news because it removed the chance of a "PDAC curse" dropping stock prices after the event. Let's see if all the voices agree.

More >

Making Green from Gold, Palladium and Pollution Concerns

Source: Frank Holmes, U.S. Global Investors (3/10/14)

"It seems that fear surrounding the international political landscape is helping to push the precious metals prices higher and higher."

More >

Zimtu Capital Analyst Says All Roads Lead to the Athabasca Basin

Source: Tom Armistead of The Energy Report (3/6/14)

To the World Nuclear Association, 2% uranium ore is high grade. At 14%, 16% and even 20% uranium, the grades in the Athabasca Basin are astounding analysts and investors around the world. Derek Hamill, Zimtu Capital Corp.'s new head of research, tells The Energy Report about where the investment dollars are moving in the Athabasca Basin, and what areas and companies are worth watching going forward.

More >

Shining a Light on Overlooked and Underfollowed Biotechs: George Zavoico

Source: George S. Mack of The Life Sciences Report (3/6/14)

Prospecting for hidden biotech gems makes sense, says H.C. Wainwright & Co. Managing Director George Zavoico, who recently joined the firm's healthcare equity research team. The digging can be hard, but the rewards of successful diligence are huge. In this interview with The Life Sciences Report, Zavoico takes readers on a discovery tour that follows clinical trial data to new ideas that could bring windfalls to portfolios down the road.

More >

Better, Faster, Cheaper—You Can Have All Three in Medtech: Ben Haynor

Source: George S. Mack of The Life Sciences Report (3/5/14)

Given that medical technology is an easy target for payers looking to cut reimbursements, it's important for investors to find device and diagnostic companies with the greatest efficiencies. Accuracy, speed and economy command a premium multiple because these features ultimately relieve pressure on margins, improve quality and reduce patient risk and institutional liability. In this interview with The Life Sciences Report, Senior Research Analyst Ben Haynor of Feltl & Co. shares his top two medtech names, which he expects will achieve outsized gains this year. He also delivers a couple of bonus names that investors could parlay into a profitable small- and micro-cap portfolio.

More >

Ron Struthers: The Juniors Are Forging the Path Forward

Source: Kevin Michael Grace of The Gold Report (3/5/14)

Is the bear market in mining equities finally over? It looks that way, says Ron Struthers, publisher and editor of Struthers' Resource Stock Report. In this interview with The Gold Report, Struthers explains what distinguishes this recovery from past ones: TSX Venture Exchange stocks, not the majors, are leading the way. But which juniors should investors favor? Struthers names several with proven management, ample funding and good share structures.

More >

Kiril Mugerman: Graphite Investors Should Look for Large Flakes, Small Resources

Source: Kevin Michael Grace of The Mining Report (3/4/14)

Companies that boast 80,000 ton-per-year production or high purity levels don't always impress Kiril Mugerman, mining analyst with Industrial Alliance Securities. Why? Because finding buyers for all those tons is a huge challenge, and thrifty end-users like to purify lower-grade graphite in-house. In this interview with The Mining Report, Mugerman explains why he looks for smaller projects that can hit revenue targets, and indicates which of the 176 graphite projects out there are worth your attention.

More >

Uranium Hot Spots: Mauritania, Gabon and Zambia

Source: Uranium Investing News (3/4/14)

"These countries have potential that has attracted many companies, from juniors to established multinationals."

More >

Michael Ballanger: Junior Miners Rise from the Ashes

Source: Brian Sylvester of The Gold Report (3/3/14)

You didn't really think that junior miners would languish forever, did you? Junior mining stocks are starting to make a careful climb from the depths after tax-loss selling in December. But some investors, beaten down as badly as mining stocks, are still hesitant. For those investors, Michael Ballanger, director of wealth management and a certified investment manager with Richardson GMP, has a win-win strategy. In this interview with The Gold Report, Ballanger talks about his investment ideas for 2014 and a less risky twist on the balanced portfolio.

More >

Evaluate Biotech Stocks with Cynicism: Debjit Chattopadhyay

Source: George S. Mack of The Life Sciences Report (2/27/14)

Biotech investing is a risky business, so investors should thoroughly examine a company's vital statistics before taking the plunge. That's the recommendation of Managing Director Debjit Chattopadhyay of Emerging Growth Equities, who brings a strict scientific discipline to stock analysis. As a former medical researcher, Chattopadhyay comes by his skepticism honestly, and in this interview with The Life Sciences Report, he brings five exciting—but critically scrutinized—growth names to investors' attention.

More >

Biotech investing is a risky business, so investors should thoroughly examine a company's vital statistics before taking the plunge. That's the recommendation of Managing Director Debjit Chattopadhyay of Emerging Growth Equities, who brings a strict scientific discipline to stock analysis. As a former medical researcher, Chattopadhyay comes by his skepticism honestly, and in this interview with The Life Sciences Report, he brings five exciting—but critically scrutinized—growth names to investors' attention.

More >

Bryan Brokmeier Remains Bullish on Life Sciences Tools and Diagnostics Companies

Source: George S. Mack of The Life Sciences Report (2/27/14)

This will be a great year for life sciences tools and diagnostics companies, says Bryan Brokmeier of Maxim Group. And no, growth won't be driven by irrational exuberance, the senior analyst explains in this interview with The Life Sciences Report. Instead, the industry is bolstered by powerful tailwinds fanning new demand for molecular diagnostics, and by the clamoring of academia, pharmas and biotechs for specialized assay platforms. As Brokmeier lays out his sector growth theory, he also highlights a group of stocks with value drivers that could power a portfolio with biotechlike growth potential.

More >

A Pair of Top Picks, a Risky Pair and an Ace in the Hole: Justin Anderson Shows His Hand

Source: Tom Armistead of The Energy Report (2/27/14)

Since its inception in 2007, the Salman Partners' Top Pick Index has made a 251% return. The index is a huge pot for investors in the international oil and gas space to bet on, but it's not for the untutored. Salman Partners Analyst Justin Anderson walked The Energy Report through the risks and returns of the game. Find out how he plays his hand.

More >

Michael Fowler: How to Find Wildflowers in the Weeds

Source: Brian Sylvester of The Gold Report (2/26/14)

Michael Fowler, senior mining analyst with Loewen Ondaatje McCutcheon Ltd. in Toronto, doesn't typically focus on midtier gold companies, but the opportunities are just too good to pass up. In this interview with The Gold Report, Fowler tells us that even private equity is getting into the game and discusses a handful of companies that are good growth plays.

Michael Fowler, senior mining analyst with Loewen Ondaatje McCutcheon Ltd. in Toronto, doesn't typically focus on midtier gold companies, but the opportunities are just too good to pass up. In this interview with The Gold Report, Fowler tells us that even private equity is getting into the game and discusses a handful of companies that are good growth plays.

More >

Gold: The Most Sought-After Metal on Earth

Source: Visual Capitalist (2/26/14)

How did gold become the most sought-after metal on earth? Visual Capitalist has some answers.

More >

Paul Renken: For 2014 Gains, Look to Uranium, PGMs and Gems

Source: Brian Sylvester of The Mining Report (2/25/14)

Paul Renken, senior geologist and analyst with VSA Capital, calls 2014 a soft year for gold and silver prices, but foresees stronger prices—and demand—for nickel, copper and tech metals as the year progresses. In this Mining Report interview, he lists the three commodities investors should feel good about and digs into the details of the Indonesian ban on exports of raw ore.

More >