Streetwise Articles

ROTH Capital's Debjit Chattopadhyay: Marriage of Diagnostics to New Therapies Breeds Biotech Winners

Source: Dan Levy of The Life Sciences Report (7/24/14)

Aging baby boomers face increased cancer risk, and growing numbers of obese and overweight Americans face metabolic disorders that could lead to cardiovascular disease. Debjit Chattopadhyay of ROTH Capital Partners recommends that biotech investors consider these trends when looking at portfolio options in the healthcare sector. A medical researcher turned biotech analyst, Chattopadhyay highlights several companies with unique diagnostic and therapeutic technologies in this interview with The Life Sciences Report.

More >

Aging baby boomers face increased cancer risk, and growing numbers of obese and overweight Americans face metabolic disorders that could lead to cardiovascular disease. Debjit Chattopadhyay of ROTH Capital Partners recommends that biotech investors consider these trends when looking at portfolio options in the healthcare sector. A medical researcher turned biotech analyst, Chattopadhyay highlights several companies with unique diagnostic and therapeutic technologies in this interview with The Life Sciences Report.

More >

Steve Palmer Buys the Summer Sleepers

Source: Peter Byrne of The Energy Report (7/24/14)

Steve Palmer, founder of AlphaNorth Asset Management, has a "buy cheap, sell dear" investment strategy that wins, as the outperforming return on one of his investment funds demonstrates. In this interview with The Energy Report, Palmer unveils a handful of resource stocks that are slumbering through the summer doldrums, gathering strength for the Fall Revival, when undervalued stocks soar.

More >

Gold: 2014 Trends and Beyond

Source: Visual Capitalist (7/24/14)

"This infographic covers gold trends that investors should be watching through the rest of the year and beyond."

More >

What Do Droughts Mean for Potash Investors?

Source: Vivien Diniz, Resource Investing News (7/24/14)

"Droughts, while not so good for farmers, are good for fertilizer prices."

More >

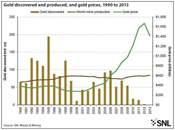

Doug Loud and Jeff Mosseri: Three Reasons Why Gold and Gold Stocks Will Rise

Source: Kevin Michael Grace of The Gold Report (7/23/14)

It's hard to see the present until it's in the past. What does this mean for gold? Money managers Doug Loud and Jeff Mosseri of Greystone Asset Management say that a bull market may have already begun. All the signs are there: rising political tension, a shortage of new supply and a cull of the weakest stocks. In this interview with The Gold Report, Loud and Mosseri list a dozen gold, silver and copper companies that should ride the crest of the wave.

More >

Prices to Buy Gold Led by Geopolitics and Bond Yields

Source: Adrian Ash, Bullion Vault (7/23/14)

"The decline in long-term real US Treasury yields also supported gold. . .[but] upward yield pressure as the global cycle improves and disappointing physical demand in China and India remain downward forces."

More >

Jocelyn August: Upcoming Catalysts for Precious and Base Metals, Uranium and Oil and Gas Plays

Source: Brian Sylvester of The Mining Report (7/22/14)

Timing the market is sometimes more important than finding the right equities. But if you can time the market and find the right equities, that can be the most direct path to success. Jocelyn August, senior analyst and product manager with Sagient Research's CatalystTracker.com, follows catalysts that move resource stocks with regularity, sometimes 10% or more. In this interview with The Mining Report, August discusses some upcoming catalysts in the precious and base metals spaces, and names others in uranium and oil and gas.

More >

Miners Must Control Costs to Improve Share Prices: Byron King

Source: JT Long of The Gold Report (7/21/14)

Global unrest and inflation will play a role in improving fundamentals for gold and silver, Byron King, newsletter editor for Agora Financial, tells The Gold Report. But miners have to control costs and clean up their internal cash flow, too. Meanwhile, investors who have run up gains in traditional investments are looking for new asset classes. King shares the names of a few well-managed companies in the gold, graphite and rare earth space that are husbanding their assets and adding value, sometimes in unexpected ways.

More >

Jet Fuel or Liquid Natural Gas: Now Available from a Trash Bin Near You

Source: Tim Sklar, Biofuels Digest (7/21/14)

"The focus of this article is to explore the Waste-to-LNG pathway in greater depth, to illustrate the complexity in trying to choose the best waste-to-biofuels pathway."

More >

Research Points to Drastic Fall in New Gold Discoveries

Source: Lawrence Williams, Mineweb (7/18/14)

"Research points to a dramatic fall in new gold discoveries, which are falling well behind global production levels. This will have a significant impact on gold supply ahead."

More >

Tempering Insane Optimism with Due Diligence: Alan Leong on Niche Biotech Prospects

Source: George S. Mack of The Life Sciences Report (7/17/14)

Alan Leong has chosen to look for investments positioned in less obvious alcoves of the market. Interestingly, this concept could be a competitive advantage for retail investors. His niche markets include orphan, metabolic and animal companion medicine, as well as some less obvious indications for regenerative medicine. In this interview with The Life Sciences Report, the CEO of biotech analysis company BioWatch News cites four unconventional biotech and specialty pharma names positioned to generate significant returns for investors.

More >

Dial In on Diabetes Solutions with LabStyle Innovations Corp.'s Dario

Source: Tracy Salcedo-Chourré of The Life Sciences Report (7/17/14)

Having a chronic disease like diabetes engenders a sense of isolation that hasn't been adequately addressed by technology until now. With Dario, LabStyle Innovations Corp. has created a device that not only provides vital medical information to a diabetic patient in real time, but also connects that patient to a community of care providers, family and online resources. In this interview with The Life Sciences Report, LabStyle President and CEO Erez Raphael describes how the Dario software platform could provide sufferers of other chronic diseases with the benefits of real-time data and community as well.

More >

Catalyst Check: Updating the Progress of Energy Stocks on the Natural Resources Watchlist

Source: JT Long of The Energy Report (7/17/14)

At the beginning of June, The Gold Report assembled an all-star expert team to create a Natural Resources Watchlist, a promising portfolio of mining and energy companies with upcoming catalysts such as a maiden NI 43-101, funding from a strategic partner, a permitting milestone or a feasibility study. Keith Schaefer, editor and publisher of the Oil & Gas Investments Bulletin, and Rick Rule, CEO of Sprott US Holdings Inc., proposed five energy companies with many resources at play. A lot has happened since that discussion in Vancouver. The total portfolio is up 14% as of today. Let's check in to see how the individual energy stocks are faring.

More >

Sean Rakhimov: Upward Trend a Silver Investor's Friend

Source: Brian Sylvester of The Gold Report (7/16/14)

An upward trend is afoot in the silver space, says Sean Rakhimov, editor of SilverStrategies.com. Rakhimov believes that at $26/ounce the reversal of the downward trend in silver will be confirmed and silver investors should set their sights on the next resistance level—$32/ounce. And if that threshold is breached, silver will test $50/ounce and more. In this interview with The Gold Report, Rakhimov talks about a few silver miners that are well positioned to ride this trend perhaps several multiples higher.

More >

Tom Hayes' Trio of Rare Earth Project Contenders

Source: Kevin Michael Grace of The Mining Report (7/15/14)

It's not the size of a rare earth elements project resource that determines its success, declares Tom Hayes of Edison Investment Research. In this interview with The Mining Report, he explains that companies will win based on their holdings of heavy and strategic rare earths and their ability to secure funding. With the race on to develop non-Chinese REE sources, he suggests three projects likely to end up on the podium.

More >

Multibillion-Dollar Takeover Reflects Lithium Market Potential

Source: Bloomberg (7/15/14)

"The market for lithium, which is also used in batteries for laptop computers, may double in a decade, with demand growing at 7–10% annually."

More >

Thomas Schuster's Five Stocks to Buy and Hold

Source: Kevin Michael Grace of The Gold Report (7/14/14)

Consulting Mining Analyst Thomas Schuster looks at the longer term in mining. He is bullish on gold but cautions that we won't see an end to the bear market in precious metals equities until financing again becomes readily available. In this interview with The Gold Report, the publisher of the "Rocks To Riches" research reports presents five companies in gold, silver and niobium with the management and projects to ride out the storm.

More >

2014 Commodities Halftime Report

Source: Frank Holmes, U.S. Global Investors (7/14/14)

"After a disappointing 2013, the commodities market came roaring back full throttle, outperforming the S&P 500 Index by more than four percentage points and 10-year Treasury bonds by more than six."

More >

Will New Technology Make You Love Going to the Dentist?

Source: Stephen Petranek, Daily Reckoning (7/14/14)

"Dentistry is ripe for high-tech blockbusters."

More >

Looking for the Next Oil Boom? Follow the Tech

Source: James Stafford, Oilprice.com (7/14/14)

"New technology has brought us full circle back to the Permian Basin in Texas and New Mexico, where the recent shift to horizontal well drilling has rendered this play the unexpected ground zero."

More >

Turnaround Stories Lead Reni Benjamin's Biotech Front-Runners

Source: George S. Mack of The Life Sciences Report (7/10/14)

The biotech bull market is not over. That's the judgment of Reni Benjamin of H.C. Wainwright & Co., who predicts high quality data from a broad range of small- and mid-cap biotechs will move shares higher during the summer and especially in the fall. In this interview with The Life Sciences Report, Benjamin showcases names with powerful platforms and market winds to their backs, which he believes could vigorously multiply investor capital over the next 12–18 months.

More >

Jeb Handwerger: Are You Ready for Doubles and Triples in Uranium Mining Stocks?

Source: JT Long of The Energy Report (7/10/14)

Are you brave enough to buy straw hats in winter? From uranium to oil services to lithium, savvy investors can find innovative ways to make money based on fundamental supply and demand rather than emotion and fashion. In this interview with The Energy Report, Gold Stock Trades editor Jeb Handwerger outlines the trends that will shape the future of energy commodity investing, and names some of the best examples of shabby chic stocks worth more than their current price tags.

More >

Chris Mancini's Keys to Successful Gold Stock Picking

Source: Brian Sylvester of The Gold Report (7/9/14)

Chris Mancini, an analyst with the Gabelli Gold Fund, spends his days finding value in gold equities—and he thinks he's found a recipe for success. Take a long-term outlook, add excellent management, fold in a great project in a quality jurisdiction with low-cost minable ounces in the ground—et voila! Mancini calls this "optionality," and in this interview with The Gold Report he says that equities with optionality will not only survive the downturn, but also provide excellent leverage to an inevitable upward move in the gold price. Check out some rising names in the Gabelli Gold Fund.

More >

Into Record-Setting Territory: Huge Q2 for Biotech and Pharma M&A

Source: Amy Brown, EP Vantage (7/9/14)

"The stampede of U.S. companies seeking shelter from the country’s high domestic corporation tax rate has largely driven the deal making. This financial engineering has been widely applauded by the markets but has increasingly been raising the ire of politicians."

More >

The Real Winners of the Iraqi Conflict Are Here in the US

Source: Byron King, Daily Reckoning (7/9/14)

"There’s a continental scale, geopolitical disaster occurring across MENA."

More >