Streetwise Gold Articles

Gartman Reckons End-Game for Gold Price Management Could Be Nigh

Source: Lawrence Williams, Mineweb (8/11/14)

"Dennis Gartman warns that the dangerous geopolitical situation could defeat the financial forces that are keeping the gold price depressed."

More >

Jason Hamlin Says Gold Is Unstoppable, with Stocks Leading the Way

Source: Kevin Michael Grace of The Gold Report (8/6/14)

Downward manipulation of gold and silver is real, declares Jason Hamlin, but the longer it continues, the higher prices will go when the free market reasserts itself. In this interview with The Gold Report, the publisher of the Gold Stock Bull newsletter argues that rising geopolitical anxiety coupled with endless monetary expansion could lead to explosive growth in precious metals and equities. He also lists his favorite royalty/streaming companies and gold and silver miners.

More >

David Sadowski: Are You Ready for Upward Pressure on Uranium Prices?

Source: Peter Byrne of The Mining Report (8/5/14)

Take advantage of the temporary bear market in uranium juniors, David Sadowski tells The Mining Report. The Raymond James mining analyst explains why uranium prices are low and why they will rise in the medium term. Hint: It has something to do with how orange juice is produced. And he talks about why a gold lining makes the metals market a solid bet.

More >

John Hathaway and Doug Groh: Buy Gold Like It's 1999

Source: JT Long of The Gold Report (8/4/14)

The overall markets are exuberant. Valuations rise regardless of value created. And gold is conspicuously not at the party. All of this sounds very familiar to John Hathaway and Doug Groh, portfolio managers of the Tocqueville Gold Fund. It is like 1999 all over again. In this interview with The Gold Report, the pair of fund managers shares their top 10 picks for a diversified portfolio that minimizes risk while maximizing the upside they see coming sooner rather than later.

More >

Ralph Aldis: Don't Get Married to Your Stocks—It's a Performance-Based Relationship

Source: Brian Sylvester of The Gold Report (7/30/14)

Ralph Aldis, portfolio manager with U.S. Global Investors, is a well-respected mining analyst. His detailed knowledge of the companies in the U.S. Global Investors Gold and Precious Metals Fund and across the entire precious metals space has taken years of meticulous work and dedication to his craft. Aldis urges investors not to get married to their stocks, but in this interview with The Gold Report, he discusses lots of names that are good for a fling right now.

More >

From Argentina to the Athabasca: Etienne Moshevich on Hot Prospects

Source: Tom Armistead of The Mining Report (7/29/14)

Unearthing lucrative investments sometimes means following the money. In this interview with The Mining Report, Etienne Moshevich, editor of Alphastox.com, describes how juniors—and investors—can capitalize on the valuable resources the majors recognize in the vast shale oil fields of Argentina, Canada's glowing Athabasca Basin and elsewhere. Moshevich discusses companies equipped with both the management and resources to hitch a profitable ride on the majors' gravy train.

More >

Paul Renken: Bottom-Fishing for the Best Junior Resource Equities

Source: Brian Sylvester of The Gold Report (7/28/14)

It's the lazy days of summer and Paul Renken, senior geologist and analyst with VSA Capital, is bottom-fishing. He sees a lot of value in unloved resource equities and spends much of his time sifting through the lot to find juniors that will get the increasingly sparse financing needed to turn potential into production. Renken offers an abundant catch of equity picks in this interview with The Gold Report.

More >

No Pain, No Gain: A Forecast for the Miners

Source: Jordan Roy-Byrne, The Daily Gold (7/25/14)

"Throughout the past year we've been looking for that final low in gold, but it has eluded us multiple times."

More >

Gold: 2014 Trends and Beyond

Source: Visual Capitalist (7/24/14)

"This infographic covers gold trends that investors should be watching through the rest of the year and beyond."

More >

Doug Loud and Jeff Mosseri: Three Reasons Why Gold and Gold Stocks Will Rise

Source: Kevin Michael Grace of The Gold Report (7/23/14)

It's hard to see the present until it's in the past. What does this mean for gold? Money managers Doug Loud and Jeff Mosseri of Greystone Asset Management say that a bull market may have already begun. All the signs are there: rising political tension, a shortage of new supply and a cull of the weakest stocks. In this interview with The Gold Report, Loud and Mosseri list a dozen gold, silver and copper companies that should ride the crest of the wave.

More >

Prices to Buy Gold Led by Geopolitics and Bond Yields

Source: Adrian Ash, Bullion Vault (7/23/14)

"The decline in long-term real US Treasury yields also supported gold. . .[but] upward yield pressure as the global cycle improves and disappointing physical demand in China and India remain downward forces."

More >

Jocelyn August: Upcoming Catalysts for Precious and Base Metals, Uranium and Oil and Gas Plays

Source: Brian Sylvester of The Mining Report (7/22/14)

Timing the market is sometimes more important than finding the right equities. But if you can time the market and find the right equities, that can be the most direct path to success. Jocelyn August, senior analyst and product manager with Sagient Research's CatalystTracker.com, follows catalysts that move resource stocks with regularity, sometimes 10% or more. In this interview with The Mining Report, August discusses some upcoming catalysts in the precious and base metals spaces, and names others in uranium and oil and gas.

More >

Miners Must Control Costs to Improve Share Prices: Byron King

Source: JT Long of The Gold Report (7/21/14)

Global unrest and inflation will play a role in improving fundamentals for gold and silver, Byron King, newsletter editor for Agora Financial, tells The Gold Report. But miners have to control costs and clean up their internal cash flow, too. Meanwhile, investors who have run up gains in traditional investments are looking for new asset classes. King shares the names of a few well-managed companies in the gold, graphite and rare earth space that are husbanding their assets and adding value, sometimes in unexpected ways.

More >

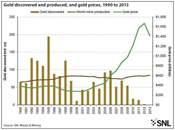

Research Points to Drastic Fall in New Gold Discoveries

Source: Lawrence Williams, Mineweb (7/18/14)

"Research points to a dramatic fall in new gold discoveries, which are falling well behind global production levels. This will have a significant impact on gold supply ahead."

More >

Sean Rakhimov: Upward Trend a Silver Investor's Friend

Source: Brian Sylvester of The Gold Report (7/16/14)

An upward trend is afoot in the silver space, says Sean Rakhimov, editor of SilverStrategies.com. Rakhimov believes that at $26/ounce the reversal of the downward trend in silver will be confirmed and silver investors should set their sights on the next resistance level—$32/ounce. And if that threshold is breached, silver will test $50/ounce and more. In this interview with The Gold Report, Rakhimov talks about a few silver miners that are well positioned to ride this trend perhaps several multiples higher.

More >

Thomas Schuster's Five Stocks to Buy and Hold

Source: Kevin Michael Grace of The Gold Report (7/14/14)

Consulting Mining Analyst Thomas Schuster looks at the longer term in mining. He is bullish on gold but cautions that we won't see an end to the bear market in precious metals equities until financing again becomes readily available. In this interview with The Gold Report, the publisher of the "Rocks To Riches" research reports presents five companies in gold, silver and niobium with the management and projects to ride out the storm.

More >

2014 Commodities Halftime Report

Source: Frank Holmes, U.S. Global Investors (7/14/14)

"After a disappointing 2013, the commodities market came roaring back full throttle, outperforming the S&P 500 Index by more than four percentage points and 10-year Treasury bonds by more than six."

More >

Chris Mancini's Keys to Successful Gold Stock Picking

Source: Brian Sylvester of The Gold Report (7/9/14)

Chris Mancini, an analyst with the Gabelli Gold Fund, spends his days finding value in gold equities—and he thinks he's found a recipe for success. Take a long-term outlook, add excellent management, fold in a great project in a quality jurisdiction with low-cost minable ounces in the ground—et voila! Mancini calls this "optionality," and in this interview with The Gold Report he says that equities with optionality will not only survive the downturn, but also provide excellent leverage to an inevitable upward move in the gold price. Check out some rising names in the Gabelli Gold Fund.

More >

David H. Smith: PGMs Will Lead the Charge of the Bulls

Source: Brian Sylvester of The Gold Report (7/7/14)

Precious metals investors have endured much hardship during the recent bear market but David H. Smith, senior analyst with David Morgan's The Morgan Report, believes that another secular bull market in precious metals is already underway. In this interview with The Gold Report, Smith says that platinum group metals will lead the resurgence and have a favorable long-term risk/reward ratio. He outlines some PGM, gold and silver companies that can grab the bull by its horns.

More >

Hints of a Mining Comeback in the Wind?

Source: Steve Todoruk, Daily Resource Hunter (7/7/14)

"It looks like companies are feeling that the bottom has been passed, while deposit valuations are still low enough to be considered attractive target acquisitions."

More >

Palladium Price Soars to 13-Year High

Source: Kip Keen, Mineweb (7/7/14)

"Palladium's performance sets it apart from platinum. While platinum prices have been strong lately, reflecting the aftermath of the platinum sector strike in South Africa, that movement pales in comparison to palladium."

More >

Inflate Your Way to Gold Profits with Edward Karr

Source: Peter Byrne of The Gold Report (7/2/14)

From his vantage in Geneva, Edward Karr, the founder of the investment firm RAMPartners SA, tells The Gold Report why European bankers are destined to inflate their way out of structural crisis and why that is good news for the price of gold. Karr believes gold has bottomed and should explode upward, and he profiles a handful of sleeping lions whose stock should roar back to life with rising precious metals prices.

More >

Rick Mills' Econ 101—Rising Demand and Falling Supply Equals Higher Metals Prices

Source: Kevin Michael Grace of The Mining Report (7/1/14)

Juniors can't fund their projects, which means that the majors' reserves will continue to shrink. Rick Mills argues that this process can have but one result: higher metals prices across the board. In this interview with The Mining Report, the owner and host of Ahead of the Herd.com highlights a half-dozen gold, silver, copper and nickel companies that will leverage these high prices, and introduces us to a Canadian company's unique cobalt project in Russia.

More >

Dodge Economic Bullets with Greg McCoach's Golden Strategy

Source: JT Long of The Gold Report (6/30/14)

There may be blood in the streets, but in today's market, the tribulations of junior miners could represent a boon for investors. With gold prices testing and retesting the bottom, and despite his dour outlook on the future of global economics, newsletter publisher Greg McCoach tells The Gold Report that to survive the endgame, investors should both hold gold and seek out stock in explorers with solid prospects.

More >

The Best Reasons to Own Gold

Source: Visual Capitalist (6/25/14)

The most simple and compelling argument for owning gold for the average investor is to diversify a portfolio.

More >