Streetwise Gold Articles

Tell Us, Christos Doulis, Can Gold Act as a Safe Haven Again?

Source: Brian Sylvester of The Gold Report (9/22/14)

PI Financial mining analyst Christos Doulis says six years ago when the financial crisis was in full swing, safe-haven buying made gold skyrocket. Today, the fear component is down, as is the price of gold. That is why Doulis believes investors need to own bulletproof, low-cost names that can survive this environment. In this interview with The Gold Report, Doulis discusses some M&A possibilities and points to management teams getting the most out of their low-cost precious metals assets.

More >

Commodities Capitulation—A Blip or the Start of Something More?

Source: Chris Berry, Disruptive Discoveries Journal (9/22/14)

"By most accounts, commodity prices are at five year lows. Almost everything, from gold to silver to iron ore to wheat to corn, is falling—hard. ."

More >

Eric Coffin: Can Investors Still Find Tenbaggers?

Source: Kevin Michael Grace of The Gold Report (9/17/14)

The continuing strength of the U.S. dollar is bad news for the price of gold, and Eric Coffin believes that in the short term a price of $1,200/oz is possible, though there is room now for an oversold bounce. This, of course, is bad news for gold miners and explorers. But in this interview with The Gold Report, the publisher of Hard Rock Analyst counsels that even in a bull market, investors are advised to seek out potential tenbaggers, and presents several companies in gold, base metals and uranium with the potential to flourish even in hard times.

More >

Jeff Desjardins and James Fraser Look at Junior Miners in a Way that May Surprise You

Source: Brian Sylvester of The Mining Report (9/16/14)

It's never too late to find a new way to evaluate mining companies, and Jeff Desjardins and James Fraser of Tickerscores.com have developed one based on over 20 different criteria. Add in some near-term catalysts and the wheat separates from the chaff. In this interview with The Mining Report, Desjardins and Fraser share the names of companies with some of Tickerscores.com's highest junior mining scores.

More >

Anticipate Before You Participate in the Market

Source: Frank Holmes, U.S. Global Investors (9/16/14)

"Gold is a classic example of a commodity that rotates through seasonal cycles year after year."

More >

Brien Lundin Says Don't Miss This Buying Opportunity

Source: Brian Sylvester of The Gold Report (9/15/14)

Brien Lundin, founder of Jefferson Financial, producer of the New Orleans Investment Conference and Gold Newsletter, believes at least a small amount of the massive liquidity produced by loose monetary policy in Western economies will find its way into mining equities following a summer pullback in equity prices—but don't wait long. Lundin expects the "buying opportunity" to last for two, maybe three weeks before seasonal gold demand pushes prices higher. In this exclusive interview with The Gold Report, Lundin discusses a select group of gold and precious metals equities that he expects to perform well as near-term news reaches the market.

More >

How Does World Disorder Affect Investment?

Source: Donald Coxe, Casey Research (9/12/14)

"Capitalism is doing its job: to expand output of goods and services, thereby preventing shortages from derailing recoveries through inflation. That success story means central bankers can keep printing away. So what should investors do?"

More >

Jeff Killeen: Cash and Catalysts Rule the Day

Source: Brian Sylvester of The Gold Report (9/10/14)

Jeff Killeen, mining analyst with CIBC World Markets, has spent much of 2014 on the road vetting junior mining projects. He says that the cash-and-catalyst mindset should remain prevalent for investors looking at explorer and developer equities, while improving operations has been the biggest motivator for producer share prices in 2014. In this interview with The Gold Report, Killeen offers his insight and hands-on perspective on several developers and producers with near-term catalysts.

More >

Filipe Martins: African Miners that Can Generate Cash Flow and Dividends

Source: Kevin Michael Grace of The Mining Report (9/9/14)

Low all-in gold cash costs are a good thing, says London-based GMP Securities Analyst Filipe Martins, but they don't tell the whole story. In this interview with The Mining Report, Martins argues that the best companies are those with strong free cash flow yields and a view to return cash to investors. Many of these companies have gold, copper, titanium and graphite projects in Africa, which boasts low-risk jurisdictions in addition to high-grade geology.

More >

Low all-in gold cash costs are a good thing, says London-based GMP Securities Analyst Filipe Martins, but they don't tell the whole story. In this interview with The Mining Report, Martins argues that the best companies are those with strong free cash flow yields and a view to return cash to investors. Many of these companies have gold, copper, titanium and graphite projects in Africa, which boasts low-risk jurisdictions in addition to high-grade geology.

More >

Sprott's Charles Oliver: Gold at $1,500 by Christmas?

Source: Kevin Michael Grace of The Gold Report (9/8/14)

Gold and silver prices are being repressed by central banks, but Sprott Asset Management's Charles Oliver argues that demand pressure will cause this dam to burst sooner rather than later. As a result, he expects big increases in the prices of gold and especially silver, with a corresponding recovery of small- and mid-cap precious metal equities. In this interview with The Gold Report, Oliver discusses companies likely to prosper thereby, most of which will be profitable now, even at current bullion prices.

More >

Gold in the USA

Source: Visual Capitalist (9/8/14)

"The United States has always had a love affair with the yellow metal. It all started in Stafford, Virginia in 1782, when Thomas Jefferson documented the first gold discovery himself."

More >

Will We Have Enough New Mines?

Source: Henry Bonner, Daily Resource Hunter (9/3/14)

"Despite a tenfold increase in the amount of money spent on exploration over the last decade, the amount of new discoveries was relatively unchanged—meaning that more money was spent per new discovery."

More >

Raj Ray: Miners' Cost Cutting Set to Deliver in Late 2014

Source: Brian Sylvester of The Gold Report (9/3/14)

When gold prices plunged in late 2013, gold producers took notice and developed mine plans that offered greater flexibility in troubled times. But even the best plans take time. Well, it's almost time for the producers to deliver, says Raj Ray, associate metals and mining analyst with National Bank Financial. He is looking for producers with flexible mine plans that can generate cash flow against a backdrop of static gold prices; the market likes developers with advanced, low-capital intensity projects with permits in place. Ray delivers his top gold producer and developer picks in this interview with The Gold Report.

More >

How is Doug Casey Preparing for a Crisis Worse than 2008? He and His Fellow Millionaires Are Getting Back to Basics

Source: JT Long of The Mining Report (9/2/14)

Trillions of dollars of debt, a bond bubble on the verge of bursting and economic distortions that make it difficult for investors to know what is going on behind the curtain have created what author Doug Casey calls a crisis economy. But he is not one to be beaten down. He is planning to make the most of this coming financial disaster by buying equities with real value—silver, gold, uranium, even coal. And, in this interview with The Mining Report, he shares his formula for determining which of the 1,500 "so-called mining stocks" on the TSX actually have value.

More >

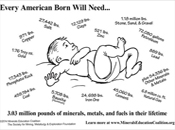

Today's U.S. 'Baby' Will Consume 3 Mlbs Metals and Minerals In Lifetime

Source: Lawrence Williams, Mineweb (9/1/14)

"The projected lifetime consumption of metals and minerals by today's U.S. baby extrapolated across the world presents an enormous challenge for the global resource sector."

More >

Keith Phillips: M&A Prey Offer Compelling Buying Opportunities

Source: Brian Sylvester of The Gold Report (8/27/14)

Keith Phillips, a managing director and head of Cowen & Company's Mining Investment Banking Group, says strong companies with solid balance sheets are on the hunt for precious metals development projects or small producers trading at steep discounts. In this interview with The Gold Report, Phillips explains that these juniors represent unprecedented value for acquirers with longer-term goals, and he tracks some potential M&A prey.

More >

Canaccord's Luke Smith: Five Aussie Companies with Cash Flows, Low Costs and MOUs

Source: Kevin Michael Grace of The Mining Report (8/26/14)

Now more than ever, only select mining companies are attracting investors. Luke Smith, head of mining research for Canaccord Genuity in Melbourne, argues that low costs, increasing cash flows and improved net cash positions are crucial for gold companies. Solid contracts with end-users and strong institutional support are crucial for commodities. In this interview with The Mining Report, Smith highlights two undervalued Australian gold companies and three Australian companies in graphite and lithium that have already seen explosive share growth and appear poised for even greater gains.

More >

K-Waves: How to Predict the Next 'Gold Rush'

Source: Henry Bonner, Daily Reckoning (8/26/14)

"It's going to be a painful period in the economy, but I believe gold will shine as we have seen before, during the long wave economic winters."

More >

Junior Mining Companies that Will Make Beautiful M&A Music: AgaNola's Florian Siegfried

Source: Brian Sylvester of The Gold Report (8/20/14)

Florian Siegfried, head of precious metals and mining investments with Switzerland-based AgaNola Ltd., knows where the music is playing in the mining M&A space. In this interview with The Gold Report, Siegfried notes that well-financed juniors with low production and capital costs, or intermediate cash-flowing producers, will be hitting the M&A high notes, and suggests a sextet of companies capable of making beautiful music.

More >

CEOs in Mining

Source: Visual Capitalist (8/20/14)

The CEOs of the top 25 gold, silver, copper, coal and base metals mining companies in the world are profiled in this infographic.

More >

Minerals Versus Marijuana

Source: Douglas French, The Daily Reckoning (8/19/14)

"Rule, Casey, Cook, and James say now is the time to invest in natural resource plays, not run for high-tech or a product to get high with."

More >

Björn Paffrath: Mining Sector Bottom Is In and Opportunities Abound

Source: Brian Sylvester of The Gold Report (8/18/14)

Björn Paffrath, Switzerland-based fund adviser and newsletter writer, is so convinced that we've seen the bottom in the mining sector that he's launching a new gold and silver fund in Europe. He says capital is trickling back into long-forgotten mining equities as the smart money seeks to rotate out of frothier sectors and into real assets. In this interview with The Gold Report, Paffrath also forecasts a broad market correction as he tells us about some promising equity positions.

More >

The Great Divide: Inequality in Gold Juniors Means Opportunity

Source: Jeff Desjardins, Tickerscores (8/14/14)

"It's clear we've reached a new level of separation between the wheat and the chaff. While it took longer than expected, this "Great Divide" makes it obvious as to which companies should be avoided by retail investors."

More >

Chris Thompson: Gold and Silver Miners that Can Make Money Now

Source: Kevin Michael Grace of The Gold Report (8/13/14)

As much as we'd all like significantly higher silver and gold prices, Chris Thompson of Raymond James doesn't expect them. The good news, he argues, is that the relative stability now characterizing the market permits investors to make informed decisions about which companies can build value and demonstrate cash flows at today's prices. In this interview with The Gold Report, Thompson lists a handful of gold and silver miners prepared to do just that.

More >

As much as we'd all like significantly higher silver and gold prices, Chris Thompson of Raymond James doesn't expect them. The good news, he argues, is that the relative stability now characterizing the market permits investors to make informed decisions about which companies can build value and demonstrate cash flows at today's prices. In this interview with The Gold Report, Thompson lists a handful of gold and silver miners prepared to do just that.

More >

Jeb Handwerger: Position Yourself for Fall Fireworks

Source: Brian Sylvester of The Gold Report (8/11/14)

Investors are all too familiar with the KABOOM in precious metals prices in the fall of 2011 and the echo that's still reverberating. Three years later Jeb Handwerger, founder of GoldStockTrades.com, believes it could be the broad market's turn—and soon. In this interview with The Gold Report, Handwerger explains why it's important to position yourself for some fall fireworks and suggests some stocks with booming fundamentals.

More >