The United States is facing significant challenges, with many people expressing concerns about the country's decline, the devaluation of its currency, and the struggles of its middle class, which is increasingly being described as the working poor due to the impact of inflation and a fractured sense of identity.

Some may wonder if this marks the end of America as we know it. Will the U.S. dollar lose its status as the world's reserve currency? Will it disappear altogether? Will alternatives like gold or Bitcoin save us from the problems that are becoming increasingly apparent despite the clouded lens of the media and the growing centralization of the state?

However, while America may be slipping, it is not coming to an end. The U.S. dollar is being repriced but not replaced. It remains a key currency for spending, liquidity, and foreign exchange. However, it is no longer the premier asset for savings or storing value.

Gold, now recognized as a Tier-1 asset, will continue to be a better store of value than any fiat currency. Bitcoin will likely make headlines in the future due to its potential for significant gains. The decline of journalistic integrity in the media is well-known, preceding the controversies surrounding figures like Don Lemon and Chris Cuomo.

As for centralization, it is not a future threat but a present reality.

Be Rational, Not Reactionary

Given the significant challenges we face, it's understandable to feel concerned and emotional. However, rather than succumbing to fear or waiting for the world to end, it's more productive to prepare rationally for the changes ahead.

Instead of getting caught up in polarizing debates over political affiliations, race, gender, health policies, or the intelligence of various resolutions or individuals, we would be better served by focusing on logic and setting aside our emotions.

In doing so, it's important to rely on our own judgment rather than putting our faith in the immature decision-makers shaping domestic, monetary, and foreign policies from Washington, D.C., to Belgium.

From a logical perspective, it's clear that the U.S. dollar and the United States as a whole are undergoing significant changes. Much like the country's recent string of weak leaders, the dollar and the U.S. government's creditworthiness are demonstrably less respected, trusted, and inherently strong than they were at the time of the Bretton Woods agreement in 1944.

Change is Apparent

In the 80 years since the greatest generation of Americans stormed the beaches of Normandy in June 1944, the United States has undergone a dramatic transformation. Once the world's leading creditor nation and manufacturing powerhouse, by June 2024, the U.S. has become the world's largest debtor and has shifted much of its labor force overseas.

This is not a fictional tale but a stark reality. A veteran who fought at Normandy recently admitted that he no longer recognizes the country he fought for — a sentiment that deserves thoughtful reflection rather than knee-jerk patriotic criticism.

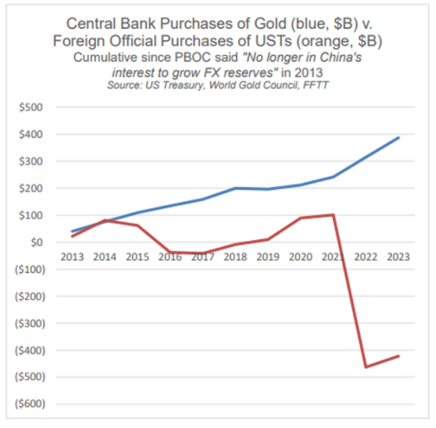

The post-2001 World Trade Organization era saw policymakers make the misguided decision to weaponize what should have been a neutral world reserve currency. In 2022, they seized US$400 billion worth of Russian assets, targeting a major nuclear power that was already economically aligned with a growing coalition of BRICS countries led by China. This move set the stage for retaliation against the U.S. dollar, as many observers realized from the first day of sanctions against Putin's Russia.

De-Dollarization

In essence, numerous countries around the globe, including oil-producing nations, swiftly realized that the world desires a reserve asset that cannot be arbitrarily frozen or confiscated and that concurrently maintains, rather than diminishes, its value.

However, instead of entirely abandoning the U.S. dollar as the global reserve currency, the majority of these nations are simply circumventing it or operating outside of its sphere of influence.

To put it more directly, the previous dominance of U.S. Treasuries and, by extension, the U.S. dollar underwent an irreversible shift in 2022.

According to insightful analysts like Ronnie Stoeferle and Luke Gromen, who focus on data and have a deep understanding of credit and currency markets, we can clearly observe the realities, rather than the sensationalism, behind these trends.

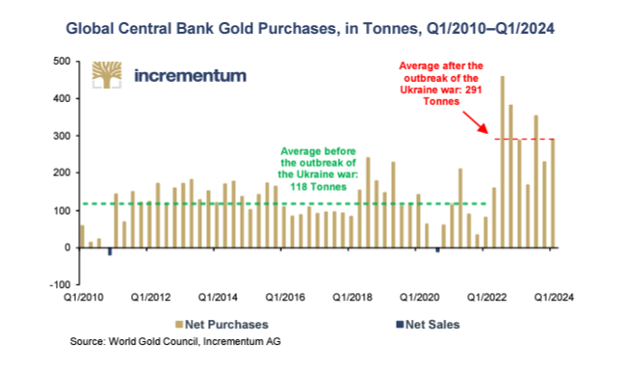

The actions, not just the rhetoric, of the BRICS+ nations and global central banks, speak volumes. As Stoeferle's objective charts illustrate, these entities prefer to save in physical gold rather than US debt obligations.

Since the U.S. weaponized its currency, there has been a clear shift away from the U.S. dollar and U.S. Treasuries, with gold emerging as the preferred reserve asset.

The evidence is undeniable: dozens of BRICS+ countries are conducting trade outside the US dollar, using local currencies for local goods, and then settling net surpluses in physical gold. Notably, gold is priced more fairly in Shanghai compared to London or New York, where physical deliveries out of the exchanges exceed inflows.

It's worth mentioning that some analysts, myself included, anticipated this development years before the White House.

This shift suggests that the decades-long practice of artificially manipulating precious metal prices on platforms like the COMEX, which some consider legalized fraud, is gradually coming to an end in the post-Basel III and post-sanction era.

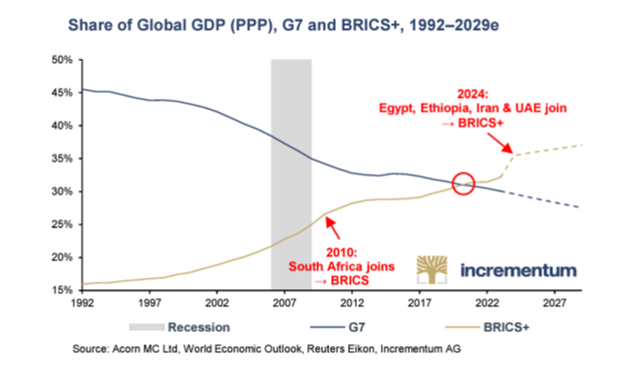

This is significant because, whether we like it or not, the growing economic power of the BRICS+ nations, which have grown weary of being controlled by the U.S. dollar's inflationary influence, is becoming more evident. These countries are experiencing economic growth independently of the debt-driven West, a fact that is supported by data on their share of global GDP, rather than sensationalism.

The Chart of Charts

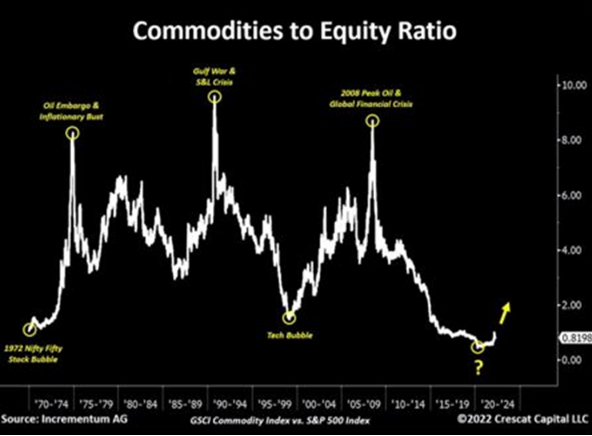

Ronni also shared a similar chart a year ago. Then he asked if this was the chart of the decade.

With those words he was asking if the world was moving toward a commodity super-cycle.

The Changing Commodities Market

The global commodity markets, particularly in the energy sector, are undergoing significant changes that are becoming increasingly apparent to those who are paying attention.

It's crucial to acknowledge the recent developments in the global energy markets, a topic I've previously addressed and, so far, accurately analyzed in prior articles.

When it comes to understanding the complex interplay between oil, the U.S. dollar, and gold, Luke Gromen stands out as a clear and insightful thinker who has provided valuable information to the public.

Gromen points out that oil, like any other internationally traded commodity, can be settled in gold rather than U.S. Treasury-linked petrodollars.

Remarkably, in 2023, 20% of global oil sales were conducted outside the U.S. dollar, a scenario that would have been unthinkable before the Biden administration imposed sanctions on Russia.

The implications of this simple yet profound observation and its potential impact on the U.S. dollar, commodity pricing, and gold are truly extraordinary.

Oil and Its Future

Before the United States weaponized its currency against Russia and publicly insulted its key oil partner, Saudi Arabia, the world adhered to the U.S. Treasury and the U.S. dollar-denominated oil trade, which greatly benefited the U.S. by allowing it to export inflation to other countries.

In the past, when commodity prices rose too high, countries like Saudi Arabia would absorb U.S. Treasuries and effectively go long on the U.S. dollar, which the U.S. produces at a faster rate than the Saudis pump oil.

This arrangement helped stabilize and absorb the otherwise overproduced and debasement-prone US dollar while also keeping U.S. government bonds in demand, thus controlling and compressing yields.

In a way, this system even benefited global growth by keeping the U.S. dollar stable and low enough for countries like China and other emerging markets to expand. These nations, in turn, would continue to purchase "risk-free-returning" U.S. Treasuries, thereby helping to refund and reflate the United States' own debt-based growth narrative.

As long as other countries continue to buy U.S. debt, the U.S. can perpetually finance the American Dream through ever-increasing debt, right?

Well, that assumption only holds true if one believes the world never changes and that reported inflation, which is utterly dishonest, makes US Treasuries genuinely "risk-free" rather than merely providing negative real yields.

Fortunately, or unfortunately, the rest of the world is witnessing the changes that Washington, D.C., attempts to conceal.

As of November last year, Saudi Arabia met with several BRICS+ nations to explore alternatives to the US dollar and US Treasuries for trade among themselves, including the oil trade.

Consider the implications: the factors that have supported the US dollar and sovereign bond market since the early 1970s, namely global demand for the US dollar via oil, are gradually but steadily unraveling right before Biden's barely open eyes.

The decades-long support and demand for U.S. dollars and U.S. Treasuries are diminishing, not increasing. This means that unloved U.S. Treasuries will need to be propped up by fake, inflationary domestic liquidity rather than everlasting foreign demand.

Incidentally, this leads to currency debasement — the ultimate fate of all debt-ridden nations.

This means that commodities, even oil, will be purchased without the dollar and settled in gold. This is most likely why the central banks are hoarding gold and net dumping USTs and have been since 2014.

Gold and Oil

In the context of a dynamic, rather than static, world, any prudent investor must seriously consider the evolving petrodollar dynamics that Luke Gromen has been tracking with clear-eyed foresight, particularly concerning gold and oil.

The upcoming compressed but inevitably rising super cycle in commodities, as illustrated in Stoeferle's chart, will be markedly different from previous rallies.

As oil prices increase, for whatever reason, the old system that once recycled those costs into US Treasury purchases has the ability (and has already begun) to pivot to another asset: gold.

Consider this scenario: Russia can sell oil to China, and Saudi Arabia can sell oil to China, but now in yuan instead of US dollars. These trading partners can then use their yuan payments to purchase Chinese goods (once made in America) and ultimately net settle any surpluses in gold rather than US Treasuries.

That gold can then be converted into any emerging market or BRICS+ local currency, from rupees to reals, instead of dollars, for trade among themselves in other raw commodities, of which many BRICS+ nations have an abundance.

This is not some distant possibility but a current and ongoing reality that can have a devastating impact on US dollar demand and, consequently, its strength.

As copper and other commodities, including oil, increasingly reprice and stockpile outside the U.S. dollar, the notion of the dollar's "hegemony" becomes increasingly difficult to believe, communicate, or maintain.

As Luke Gromen observes, though few are willing to acknowledge, if and when gold becomes the "de facto release valve for non-USD commodity pricing and net settlement," the impact on the long-term gold price will be a matter of simple mathematics rather than debate.

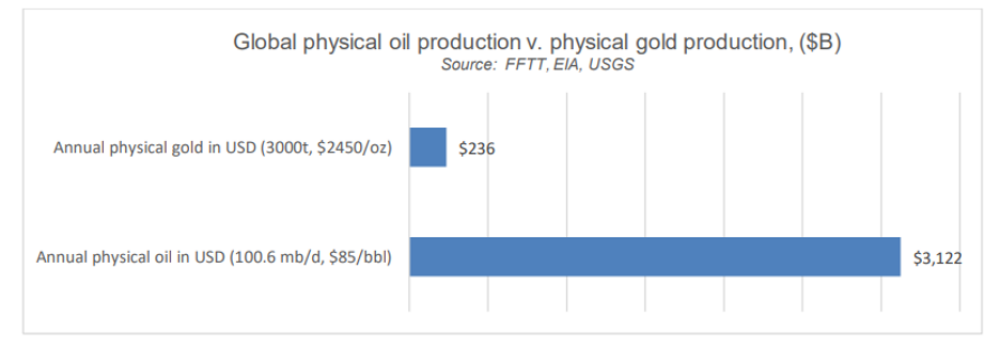

He consistently points out that the global oil market is 12-15 times larger than the global gold market in terms of physical production.

Based on the information provided, it is reasonable to conclude that oil, and commodities in general, have the potential to drive gold prices higher.

This trend is already evident when examining the global gold/oil ratio, which has increased by a factor of four since Russia began accumulating gold in 2008, coinciding with the Federal Reserve's preparations to create trillions of dollars out of thin air in Washington, D.C.

A Misunderstood Asset

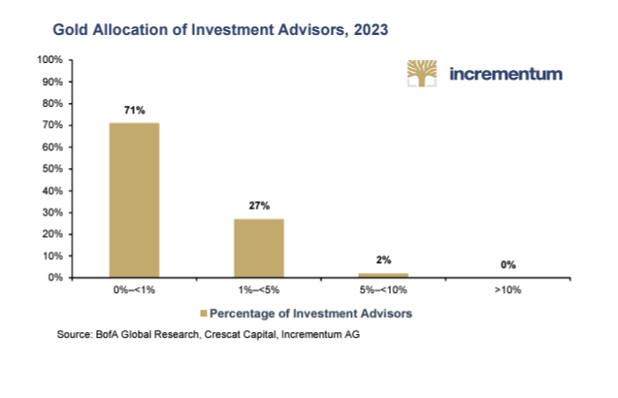

Surprisingly, despite the changing landscape, gold remains a largely misunderstood and underappreciated asset. Current consensus thinking allocates only 0.5% of global assets to gold, significantly lower than the 40-year average of 2%. Even among family offices, gold accounts for just over 1% of allocations as investors continue to take on increasing risk in pursuit of yield.

This raises the question of whether the reluctance to embrace change stems from human nature or is driven by political and monetary self-interest, even as evidence of the shifting dynamics surrounding us. Regrettably, few recognize gold's true role and potential in the current economic environment.

For long-term gold investors who think in terms of generations rather than daily news cycles and who recognize that preserving wealth is the key to having wealth, this asset and the changes it represents are not cause for fear but rather for understanding.

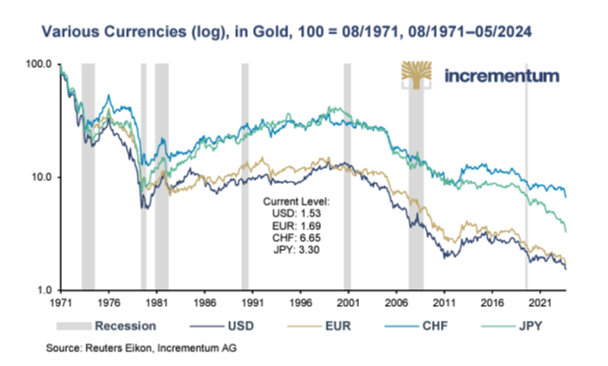

At its core, gold serves to preserve wealth, while paper currencies erode it over time. This is why, despite factors that are traditionally seen as headwinds for gold, such as positive real yields, a relatively strong U.S. dollar, and supposedly contained inflation, gold is breaking free from these correlations and reaching all-time highs.

The reason is simple: gold is trusted far more than the broken currencies of financially troubled countries, including the once-revered United States in particular and the Western and Eastern world in general.

As Ronni aptly states, "In gold, we trust." This sentiment aligns with both common sense and historical evidence.

One only needs to do math and study history to understand the enduring value and importance of gold as a means of preserving wealth in an ever-changing world.

| Want to be the first to know about interesting Gold and Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.