Emerging as a leading exploration and development company, NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) is dedicated to uncovering large-scale mineral systems in established mining districts across Nevada, Idaho, and British Columbia. The company's strategic approach encompasses a diverse project portfolio, including a 100% interest in the Limousine Butte and Cedar Wash gold projects in Nevada, alongside the Ptarmigan silver-polymetallic project in Southeast BC. NevGold also holds an option to acquire 100% of the Nutmeg Mountain gold project in Idaho.

At the helm of NevGold is Brandon Bonifacio, President, CEO, and Director, leveraging over a decade of expertise in project development, mergers and acquisitions, and project evaluations. Bonifacio expressed optimism for the Zeus Project, citing its geological similarities with the neighboring Hercules Project and the district's burgeoning potential.

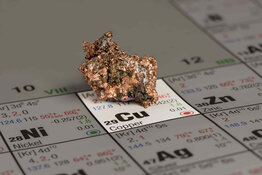

"All of the geological signatures that we encountered through our geological review and time in the field solidify our view that Zeus has very strong copper porphyry potential and is some of the most strategic ground in this emerging Hercules Copper Trend," Bonifacio said in a company press release.

In addition to the Zeus Project, NevGold maintains a steadfast focus on advancing its oxide, heap-leach gold resource projects in the Western USA, including Nutmeg Mountain in Idaho and Limousine Butte in Nevada. Leveraging its established reputation and robust relationships in Washington County, Idaho, NevGold is poised to capitalize on the vast opportunities presented by its diversified project portfolio.

Drawing parallels with Hercules Silver Corp., NevGold's Zeus Project showcases Triassic age plutons, Olds Ferry terrane rocks, and a cover sequence mirroring the Hercules Project. These striking similarities underscore the Zeus Project's immense copper porphyry potential, positioning it as a frontrunner in the burgeoning Hercules Copper Trend.

As NevGold pushes forward with exploration, the company remains steadfast in its commitment to advancing the Zeus Project through comprehensive surface geochemical sampling, geophysical surveys, and targeted drilling initiatives. These endeavors are poised to unlock the project's full potential, marking a transformative journey of potential discovery and growth for NevGold.

Important Disclosures:

- NevGold Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.