USD index has given back recent gains this morning with bond yields continuing to rise.

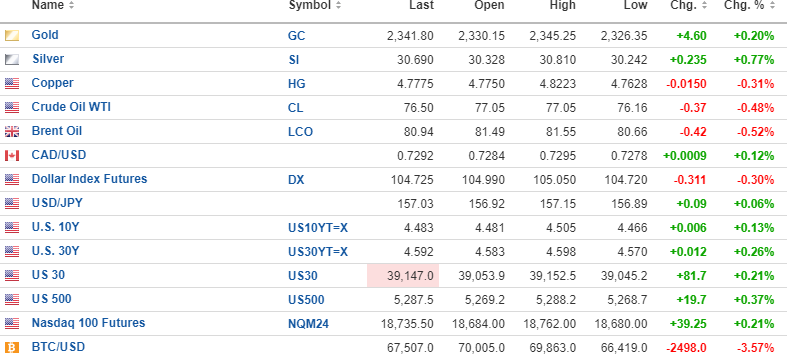

Gold (+.2%) and silver (+.77%) are rebounding very slightly but there has occurred some s/t technical damage, especially for gold. Copper (- .2%) and oil (-.08%) are lower, while stock index futures are modestly higher across the board.

Yesterday was one of those classic days where the powers that be decided that Jerome Powell was correct in his last press conference when he said, "I don't see any "stag," and I don't see any "inflation."

Accordingly, they took gold, silver, and copper lower with a vengeance as well as stocks after the Nvidia (NVDA:NASDAQ) earnings seemed to suck all of the bullish air out of the room.

I added to Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) yesterday with the June $20 calls at $1.60, so my new average is $1.775. PAAS is called $0.30 higher.

Silver must hold the $30 level lest I be forced to jettison the entire silver position, which is comprised of only the shares and calls in PAAS. If silver cannot hold that critical and much-publicized breakout level at $30, I see $28 and then $26 in a hurry.

I continue to add to American Eagle Gold Corp. (AE:TSXV) as I learned that drilling commences on the mighty NAK discovery on Monday. While it will take a few months to get results, I expect some speculative buying to propel AE north of $1.00 quickly and prior to results.

I will be working on the weekly missive for most of the day, but I leave you with two charts: gold and silver.

Gold looks like it is heading to $2,275-2,280, having broken the uptrend line with yesterday's crash.

Silver, however, is still in an uptrend and while it is coming down off an overbought condition, if it can hold $30, it might be a perfect entry level.

However, I will not add until it gets safely back above $31 and stays there for a few days.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Eagle Gold Corp. and Pan American Silver Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.