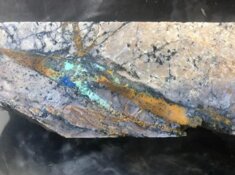

AngloGold Ashanti Ltd.'s (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) phenomenal Beatty District project in southern Nevada continues to grow with potential for more, as the project advances. Permitting is underway at North Bullfrog, the deposit where mining of the district will commence. At the far larger Silicon and adjacent Merlin deposits — what Anglo calls The Expanded Silicon Project ("ESP") — a pre-feasibility study is underway, focusing, among other things, on trade-off studies.

It is expected to be completed in the second half of next year, but the continued growth there has already meant changes to initial plans. After saying that the company "tries not to put out statements that are not supported by our studies," CEO Alberto Calderon said that production at the ESP "is obviously going to be much, much higher" than the earlier estimate of 300,000 ounces production a year. The "massive resource . . . is even much larger than what we have stated."

As discussed, Orogen Royalties Inc. (OGN:TSX.V) has a 1% royalty covering virtually all of the adjacent Silicon and Merlin deposits. (The Bullfrog deposit referred to above is outside of its royalty area.)

Altius Minerals Corp. (ALS:TSX.V)has a 1.5% royalty, which it claims covers the entire district but is the subject of arbitration. We continue to accumulate both as the deposit continues to get larger.

Obviously, Orogen's royalty is more important to it, as a smaller company, than Altius' larger royalty to the far larger company. But is it nonetheless very significant, and could add 40- 50% to the company's value.

More Growth Potential Signalled to the West, North, and South

The room for additional resources is enormous. Hidden in a filing, Anglo Gold said that in drilling for water "north of Silicon," it hit "significant" gold. The company also found some early cash-generating potential in the southern extension of the property (probably outside of the Orogen ground). The very short mine life outlined in the Merlin technical study and the plan for both a leach and a mill suggest resource growth.

Anglo talked about the success of exploration immediately to the west of Merlin, and now there is potential for the north. It is probably that the deposit also continues at depth. Valuing the royalty of either company is difficult since it is a rapidly changing situation as the known deposit keeps getting more valuable with continued indications of further potential.

Both Orogen and Altius Are Undervalued as Silicon Grows

Looking at Orogen's 1%, I arrive at a present value on Merlin of around US$150 million (at today's gold price, NPV 5%) and perhaps another $60 million for Silicon. So, the ESP royalty could be worth $210. (Note: In my last review, Bulletin #910, after the Merlin technical study was released, after referring to the peak-year output of 1.8 million oz, I mentioned that the royalty would generate $42 million.

It was not clear that the number referred to the one-year production only.) The cash-flowing Ermitaño Royalty (as well as royalties on adjacent land) is valued at $40 million, while cash and the rest of the royalty generation business is another $20 million conservatively. Add it all up, and this puts a value of CA$1.90 per share. As the ESP continues to grow, the ultimate value could be meaningfully more.

This is why we continue to recommend buying Orogen, even after a 64% price increase since mid-February.

Altius' Royalty More Difficult To Value

Altius has an uncontested 1.5% royalty over most of the ESP but also potentially over the entire Beatty Regional District. As of the end of the year, that had 16.6 million ounces but is clearly more today. Although the North Bullfrog is a reasonably modest deposit, by virtue of being the first into production, it would bring revenue sooner.

A back-of-the-envelope valuation on Atlius' expanded royalty on currently known resources would be almost $400 million, with the potential for significant growth if the deposits to the south of Merlin (known as "the string of pearls") prove up. Remember, once the mill facilities are built, then all incremental resources in deposits in the region become of value, however small they may be individually. We continue to recommend accumulating Altius, even after an almost 50% move from mid-February.

Clearly, with a far more diversified asset base, it is subject to more influences than Orogen but remains a core holding, and we would buy it if it is underweight.

How Will It Play Out?

There is also the question of how much a major royalty company would pay for the royalties. They would perhaps pay a premium for what is known but not necessarily for the potential. However, given the rapid growth in the ESP as well as the potential at depth and enticing suggestions of further growth to the west, north, and (for Altius) to the south, this is not mere "blue sky," but very real potential for additional resources over the next several months.

Anglo will give its next update on the deposit in August. It is possible that a senior royalty company makes an offer for Orogen difficult to turn down. However, given that about 37% of the shares are held by two friendly institutions and insiders, a low-ball or hostile bid would be unlikely to succeed.

If it were sold, the most likely outcome would be that every asset except the ESP royalty would be spun out to shareholders. That in itself, with a strong balance sheet, cash flow, and multiple projects, would make an attractive company, but we are getting ahead of ourselves.

Altius' preferred route is to exchange its royalty for base metals royalties and some cash, but I suspect that it may have difficulty exchanging for base metals royalties of comparable value and quality and may hold on to it.

This is all supposition. What we do know, however, is that the royalties, both Orogen's and Altius', are very valuable and growing and that the share price of neither company fully accounts for them.

Metalla To See New Revenue Sources Ahead

Metalla Royalty & Streaming Ltd. (MTA:TSX.V; MTA:NYSE American) reported first-quarter results a tad shy of expectations, with lower revenue and higher G&A. It generated 624 Gold-Equivalent Ounces ("GEOs") down from 927 a year ago, though a decline was anticipated as the Higginsville royalty ended.

The company reiterated in 2024 guidance. I suspect this quarter will be the low for the company, with growth in the second half and beyond, as it expects to see some revenue in the third quarter from two new royalties, on Tocantinzinho in Brazil and Amalgamated Kirkland in Ontario, with possibly a third, Endeavor in Australia by year-end.

The Cȏté mine is expected to generate some revenue for Metalla by the end of next year as mining progresses to its royalty land, gradually building until the Gosselin area is incorporated into the mine plan. Other projects on which Metalla holds royalties, including Equinox's Castle Mountain, Agnico's Wasamac, and First Quantum's Taca Taca, are all progressing along their development schedules. CEO Brett Heath tantalizingly noted that the company will "look for ways to refine our current portfolio" without giving additional information. The stock popped 24 cents on Friday, so we will look to buy more as it settles down from that four-week high.

We were buying under $3 in the last couple of weeks as a newsletter sell recommendation took the stock down. It is selling at little more than 50% of NAV, so it remains very undervalued, and if you do not own it, Metalla can be bought.

Nestlé Is Turning Around After Soft Quarter

Nestlé SA (NESN:VX; NSRGY:OTC) reported organic growth of 1.4% in the first quarter, boosted by price increases of 3.4%; what it calls "real internal growth" was, therefore, a negative 2%. The largest factors accounting for lower Swiss franc sales were foreign exchange and net divestitures. Europe and emerging markets saw growth, offsetting a sales decline in North America, while by category, pet care once again was a leader.

The company reiterated its full-year outlook of organic sales growth of around 4%, with an increase in underlying earnings (in constant currency) of between 6% and 10%, targets CEO Mark Schneider said he was "very confident" of hitting.

One new launch that could see growth is Nescafé Espresso Concentrate, designed to make iced coffee at home. According to Nestlé, last year, virtually one-third of the coffee consumed at home was cold, and this new product aims to enable consumers to make "barista-styled iced coffees" at home. Since the stock has jumped over the past two weeks from a four-year low to a 3-month high, we are holding off on additions.

We do believe a long-term turnaround in the company is underway, but we will wait for a pullback to add. We were buying under SFr 92 as recently as two weeks ago.

Kingsmen Awarded Multi-Year Contract

Kingsmen Creatives Ltd. (KMEN:SI) said it had been awarded work valued at S$53 million for the Formula 1 Singapore Grand Prix for the next five years, extending the company's involvement in the event back to 2008.

As the Asia region continues to recover from the COVID-related lockdowns, we expect Kingsmen to continue to generate new contracts and increase revenues.

It's a buy.

TOP BUYS this week, in addition to above, include Lara Exploration Ltd. (LRA:TSX.V) and Midland Exploration Inc. (MD:TSX.V). We are buying little in the larger resource space right now because of recent moves, after having been buying consistently over the past year and more. This does not signal any change in sentiment. New investors should certainly buy some gold stocks.

NEWSLETTER PUBLISHING GIANTS DIE Two giants of the newsletter industry died over the past month. Tom Phillips founded his eponymous firm in 1974 in the Maryland suburbs of Washington, D.C., and later the conservative book publisher Regnery. I did not know him well but I knew him not only as a great businessman but also as a very generous individual.

Wallis "Chip" Woods, in addition to being a newsletter publisher, was a radio host and book publisher. I am sure that many of you will remember him as an MC at various investment conferences, including the Atlanta Autism Conference, for many years. Chip was ever the optimist, and time spent with him, whether a quick coffee or a leisurely dinner, was always interesting and time well spent. May they both rest in peace.

WHAT BETTER TIME FOR A RESOURCE CONFERENCE? Don't wait to register for Rick Rule's upcoming Resource Symposium, July 7th to 11th in Boca Raton. A must-attend event for anyone interested in investing in resources, there is a distinguished line-up of speakers, including Robert Friedland, Sean Boyd (former CEO of Agnico Eagle), Grant Williams, Brian Dalton, Sean Roosen, and many more. Could it get much better? Space is limited, so register now.

| Want to be the first to know about interesting Gold, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Altius Minerals Corp., Orogen Royalties Inc., Metalla Royalty & Streaming, Lara Exploration Ltd., and Midland Exploration Inc.

- Adrian Day: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.