Now that the political situation continues to cool in Ecuador, green tech company BacTech Environmental Corp. (BAC:CSE;BCCEF:OTCQB;OBT1:FRA) is exploring ways to finance its proposed bioleaching plant there.

BacTech President and Chief Executive Officer Ross Orr wrote in his "Sunday Morning Coffee" email to supporters and shareholders on Sunday that the company has given access to its data to various groups wanting to learn more. He said they are impressed with the numbers they are seeing.

"When you consider the project produced very good numbers at (US)$1,600 gold, imagine what can be done at (US)$2300+," Orr wrote. "Obviously, the key is getting the plant up and running to take advantage of this gift."

BacTech had just received its long-awaited environmental license for the plant when drug gang violence and unrest made global headlines in the South American country.

Since then, Ecuadorians have voted to support President Daniel Noboa's security measures to bring the situation under control, including allowing the military to patrol with police, extraditing accused criminals, and increasing prison sentences for terrorism and murder.

The Catalyst: Some 'Very Innovative Pitches'

In another recent "Sunday Morning" note, Orr pointed out that recently announced deals like Silvercorp Metals Inc.'s (SVM:TSX; SVM:NYSE) acquisition of Ecuador-based Adventus Mining Corp. (ADVZF:OTCMKTS) were "great news for everyone" that some semblance of normalcy was returning to the country.

Orr said a major stumbling block for getting the plant built is a "lack of assets on the balance sheet."

"We are hearing some very innovative pitches to obtain what we need," Orr wrote. "Sifting through everything and coming to a final decision is our job and we hope to make a decision soon. Even while working on the Ecuador project, I continue to receive enquiries from all over. My standard response is, we will look at your project once Ecuador is financed."

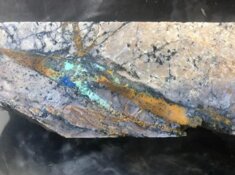

BacTech is building the plant in Tenguel. Its bioleaching process uses naturally occurring bacteria, harmless to humans and the environment, to extract precious and base metals from ores, concentrates, and tailings. Its motto is "Our bugs eat rocks."

Between $0 and $1 Billion

The company recently filed an expanded application for what it says is the first zero-waste bioleaching process for recovering metals, fertilizer, and iron from millions of tons of mine tailings worldwide.

From 1 tonne of waste, five different products can be sold, leaving behind zero waste, the company said. Those products are iron for steel or battery manufacturing, premium organic fertilizer, and the base metals nickel, cobalt, and copper. What's left are silicates that can be used as industrial filler or paste for backfilling in mines.

"Someone asked me what I thought the value of such a technology could be," Orr said in his weekly email. "My standard response is somewhere between $0 and $1 billion. When you think of the amount of tailings that exist globally and the amount of iron that they contain, it’s somewhat staggering."

Technical Analyst Clive Maund, who noted he was staying long on the stock and rated it a Buy for all timeframes, agreed with the impact the process could have.

Technical Analyst Clive Maund, who noted he was staying long on the stock and rated it a Buy for all timeframes, agreed with the impact the process could have.

"It is hard to overstate the significance of the technology BacTech has developed for the mining industry and the environment worldwide," wrote Maund. "There are hundreds of millions or even thousands of millions of tons of these tailings lying around all over the world."

"BacTech's technology has the capacity to convert all of this waste into profitable assets and clean up the mess at the same time," Maund noted. "This is why, given that BacTech has patented its processes and technology, its stock has such huge potential upside."

Chris Temple, editor and publisher of The National Investor, has been a shareholder and supporter of the company for some time.

The company, which was "an already compelling 'green mining' story . . . just got a whole lot better and potentially more explosive," he wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

BacTech Environmental Corp. (BAC:CSE;BCCEF:OTCQB;OBT1:FRA)

"Taking the bioleaching process to its conclusion can also lead to both iron recovery be used in steel making and even an organic fertilizer product," he wrote.

Ownership and Share Structure

Nearly half of the company, 49%, is held by insiders, management, and strategic shareholders, the biggest of which is Option Three Advisory Services Ltd., which owns 8.48%, or 15.57 million shares, according to Reuters. That also includes CEO Orr, who owns 3.57% or 6.54 million shares, and Board Director Timothy Lewin, who owns 0.54% or 0.98 million shares.

The rest is retail.

The company has 193.04 million shares outstanding. Its market cap is CA$12.05 million, and it trades in a 52-week range of CA$0.10 and CA$0.05.

| Want to be the first to know about interesting Silver, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- BacTech Environmental Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, BacTech Environmental Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of BacTech Environmental Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Contributing Author Disclosures

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.