Perpetua Resources is a momentum play and the reason why we are looking at it now is that it looks like the current strong upside momentum will continue for a while yet and if so it will result in substantial gains over the short to medium-term and these gains will likely occur over the short-term for reasons that quickly become apparent when we look at its 6-month chart.

The story with this stock and the reason for its recent strong gains is that Perpetua Resources Has Received Indication for up to $1.8 Billion Financing from Export-Import Bank of the United States for Stibnite Gold Project and a big reason for this appears to be that the mine, once constructed, will also produce large quantities of antimony that is used in munitions which currently is not produced at all in the US. This funding is subject to certain conditions being met, but by the look of it they will be. On the 6-month chart we can see that upon this news being released the price shot up on the 8th of this month but after further gains the next day resulted in it becoming extremely overbought short-term it settled down to mark out what looks like a bull Pennant that once completed calls for a move of similar magnitude to the one leading into it. The way volume has died back steadily as this Pennant has formed indicates that it is genuine and not a top. We can therefore expect another sharp towards the resistance level in the $9 area that would result in a swift near 50% gain, and that could happen in short order given that this Pennant is now fast closing up.

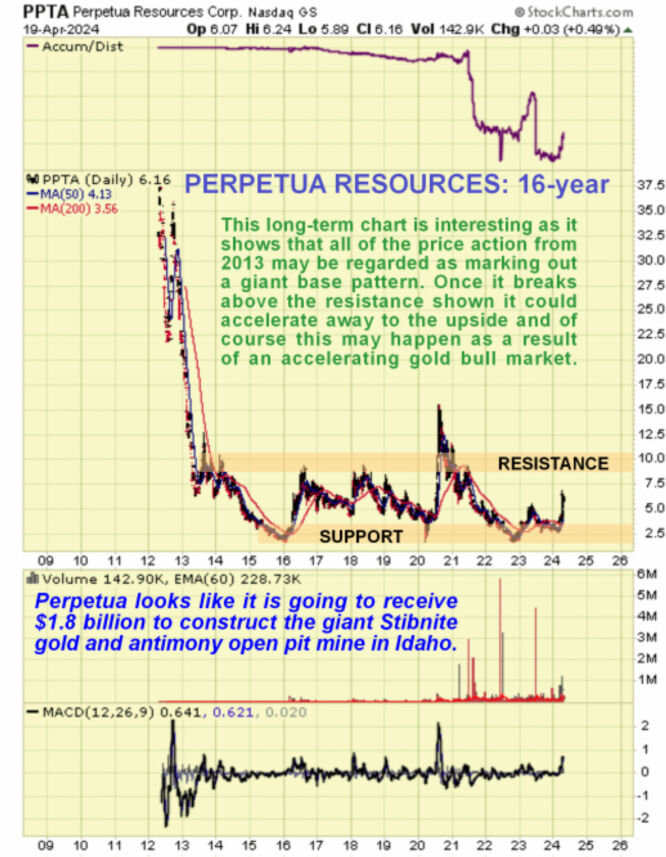

The 5-year chart shows us the origins of the resistance that caused the advance to halt temporarily early this month and also the origins of the resistance in the $9 area which is our next target…

The long-term 16-year chart is interesting as it shows us that all of the action from 2013 may be regarded as marking out a giant base pattern and if this is the case it is not unreasonable to suppose, given the enormous upside potential of gold in the next several years, that once it succeeds in breaking above the resistance in the $9 - $10 area it could drive rapidly higher to equal or even exceed its 2012 highs in the $37.50 area.

Perpetua Resources is therefore rated a buy for all timeframes that will appeal to quick fire speculators who want to make a big gain fast and a stop may be placed beneath the lower boundary of the Pennant, say at $5.45, to limit loss in the (unlikely) event that it breaks down from it. This would probably only happen in the event that EXIM says to the company “You know that money we said we were going to front you to build that mine? – well, you’re not getting it…” This seems highly unlikely.

Perpetua Resources website

Perpetua Resources Corp., PPTA on NASDAQ GS, PPTA.TSX, closed at $6.16, C$8.48 on 19th April 24.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe