Natural gas futures have gained a bit of momentum in April after Henry Hub spot prices recorded their lowest monthly price on record in March, but a multi-year buildup of massive commercial stockpiles in the western hemisphere continues to loom large over any potential bullish outlook. The U.S. Energy Information Administration (EIA) estimated working natural gas inventories at 2,290 billion cubic feet (bcf) on March 31 — the end of the winter heating season. That was 39% above the previous five-year average as the U.S. concluded its warmest winter on record, which severely suppressed demand for heating across the country.

In the most recent data, covering the week through April 12, U.S. gas storage was up 22.2% YoY and still more than 36% above the five-year average. It will take some time to work through this increase, leading the EIA to expect gas inventories to remain "relatively high" and spot prices to stay "relatively low" through 2025. Natural gas futures were trading around $1.73 per million Btu on Wednesday morning, down about a quarter from the same time a year ago.

European gas storage is also brimming with supply, as EU stocks ended their own heating season in March at nearly 59% full, according to industry body Gas Infrastructure Europe. That is about three percentage points higher than a previous record high set last year. Europe's gas storage sites are mandated by law to be at least 90% full by the start of November, but supplies were so plentiful last year that this target was reached months ahead of schedule on August 18. By mid-November, gas storage was nearly 100% full, and extra storage space had been utilized outside of the EU in Ukraine's massive underground gas storage (UGS) facilities.

According to Bloomberg reporting, traders injected 2.5 billion cubic meters (bcm) of gas into Ukrainian storage sites last year. Throughout the duration of 2024, Ukraine's state-owned Naftogaz has aimed to increase the volume of European traders' gas in Ukrainian underground storage by 60% to 4 billion cubic meters. MRP has covered recent Russian air assaults targeting these facilities, which could threaten to drive up European gas futures to some degree, but the amount of storage being held in Ukrainian UGS stores is small relative to stockpiles built up within the EU itself, which can exceed 105 bcm at full utilization.

A significant disruption would likely need to occur for inventories to be drawn down at an aggressive rate, and such a factor may now be coming down the line in the form of generative AI. Per analysts at Tudor Pickering Holt & Co, their base case sees 2.6 bcf per day of additional natural gas demand piled onto the U.S. energy grid by 2030 in the wake of spiking power usage from data centers powering AI applications. In scenarios where AI adoption and rollouts are more expedient, as much as 8.5 bcf per day of natural gas could be required to meet the demands of increasingly power-hungry data centers.

According to Statista, U.S. demand for natural gas was equivalent to 100 bcf per day in 2023, but 20 bcf of that figure is tied to exports. If we apply Tudor Pickering Holt & Co's estimates to the remainder, the additional gas capacity needed to power AI data centers would be equivalent to anywhere from 3.3% - 10.6% of all current U.S. demand across the industrial, commercial, residential, and power sectors. When we narrow that cohort down to gas demand from the power sector alone (equivalent to about 35 bcm), that range rises to 7.4% - 24.2%.

In a previous Intelligence Briefing, MRP noted that AI has already flipped the script for American utility firms that had dealt with a decade-and-a-half of slowing growth in electricity consumption until very recently. Since 2004, industrial use of electricity has not exceeded an estimate of roughly 1.0 trillion kilowatt hours. Similarly, commercial electricity usage has been rangebound between 1.3 and 1.4 trillion kilowatt hours. Per the International Energy Agency (IEA), the U.S.'s 2,700 data centers consumed more than 4% of the country's total electricity in 2022, but that figure is projected to grow to 6% over the next two years. As data centers increase their share of electricity consumption, they will also expand U.S. electricity use in general.

Per Newmark, hyperscalers like Amazon and Microsoft — owners of larger data centers that operate facilities directly under their own management — currently need anywhere from 10-14 kilowatts (kW) to power each rack currently in data centers, but this is likely to rise to 40-60kW for AI-ready racks equipped with the resource-hungry GPUs so critical to generative AI processes. This means that overall consumption of data centers across the U.S. is likely to reach 35 gigawatts (GW) by 2030, up from 17GW in 2022. Natural gas resources will be leaned on heavily to bolster AI's electricity needs, as gas-fired generation accounts for more than 40% of U.S. power demand.

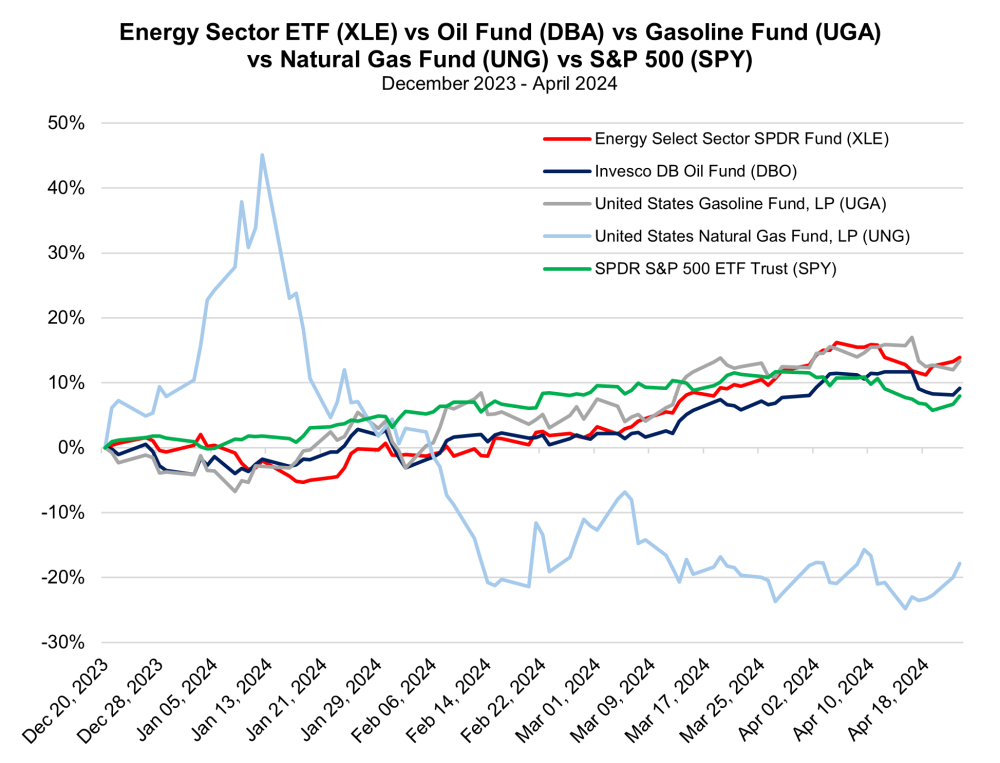

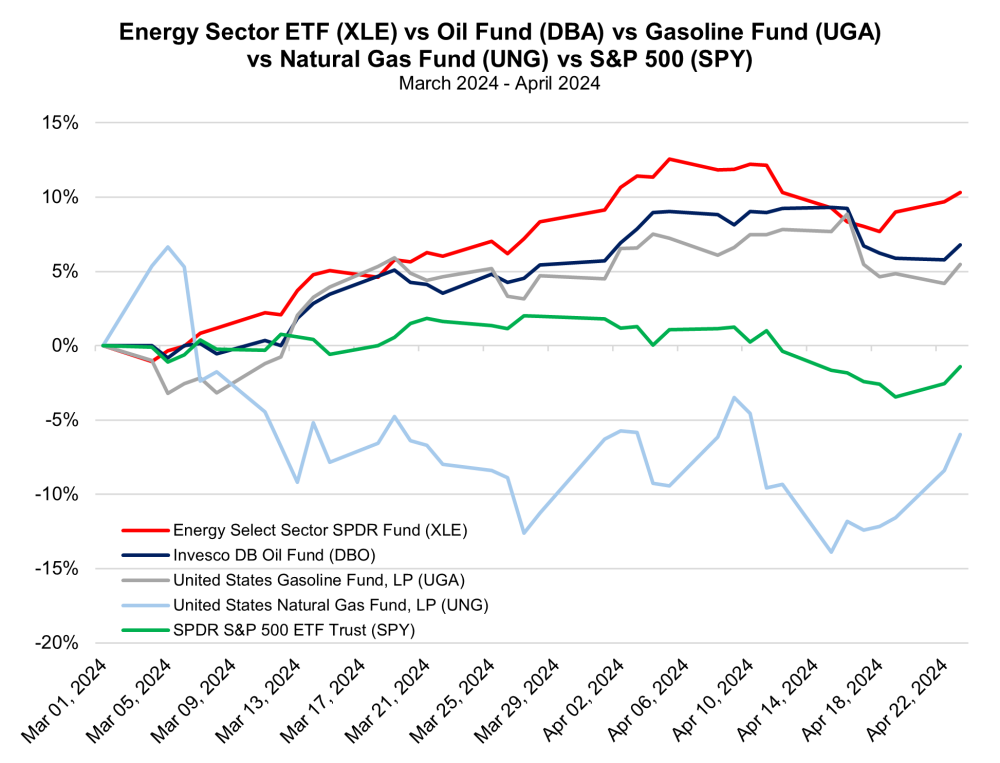

Charts

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.