Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS;939:FRA) has done very well since it was recommended for purchase two months ago, rising by approximately 60%. In this update, we will see why its new bull market looks set not just to continue but to accelerate with the real possibility of spectacular gains ahead.

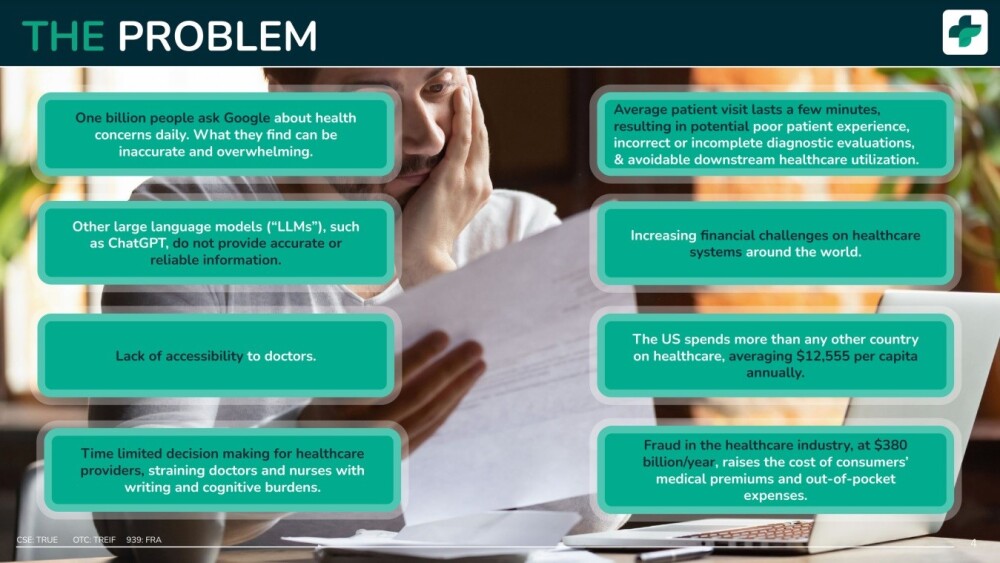

The inefficiency and waste in the healthcare industry is legendary, with patients sitting around in waiting rooms sometimes for hours waiting to see a doctor who, due to time pressure, often cannot spend an adequate amount of time with them, doctors, nurses, and other healthcare professionals burdened with mountains of repetitive paperwork and so, perhaps more than in any other field, the potential for AI to improve the efficiency and quality of life for all involved is immense.

Following is a range of relevant and important sides lifted from the company's latest investor deck produced this month.

Treatment.com AI has positioned itself to be the central go to resource in the booming AI revolution in the Healthcare industry.

This revolution is set to streamline the healthcare industry, vastly reducing the time wasted by both doctors and patients as a result of dealing with cumbersome and repetitive bureaucracy and general matters and questions that can be much more efficiently handled by AI.

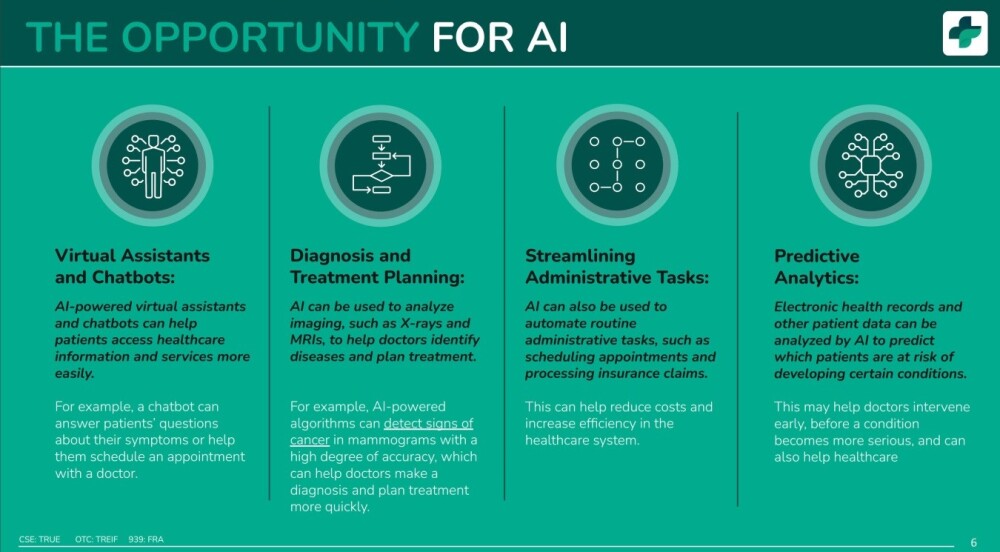

Here are the ways that AI can positively impact healthcare.

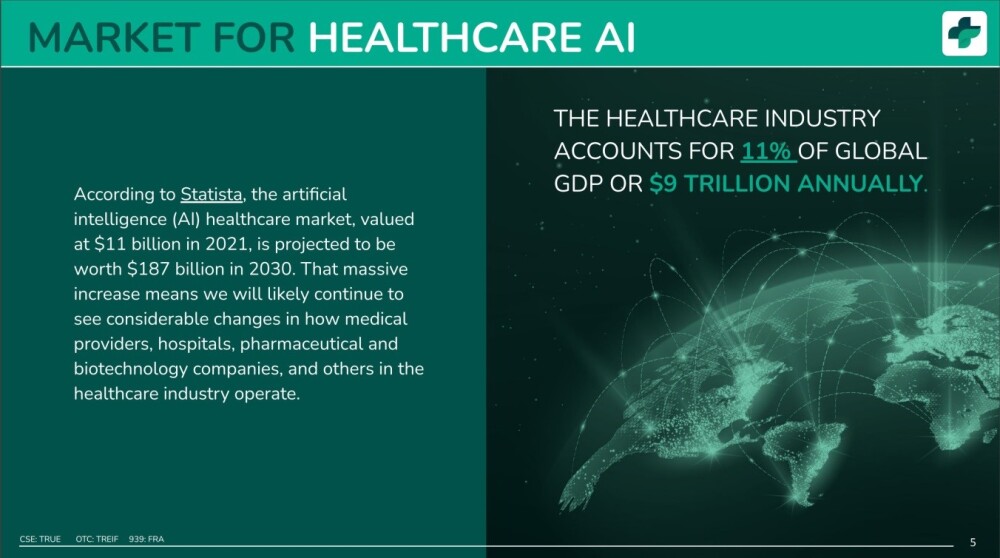

To quote the company, "The AI healthcare market, valued at US$11 billion in 2021, is projected to be worth US$187 billion in 2030."

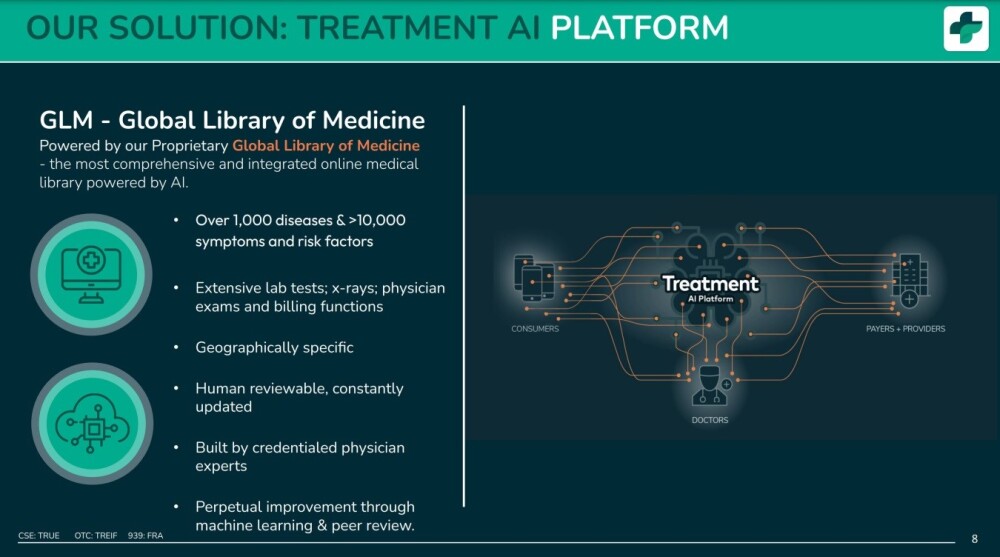

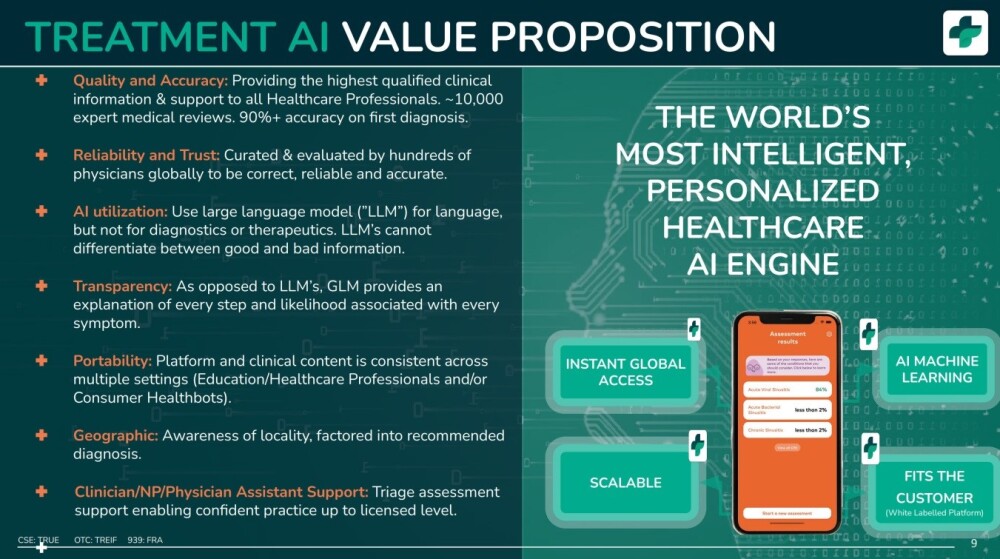

With the input of hundreds of healthcare professionals globally and utilizing proprietary algorithms, Treatment.com has created the most comprehensive and integrated online medical library powered by AI — the Global Library of Medicine (GLM).

The GLM provides the highest level of qualified clinical support to all healthcare professionals, ensuring enhanced diagnostic accuracy and transparency in every step of support provided.

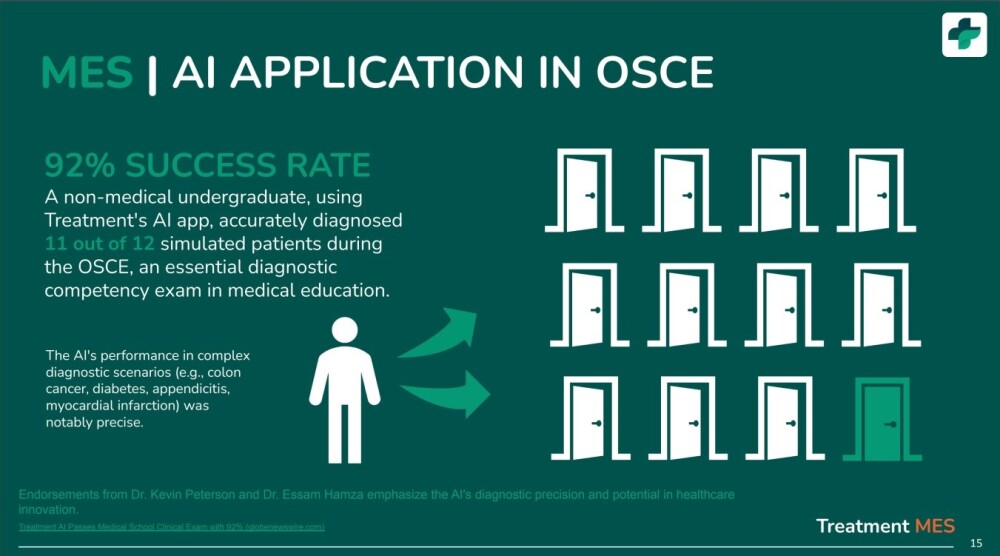

To underscore the accuracy of its platform, the company recently announced that non-medical undergraduates using its AI software passed a medical clinical exam, exceeding a 92% success rate.

Here are the characteristics and features of the Treatment AI Healthcare AI Engine.

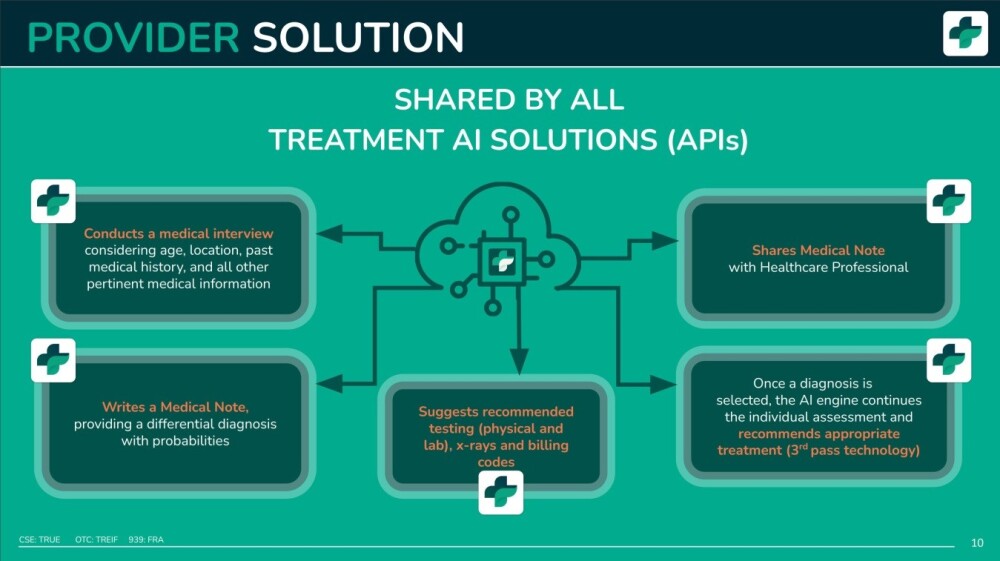

The following slide makes clear how the Treatment AI Engine streamlines and expedites the diagnosis and treatment option process.

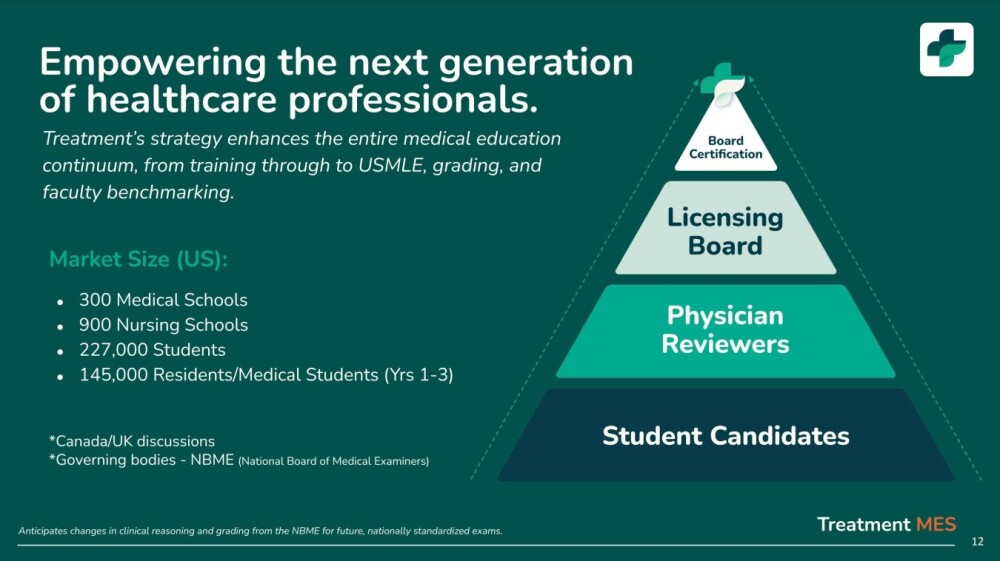

This slide shows how Treatment's strategy enhances the entire medical education continuum and thus the enormous size of the market.

Note that slides not included here may be viewed in the company's latest investor deck and linked again here for convenience.

There has been a stream of positive news out of the company since we first looked at it and its stock, as follows.

On March 27, we had the news that Treatment.com received NIH funding for med history AI. Treatment.com has partnered with Rush River Research in Minneapolis to develop an artificial intelligence (AI) approach for collecting information about family medical history that is culturally sensitive and appropriate for African-American families.

As part of its work building the world's most comprehensive and integrated online medical library powered by AI (the Global Library of Medicine), Treatment.com is aggressively acting to ensure that diagnostic and treatment information in the future will be provided by platforms that are free of the inequity commonly reflected in medical AI programs today.

On April 5 came the news that Treatment.com AI closed a shares-for-debt deal whereby the company cleared an outstanding debt (not that great) by means of issuing more stock.

Then, on April 8, Treatment.com AI welcomed the federal government's announcement of its plan to fund US$2.4 billion in its upcoming budget towards AI adoption, and of this, US$200 million of the proposed funding will specifically go toward boosting the adoption of AI in sectors like agriculture, clean technology, and healthcare.

On April 10, we heard that Treatment.com partnered with aiXplain Inc. to extend access to its global library of medicine (GLM). aiXplain is the industry's first no-code/low-code integrated AI development platform and has an ever-growing dynamic artificial intelligence (AI) marketplace. aiXplain's marketplace makes it possible for healthcare organizations to access Treatment's AI engine through its development framework and enhance the quality of clinical diagnosis within their organizations across multiple platforms.

A particular advantage of this partnership is that Treatment and aiXplain also intend to explore mutually beneficial international opportunities that may arise as a result. Both parties have a shared interest in providing the GLM in multiple languages in the future.

On April 17 came the news that Treatment.com will roll out AI Patient and AI Doctor tools, which are new additions to its Medical Education Suite, which is designed to educate the next generation of healthcare providers.

Lastly, on April 20, it was announced that Treatment engaged with a marketing provider, GRA Enterprises PLC, which does business with the National Inflation Association.

With a flow of news like this, it is perhaps not surprising that the stock has performed as well as it has over the past two months.

Now it's time to review the latest charts for Treatment AI stock.

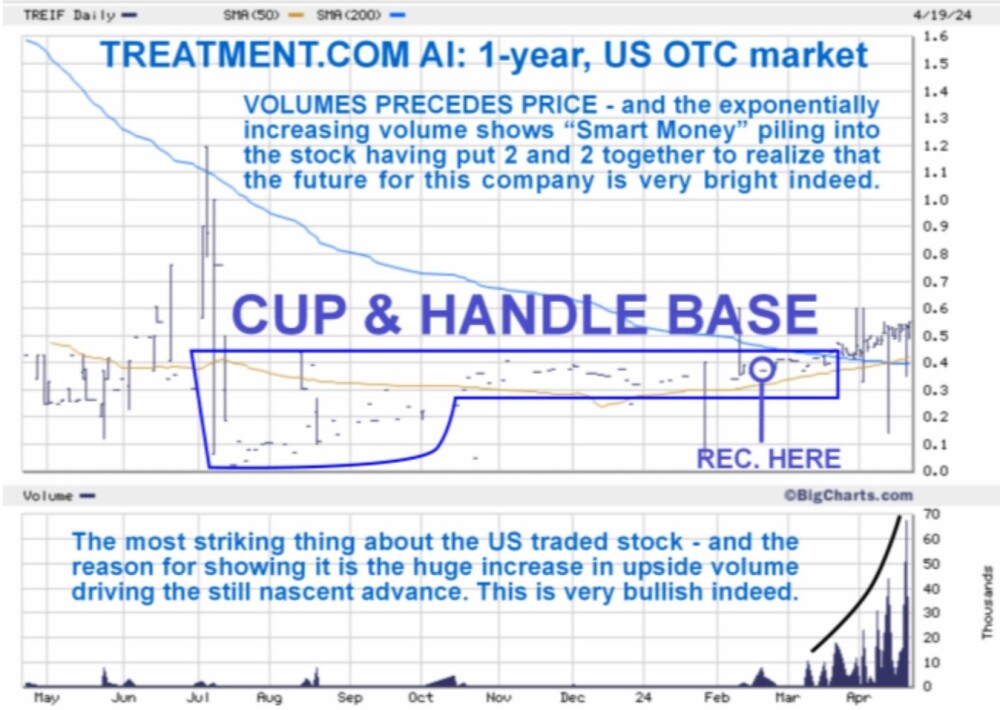

Starting with the 1-year chart, we see that the interpretation that the stock was completing a large Cup and Handle base has been proven correct by the subsequent price action with it since breaking out of the pattern and advancing on heavy volume.

So far, the advance has been measured and is steady, which is why it is still not very overbought on its MACD indicator, despite having been appreciated by about 40% from where we looked at it in February. This being so, the advance can not only continue but accelerate.

Most notable is the massive pickup in volume from around the time the price broke out of the Cup and Handle base. This is almost all upside volume, which is why the Accumulation line and the On-balance Volume line have both been rising strongly, which has strongly bullish implications. This chart also gives us a first target for this bull market, which is the highs of last June and July at CA$1.20.

It's worth taking a quick look at the stock traded on the US OTC market, where we see an exponential increase in volume that is viewed as evidence of "Smart Money” piling in, having figured out the very bright prospects for the company. This is useful for U.S. investors to know as it means that liquidity in the stock is now greatly improved.

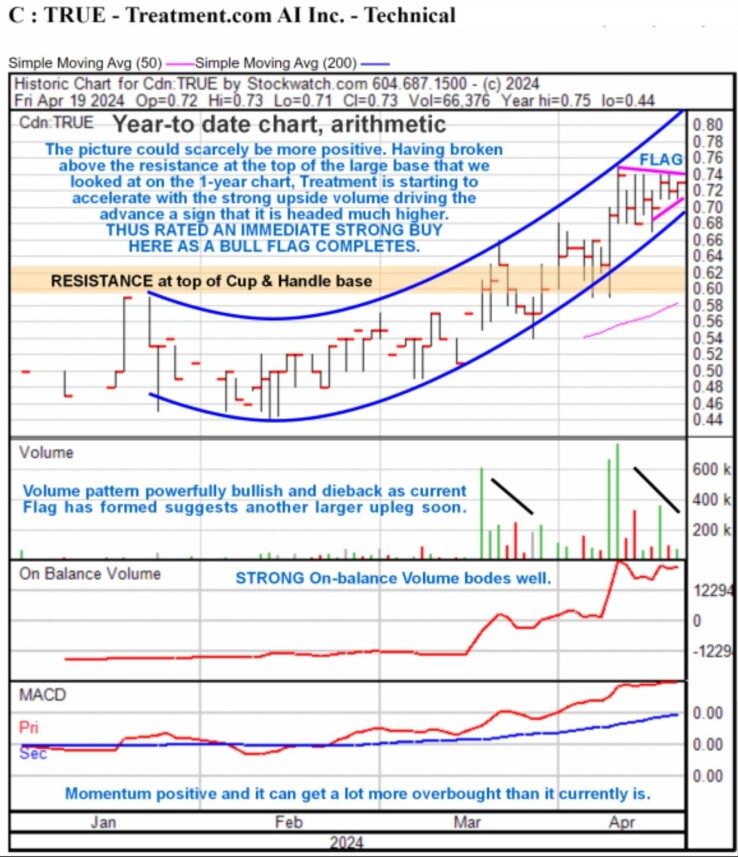

Looking at recent action in more detail on the year-to-date chart, we see that the price had been gradually starting to accelerate to the upside in a parabolic uptrend even before it arrived at the breakout point at the upper boundary of the Handle of the Cup and Handle.

Once it did break out, it accelerated further, with volume picking up in a dramatic manner. With the volume pattern powerfully bullish and both volume indicators strongly positive (On-balance Volume is shown on this chart and the Accumulation line on the 1-year chart), the advance looks set to continue to accelerate away to the upside. Right now, a small Bull Flag / Pennant appears to be completing which promises another upleg soon.

The conclusion is that this is an exceptionally bullish setup, both fundamentally and technically. So we stay long, and Treatment AI is rated as a Strong Buy here for all timeframes.

Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS;939:FRA) closed at CA$0.73, US$0.55 on April 19, 2024.

| Want to be the first to know about interesting Life Sciences Tools & Diagnostics investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Treatment.com AI Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Treatment.com AI Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.