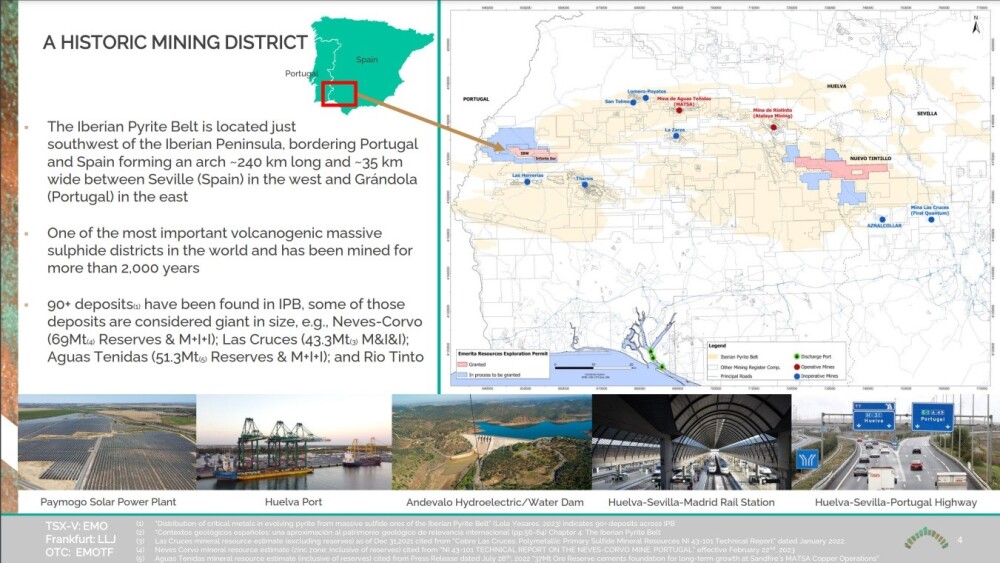

Emerita Resources is a polymetallic exploration company (including gold and silver) whose operations are in Spain where it has one of the largest mineral exploration holdings in the EU at 26,000 hectares. The company’s properties are in the historic Iberian Pyrite Belt and situated west of the city and district of Seville towards the border with Portugal, as shown on the following slide.

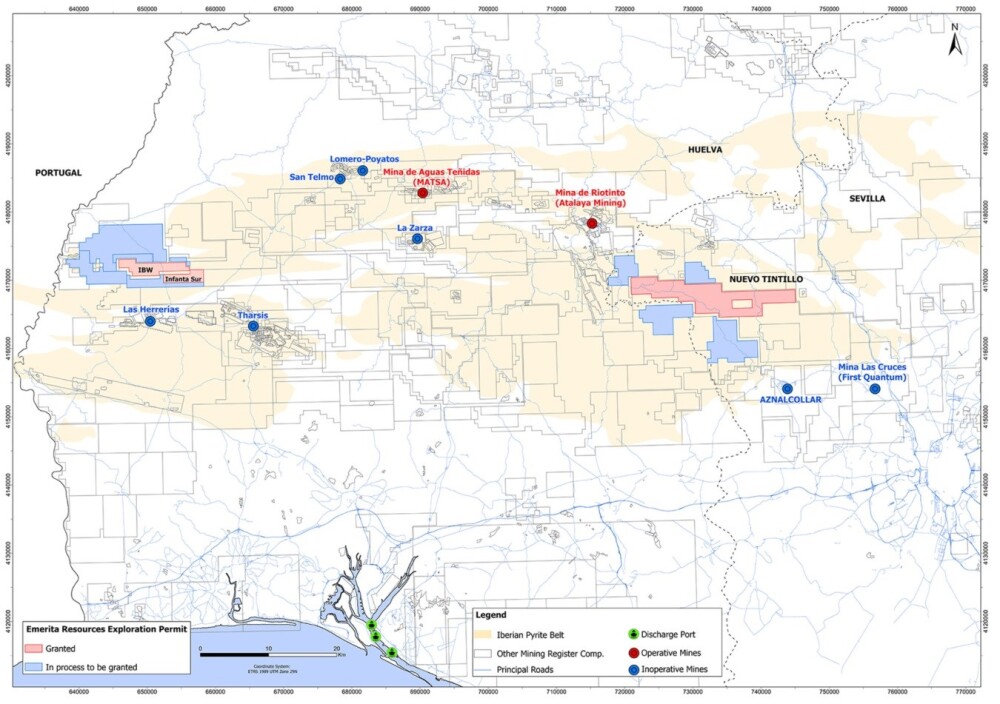

On the above map we can see the Iberian Pyrite Belt as the beige colored region and the red shaded areas are the company’s exploration properties. The westerly one, very close to the border with Portugal is the Company’s Iberia Belt West (IBW) Project where it has recently applied for a mining license.

The following slide shows the district in more detail and on this slide it is easier to see the company’s exploration properties in somewhat more detail.

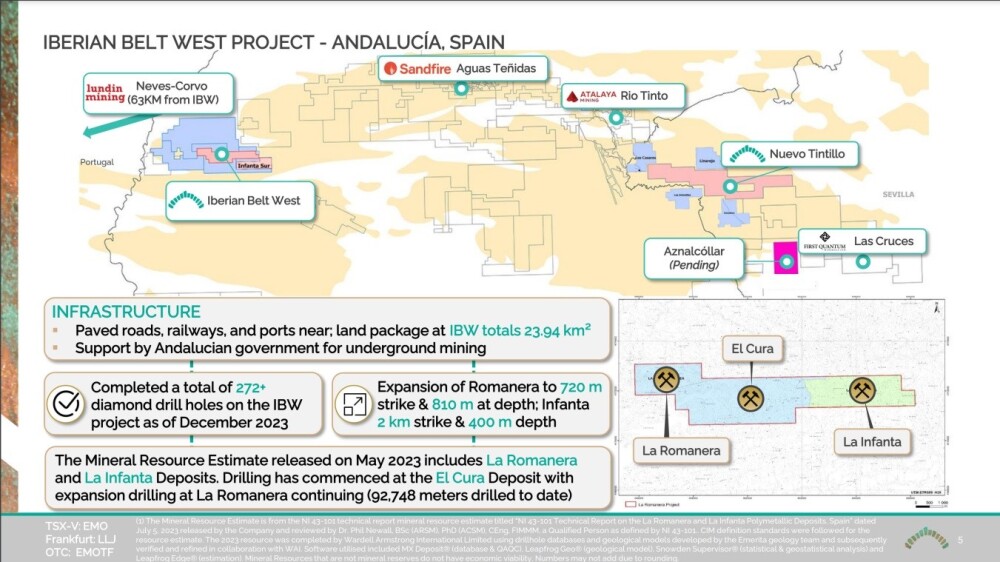

The importance of the following slide is that it clarifies what targets (future mines) lie within the company’s Iberian Belt West by means of the inset in the bottom right corner of it, so that you can understand what they are talking about when they report on drilling progress at these individual sites…

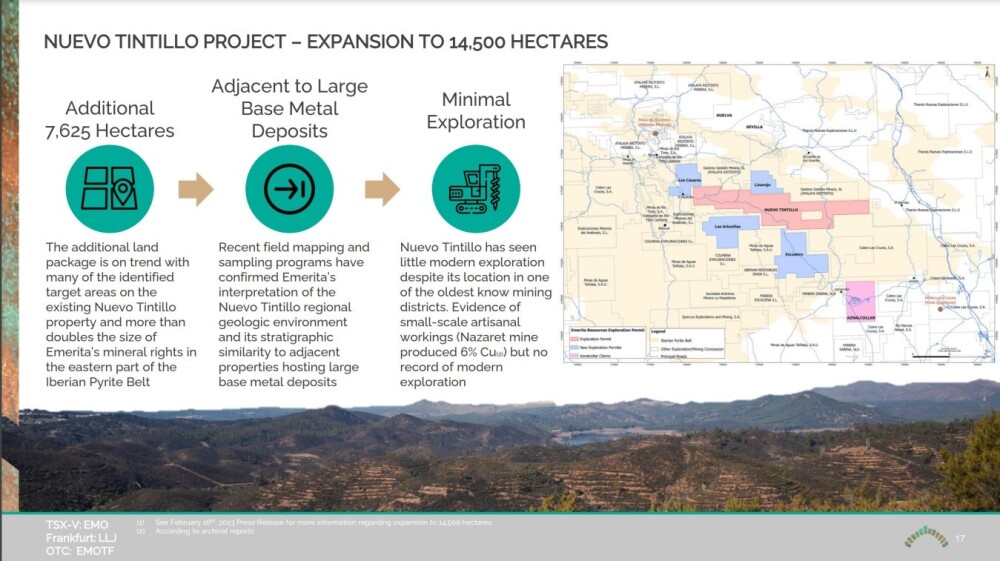

The more easterly of Emerita’s large properties is Nuevo Tintilla, and some information about it is provided by the following slide.

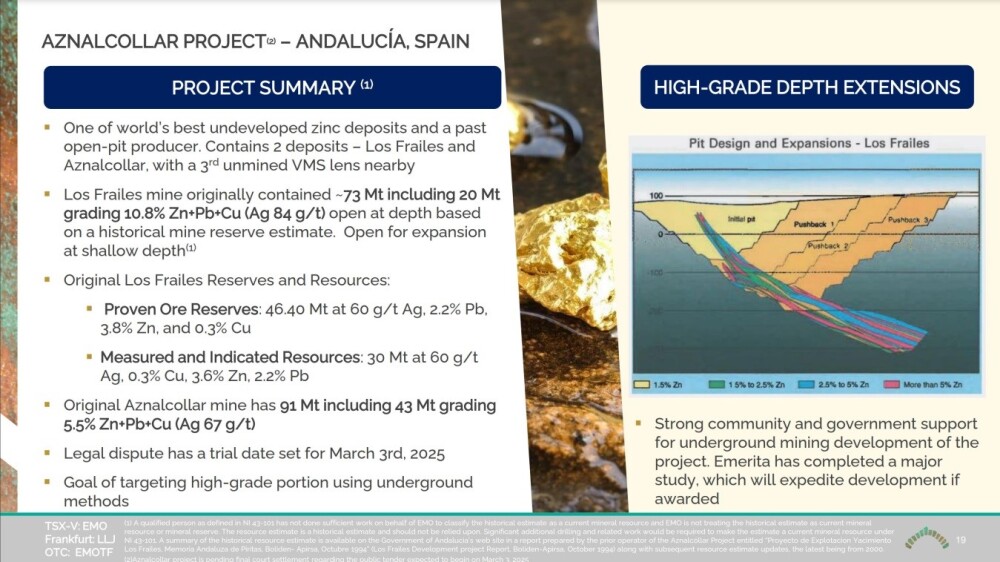

Lastly with respect to the company’s properties, the Aznalcollar Project, shown in pink on the map above, is a potential valuable addition to the company’s portfolio. It is the subject of a legal dispute with a trial date set for March of next year, but it is important to note that an out of court settlement seems likely prior to that.. The following slide gives some details of the project…

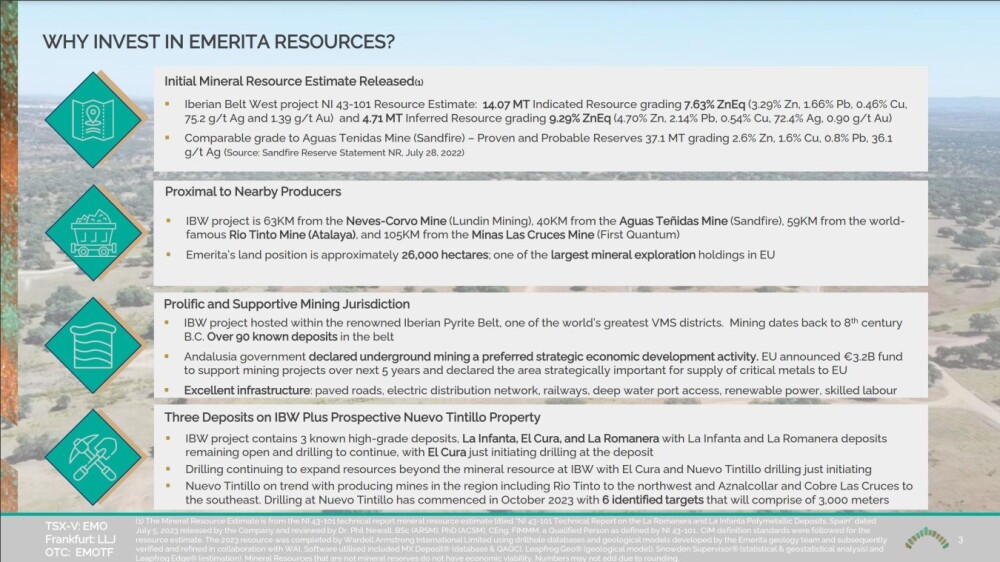

A key point to note with respect to Emerita Resources is that in addition to its properties being in a very favorable location that is blessed by excellent infrastructure, the EU is moving to secure critical minerals and to this end has declared the area strategically important for the supply of critical metals and expedited the permitting process with strategic projects such as Emerita’s eligible for additional financial support.

The following slide WHY INVEST IN EMERITA RESOURCES? sets out interesting details about the company, in particular about the NI 43-101 Resource Estimate.

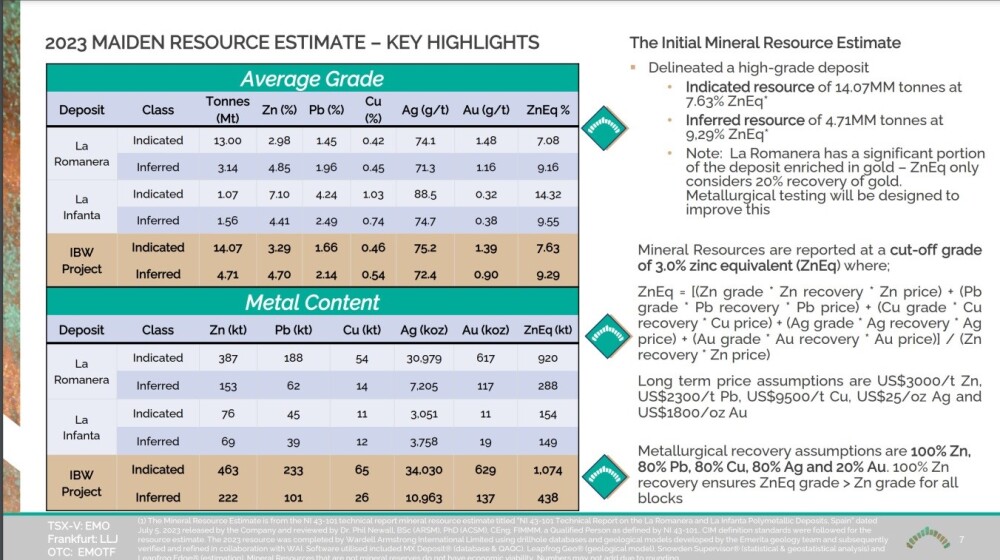

Here are the highlights of the Maiden 2023 Resource Estimate, where the figures for the IBW Project are the summations of the figures from the two targets within it, La Romanera and La Infanta.

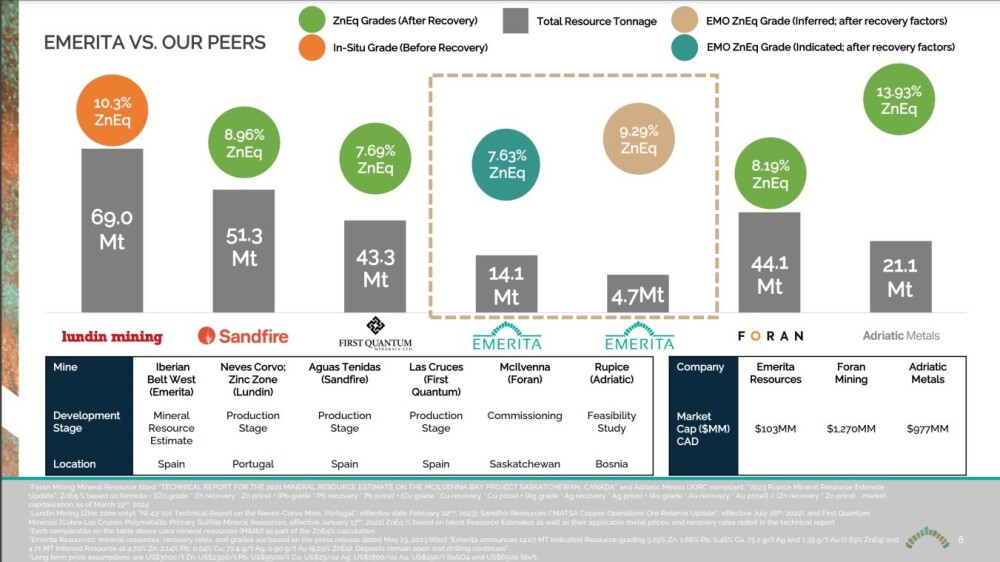

The following slide compares Emerita with its neighbors operating in the Iberian Pyrite Belt.

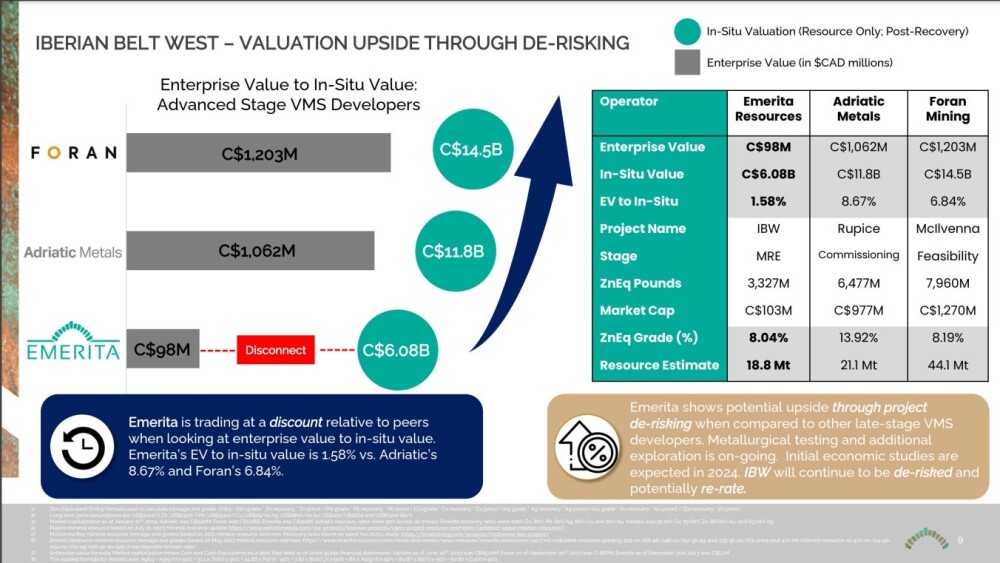

Now there follows a most important slide which shows the huge valuation upside that has the potential to be realized through the derisking of Emerita’s projects, which of course is what the company is working on in large part by means of its extensive ongoing drilling programs.

Clearly, if Emerita can achieve what its neighbors in the zone already have, its projects will be revalued from their current C$98 million to C$6.08 billion, which is a huge valuation increase and this is not unrealistic given that its properties are likely to approximate in quality to those of its neighbors and even if they are only half as good, we are still looking at huge valuation upside from here. The implications for shareholders are obvious which is a big reason why this report is being written.

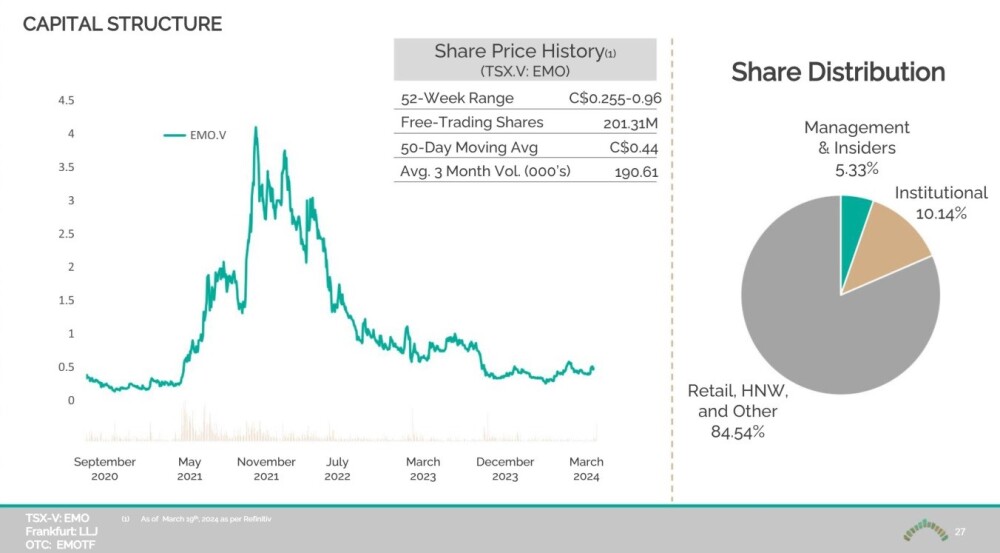

Turning now to the capital structure we see on the following slide that the number of shares in issue and trading publicly is on the high side, although with the stock now trading at 10% or less of its price at its 2021 peak, this has clearly been factored into the price.

The company has no debt or debt royalties or streams and has 100% ownership of its properties.

Turning now to the stock charts for Emerita we see on the 1-year chart that it is in the very late stages of completing a large Head-and-Shoulders bottom. While the volume pattern didn’t provide much of a clue as to what was going on during much of this pattern, upside volume rose noticably as the price has started the ascent out of the Right Shoulder low around the start of this month which is a most encouraging sign. So the dip of recent weeks back towards the support at the Right Shoulder low is viewed as presenting what will likely turn out to be the last opportunity to pick up the stock at these sort of low prices before it moves ahead to break out of the entire pattern against the background of a strengthening broad metals bullmarket that is expected to include not just gold and silver of course, but also base and industrial metal like copper and zinc etc.

Zooming out via the 6-year chart we see that the Head-and-Shoulders bottom that we just examined on the 1-year chart certainly has something to reverse as the pattern was preceded by a brutal bearmarket down from the 2021 – 2022 highs. In fact, this bearmarket dwarfs the Head-and-Shoulders bottom, making it rather hard to see on this chart. The chief important point to observe on this chart, which is why a 6-year timeframe for it was selected, is the strong support that is underpinning the H&S bottom and has caused it to develop in this price range. This strong support arises from the price having dropped into the upper reaches of a giant Pan & Handle base that formed from 2018 through early-mid 2021 which is shown on the chart, so clearly this is a good price zone for a reversal pattern to form. Whilst it might ordinarily “fiddle around” in this price zone perhaps for quite a long time before breaking higher this does not look likely because of the gathering massive bullmarket in metals caused by a combination of falling interest rates and accelerating inflation with money creation continuing to ramp up exponentially. So we look for this emerging metals bullmarket to trigger a breakout by Emerita into a major bullmarket – and soon.

Lastly we will look at the very long-term 14-year chart for Emerita which covers the entire life of the stock and shows that apart from the boom and bust cycle of 2021 through 2023 which left being a giant “stalagmite” pattern on the chart, that was birthed by the giant Pan & Handle base that we looked at on the 6-year chart, Emerita has essentially been in a giant trading range bounded by 0 on the downside and about C$1 on the upside for all of its life. The rather rare “Stalagmite” pattern, which you can’t call a top because by the time it’s completed you are back at the bottom again, is caused by a wild speculative frenzy being following a precipitous drop that is almost as steep, resulting from greed switching into fear as traders “jam the exits” trying to get out before the price drops any further. The price is currently a little below the midpoint of this long-term trading range and it is clear that if it should succeed in breaking out the top of it, by breaking above the key resistance in the C$1 area, and this is what is expected to happen sooner rather than later, a major bullmarket will be “on the cards” that in the environment we are moving into of amjor metals bullmarket could be spectacular.

The conclusion is that Emerita is a very attractive resource stock play at this juncture and it is therefore rated a strong buy for all timeframes and especially now with it being at an excellent entry point. It should be noted that a catalyst for the stock may well be an out of court settlement relatively soon regarding the dispute concerning the Aznalcollar property, which would result in the property becoming an asset that the company can then get to work on developing.

Emerita Resources <A HREF="https://www.emeritaresources.com/">website</A>

Emerita Resources Corp., EMO.V, EMOTF on OTC, clsoed at C$0.40, $0.294 on 28th March 24.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe