Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA) created a three-dimensional model of its main, "very compelling," potentially lithium-bearing target at its Columbus project in Nevada to better understand the subsurface structures and brine formations, noted a news release. The company incorporated into this predictive model its structural and stratigraphic interpretations of historical drill results and 15 years' worth of geophysical data.

"The evidence is strong that Canter is on to something here," wrote Jeff Clark of The Gold Advisor newsletter on March 20. "The geophysics here definitely suggests brine fluids are present, with the million-dollar question [being] what kind of lithium concentrations exist in those brines. It appears that answer is potentially very exciting."

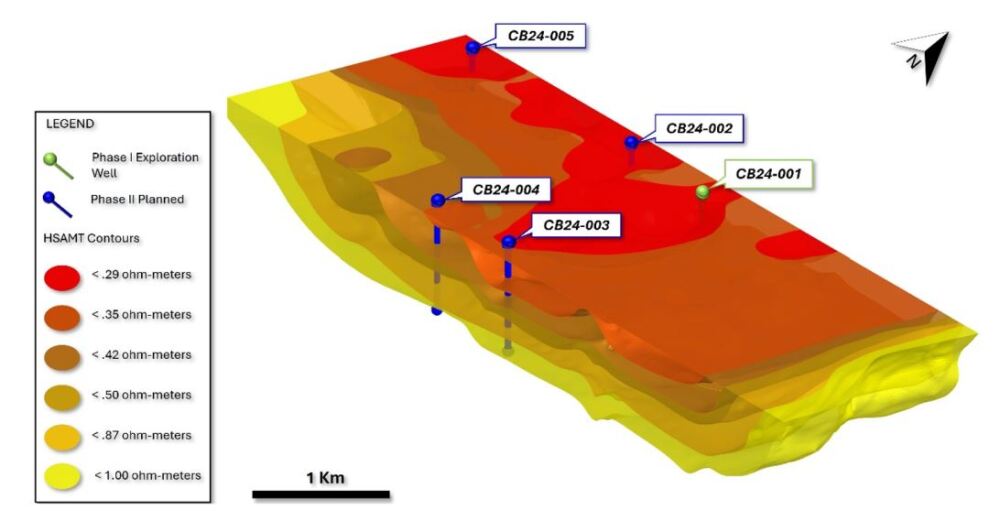

The proof includes a series of HSAMT (hybrid source audio magnetotellurics) resistivity values that indicate the presence of highly conductive material, lithium brine fluids, in this case. The lower the HSAMT value, the better the result. The target at Columbus returned many HSAMT resistivity values under 1 ohm-meter; Canter considers values under 0.5 ohm-meter, especially favorable.

These pockets, or shells, of HSAMT resistivity, comprising the primary target, are subsurface, in the central part of Columbus, and span an area that is 5 kilometers (5 km) wide, 10 km long, and 600 meters (600m) deep.

"It could go deeper, too, maybe a lot deeper," Clark noted.

In fact, the company said, gravity surveys showed a deep basement extending down to 3,658m, which implies that exploration upside and potential exist at depth.

Canter pointed out that this target at Columbus is similar, in terms of geology and deposit style, to Albemarle Corp.'s Silver Peak 28 miles away, also in Nevada. The Silver Peak mine has been producing lithium since the late 1960s.

There is even more evidence that supports lithium being present at Columbus, Canter said, based on results of historical surface sampling and prior drilling done in less conductive areas. They showed lithium values up to 1,600 parts per million (1,600 ppm) and boron levels higher than 10,000 ppm, and indicators of a multitiered aquifer system.

Has Potential for Major Lithium Discovery

Based in Vancouver, British Columbia, Canter Resources is a junior lithium and critical metals exploration with three properties. Its flagship, the Columbus lithium-boron project, spans 23,000 acres in Nevada, a Tier 1 mining jurisdiction deemed the world's best by the Fraser Institute in 2022. The property is the largest land holding in the Columbus salt marsh, after which it is named.

"Columbus is unique in that it is a structurally and hydrologically closed basin in Nevada with surrounding lithium bearing tertiary volcanic ash and tuffs that have fed the basin for the past 23 million years," according to the company's website.

This project is only a three-hour drive away from Tesla Inc.'s gigafactory in Nevada, which supplies lithium-ion batteries and component for Tesla's electric vehicles.

Canter also fully owns the Beaver Creek lithium property, covering a 1.3 km long by 0.3 km wide bed of lithium-rich outcrop near Lincoln, Montana. There, 99 surface samples returned lithium grades up to 1,500 ppm and averaging 500 ppm.

So, the Canadian explorer plans to do additional sampling from and mapping of this prospective area to validate historical data and further investigate the potential of these lithium occurrences, according to its 2024 corporate presentation.

Canter boasts a leadership team, which includes key personnel from American Pacific Mining, with a successful track record in navigating corporate and capital markets and mining exploration and discovery. American Pacific was named the world's top-performing gold stock globally in 2021 and was a finalist in the running for Deal of the Year in 2021 and 2022, part of S&P Globals Platts Global Metals Awards. Further, Canter's exploration team has extensive experience working at some of the largest lithium deposits in Nevada.

Since November 2023, the company has raised CA$4.4 million in equity, submitted and received all necessary permits from the BLM and NDOM, acquired third-party data, reinterpreted geophysics and created a new 3D model, secured the same technical team that worked with property vendor on large scale lithium projects in the region, secured dirt work contractor for site preparation and contractor for Geoprobe ahead of a Phase 1 drill program during the first half of 2024.

Sectors To See Continued Growth

Canter Resources straddles two growing sectors: lithium and boron.

Regarding lithium, the need for the metal is constant, given its use in lithium-ion batteries, which are used to power a vast array of products, from remote controls and cellphones to large appliances and electric vehicles, according to Eco Lithium. Other applications include digital cameras, pacemakers, laptops, watches, power packs, mobility scooters, alarm systems, backup power systems, golf carts, and energy storage.

Global demand for lithium has been rising steadily since 2020, and is expected to continue this trend to at least 2035, Statista data show. By then, demand will have reached an estimated 3,829,000 metric tons of lithium carbonate equivalent, a 317.5% increase from 917,000 metric tons in 2023.

The primary driver of lithium demand is the electric vehicle industry. For example, in China, the penetration rate of neighborhood electric vehicles is expected to reach 50% in the next three months, Stockhead reported on March 20, and this would "be a big boost to lithium demand."

As such, the lithium market is projected to expand at a 20.4% compound annual growth rate (CAGR) to US$6.4 billion (US$6.4B) by 2028 from US$2.5B in 2023, according to Markets and Markets.

With respect to the global boron market, Mordor Intelligence forecasts it will reach 6,040,000 tons (6.04 Mt) between 2004 and 2029, reflecting a 4% CAGR. Currently, the market is an estimated 4.89 Mt in size.

Demand for boron/borates for applications in agriculture, metallurgy, nuclear energy, advanced materials and high-tech is growing, the report noted. The increasing use of fiberglass in various end-user industries is also increasing demand.

According to the U.S. Geological Survey, borates are also used in abrasives, cleaning products, insecticides, insulation, ceramics, and semiconductors.

The Catalyst: Maiden Drilling

Canter is striving to deliver a major catalyst in H1/24 in the form of lithium brine results, it said. Soon the company will launch a phase one program at Columbus, to consist of Geoprobe and exploration well drilling.

"To the company's knowledge," Jeff Clark reported, "this will be the first drilling within the Columbus basin that tests zones with resistivity values with this degree of conductivity."

The newsletter editor and publisher pointed out that Canter's share price, which barely moved up on the recent news, remains at a good entry point for investors.

"I'm holding on to the stock and suggest the same if you own it," he wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA)

Ownership and Share Structure

As for ownership, according to Reuters, four insiders own 5.32%, or 2.71 million (2.71M) shares, of Canter Resources. From most to least shares owned, these individuals are CEO and Director Joness Lang with 3.26% or 1.66M shares, Chief Financial Officer Alnesh Mohan with 0.98% or 0.5M shares, Director and Technical Adviser Eric Saderholm with 0.59% or 0.3M shares, Strategic Advisor Michael Gentile with 4% or 2.1M shares, and Director Brian Goss with 0.49% or 0.25M shares.

Retail and institutional investors own the remaining 94.68%, including Palos Asset Management, EarthLabs Inc., Clarus Securities Inc., and Echelon Partners.

Regarding share structure, according to the company, it has 50.99M outstanding shares, 580,000 options, and 3.66M warrants, for a total of 55.23M fully diluted shares.

Canter's market cap is US$18.9M, and its 52-week trading range is US$0.07-0.99 per share.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Canter Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Canter Resources Corp.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.