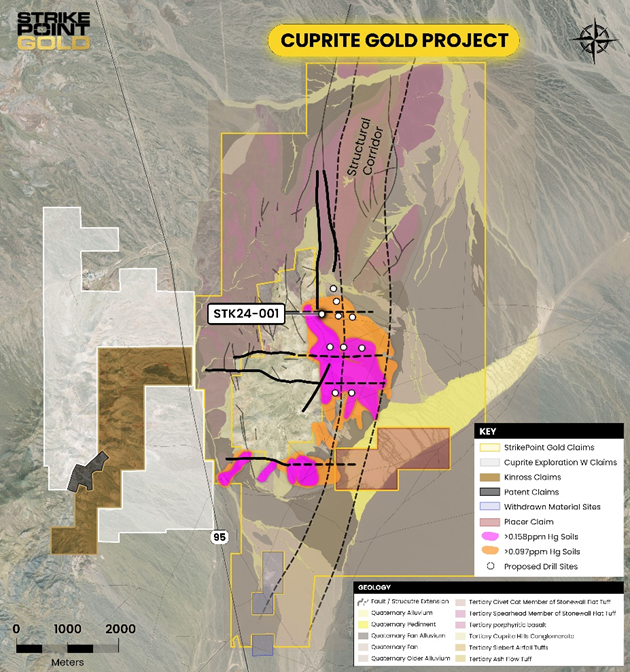

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) began a maiden drill program at its Cuprite gold project in Nevada's historical Walker Lane trend, it announced in a news release.

Envirotech Drilling will carry out the work, comprising seven to ten holes placed over 5,000 meters (5,000m), at this property near other notable mining projects.

"The surface similarities to AngloGold's new Silicon and Merlin discoveries make the Cuprite gold project a compelling drill target," StrikePoint President and Chief Executive Officer Michael G. Allen said in the release. "Silicon and Merlin are new blind discoveries totaling over 13,000,000 ounces (13 Moz) of gold and prove that there are still Tier 1 gold discoveries to be made in Nevada, particularly in the Walker Lane Trend."

Last month, StrikePoint announced it identified drill targets at Cuprite through an induced polarization survey.

"These targets appear to be relatively close to surface and of a size that could support a major new discovery in Nevada," the company said.

Metals Rich Project Portfolio

StrikePoint Gold, based in Vancouver, British Columbia, is a gold explorer with three projects aiming to build precious metals resources.

Cuprite is the company's flagship project. It consists of 574 unpatented claims covering 44 square kilometers in an underexplored mining trend, home to the Comstock Lode, Anaconda, and Candelaria mines of yesteryear, in Nevada. This Tier 1 jurisdiction was the U.S.'s top gold-producing state last year, according to the U.S. Geological Survey (USGS).

Strikepoint acquired Cuprite, it said, because of its similarities to another project in Walker Lane, Anglogold's Silicon, the 4.22 Moz gold resource of which was announced in 2022. The steam-heated alteration seen at Cuprite may, in fact, be larger than that at Silicon.

"Cuprite represents a low-cost, high-impact entry into Nevada," StrikePoint said.

In recent years, many mergers and acquisitions have occurred in the Silver State. They include AngloGold purchasing Corvus Gold and the Sterling project and Centerra Gold buying the Gemfield project.

"Last year saw a lot of activity on the Walker Lane trend nearby, especially by AngloGold," Technical Analyst Clive Maund wrote in a February 22 report. "The chances of StrikePoint finding something very worthwhile this year at the Cuprite gold project are considered to be high."

"Last year saw a lot of activity on the Walker Lane trend nearby, especially by AngloGold," Technical Analyst Clive Maund wrote in a February 22 report. "The chances of StrikePoint finding something very worthwhile this year at the Cuprite gold project are considered to be high."

Certain members of the leadership team have experience in the mining industry in Nevada. CEO Allen, for example, previously was involved in exploring the nearby Sterling project as well as other properties in the state.

StrikePoint's other two projects, both in the advanced exploration stage, are in British Columbia’s Golden Triangle. One, the gold-silver Porter-Idaho project, sited at the head of the Portland Canal, boasts two past-producing mines, Silverado and Prosperity-Porter Idaho. Between these two former mines is an unexplored, undrilled, 2,000m area.

"Veins at both sites run at a similar orientation; therefore, it is hypothesized that the system may be continuous under the peak of Mount Rainey," the company said.

An existing resource, calculated from Porter's Prosperity and D veins in 2012, includes 394,700 tons of 868 grams per ton silver (868 g/t Ag) in the Indicated category and 88,900 tons of 595 g/t Ag in the Inferred category.

StrikePoint's other Canadian project is Willoughby, encompassing three mineral claims over 995 hectares. Significant historical drilling was done there and showed the presence of excellent gold and silver grades. One intercept, for instance, from the North zone, hole U96-02, returned 120.3 g/t gold (Au) and 2,434.84 g/t Ag over 3.5m. The most recent exploration work done at Willoughby was a 1,715m drill campaign in 2020.

Exploration Unearths New Deposits

Gold is an important metal used in various products, including computers, communications equipment, spacecraft, jet aircraft engines, jewelry, and more, and is a long-term store of value, according to the USGS.

Silver is one of the metals needed in large quantities for the transition to green energy, the International Precious Metals Institute reported in January. Thus, demand is growing, particularly for use in solar power generation and electric vehicles, but supply is constrained.

Precious metals exploration companies, like StrikePoint, are crucial to the mining industry and the world, experts said.

Exploration "leads to the discovery of new mines, more investments, and new jobs in the sector," Josie Osborne, British Columbia's minister of energy, mines, and low-carbon innovation, asserted in a recent statement. "Mineral exploration is vital to unearthing new deposits, including critical minerals."

Stocks of junior mining companies offer exposure to a commodity, the precious metals, in the case of StrikePoint. They tend to be less expensive than those of the seniors, and the payoff can be big. When early-stage mining companies are successful, according to mining investment firm Lion Selection Group, "they can provide outstanding investment returns."

The Catalyst: Project's First Drill Data

With drilling now underway at Cuprite, a flow of results will follow. They could boost StrikePoint's stock price.

"The potential for rapid appreciation of the stock," Maund commented, "centers on the big maiden drilling program that will commence on the property in March, with results expected as soon as April. This clearly could generate some serious interest."

Maund, just last month, recommended StrikePoint as a Strong Buy for all time frames. In his report, he wrote that the stock, then only CA$0.05 per share, was an exceptional bargain. This is about where it is today, still only roughly 1% of the price at its peak in 2009-2019.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB)

In sum, now is the time to invest in StrikePoint, as the price is now cheap and could jump up on positive drill results. The upcoming data are likely to be good and are expected shortly.

Ownership and Share Structure

Reuters provided a breakdown of the company's ownership and shares structure, where management and insiders own approximately 1.84% of the company.

According to Reuters, Executive Chairman Shawn Khunkhun owns 0.55% of the company, President and CEO Michael G. Allen owns 0.89%, Director Ian Richard Harris owns 0.13%, and Director Adrian Wallace Fleming owns 0.04%.

Reuters reports that institutional investors own approximately 16.42% of the company, as 2176423 Ontario, Ltd. owns 13.96% of the company, U.S. Global Investors, Inc. owns 1.29%, and Sprott Asset Management L.P. owns 1.17%.

According to Reuters, there are 213.78 million shares outstanding with 180 million free float traded shares, while the company has a market cap of CA$12.83 million and trades in a 52-week range of CA$0.035 and CA$0.085.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- StrikePoint Gold Inc. a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of StrikePoint Gold Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Contributing Author Disclosures:

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.