Tisdale Clean Energy Corp. (TCEC:CSE; TCEFF:OTCQB; T1KC:SE) began drilling the Fraser Lakes B uranium-thorium deposit earlier this year, and Chief Executive Officer and Director Alex Klenman is optimistic about the future of this South Falcon East project in Saskatchewan's Athabasca basin, he said in a recent interview.

"I think we've got something here we can develop and really build value on," Klenman said.

The Canadian uranium explorer has the option to earn a 51% stake in South Falcon East and then potentially increase it to 75% by exploring and developing the project, per an existing agreement it has with owner Skyharbour Resources Ltd., Klenman explained. It calls for Tisdale to spend about US$10 million (US$10M) on advancing the project and pay Skyharbour about US$11M in cash and shares. Tisdale has fulfilled the required obligations so far.

"What we like about the project and found so compelling is to have our market cap where it's at and to be able to earn into the majority of a deposit," said Klenman. "An asset that eventually backs your valuation is critical."

Building on a Historical Resource

The initial objective with drilling at Fraser Lakes B, said Tisdale Geologist Trevor Perkins, who also participated in the interview, is to twin the holes having the best mineralization historically "to improve our confidence of how the mineralization looks, where exactly it is." Subsequently, over the next two to three years, the company will work to increase the deposit grade and size.

To date, Tisdale has drilled two holes there in known mineralization, results of which it expects to receive within six to eight weeks. Meanwhile, while the drill rig is on a nearby project, Tisdale is taking a break and will resume drilling later in the year. The project is located so that drilling can be done almost year-round.

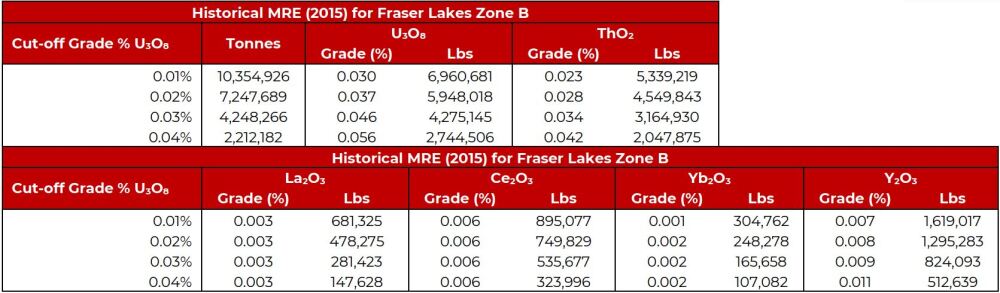

The Fraser Lakes B deposit contains an Inferred resource of 6,960,000 pounds (6.96 Mlb) of 0.03% U308 at a cutoff grade of 0.01%, according to an estimate prepared in 2012. Also present at the same cutoff grade are other elements Tisdale may be able to monetize. They are 5.3 Mlb of thorium and rare earth elements: 1.62 Mlb of yttrium, 895,000 pounds (895 Klb) of cerium, 681 Klb of lanthanum, and 305 Klb of ytterbium.*

Skyharbour did some drilling of Fraser Lakes B in 2015. Some of the uranium intercepts returned then were 3 meters (3m) of 82% U3O8, including 2m of 0.10% U3O8. Hole 15, for example, showed 6m of 0.1% U3O8, including 2m of 0.165% U3O8, at 135m downhole as well as 2.5m of 0.172% U3O8 at 145m downhole.

"That's almost a 500% increase over the grade of the deposit," Klenman said. "We're showing that there's higher grade material within this deposit and potentially elsewhere on the project ground, and that's important."

Thus, resource expansion potential is significant. For one, the results of drilling by Skyharbour were never incorporated into the existing resource, noted Perkins. Also, the deposit remains open in all directions. Further, management believes Tisdale will discover additional deposits on the property, Perkins said, given South Falcon East's size, just over 12,000 hectares, and the Athabasca's prolific mineralization. Whether big or small, any newly discovered deposits would increase the project's value.

David Talbot, Red Cloud Securities analyst, reported that Tisdale's upcoming drill plan for the Fraser Lakes B deposit will span 1,500m and commence in winter 2024.

Klenman discussed the location of South Falcon East. For Tisdale, a company with a low market cap, he pointed out, it is in a "very high rent district" given the major players all around. They include Rio Tinto, Uranium Energy, Orano, NexGen, Denison, and Cameco.

South Falcon East is on the perimeter of the Athabasca basin, in an area known for unconformity-style deposits and where mineralization is near surface, not underneath sandstone, explained Perkins. He added that Fraser Lakes B is hosted in pegmatite and its mineralization is shallow, ideal for open-pit mining.

Overall, said Klenman, Tisdale Clean Energy has a mineralized deposit in Fraser Lakes B, great regional exploration potential at South Falcon East, high prospectivity, an experienced geologist in Perkins, a great partner in Skyharbour and its CEO Jordan Trimble, and no cheap financings.

"There's a lot to like here," the CEO added.

Stock at a Good Entry Point

David Talbot, Red Cloud Securities analyst, reported in a February 9 research report that Tisdale's upcoming drill plan for the Fraser Lakes B deposit will span 1,500m and commence in winter 2024.

"We look forward to the results of the program," he added. "The confirmation drilling should help in eventually making the historical resources current, with [the] potential to expand the resource base if the results of extension and regional drilling are positive."

Technical Analyst Clive Maund wrote in a January report that Tisdale's stock was at a favorable entry point and offered great upside potential, in large part because its float is low.

He explained, "The bullish volume pattern and continuing uptrend in the accumulation line are most auspicious and suggest that a breakout into a major new bull market is incubating."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Tisdale Clean Energy Corp. (TCEC:CSE; TCEFF:OTCQB; T1KC:SE)

As such, though speculative, Tisdale looked attractive and "worth going overweight on while it is still at a low price." At the time, the stock was trading at about CA$0.17 per share; it is trading even lower now.

Ownership and Share Structure

Tisdale provided a breakdown of the company's ownership and share structure, where CEO Alex Klenman owns 3.2% of the company with 1.02 million shares.

Planet Ventures Inc. owns approximately 12% of the company, with 3.88 million shares, while Skyharbour Resources owns approximately 3.5%, with 1.11 million.

There are 31.5 million shares outstanding, while the company has a market cap of CA$4.7 million and trades in the 52-week period between CA$0.14 and CA$0.72.

*The historical resource is described in a technical report on the Falcon Point uranium project, Northern Saskatchewan, dated March 20, 2015, and filed on SEDAR by Skyharbour Resources Ltd. Tisdale is not treating the resource as current and has not completed sufficient work to classify the resource as a current mineral resource. While Tisdale is not treating the historical resource as current, it does believe the work conducted is reliable, and the information may be of assistance to readers.

Want to be the first to know about interesting Uranium and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Tisdale Clean Energy Corp. and Skyharbour Resources Ltd. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Tisdale Clean Energy Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tisdale Clean Energy Corp. and Skyharbour Resources Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.