Clinical-stage biopharmaceutical company Verona Pharma Plc (VRNA:NASDAQ; VRP:LON) is looking toward a pivotal year as its new chronic obstructive pulmonary disease (COPD) drug ensifentrine nears possible approval by the FDA.

The company's new drug application (NDA) was accepted last year, and the FDA has set a date of June 26 for its possible approval. The FDA also notified Verona that it is not planning to hold an advisory committee meeting on the application.

"The NDA acceptance brings us closer to our goal of delivering ensifentrine to the millions of patients suffering from COPD," said Verona President and Chief Executive Officer David Zaccardelli. "If approved, ensifentrine is expected to be the first novel inhaled mechanism available for the treatment of COPD in more than 20 years."

On the strength of the possible approval, at least two research companies have the company on their lists of top picks for 2024, including Jefferies Research Services LLC and Wedbush Securities Inc.

"In 2024, we think VRNA stock is poised to break out of its consolidation pattern, as novel ensifentrine (twice-daily PDE3/4 nebulizer) for uncontrolled COPD (1) is 90-95% likely to be FDA-approved by June 26, (2) could produce strong sales immediately thereafter, and (3) should eventually reach [US]$1B+ (billion-plus) peak sales," analyst Andrew Tsai wrote for Jefferies.

Jefferies analyst Andrew Tsai, who gave the stock a Buy rating with a price target of US$38 per share, said the company's management is also "well-prepared to launch quickly after approval."

Tsai, who gave the stock a Buy rating with a price target of US$38 per share, said the company's management is also "well-prepared to launch quickly after approval," with 100 representatives to target the thousands of high-prescribing pulmonologists, nurse practitioners, and physician assistants who write 70% of prescriptions.

"We think (ensifentrine) could become an attractive [US]$1B+ add-on therapy that expands the [US]$10B+ branded COPD market (rather than take share)," Tsai noted. "We have 90-95%+ conviction in an FDA approval, given Ensi's strong efficacy across two pivotal studies (not randomness), SGRQ symptom improvement (important), and placebo-like safety. Net-net, we see the stock climbing higher in 2024."

The Catalyst: Nearly 16 Million Adults Affected in US

COPD is caused by damage to the airways or other parts of the lung that blocks airflow and makes it hard to breathe, according to the National Heart, Lung, and Blood Institute.

"In the United States, COPD affects nearly 16 million adults, and many more do not know they have it," the institute noted. "More than half of those diagnosed are women. COPD is a major cause of disability, and it is the sixth leading cause of death in the United States, according to the Centers for Disease Control and Prevention (CDC)."

"In the United States, COPD affects nearly 16 million adults, and many more do not know they have it," the institute noted. "More than half of those diagnosed are women. COPD is a major cause of disability, and it is the sixth leading cause of death in the United States, according to the Centers for Disease Control and Prevention (CDC)."

The World Health Organization (WHO) said COPD is the third-leading cause of death worldwide, causing 3.23 million deaths in 2019. More than 80% of those occurred in low- and middle-income countries.

The aging of the world's population is expected to contribute to a rise in such conditions. The World Ageing 2020 report predicted the number of people aged 65 or older will more than double from 2020 to 2050, increasing from 9.3% of the world's population to 16%.

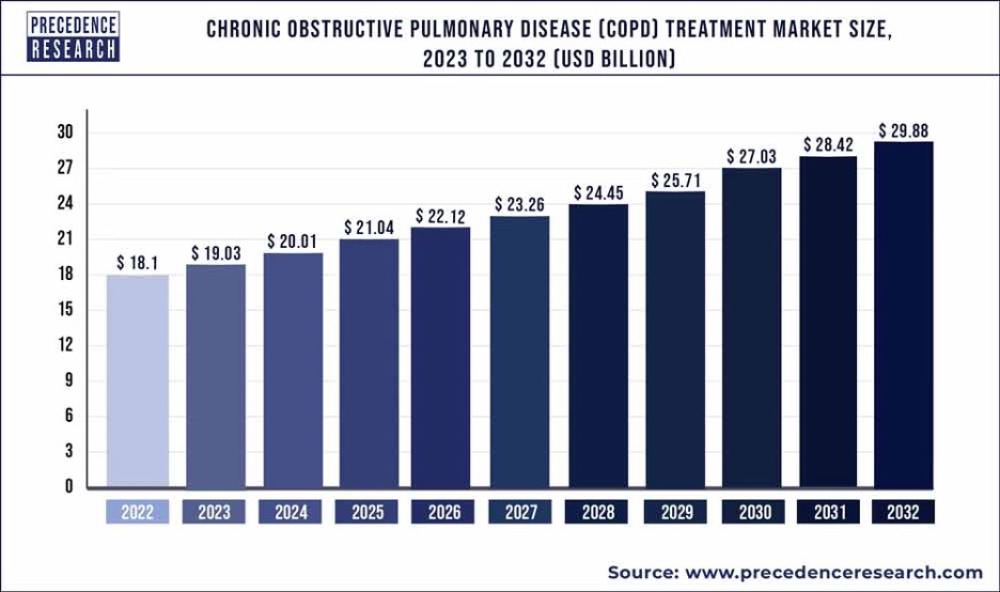

The global asthma and COPD drugs market revenue was valued at US$37.2 billion in 2022 and is expected to rise to about US$56.8 billion by 2030, with a 5.4% compound annual growth rate (CAGR), according to a study published by Towards Healthcare, a sister firm of Precedence Research.

'Blockbuster' Sales Coming?

Wedbush analysts Andreas Argyrides, Liana Moussatos, and Caroline Pilcher noted Verona is also preparing Phase 2 trials for a nebulized, fixed-dose formula of ensifentrine/glycopyrrolate in COPD and for nebulized ensifentrine in non-cystic fibrosis bronchiectasis (NCFBE).

They also projected "blockbuster" sales of US$2.4 billion for ensifentrine for COPD maintenance therapy, "assuming a U.S. launch in July 2024."

Wedbush, which also named the stock a top pick of the year, rated it Outperform with a 12-month price target of US$33 per share.

Analyst Raghuram Selvaraju of H.C. Wainwright & Co. rated VRNA a Buy with a US$32 per share target price, saying the company "ought to be able to execute a comprehensive launch of ensifentrine in the second half of the year."

Analyst Raghuram Selvaraju of H.C. Wainwright & Co. rated VRNA a Buy with a US$32 per share target price, saying the company "ought to be able to execute a comprehensive launch of ensifentrine in the second half of the year."

"In our view, Verona appears substantively risk-mitigated, and we continue to believe that there ought to be substantial interest in Verona as an M&A target if ensifentrine wins FDA approval," the analyst wrote.

Until the possible approval of the drug, Verona plans to finalize the pricing, distribution network, and patient service programs to support it. It also plans to leverage an unbranded COPD awareness campaign and have a presence at large medical conferences this year.

Ownership and Share Structure

According to Reuters, 1.03% of the company is with management and insiders, and 85.21% is with institutions.

Top shareholders include RA Capital Management LP with 7.82% or 6.32 million shares, New Enterprise Associates with 6.32% or 5.11 million shares, Fidelity Management & Research Company LLC. with 5.29% or 4.27 million shares, and Vivo Capital LLC with 5.26% or 4.25 million.

The rest is retail.

Verona Pharma Plc has a market cap of US$1.34 billion with 80.82 million shares outstanding, and 72.34 million free float shares. It trades in a 52-week range of US$23.81 and US$11.83.

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Verona Pharma Plc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.