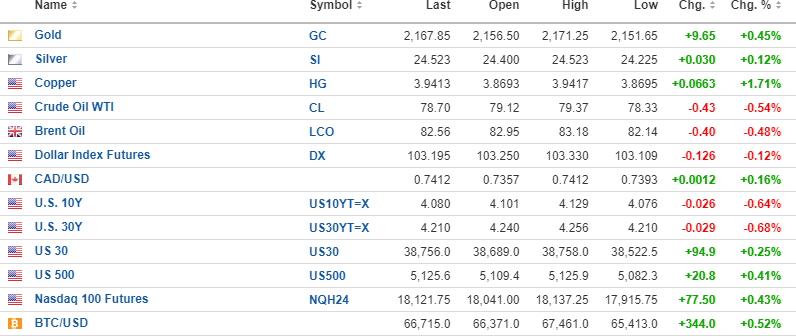

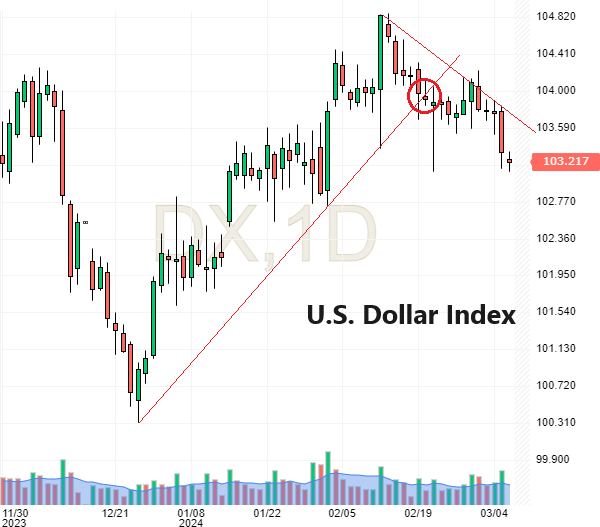

The USD Index is continuing its lower trajectory today after Fed Chairman Jerome Powell's testimony before Congressional leaders offered a somewhat dove-ish bent, which is just what the bond and stock markets love to hear.

While gold and silver are higher by 0.45% and 0.12%, respectively, this morning's big story is copper — up 1.71% or $0.066/lb to $3.94/lb. It seems that China has announced that major copper smelters may cut production.

Bond yields are lower along with oil prices, triggering some buying into the stock index futures, which are all up going into the 9:30 opening.

The entire commodity complex being quoted globally almost entirely in U.S. dollars is dependent upon the direction of the dollar as there is a near-100% inverse correlation between the dollar and commodities.

The algorithms that control the automated trading systems around the world 24/7 have no analytical bone in the pre-programmed "brains."

They are 100% reactive, and as such, they respond to movements in the USD that are, in turn, responding to inputs such as Fed policy, earnings, inflation, and employment.

May copper appears to be prepared to challenge the highs of late December when it registered a $3.97/lb. print. The news out of China came out of left field as all eyes have been on Chinese demand numbers rather than a possible production cut, which is a supply issue and may well be the catalyst that allows copper to take out the psychologically important $4.00/lb. level.

If that occurs, my portfolio will be quite happy as I am overweight copper by way of Freeport McMoRan calls, Fitzroy Minerals Inc., and American Eagle Gold Corp. Also on the radar are the two copper miner ETF's, COPX:US (senior producers) and COPJ:US (Juniors), which I have mentioned in the past but have yet to formally include in either of the model portfolios.

GLD:US ($199.80)

The market is now solidly in "overbought" territory so while I respect the breakout more than I fear the stretched technical position, prudent traders and investors are wise to delay new purchases of any of the gold names. That said, I will not sell the calls as they are now up over 137% in seventeen days but still have 106 days left until expiry. I own a 60% position and am looking to buy the other 40% into weakness, but that is only if I can get the RSI down below 50.

The June $185 calls hit $17.90 this morning, so they are within striking distance of my $20 target price for the calls, which is $205 on the stock. As I wrote yesterday, however, the point-and-figure diagram suggests $220 as a possible price objective but that will be after the overbought condition gets rectified by either a 3-5% pullback to between $189.81 and $193.80.

With over three months until expiry, I can afford to hold them and add to any corrective action.

Frepport-McMoRan

Freeport-McMoRan Inc. (FCX:NYSE) is up 5.74% today, taking the June $40 calls from a loss to an 18% profit in one day.

FCX is a copper-gold producer, and since copper and gold are my two top metals for 2024, this is the perfect blue-chip proxy for performance within the metals space.

Subscribers that do not trade options but want leverage need look no further than FCX because with gold screaming higher and copper soon to follow, you will see a huge lift in FCX when the "generalist" portfolio managers start to reallocate capital away from tech and crypto and into the metals, which most surely is on the horizon.

Fitzroy Minerals

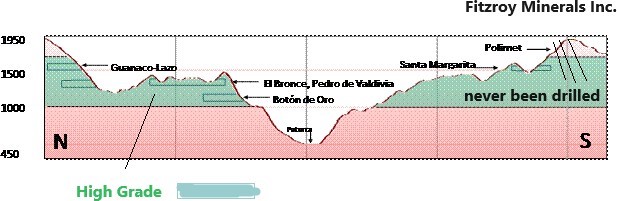

Speaking of copper and the juniors, I had a great luncheon meeting yesterday with Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) brass, including Chairman Campbell Smyth and newly-appointed CEO/President/Director Merlin Marr-Johnson but the delightful surprise was meeting former senior Vale geologist Gilberto Schubert, whose team did all the early work on FTZ's Caballos Copper project prior to the pandemic in 2020.

I plan a Special Situations report this weekend on not only Caballos but also on Gilberto Schubert, who is about to join the Fitzroy Advisory Board for guidance on both Caballos and the Polimet gold-copper project located next door to Caballos. Discussing both projects with Gilberto, I came away with a heightened level of comfort verging upon excitement because this is a Chilean national who knows the country and knows the politics, but most importantly, he could actually build and operate a copper mine in addition to finding a deposit that could qualify.

I have not spoken or written very much about the Polimet acquisition, but after speaking with Gilberto, the grades of gold and copper between the 1,000' and 1,600' levels (above sea level) are nothing short of obscene, which I will explain in the report. Small-scale mining at Polimet has revealed these kinds of grades, but there has never been any advanced exploration on the property, which is planned for 2024. From the diagram shown below from the FTZ website, you can see where mines are operating within the 1,000-1,600 zone and also how wide open Polimet is to future drilling into that highly- fertile zone.

In my 45 years covering juniors, this is the type of exploration program that gives me goosebumps that only come when I smell a big, new, high-grade discovery. From the website: "The partial records of sales to the state-owned Enami show weighted average grades of 33.5 g/t Au, 55 g/t Ag and 6.9 % Cu for the 117 tonnes of DSO material, and 4.7 g/t Au, 10 g/t Ag and 1.0 % Cu for the 618 tonnes of sulfide ore." Those grades are world-class.

This is why I say that the luncheon included the unexpected delight of meeting the one man who knows the two projects intimately and can describe with great confidence and detail the incredible opportunity subscribers have in the shares.

Drilling in the order of 3,000 meters at Caballos and 2,000 meters at Polimet is included in the 2024 budget.

We all own lots of Fitzroy through earlier purchases in Norseman Silver, but I have added more, though this $0.15 unit (1/2 warrant at $0.25) is still available for a very short period of time, as management is now in London (U.K.) for a week of marketing during which the offering will undoubtedly close.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Eagle Gold Corp. and Fitzory Minerls.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.