Centenario Gold Corp. (CTG:TSX.V) announced the results of maiden drilling at its Eden gold-silver property in Durango and Sinaloa, Mexico, and its intention to keep exploring the property, a news release noted.

"The information we got from this first drilling program confirmed that the Buenavista mineralized system is continuous at depth and along strike," Chief Executive Officer Alain Charest said in the release.

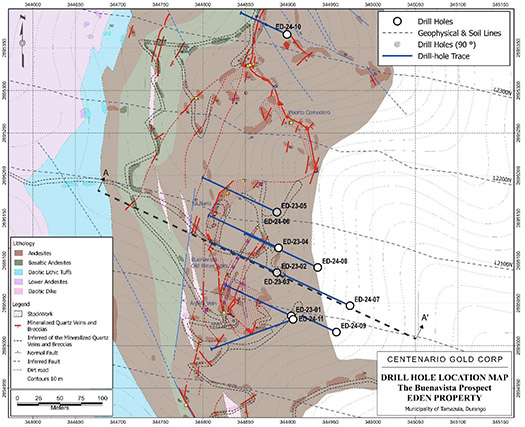

Eden hosts a series of high-grade, north to northeast-trending epithermal gold-silver vein structures. In one of them, Buenavista, Centenario has proven the existence of a 2.8 kilometer (2.8 km)-long mineralized corridor. On previously carried out sampling, one area of the corridor returned gold grades as high as 239.9 grams per ton (239.9 g/t) and silver grades up to 1,390 g/t.

Eden hosts a series of high-grade, north to northeast-trending epithermal gold-silver vein structures. In one of them, Buenavista, Centenario has proven the existence of a 2.8 kilometer (2.8 km)-long mineralized corridor. On previously carried out sampling, one area of the corridor returned gold grades as high as 239.9 grams per ton (239.9 g/t) and silver grades up to 1,390 g/t.

It was in a 650m section of this specific area that the company drilled the 11 holes of its initial campaign, each to a depth of 100–150 meters (100–150m).

Results showed that all 11 holes intersected the Buenavista vein-breccia structure at a depth of between 50m and 110m. Down to this depth, low-temperature quartz textures were shown to be present. One hole, ED23-01, also hit a parallel structure, rich in quartz.

The occurrence of quartz both at surface and at depth suggests a gold-silver system may exist further downdip, the release noted. Findings from previous exploration work support this possibility. They showed the presence of a quartz-rich mineralized zone in the old mine workings area and that it is continuous to the north-northeast and dips slightly along strike.

"The drill information will further help us to better vector in on the mineralized zones within the system," Charest added.

Compelling Precious Metals Asset

Centenario Gold is a mineral explorer headquartered in Vancouver, British Columbia, with a highly prospective asset in Mexico's historical Guadalupe de Los Reyes mining district. Centenario's Eden project spans 5,689 hectares and is comprised of three adjoining mineral concessions.

To date, the company has identified four mineralized vein-breccia systems at Eden. Along with Buenavista, its primary target so far, they are Paloma, Guadalupana and Provedora. Because Centenario has only drilled Buenavista and a small portion of it at that, numerous targets remain along the four structures and beyond.

"The company believes that the Eden property, as a whole, hosts a significant gold-silver system as proven by the exploration work completed so far," noted the release.

The location of Eden bodes well for the project, too, the company said. Less than 8 km to the south of the Buenavista mineralized corridor is Prime Mining's Los Reyes gold-silver project. The mineralization and geology of the two projects are identical, Centenario said. Los Reyes' latest resource estimate is 1,470,000 ounces of gold equivalent (1.47 Moz Au eq) in the Indicated category and 0.73 Moz Au eq in the Inferred category.

Earlier this year, Centenario closed a private placement financing that generated CA$50,000 in proceeds, a news release indicated. The company will use the funds to continue exploring Eden.

Critical Segment of Mining Industry

Mineral exploration and the junior companies that do it, like Centenario, are crucial to the mining industry and the world, experts said.

Exploration "leads to the discovery of new mines, more investments and new jobs in the sector," Josie Osborne, British Columbia's minister of energy, mines and low-carbon innovation, asserted in a recent statement. "Mineral exploration is vital to unearthing new deposits, including critical minerals, which are the building blocks of clean technology and today are more important than ever because of their role in helping us to transition away from fossil fuels and toward a clean-energy future."

Silver, for example is one of the metals needed for this green shift, the International Precious Metals Institute reported in a January article. Yet, demand is growing, particularly for use in solar power generation and electric vehicles, and supply is constrained.

Stocks of junior mining companies offer exposure to a commodity, the precious metals in the case of Centenario. They tend to be less expensive than those of the seniors, and the payoff can be big. When early-stage mining companies are successful, according to mining investment firm Lion Selection Group, "they can provide outstanding investment returns."

Also notable, Financial Analyst Matthew Badiali pointed out in a 2023 article, "The mineral exploration sector is ripe for investment."

The Catalyst: Fresh Exploration Plan

While Centenario awaits the outstanding results from holes ED24-09 and ED24-11, it will finish analyzing and interpreting the existing drill data. Then it will plan another exploration program for Eden, to include more sampling, mapping and drilling, targeting the Buenavista extensions and Paloma, Guadalupana and Provedora.

"We are firmly determined to continue exploring and initiate the second phase drill program," Charest added.

Ownership and Share Structure

According to Reuters, management, directors and insiders own 12.05%, or 5 million (5M) shares, of Centenario Gold.

From greatest to least percentage owned, these individuals are CEO, Vice President of Exploration and Director Alain Charest with 4.42% or 1.83M shares, President, Corporate Secretary and Director Douglas Fulcher with 3.01% or 1.25M shares, Chief Financial Officer Jonathan Younie with 2.19% or 0.91M shares, Director Kevin Milledge with 1.08% or 0.45M shares, Director Pablo Mendez Alvidrez with 0.99% or 0.41M shares and Director Mary Ma with 0.35% or 0.14M shares.

Retail investors own the remaining 87.95%. There are not any institutional investors at this time.

Centenario has 41.5M shares outstanding and 36.5M free-float traded shares. Its market cap is CA$1.84 million and its 52-week trading range is CA$0.04−0.18 per share.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |