Tisdale Clean Energy Corp. (TCEC:CSE; TCEFF:OTCQB; T1KC:SE) announced in a press release that the company has begun moving equipment to the Fraser Lakes B deposit on the South Falcon East uranium project for its upcoming drill program. The company is a partner of Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE), and has an option agreement with Skyharbour that stipulates that Tisdale may earn 75% interest in the property.

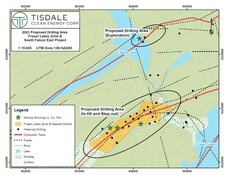

The company reports that Phase 1 of the drilling will cover 1,500m on the property and will consist of infill drilling to provide a better picture of mineralization on the property and stepout drilling to expand on the deposit, which is currently open.

Tisdale stated that it would also follow up on anomalies in the T-Bone Lake area, where it hopes that drilling would reveal further mineralization on the South Falcon East project.

Trevor Perkins, the Consulting Geologist with Tisdale, stated, "We are happy to finally be getting on the ground at South Falcon East. This program will be the first step to confirming and expanding the Fraser Lakes B Uranium Deposit. We believe that the size and grade of the existing deposit can be increased and are confident we can discover new deposits in the vicinity. We anticipate several exciting years ahead as we advance the South Falcon East Project."

Uranium On the Rise

Uranium has seen increased demand as the world struggles to meet green energy goals.

However, as Dominic Frisby with The Flying Frisby reports, uranium is looking at a looming deficit. Kazatomprom, the world's largest uranium producer, and Cameco, North America's largest producer, have both announced that they have struggled to meet production goals.

As supply continues to tighten, prices are expected to continue rising.

A report from Katusa Research on February 7, 2024, concurred, commenting, "With its price skyrocketing to a 17-year high of US$106 per pound, uranium has become the poster child for dramatic market shifts."

A Strong Buy

Technical Analyst Clive Maund rated Tisdale Clean Energy positively on January 30, 2024, as a "Strong Buy here for all timeframes."

He examined the company's stock patterns and commented, "We can see that, following a severe decline, the stock started a basing process back last July-August, and it is clear that this base pattern has taken the form of a fine low Cup & Handle base that now looks to be about complete, and it may even already be complete." He continued, "Then it only remains for the price to break above the resistance marking the upper boundary of the entire base pattern — once it does that, a major new bull market will ‘officially' have begun."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Tisdale Clean Energy Corp. (CSE: TCEC;OTCQB: TCEFF;FSE: T1KC)

Michael Ballinger with GGM Advisory Inc. also reviewed the company positively and commented that investing in Tisdale, as opposed to an organization with a larger market cap, "takes me out of the CA$90 million market cap of WUC/WSTRF and into a CA$2.9 million market cap in TCEC, a 30-times differential."

As for catalysts, the company's investor presentation reports that data from the drill program will be used to construct an updated resource estimate.

Ownership and Share Structure

Refinitiv provided a breakdown of the company's ownership and share structure, where CEO Alex Klenman owns 4.43% of the company with 0.83 million shares.

As for institutions, Planet Ventures Inc. owns 5.95% of the company with 1.11 million shares.

Refinitiv reports that there are 18.69 million shares outstanding with 16.75 million free float traded shares, while the company has a market cap of CA$2.29 million and trades in the 52-week period between CA$0.14 and CA$0.72.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. and Tisdale Clean Energy Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources Ltd. and Tisdale Clean Energy Corp.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.