Lithium Prices are bottoming. Major Lithium Producers have price bounceMarket sentiment negative, so in line to create a low.

Key Points

Lithium

- Lithium price holding gains above recent lows

- Inventory adjustment may have run its course

Lithium ETFS

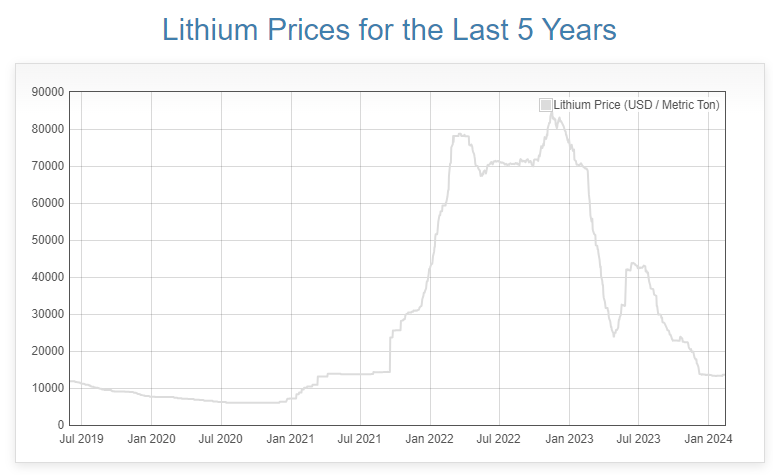

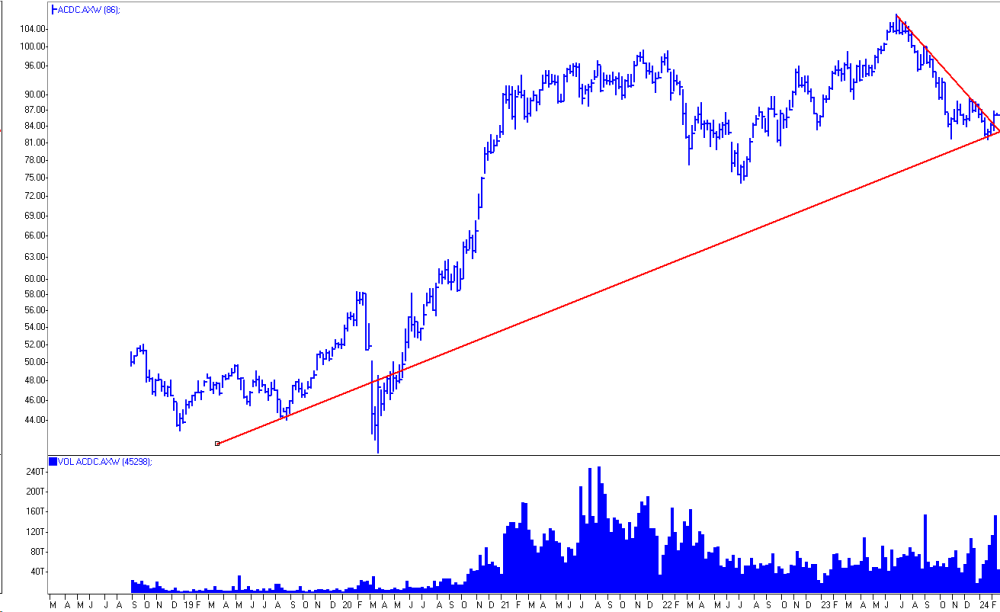

- Globex NY LIT ETF bottoming

- Globex ASX ETF breaks downtrend

Major Lithium Producers

- Bottoming

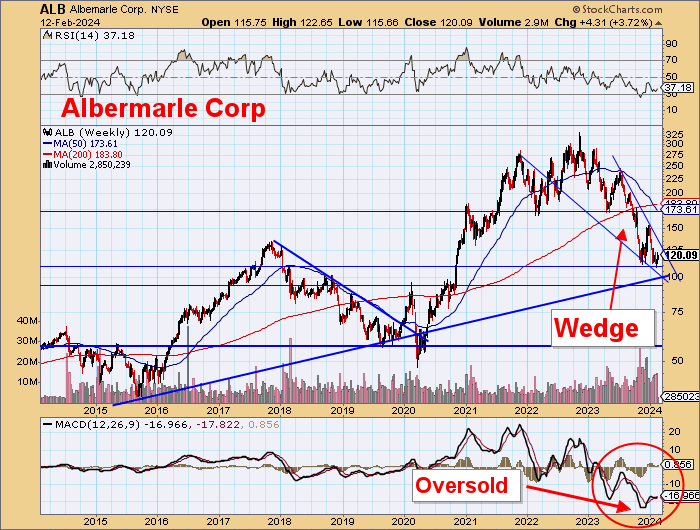

- Allbermarle (24% Global primary lithium)

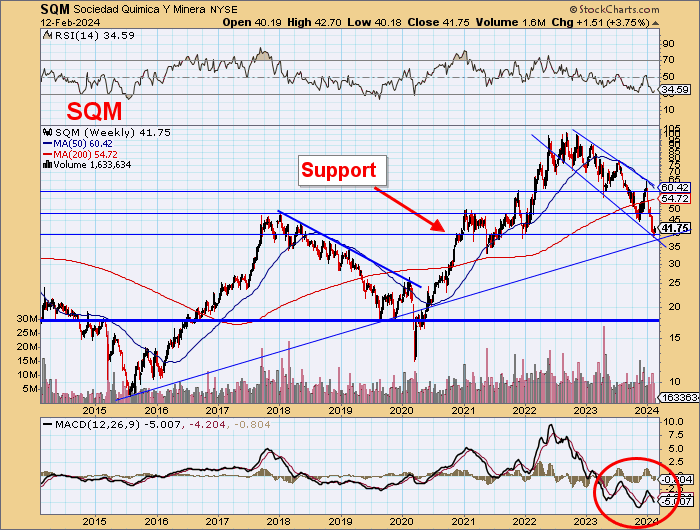

- SQM (20%)

- Gangfeng (5%)

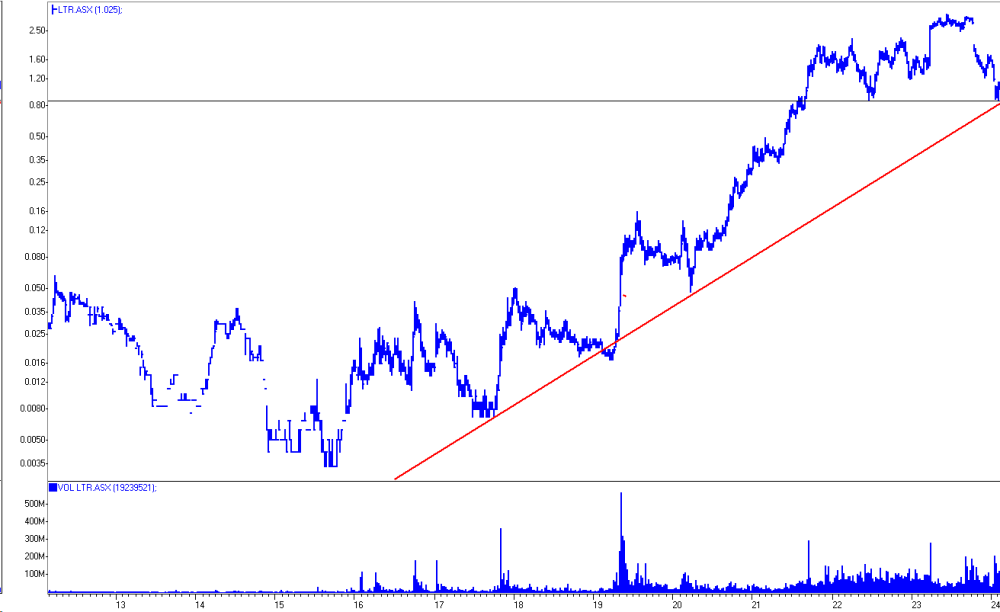

- ASX Lithium producers

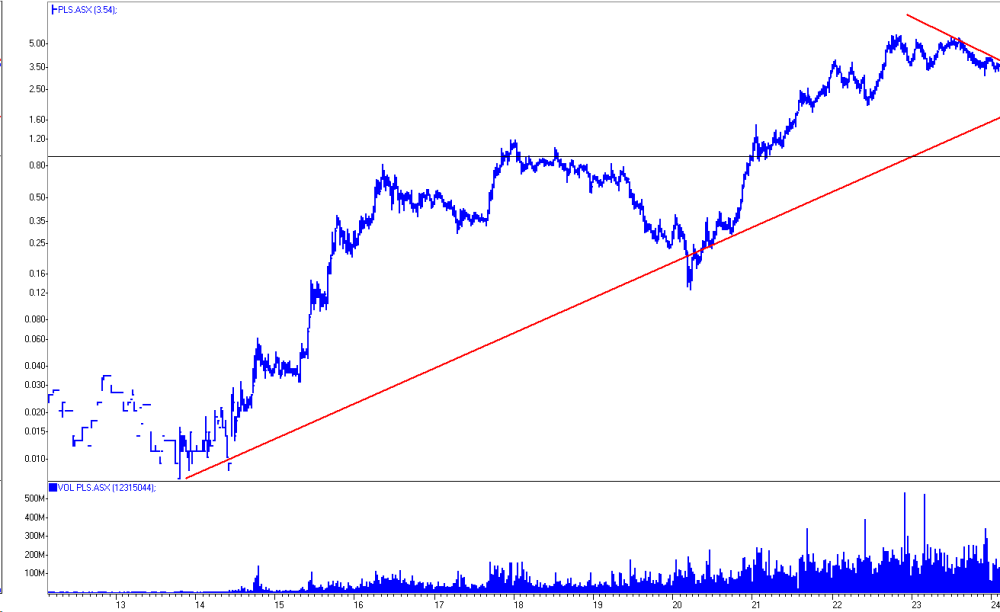

- Pilbara (8%)

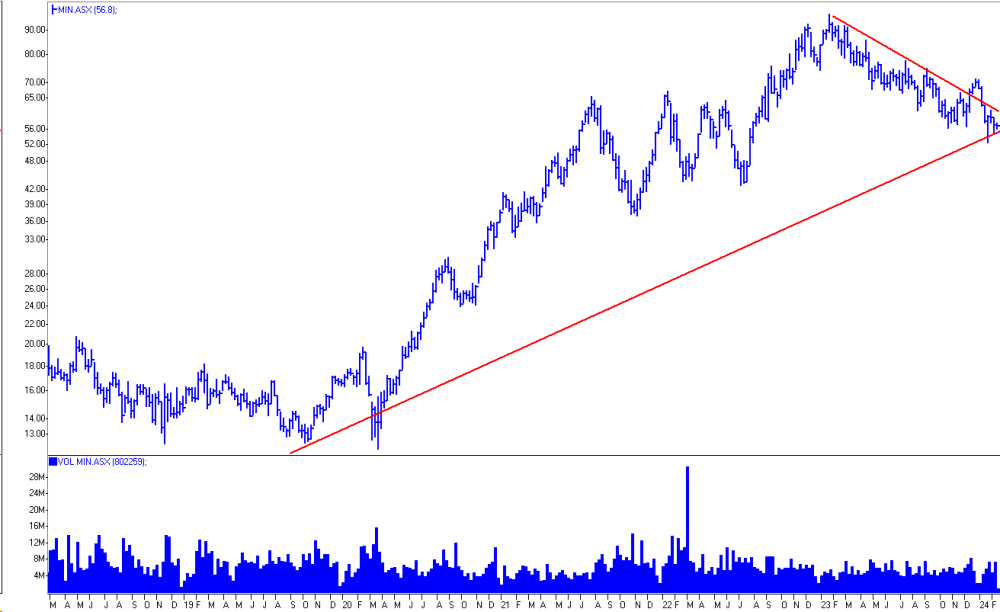

- MinRes (5%)

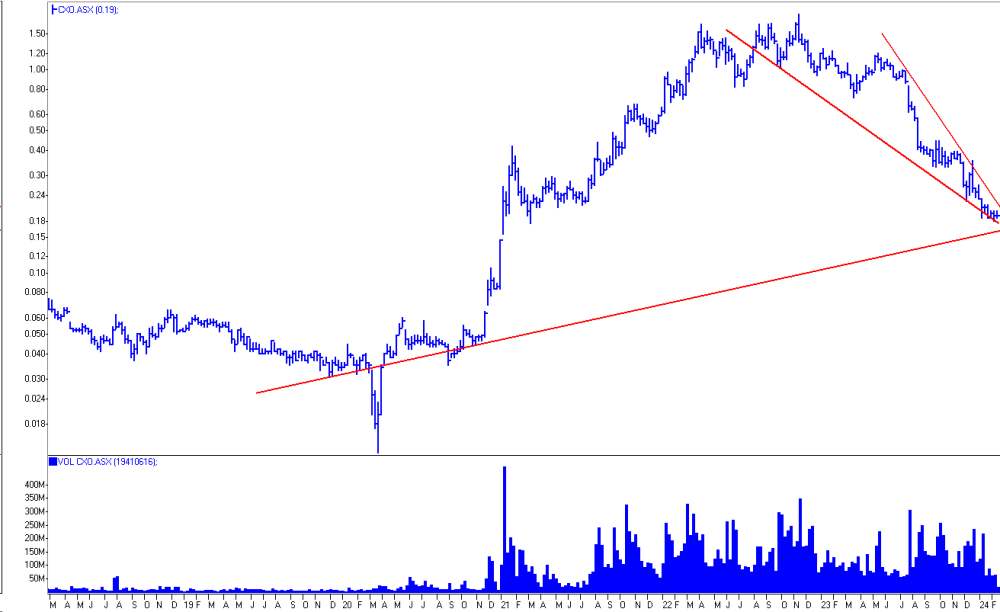

- Core

- Liontown

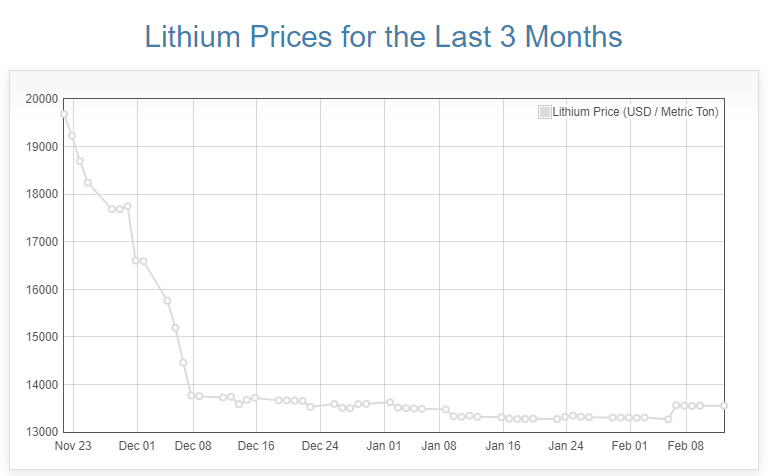

The lithium chemical price fell over 80% from highs in Jan 2023 and bottomed a year later. The first price rise from these lows was in early February 2024, and it has held the gains so far.

Overstocking and lower-than-expected EV demand caused destocking across the board in the lithium-related supply chain. This inventory adjustment may have now run its course.

EV demand is >60% in China and 30% EU, with U.S. just around 8%. U.S. demand is slow, but China will continue to grow, and exports of Chinese EVs will grow faster.

European demand is mandated, so that will also grow. The U.S. doesn't matter, and apart from Canberra, Australia doesn't matter.

Lithium demand overall remains strong, so the current price of ~US$13500/t will delay new lithium sources needing much higher prices, so a price recovery is essential. It is useful to watch the prices of the Lithium ETFs and the major producers of primary lithium.

Note that Australia produces ~53% of global primary, with China about 10% and the brines the rest. Europe is nil.

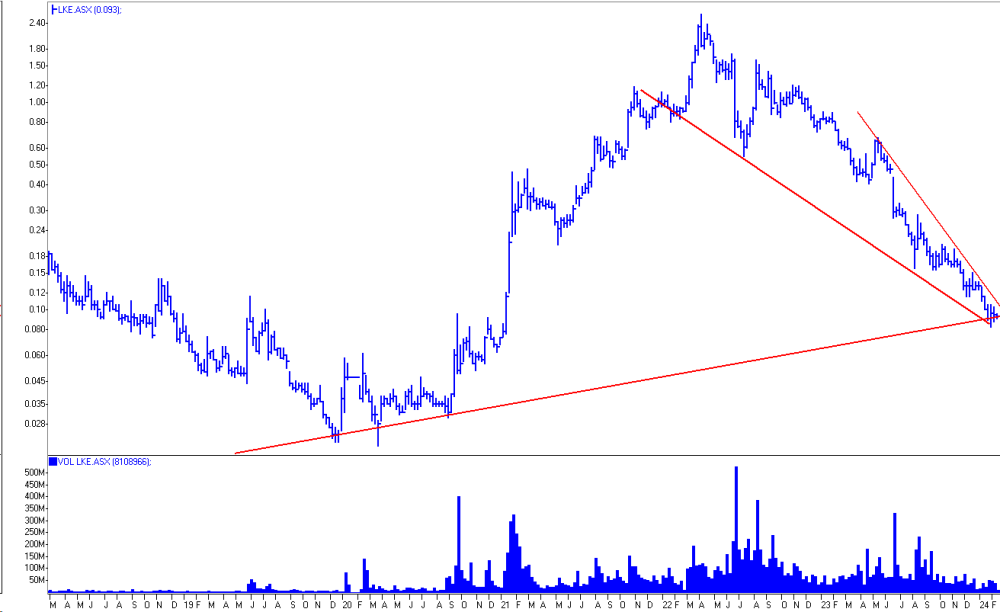

China produces ~65% of refined lithium products, Australia ~1%, and Europe nil. Australian spodumene is critical to the world. As is DLE for brines ( See LKE)

The Lithium ETFs cover a range of the lithium complex continuum and are showing signs of bottoming. The Globex LIT ETF covered here seems to be completing an important technical price reversal. The Globex ASX ACDC ETF has broken a downtrend.

The major lithium producers Albermarle and SQM are showing reaccumulation, and even Gangfeng may be reversing up.

Local producers Pilbara Minerals, MinRes, and Core may also be bottoming.

Liontown and LKE developers look very attractive.

Lithium Chemical Prices

Lithium NY ETF

Note the parabolic decline here over the past two years.

A good sign of the completion of a market decline.

ASSX ACDC Globex Lithium ETF

Lithium Producers

Big declines into support.

ASX Lithium Producers

Lithium Developers

Head the markets, not the commentators.

Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe