If you are bullish on the future prospects of copper and gold (and somewhat different drivers are uniquely behind each as I'll be explaining further in the coming days), then there's no way you can't be as table-pounding bullish as I am on Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT).

And you'll understand all the many reasons why that's so when you watch MY NEWEST C.E.O. INTERVIEW -- this with Seabridge Co-Founder, Chairman and C.E.O Rudi Fronk.

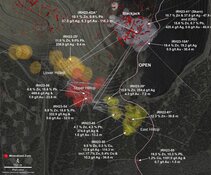

As you will hear, even some "experts" in the precious metals space are WAY behind in their understanding of just what kind of world-class monster Seabridge's flagship KSM Project in British Columbia's Golden Triangle has become.

For now, here are the key points of Seabridge's most recent Prefeasibility Study at KSM, contemplating a 30+ - year initial mining plan:

* Production will all be from surface open pits; no underground mining.

* One million ounces of gold annually would be produced, rendering KSM the fifth-largest single mine producer in the world.

* 178 million pounds of copper would be produced.

* And all the above--are you ready for this?--at an All-in-Sustaining-Cost of approximately $600 per ounce of gold (treating copper production as a byproduct credit.)

I believe that once Fronk & Co. have tied up their one (or more?) development partners, we'll see a major rerating of Seabridge shares.

And on top of KSM, when you consider the rest of Seabridge's world-class portfolio, I think you'll feel--as I expressed--that Seabridge deserves to be a core holding in your portfolio.