Blackwolf Copper & Gold Ltd. (BWCG:TSX.V) released the final results of 2023 drilling at Harry and Cantoo, both among its Hyder properties in Alaska, reported Red Cloud Securities analyst Taylor Combaluzier in a Jan. 22 research note.

"The company has made good progress and has likely improved its understanding of the geology at Harry," Combaluzier wrote. "Similarly, at Cantoo the company has armed itself with a better understanding of the geology."

293% return implied

Based on the news, Red Cloud maintained its CA$0.55 per share target price on the Canadian precious and base metals explorer, now trading at about CA$0.14 per share, noted Combaluzier.

The difference between the current and target prices signifies a compelling return, of 293%.

Blackwolf remains a Buy.

"Positive exploration results and/or a discovery could potentially help drive the stock price higher," Combaluzier commented.

Alteration, mineralization noted

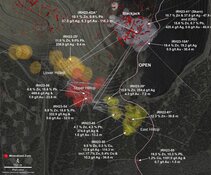

Combaluzier reviewed the new drill results of four holes Blackwolf drilled at Harry and three holes placed at Cantoo.

At Harry, the analyst noted, the new data are "not as impressive" as those of the very first hole. However, they reveal two new zones of high-grade mineralization.

One zone, identified with hole H23-018, contains high-grade gold-silver veins with quartz-sericite-pyrite (QSP) alteration. Notable mineralized intercepts were 1.3 grams per ton gold (1.3 g/t Au) and 2.9 g/t silver (Ag), over 2 meters (2m).

The other zone, noted via hole H23-012, contains high-grade silver and base metal veins showing 374 g/t Ag, 5.34% lead and 1.41% zinc over 0.47m. These veins are part of a 150m mineralized trend of 0.3−3m-wide sheeted veins at Swann.

As for results of surface samples, they showed the presence of silver and base metals over a trend spanning 3 kilometer. Also seen were two areas of QSP alteration resembling what was previously seen in the Swann zone where the drill bit encountered these intercepts: 312 g/t Au and 101 g/t Ag over 1m.

At Cantoo, Combaluzier reported, the maiden drill program identified a zone of alteration resembling the porphyry intrusion at Premier Gold's nearby mine. From Cantoo hole CT23-003, the standout intercepts were 1.53 g/t Au and 1.01 g/t Au, both over 1.5m. These data should help Blackwolf select targets to be drilled next.

"More drilling to the southwest is required to potentially vector into higher-grade shoots," noted Combaluzier.

Upcoming catalysts

The analyst pinpointed events this year that could boost Blackwolf's share price.

At Harry, the mining company intends to drill the various targets it identified through surface sampling, Combaluzier reported. These include the Golden Summit prospect and the alteration haloes at the Harry and Ursula prospects. The company plans to also drill three zones of veins containing silver and base metals, including the Sheeted Vein and Saw Cut prospects.

Blackwolf also intends to drill further at Cantoo.

"With a healthy treasury and a fully funded 2024 drill program, we believe Blackwolf is poised to hit the ground running in the next field season," Combaluzier wrote.

Another catalyst, expected in Q1/24, is completion and results of Phase 2 processing studies, to be conducted with the company's memorandum of understanding partners, pertaining to a potential polymetallic mill at Kitsault.

| Want to be the first to know about interesting Base Metals, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |