Blackwolf Copper and Gold Ltd. (BWCG:TSX.V) announced the results of the company's drill results from the Cantoo property and the Harry property. According to the press release, which the company put out on January 19, 2024, the drilling uncovered significant mineralization on both sites.

The Harry property, the company stated, saw surface sampling and drilling, which revealed two major mineralization styles in the Swann Zone. According to the press release, the company's surface sampling found 4.16 grams per tonne (g/t) of gold (Au) and 9.71 g/t silver (Ag), while drilling found 1.30 g/t Au and 2.90 g/t Ag across 2.0m. The second style of mineralization contained 1,049 g/t Ag, according to Blackwolf's surface samples, and 4.447 g/t Au, 1.521% copper (Cu), 8.0% lead (Pb), 1.55% zinc (Zn), and drilling found 374 g/t Ag, 5.34% Pb, and 1.41% Zn across 0.47m.

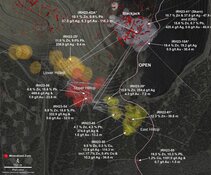

On the Cantoo property, the company reports that it encountered 29.2 g/t Au, 2,378 g/t Ag, 4.345% Cu, 7.24% Zn, as well as 19.9 g/t Au, and 7.92 g/t Ag in surface sampling, while the drilling found 1.53 g/t Au and 1.01 g/t Au across 1.5m, along with geological evidence of a structure similar to surface veins on the property.

Rob McLeod, the Executive Chairman of Blackwolf, commented, "Encountering Brucejack-style remobilized coarse electrum veins at Harry was the highlight of the 2023 program. Extensive multiphase sulfide-rich veining within a wide halo of strongly anomalous gold and silver is highly encouraging." He continued, "Drilling in 2024 will target additional high-grade surface values and structural/geochemical traps located up dip from the high-grade veins. At Cantoo, geochemical vectoring and surface sampling are suggesting a northeast strike and steep dip to the wide veins; subsequent drilling will test this concept."

In an explanation of gold grades, Investopedia stated that gold grades of more than 8.0 g/t are considered high grade.

Blackwolf announced in a press release on January 24, 2024, that it had received approval to trade the company's shares on the OTCQB Venture Market. The company stated that it will continue to trade on the TSX Venture Exchange but that it hopes listing shares on the OTCQB will help it diversify its investor base and increase awareness of the company's stock.

Gold Moving Up

Alasdair Macleod with Goldmoney released his predictions for gold this year on December 28, 2023, where he stated that he believes gold will thrive as a result of economic uncertainty and a weakening American dollar.

Macleod commented, "To support this thesis, the relative price volatility for commodities and energy in dollars and gold are compared. Gold wins hands down as the objective value in commodity transactions." As U.S. debt rises and countries like Russia and Saudi Arabia try to distance themselves from American currencies, Macleod predicts that gold will find value as a safe haven investment.

Egon von Greyerz with Gold Switzerland also predicted that gold will do well in 2024 as the dollar falters. Von Greyerz stated, "If you have never been a gold bug, this is the time to become one."

Possible 89% Upside

Taylor Combaluzier with Red Cloud Securities rated the company as a "Buy," with a target share price of CA$0.55 in October of 2023. According to the report, the company's stock has a potential return on investment of 139%.

On December 7, 2023, Couloir Capital rated Blackwolf as a "Buy" with a target share price of CA$0.39, and a possible upside of 89%.

Combaluzier highlighted the advantageous location of the company's projects in the Alaskan portion of the Golden Triangle, as well as the encouraging drill results from the Harry project. According to the report, further drill results could push the company's stocks up.

Technical Analyst Clive Maund reviewed the company on October 24, 2023, and rated the company as a "Strong Speculative Buy here for all timeframes." Maund stated that he believes, based on a Head-and-Shoulders pattern on the 6-month chart, that the company's stock may be poised for a breakout.

On December 7, 2023, Couloir Capital rated Blackwolf as a "Buy" with a target share price of CA$0.39, and a possible upside of 89%. Couloir Capital identified the pending assay results from the Cantoo property as catalysts for the company that could have a positive effect on the company's stock value.

The company has a number of catalysts to report, according to its investor presentation, including open mineralization on the Harry project and opportunities for expansion on the Niblack project.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Blackwolf Copper & Gold Ltd. (BWCG:TSX.V)

Reuters provided a breakdown of the company's ownership and share structure, where management and insiders own approximately 19.81% of the company. According to Reuters, Frank Giustra owns 14.65% of the company with 15.96 million shares, Executive Chairman Robert John McLeod owns 2.24% of the company with 2.44 million shares, Director Andrew William Bowering owns 1.73% of the company with 1.89 million shares, CFO Susan Marie Neale owns 0.69% of the company with 0.75 million shares, Director Jessica Van Den Akker owns 0.30% of the company with 0.33 million shares, CEO Morgan Lekstrom owns 0.18% of the company with 0.19 million shares, and Corporate Secretary Lindsey Le Ho owns 0.02% of the company with 0.02 million shares.

According to Reuters, Institutional investors own approximately 5.21% of the company, as Crescat Capital, L.L.C. owns 4.66% of the company with 5.08 million shares, U.S. Global Investors, Inc., owns 0.46% of the company with 0.50 million shares, and Nanjia Capital Limited owns 0.09% of the company with 0.10 million shares.

Reuters reports that there are 108.96 million shares outstanding with 87.38 million free float traded shares, while the company has a market cap of CA$10.95 million and trades in the 52-week period between CA$0.11 and CA$0.49.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Blackwolf Copper and Gold Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blackwolf Copper and Gold Ltd.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.