The Year of Our Lord 2024 is officially underway with an inauspicious start as the much-vaunted Santa Claus Rally failed to deliver much in the way of a year-end celebration. It seemed as though out of sheer exhaustion from an unprecedented seven-week eruption of laissez-faire capitalism, the markets decided to "lie themselves down for a long winter's nap."

As the calendar flipped over from 2023 to 2024, the Wall Street bulls, lulled into a sense of complacency by buoyant stock prices and ample year-ended bonus pools, decided to turn paper profits into taxable capital gains and for the First Five Days of the new month, stock prices failed to close positively thus negating the first two legs of the "January Trifecta" a three-pronged series of indicators that when combined with an "up" January, register a 90.3% probability of a positive result for the year.

This week was dominated by talk of the final and surprising SEC approval of the Bitcoin ETF's being spun out by the mighty Blackrock (as if there should have been a surprise), which resulted in a 5% end-of-week sell-off which should come as no surprise to anyone that knows the gold and silver markets. After over forty years of the paper markets controlling spot precious metal prices, the preachers of the "store-of-value" Bitcoin narrative just gave the paper merchants at 33 Liberty St. in NY the ability to control prices at the drop of a hat — or shall I say "hint" — as one whisper to the NSA and Bitcoin will be relegated to "Public Enemy Number 3" behind silver and gold which hold the top two rankings.

The kiddies that are new to the entire concept of monetary debasement, which I first learned of over fifty years ago, are in for a rather rude awakening when they suddenly realize that they just let a ravenous fox into the henhouse to guard the brood. Until this week, Bitcoin holders managed their own market; now, they are going to be managed by the Wall Street paper-hangers, who are absolute masters of intervention, interference, and manipulation. Good luck to you…

Michael Saylor: Master of the Bitcoin Universe

Stocks

The late, great Richard Russell actually fine-tuned the January Barometer into four main observation points: the Santa Claus Rally, the First Five Days Indicator, the mid-month reading, and the end-of-month reading. He used mid-month (which falls this Tuesday due to MLK Day market closures) as a method of handicapping the odds of a down January because if combined with down SCR and FFD readings, the odds of a down January vaulted higher.

The week went out with the S&P 500 up for the month but the Dow Jones and the NASDAQ lower. Mind you, the S&P needs only a 15-point downtick by the closing bell on Tuesday for it to be unanimous, and while I am in the "bear" camp right now, I will turn on the proverbial dime if the indicators move to an oversold condition. As of the end of the first full trading week of 2014, the indicators are no longer oversold, but both MACD and MFI are on "sell signals," suggesting lower prices are still ahead.

The Talking Heads on CNBC are all spun up on the belief that Janet Yellen's "No Landing" pronouncement is going to carry the day for the bulls and be a perfect set-up to avoid a Donald Trump landslide victory in November.

The "Cash-on-the-Sidelines" mantra that dominated the November-December rally can certainly no longer be held out as gospel because the portfolio managers the world overshot their collective bolts in order to beat their benchmarks and seize upon those 2-and-20 bonuses that could only accompany the "fully-invested" prerequisite. They are now sitting on vacuous cash reserves, hoping and praying that a new source of liquidity will come riding to the rescue.

From a technical perspective, I point to the last protracted period in which stocks stayed in overbought territory for more than a cup of coffee, which was November 2017 until January 2018, in which the Dow had an RSI above 70 for over ten weeks. After the markets came off the overbought condition, they corrected with a vengeance and proceeded to lose 12.2% in — literally — a month. Now, there is a great deal of political capital riding on a positive stock market going into November, so being a bear in this set-up is akin to riding shotgun on Clyde Barrow's ‘34 Ford V8 on a back road in rural Louisiana in May of 1934.

When I hit the hay every night at 10:00 p.m., I first check out the NHL scores and the Asian market news, and then I plug into either my favorite Jazz station or listen to podcasts by those whose utterings and mutterings are closest to my heart. They are rarely people in the spotlight and never "featured contributors" to CNBC or BNN.

They are almost always people whose content is a true learning experience for old geysers like me who need to be brought up to speed quickly, if not for fear that actuarial tables will be proven correct as to like expectancy but more because the kiddies now control all of the money and since most are code-writers rather than financial analysts, I need to know what they know, and fast. One such brilliant mind is that of Cem Karsan of Kai Advisors, whose singular task is to gauge volatility in today's markets. I passed the exams for the title of "Certified Investment Manager" in 2014 and thought it was a new universe I was transversing then, but listening to Cem talk about "volatility" pertaining to "beta," "vega," and "alpha" is like listening to Toronto cab driver talking to his mother in Ethiopia. Totally foreign. . .

Cem thinks that a "watershed moment" may be upon us at the expiry of the January series of calls and put options that go out next Friday (the 19th). It is interesting that big money went into 2024 net short "the world" through naked calls all written against long positions held by the "tax adverse" public, so now that the 2024 taxation year is upon us, the January calls and puts (of which "short calls" dominate) have to be reversed. That means the big option prop desks are going to be buyers of stock right into next Friday, which is why I want to be short by the end of next week.

Uranium

A crazy market of sorts in which we find ourselves here in 2024. The narratives that drove the retail public into buying lithium stocks at the absolute peak until the middle of last year have now gripped the uranium juniors, albeit driven by a soaring yellowcake price, which eclipsed US$92/lb.

This week, as my top blue-chip pick, Cameco Corp. (CCO:TSX; CCJ:NYSE) sailed north of US$51 on Friday. I am thoroughly enjoying the move in uranium because it has taught me the art of being patient in waiting for the money flows to come toward me, rather than chasing them like the kiddies were doing this time last year in the battery–er–narrative-controlled–metals where those master podcasters and video-pumpers under the guise of "unbiased reporting" trotted out the same group of YouTube notaries spewing out the same bullish diatribe on EV growth trends and untenable deficits in all things lithium.

If there is one thing I have learned over the years that transcends textbooks, it is that "the best cure for high and rising prices is high and rising prices," as price always governs supply. Rising oil prices immediately after Russia invaded Ukraine gave birth to a veritable gusher (pun definitely intended) of oil supply emanating from the Strategic Oil Reserve and every other imaginable source of fossil fuel sources on the planet. Since then, with the help of the emptying of the Strategic Oil Reserve, oil prices have tanked as supply raced after those high and rising prices.

Whenever shortages are allowed to materialize from either low prices or ill-sighted government policies, supply remains shuttered in protest over a lack of fair and just treatment by the marketplace. It stays in its bunker of bitterness until the needs of the marketplace supersede availability, at which point the absolute beauty of free market economics kicks in and allows the price to serve as the impetus for accelerated production.

At this point, speculative capital rushes to the fore and seizes upon the opportunity to finance new sources of supply to aid its delivery to the starving marketplace. That was where uranium was in 2017-2020 and why it is now being treated most wonderfully by undersupplied end users today. Lithium in 2020 and uranium in 2021 were two classic examples of undersupplied materials suddenly exploding out of the gate and today being chased by those skilled in the art of FOMO — Fear Of Missing Out — the act of the speculating throng that always arrives at or near the end of major moves in markets.

As a professional speculator, I try to avoid the agony of being locked into value traps such as gold and silver largely since August 2020, where conditions for record purchases and all-time highs were as clear as the rising sun in the morning but where demographic shifts delayed the inevitable arrival of a mania-type environment the nature of which we have seen in recent moon-rockets by lithium and uranium. This week was yet another example where American and British warplanes bombed numerous Houthi targets in Yemen, taking both gold and silver sharply higher in the overnight sessions only to be beaten back by Western paper merchants, all this happening as Cameco Corp. quietly and unassumingly hit all-time highs.

Copper

From where I sit, the next commodity to move to the mania phase is going to be the red metal — copper — which is sitting idly in the market doldrums, out of the limelight and in not one set of avarice-filled crosshairs anywhere.

I recall the early uranium podcasters that kept pounding the uranium table with viscous tenacity and unbridled passion back in 2017 and 2018 and 2019 and 2020 and were mercilessly assailed for their "lack of vision" and "paid pumper" monikers. It was a long wait, but we uranium bulls were eventually rewarded in spades.

Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB)

I do not believe that it will take more than a quarter or two before the money flows begin to position themselves in the Senior Global X Copper Miners ETF (COPX:NYSE) and JuniorSprott Junior Copper Miners ETF (COPJ:NASDAQ) copper miners in anticipation of the torrent of demand that will pour into the copper space once the supply crisis is recognized. I have been a vocal proponent of the bullish case for copper despite the fact that it has, over time, been anything but a popular metal.

You rarely see throngs of people staking vast acreage in the wilderness of northern Canada due to a "Copper Rush," and you have certainly not heard the expression "The ain't no fever like copper fever!" in reference to a greed-driven mania any time in the past 50 years.

However, the supply-demand imbalance is on the horizon, and once it arrives, one will be amazed at how quickly the low-hanging fruit disappears from the bountiful vine. There are a handful of quality copper juniors out there, including a couple of new discovery plays such as Hercules Silver (BADEF:OTCMKTS;BIG:TSXV) and American Eagle Gold Corp. (AE:TSXV:AMEGF:US), where recently announced high-grade intercepts of copper-gold mineralization have been reported.

What caught my attention is that unlike gold and silver, where decent drill results get yawned at, these copper intercepts evoked big volume spikes and immediate interest for the likes of Barrick (15.03% of BIG) and Tech (19.9% of AE). Also of note is the transition by Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB) to copper exploration and development accompanied by significant additions to their Board and management teams in the form of Merlin Marr-Johnson whose knowledge of both rocks and capital markets is a double advantage in an industry starved for either.

Gold and Silver

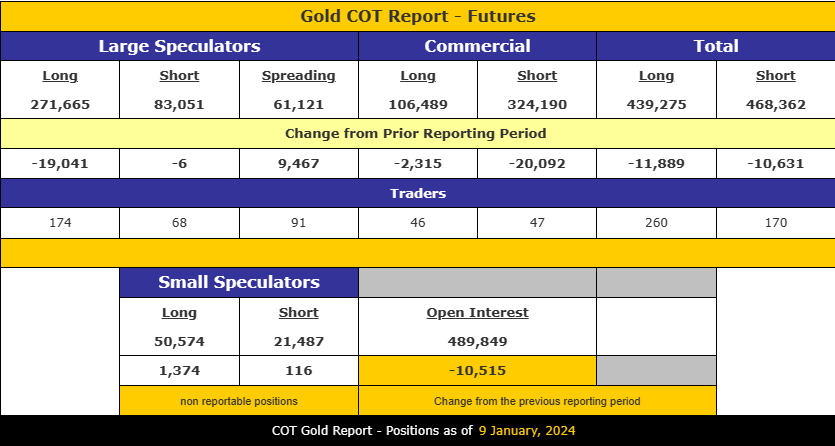

On December 22, the Dec. 19 COT report revealed around 15,000 new purchases of Feb. Gold futures by Large Speculators (hedge funds, managed money, etc.), which was 100% supplied by the Commercials (bullion bank traders) who were eager sellers at the time. Gold went out on December 19 at around US$2,080. Then, for the COT week that ended January 9, gold prices bottomed at around US$2,035, some US$45 lower than the December 19 reading.

Now, what, pray tell, would you imagine the Large Speculators were doing during that COT week?

Why selling, of course!

Around 19,000 "cars" (pit slang for contracts) were blasted out of their portfolios, and who might be the buyers?

Why, the Commercials mystically and magically appeared as if sent by the Archangel Michael and bought 20,000 contracts to ease the pain of the Large Specs, which were some US$45 per ounce lower than the level at which the specs were loading up. Three days later, the gold price trades as high as US$2,067 and ends the week at US$2,053.60 for February delivery. The bullion bank behemoths have gold on a rope (and even worse for silver). Now, that is great work if one can find it. . .

Despite my largest holding being in a Nevada gold developer named Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), I am short the GLD through a small position in the Feb US$190 put options, which was behaving nicely until some idiot at NATO decided to bomb the Houthi bases in Yemen on Thursday.

However, most event-driven moves in gold (and most markets for that matter) are short-lived, so I expect that next week, we will see a large uptick in Commercial short interest as they feed contract after paper contract into the Chicago trading pits (and the electronic fantasy pits) in order to stem such "disorderly conduct" resulting in a declining price and more capital losses for the large speculators that were clamoring in a frothing FOMO fit to top-tick gold due to the geopolitical flare-up. The cycle repeats and repeats and repeats and. . .

There are 12 trading sessions left in January, which means it has a couple of weeks to find its footing and go positive for the year. Statistically, the failed Trifecta already portends a least robust year for returns, but if January fails, there is a 90.3% probability of a negative return year.

Will U.S. election turmoil be the culprit?

Many in my wheelhouse believe it will, but for this spinner of yarns, I am convinced that the Trump Train is going to demand his presence on the ballot, and any failure to allow it will be met with more than a few sawed-off shotguns and Confederate flags waving from the back of pick-up trucks.

God Bless America.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [Norseman Silver Inc.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Cameco Corp., Getchell Gold Corp., Norseman Silver Inc., and American Eagle Gold Corp.].

- [Michael Ballanger]: I, or members of my immediate household or family, own securities of: [All]. My company has a financial relationship with [Norseman Silver Inc.]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.