The central theme of the GGM Advisory 2024 Forecast Issue finds at its starting point the premise that we have now arrived in a global environment of total sovereign insolvency.

Classifying politicians around the planet as "global government, " thrown into one common stew pot of can-kicking, subterfuge, misinformation, and outright fraud, I put forth the notion that while the vast majority of politicians around the world are using their mainstream media servants to assure voter-citizens that government debt is "manageable." It is in fact not only unmanageable but in fact terminal, in that the Day Of Fiscal Reckoning they so valiantly vow to avoid/delay/prevent is actually here.

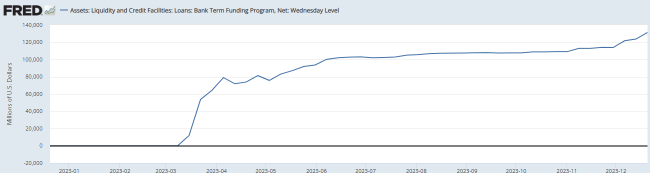

The preparation of the ground for the arrival of the debt crisis began when Ben Bernanke and Hank Paulson in 2008 knelt down in front of the U.S. Congress and begged for government assistance in avoiding a financial system meltdown created by the very institutions that were enriched by it. However, it arrived with ultimate finality in March of 2023 with the establishment of the Bank Term Lending Facility (by the U.S. Federal Reserve) that essentially allowed regional U.S. banks to access much needed capital, the deficiency of which was caused interest rate increases engineered by the Fed itself.

Now, let me get this straight. If in January of 2023, the average citizen took $100,000 and then leveraged it 10:1 purchasing $1,000,000 worth of U.S. 30-year Treasury Bonds in anticipation of a Fed "pivot" by year-end, he would have had margin calls beginning in March that would have culminated by October with a $228,800 loss as interest rates soared taking bond prices into a steep decline. The average citizen would have been taken out of the position and the account closed.

However, on the presumption that regional banks and their corresponding shareholder equity were sacrosanct and critical to the survival of the financial system, the Fed allowed its "member" (read: "owner") banks to access capital provided by the Fed in order to meet those same margin calls that wiped out the average bond investor.

Bank Term Lending Facility

At the point where bad investment behavior by regional bank managers of the loan books involved borrowing short and lending long, the cost of servicing their short book escalated while the long portion was fixed, setting up a crisis

called "cash-flow insolvency." However, such poor planning and ill-sighted actions resulted in only a couple of notable bank failures (Silicon Vally Bank and First Republic Bank) whose roles as sacrificial lambs served only to frighten the public into accepting the Fed's "magical solution," once

again flooding the system with billions ($140 billion, to be precise) of dollars created by the wondrous keystroke of the Fed printing press.

Lifted by a magical levitation of bond prices in the final quarter of 2023, stocks have now gotten the Fed's memo with the blue-chip Dow Jones Industrials moving to record highs thanks to a tsunami-like onslaught of Wall Street's favorite new narrative known as "excess liquidity" which really dovetails beautifully with that famous quote that I use with irritating regularity:

"Never underestimate the replacement power of stocks within an inflationary spiral."

Until late October, investors were doing exactly that: they underestimated the replacement power of stocks in an environment where the only solution to insolvency is liquidity, and whether manufactured, counterfeited, or simply created with the wave of a monetary wand, monetary and fiscal imbalances are made to disappear into a Keynesian utopian dream.

I sat down in 2019 and decided to create a newsletter in which I might impart forty-three years of experience in the North American capital markets upon the masses with migration to the world of commodities as a new generation of investors comprised of Millennials and

Generation "X"-ers discovered the utility of gold and silver as hard money replacements for paper assets, with sovereign entities rejecting cryptocurrencies like Bitcoin.

Then, as if summoned by the money-changers amidst over-priced markets and REPO hell of the prior two quarters, along came the COVID-19 pandemic. I do not need to repeat what happened to the Federal Reserve and U.S. Treasury balance sheets in the months after its arrival. The massive liquidity created in 2020 and 2021 was government ineptitude of the highest possible order.

Standing unmasked in front of the television cameras with legions of masked political henchmen posing at attention, they ordered citizens to inject themselves with untested, DNA-altering experimental sera while taking away their jobs and their pensions for failure to oblige. Distracted by the campaign of terror and disinformation, citizens paid little attention to the mandated shutdown of global trade and production while trillions of new dollars, euros, pesos, and yen were parachuted into the bank accounts of the shuttered citizenry.

With the supply of goods and services severely crimped by the idiotic actions of the political class, the stimulus efforts served only to increase prices for everything from housing to toilet paper while doing nothing to alter the eventual cessation of the virus as natural immunity present in the human species for hundreds of thousands of years finally did its job.

Today, in 2023, the world is no better off from the actions of those near-sighted political opportunists, but the real beneficiaries were the money-changers — the banks, both member and central — that get built-in pay raises every time a nickel enters their doors. Increasing the supply of currency and credit is an automatic increase in the supply of fee-based revenues.

In many Western nations, the citizenry is so deeply buried in mortgage debt that they can never escape. They have never sat down and actually run an actuarial table showing how a mortgage gets paid off and just how much interest is paid to their money-changing masters. The spike in housing prices the world over is the direct result of central bank monetary policy but what we fail to read in mainstream media commentary is the identity of the main beneficiaries of such massive inflation — the mortgage holders.

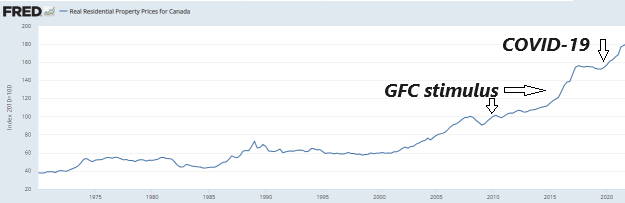

Canadian Housing Since 1970

There has been some recent evidence that the chickens are coming home to roost as the "Big Six" Canadian banks are increasing loan loss reserves due to the meltdown primarily in Commercial real estate but rapidly being eclipsed by residential loan risk.

Alas, it is a crime to watch young couples striving to stay above water as their mortgages come up for renewal and are suddenly hit with a massive monthly increase. Canadian housing used to increase at a maximum of 2% per year, but as the chart posted above would confirm, it took twenty years from 1970 to 1990 for housing prices to double, but then after a modest dip, it took until Q4/2003 — 13 years — before they got back to 1990 levels. From Q4/2000 until Q3/2015, housing again doubled and then from 2015 until 2022 added another 25%.

You can see how the chart of Canadian housing went from "gradual" to "vertical" in response to the massive stimulus efforts made by the Liberal government to thwart the COVID-19 pandemic and as I have tried to remind subscribers ad nauseum, any price chart that metamorphoses from "gradual" to "vertical" is always nearing a top, which occurred simultaneously with the hike in mortgage rates that began in Q4/2021.

Once again, the Big Six Canadian banks were fanning and feeding the conflagration lit under Canadian housing prices with full cooperation from the Bank of Canada and with the blessing of governments regardless of party affiliation. As long as the collateral underpinning the residential mortgage book kept rising, bank profits tagged right along, but now, with that collateral in decline, banks have begun to take steps to limit losses and curtail lending.

You see, banks are known as the only institution in history that will sell you umbrellas right up until it starts to rain.

When I look back at the world in 2019 and compare it to the world in the final days of 2023, it appears as though the gods ripped a gaping hole in the time-space continuum. The continuous cycle of Fed tightening and Fed loosening in order to control stock prices and inflation is once again alive and well. After a couple of years of "higher-for-longer" interest rate policy, the Fed is now in "pause" mode, with the think tanks now looking out to seven rate cuts in 2024, with the first one estimated to be in March.

The absurdity behind the orgies of monetary and fiscal stimulus in 2020 through 2022 is to be discounted with "moderate" inflation now the norm after hitting 9% CPI in August of 2021. Jerome Powell told us in 2011 that it was all "transitory" but then relented and changed it to "structural" in 2022 and most of 2023. Soybean prices are still up over 50% from 2020 prices, with live cattle (early-stage "beef") up over a double in the same time frame. To really hammer home the impact of this global monetary debasement, look at lumber prices where, despite a slowdown in housing construction literally everywhere, they are still double where they were in 2020.

We march into 2024 with the pronouncement from the U.S. Federal Reserve that they are "pleased" with the pace of moderation in the CPI and would ask all of us to kindly pat them on the back for "Mission Accomplished" and accolades for "a job well done" but the reality is that commodity prices are still up over 152% from the lows of 2020 and a mere 36% off the 2022 peak.

To wit, if one uses the data from the Goldman Sachs Commodity Index, this is yet more of the same Wall Street spin that dominates the narrative every single time stocks come under pressure for more than a mere 10% correction.

There are very few (if any) that were employed in the securities industry in 1979 when Paul Volcker took command. As a rookie stock salesman, I was trying to build a book of clients during a period in which public affection for stocks hit the lowest point since 1937. In 1982, at the absolute bottom of the '81-'82 bear market, less than 4% of American households held common stocks; in 2023, that number is +58%. At the lows of 1982, the S&P 500 traded at 8 times earnings (versus 25.57 today) and posted a dividend yield of 6% (versus 1.62% today).

During the summer of 1982, I would make fifty calls per day pitching Bell Canada for its 9% yields and 4.9 P/E, with the result being 45 brief conversations and 5 hang-ups. People not only avoided stocks; they hated the bloodsuckers that were selling them.

In 1982, there were no "wealth advisors" or "portfolio specialists"; there were only "salesmen." To be sure, they tried to put lipstick on the "pig" that was the registered representative of the securities firm, but in the end, within the walls of those "old school tie" institutions like Wood Gundy, Dominion Securities, or McLeod Young Weir, the next step up from a job in the mail room was to be in "retail sales." We were known as "retail honkies" with some vague reference to the incessant "honking" by the geese on Toronto Island that would rarely shut up.

If you were trained to market the most detested asset class in decades and succeeded, you found the next twenty years to be like sailing the Deep Blue with a 30-knot gale at your back. I did indeed succeed, but it was about as difficult a task as I could remember. It was as difficult a personal challenge as preparing for the Saint Louis Blues NHL Training Camp in 1976. I was running the 7-mile bicycle route with Billiken basketball starter Ken Loddeke every morning at 6 a.m. in the summer Saint Louis humidity, and then after working the hockey school job all day, I would meet him again at 6 a.m. for another 7-mile run.

The agony of shin splints from lack of hydration was nothing compared to the agony of telephone rejection, day in, day out, non-stop, and without relief for all of 1981 and most of 1982.

The reason I relate this to many of you is that today, the vast majority of financial advisors know only how to sail with the wind at their backs or, better still, with the Fed at their backs. They get painful little "snapbacks" where the Fed jerks their chain and takes away the money-printing punchbowl for a brief interlude, but they only pretend to be injured because they know that it is only a matter of time before the punchbowl returns, fully- spiked, filled to the brim, and ready for "liberal disbursement."

If there is one event that would please me to no end, it would be that stocks finally decouple from obedience to the whims and wishes of the Federal Reserve and its Wall Street owners. I sincerely pray that this insidious cycle of yank-and-shove of investor sentiment would and could end forever. I long for the days when only the finest of stocks sold by only the most effective of salesmen prevailed.

They say that recessions tend to remove inefficient businesses from the marketplace in the same way that regional forest fires eliminate the deadwood underbrush that are in recent times, creating massive fires, prompting fears of global warming and ecological disaster. I can tell you that recessions also remove the deadwood underbrush of the global securities industry, which knows the price but not the value of that which they pitch. Nothing would I love more than a three-year bear market in financial assets in order to separate the wheat from the proverbial chaff.

2024 Electrified

As a card-carrying member of the Baby Boom Generation — that massive demographic born between the end of WWII and the mid-60s — I can pinpoint the day in which America lost its innocence and, with it, the blind and never-ending faith In The American Dream. It was November 22, 1963.

I was in sixth-grade music class as Mr. Storey was attempting to play a tune on his recorder when there was a sudden crackle of the public address speaker located at the front of the classroom, just beneath a portrait of Queen Elizabeth II with the words "assassin's bullet" heard clearly not only in the classroom but around the world.

Five years later, I wrote an essay for my "Social Studies" class in which I penned, "While the assassin's bullet shattered the skull of an idolized President, it also shattered the hopes and dream of an entire generation who would never again know the innocence of the post-war American psyche."

What followed that day in 1963 were more assassinations (Robert F. Kennedy, Martin Luther King, Malcom X., and Medgar Evers), wars (Vietnam), economic upheaval (Arab Oil Embargo of the 1970s), and an entire slurry of events both political and economical that continues to this very day in eroding the stature and standing of that now-elusive "American Dream."

However, despite the ongoing deterioration of public opinion of the various branches of government (executive, judicial, and legislative), the one institution that has grown in size and power is the U.S. Federal Reserve Board. Carefully and diligently grooming its public image, it progressed to the point where its members could be found on the cover of international magazines as "Person of the Year," as occurred in 2009 with Federal Reserve Board Chairman Ben Bernanke, who was credited with "saving the global financial system" through the trillion-dollar bailout of member banks not only in the United States but also abroad and on five different continents.

To say that a university professor hired by a consortium of Wall Street banks to keep them from failing deserved to be on a list with figures in history like Winston Churchill, Nelson Mandela, and Charles Lindberg was folly at its misaligned best.

Nevertheless, that institution, founded almost exactly one-hundred-and-ten years ago after a curtains-drawn series of clandestine meetings on Jekyll Island, S.C., has not only survived despite a horrendous record of economic forecasting and ill-timed policy moves, but it has grown to the position of "rock star" status with its leadership followed chapter-and-verse for every nuance of speech that might provide clues to policy changes affecting the bond and stock markets.

To give one an idea of how the world has changed, in 1977, when I first entered the Canadian Securities industry, I had no clue who ran either the U.S. Fed or the Bank of Canada. Today, teenagers trading stocks on pre-programmed iPhones know the name, alma mater, birthplace, and shoe size of the Fed Chairman. They know when and where his speaking and what he is likely to say. In the 1970's, there were no press conferences. In 2023, the Fed "presser" is an international media event beamed into the boardrooms of thousands of companies around the globe.

The tentacles of the U.S. central bank "Kraken" reach around the globe and have a massive influence on global central banks whose policy decisions affect elections and foreign policy and even decisions to go to war. The growth of stock ownership by households from 4% in 1979 to 58% today is a testimonial to the power and influence of the U.S. Fed, and to minimize its importance as a national security tool is both naïve and dangerous.

When I look out into the swirling clouds of 2024, I find it impossible to forecast anything that does not involve The Fed. The upcoming U.S. elections can be won or lost by the closing level of the S&P 500 next October. With nearly every voting-age citizen of sound mind and body also dutiful followers of the NASDAQ 100, disciples of every new technological fad and favorite, Federal Reserve policy decisions will be as important in 2024 as were Richard Nixon's "5 o'clock shadow" in 1960. (It was said that his stubble during the Kennedy-Nixon debates made him look like one of the "bad guys" in the old B-rated westerns of the 1950s.)

There is one trend that is accelerating around the globe, and that is the move toward the "electrification" of everything that moves, flies, or floats. I have long described the transition away from the internal combustion engine ("ICE") as the "electrification trilogy," where the success of the movement depends on the supply of three primary elements — uranium, copper, and lithium.

Uranium

As far as the resource sector is concerned, the primary theme for the post-pandemic world has been centered around the movement away from fossil fuels and toward the clean energy transformation that, until last year, was focused on wind and solar, two energy sources now known to be sadly inadequate in feeding the electrical grid on virtually every continent.

The Germans were the first two try to pepper their landscapes with massive wind turbines and enormous solar panels that became woefully weak during periods of deep calm and/or darkness. After suffering from huge electricity bills for years, they have finally decided to scrap the unsightly ogres of the green movement landscape in favor of the safest, cleanest fuel known to mankind — nuclear — and with that, the mineral that provides the energy source — uranium.

Uranium is the first of the three components of the trilogy because with fifty-seven reactors currently under construction around the world, the demand for "yellowcake" is now moving into the mania phase, with uranium prices now up 450% from the lows of 2020 under $20/lb.

The Twitterverse abounds with uranium bulls, with the blogosphere rife with newborn uranium "gurus" constantly recycling the same handful of self-promotional "influencers" pumping the merits of owning uranium or a basket of the junior uranium developers or explorers generally hoped to be heir-apparent to the Cameco crown.

I took a different, much simpler approach that did not involve religious adherence to the U3O8 cult.

Cameco Corp.

I bought shares in Cameco Corp. (CCO:TSX; CCJ:NYSE) around the $40 level right after their earnings call in October, where the CEO Tim Gitzel stated:

"We are seeing durable, full-cycle demand growth across the nuclear energy industry. These factors lead us to believe that we are experiencing the industry's best ever market fundamentals. . ."

Those four words — "best ever market fundamentals" — prompted me to do something I would normally never do, that being start a position in a bullish news event.

The reason I did was that in all my years of reading news releases and listening to earnings calls, I had never encountered such outright enthusiasm for an entire industry rather than the speaker's own company.

In a sector that has been the darling of the pundits for the past three years, owning a basket of junior uranium stocks is like buying a ticket to a baseball game already into the seventh inning.

There might be more excitement for a couple more innings, but it will soon be the bottom of the ninth with two down and an 0-2 count.

Alas, since I cannot ignore those four words, I have chosen to own the biggest and the best in the uranium industry, and that is Cameco Corp., in order to fully benefit from the explosion in demand for the element that provides the safest and cleanest source of electricity on the planet.

With this gargantuan arrival of new electrical power around the world, it does humanity little good if there is no commensurate increase in the transmission system — the "grid" — a system of power lines that will transport a tsunami of electricity from these new and highly-efficient modular reactors to the intended recipients, households and businesses the world over.

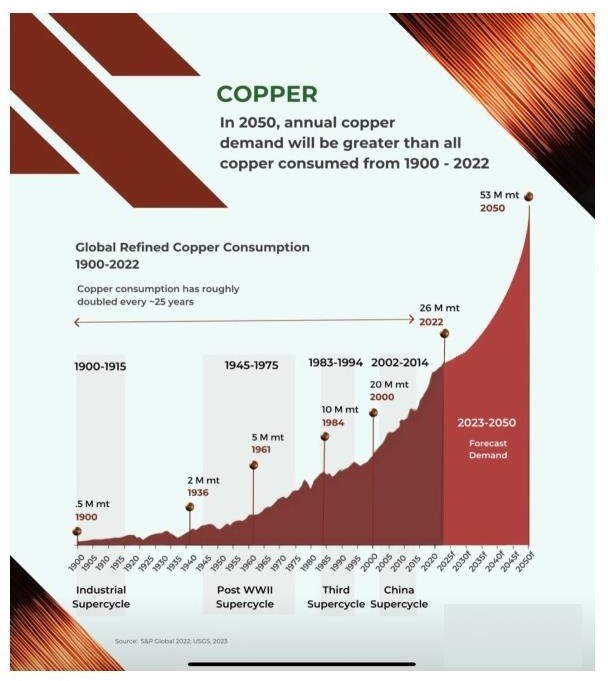

So, if you can imagine a tenfold increase in electrical power, you have to imagine a corresponding increase in demand for the element that conducts it, and that metal is copper.

During my 43-year career trying to carve up the capital markets, the most alluring of the metals was always gold for its 5,000-year history of monetary utility and safe haven legacy. The most exciting of the metals was silver for its role as "the poor man's gold" and for its uncanny ability to outshine gold as a monetary asset during the latter stages of inflationary bull markets.

The "stodgiest" of all metals, without a doubt, is copper, whose attributes are all but ignored by anyone looking for near-term excitement. During this entire post-pandemic period in which the "sexy" metals such as lithium and uranium have rightly taken to the forefront of investor interest and speculation, the one metal that remains absolutely critical to global growth and to the movement toward electrification is copper.

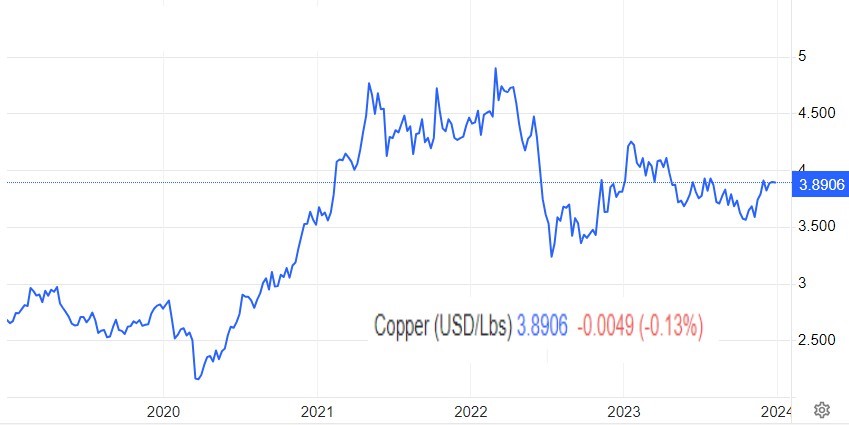

As far as the junior space is concerned, the best vehicle for participation is the Sprott Junior Copper Miners ETF (COPJ:US), whose share price has moved up over 22% since the late-October lows. It is comprised of a basket of junior copper producers and provides concentrated leverage to the future price of the red metal.

I am urging all subscribers to use this vehicle as their equity proxy for copper, which I believe is headed to price levels needed to justify the exorbitant costs of building a world-scale copper mining facility in this post-pandemic era of escalating CAPEX numbers.

That works out to around $15,000 per metric tonne of copper, which equates to $6.80/lb., a 78% increase above today's COMEX price of $3.80/lb. In an environment of price increases of that magnitude, the junior copper developers will soar, as will the junior producers, but where there could be enormous fireworks is in the early-stage explorers where a copper discovery has been made but where its economic viability has yet to be established.

Just as the junior lithium explorers were stagnant until the underlying lithium price took off in 2020, the same event is lying immediately ahead of us for the copper juniors.

In the junior exploration camp, my top pick remains Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB), whose management team is not only impressive but it is also visionary as they have made their own corporate "pivot" to the space known as "critical metals" from the formerly unicentric "silver" space where one can experience a true "rapture" of sorts occurring perhaps once per decade lasting several weeks or perhaps months (at best). Unfortunately, depending on the "#silversqueeze" pumpers to lift your stock has been an agonizingly slow endeavor as it has been laboriously painful since February 2021, the last time silver pressed $30/ounce only to be thrashed mercilessly by the Comex Commandos known as the bullion banks.

Shifting to the Caballos Copper project in Chile, where this highly prospective property was worked by multinational metals giant Vale Inc. until 2020, when the pandemic and global shutdown forced them to drop the project not because of disappointing geology but far from it as surface sampling had confirmed a highly anomalous section believed to contain potential for millions of pounds of mineable copper.

The property, located in the mineralogically-fertile Valparaiso Region, is surrounded by majors like Codelco, Freeport, Newmont, and Los Andes Copper who are either in the production, development, or exploration stages. NOC is planning a 12-hole fence on a portion of the property where surface sampling yielded significant high-grade results in an area that could contain over a million tonnes of mineable copper.

While there is a normal measure of risk associated with drilling programs, previous results obtained from the property vendor confirmed Vale's opinion of the project by way of a recommended diamond drill program that unfortunately got scuppered by the COVID-19 global shutdown.

At the ripe old price of CAD$0.12 per share ($0.0903), Norseman Silver Inc. is an inexpensive speculation on a highly prospective project in a known copper-producing region, sandwiched between the big boys whose head frames can be seen for the adjacent Caballos ridge.

Lithium

The third line of the Electrification Trilogy is the one element so critical to the storage of these new leviathan levels of electricity being conducted to households and factories around the world.

If it is not used, then it must be stored, and if it needs to be stored, it will need millions upon millions of additional tonnes of battery metals, including nickel, cobalt, lead, and most importantly, lithium.

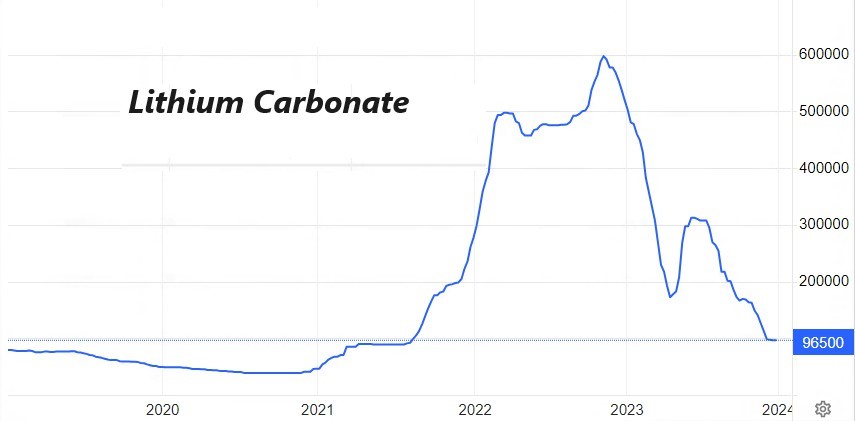

At this point in the discussion, it is imperative that I emphasize that the mania I expect for copper in 2024 and beyond is exactly where lithium was in 2020. The case that was made for stockpiling lithium in advance of a looming lithium deficit was dependent upon Chinese demand maintaining its feverish pace in 2023 and beyond, but a recent quote from Trading Economics: "These developments <weakening Chinese EV sales> drove key market players to forecast the next lithium deficit to return only in 2028, an aggressive twist from speculations of persistent shortfalls that took lithium prices to CNY 600,000 in November 2022."

From the top seen in late 2022 at 60,000 CNY/mt to the current 9,500 CNY/mt, lithium prices have corrected over 84%, along with the companies that produce them. The U.S. lithium bellwether, Albemarle Corp. (ALB:NYSE) has fallen from a high of $331 in November 2022 and hit a low of $111.68 in November before the year-end rally lifted all boats.

The drop from the Q4/2022 highs is a classic illustration of what can and will happen after a mania grips any market, whether it be lithium or artificial intelligence stocks at some point in the future (and yet to be determined). The $64,000 question for lithium is, "When will that lithium deficit narrative return?"

If the people at Trading Economics are correct, then a return to the pre-pandemic levels of around 3,500 CNY/mt is yet another 65% haircut from current levels, taking an entire generation of lithium juniors back to single-digit pennies from whence they came. The poster child for the Canadian lithium miners, Patriot Battery Metals Inc. (PMET:CA) has fallen from CA$17.74 to CA$8.75 before recovering in December.

Lithium "briner" E3 Lithium Ltd. (ETL:TSXV;EEMMF:US) was down from CA$5.74 to CA$1.96 before the current bounce set in. The Twitterverse and the Blogosphere was a feverish cacophony of bullish commentary all through 2022 and during the first half of 2023, with dips being bought and bottoms called right up until Q4 arrived when the floorboards parted, and the long plunge to the bottom began.

I own one lithium name, and that one is Volt Lithium Corp. (VLT:TSV;VLTLF:US). It is a new "briner" that has developed a highly effective technology for removing impurities from oilfield brines with two of the substances recovered in the "direct lithium extraction" or "DLE" process being oil and lithium. It traded as high as CA$0.55 last May at the height of the lithium bubble but has held its CA$0.20 underwriting prices from two capital raises in January and August of 2022.

It has an impressive board and a very impressive CEO in Alex Wiley, but a couple of missed milestones in late 2022 forced me to move VLT from a "BUY" to a "HOLD," which are not usually deal-killers in mania phases but are definitely red flags in a post-mania market. For this to turn out favorable, I am going to need to see meticulous execution from the Volt team to effectively combat the lithium price headwind into which they are piloting the plane.

Looking out ten years or so, studies done by those in the "know" suggest that of the three metals that comprise the Electrification Trilogy, lithium secondary supplies coming from scrap batteries from the automotive sector are going to weigh heavily on prices, but the same cannot be said of uranium. The one metal with a clear blue sky immediately on the horizon is copper, with only minor worries of a global recession beginning in 2024 as its headwind.

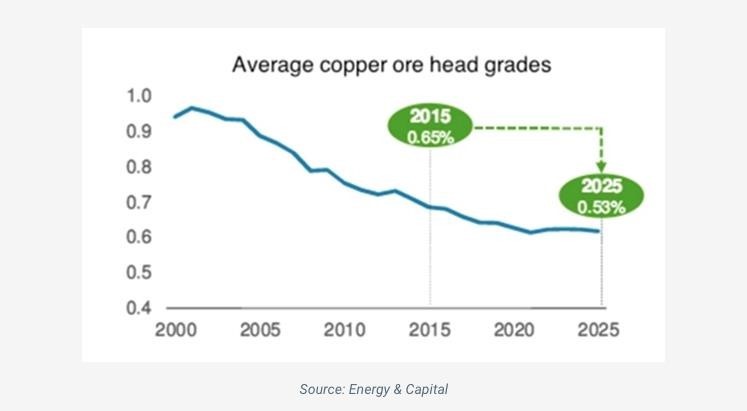

Absent the "hard landing" narrative, copper could quite handily slingshot ahead of the pack not because demand is going to explode off the map as happened in the 2001-2011 Chinese infrastructure build-out but rather due to the exhaustion of stable sources of supply. Most of the major copper mines around the world are on their last legs.

The formerly high-grade Codelco mines in Chile, once the pride of the mining litter, are now in decline as grades are now less than a third of what they once were. Because of government regulations that hampered permitting of prospective copper mines, no new, large-scale projects are planned, and of the five new mines where expansions are ongoing, all of the ore has been committed to either China, South Korea, or Japan.

In conclusion, I remain a fervent believer in the use of electrical energy in powering the global economy, replacing conventional coal-fired or natural gas-driven power facilities.

I have enjoyed the lithium boom and avoided the lithium bust; I am still invested in uranium and remain bullish for at least the next few quarters; and I am a table-pounding bull on copper and thank the pundits for focusing on global growth rather than global supply as the dominant driver for prices. Buying a metal before the mania sets in is like owning a winning lottery ticket before the draw.

Gold and Silver

My passion for the mining business began in 1977 when I first joined the securities industry. I observed with fascination the hierarchy within the blue-blood firm that first hired me where those from the private school, blue-blazer-grey-flannel clique ascended the ranks with amazing buoyancy while the public school, checkered-jacket-stretch-corduroy throng were relegated to the back of the sales floor. The bulk of the hot new issues stayed in the front, where the UCC grads all told well-worn stories while the Scarborough High gang fought for the scraps.

Despite this incongruous state of affairs in the heart of free market capitalism, there was one of the ne'er-do-wells in the back part of the "pit" (as I affectionately called it) that never took new issues and never placed one of the sacred and heavily-lusted-for Government bond issues.

This little Irishman was a gold broker. He talked very little, chummed with very few, and came and went ever day at the same time. He never attended cocktail hour functions in the 32nd-floor executive boardroom and never went to staff Christmas parties. In fact, he was looked upon by his co-workers as a cross between Sherlock Holmes and Jack-the-Ripper. Fortunately for me, I discovered his unique personality in a dark, dingy corner of a low-brow, working-class haunt called The Nag's Head Tavern, which featured large, sweaty waiters in white shirts, white aprons, and black bow-ties slinging trays of draft beer around with uncanny precision.

I was looking for an ex-teammate of mine from junior hockey days when I came across him seated alone under a dim pot light reading a copy of the Johannesburg "Weekly Mail" (now the "Mail & Guardian") where he was cutting out the prices for the South African gold mining stocks. The quotation machines back then provided detailed quotes for only North American stocks, and what "Jammie" (Irish pronunciation of the name "Jimmy") needed was the volume and price data for about thirty obscure little South African "penny dreadfuls" that would never be found in any of the blueblood portfolios of his co-workers.

When I greeted him, he looked shocked and immediately cased out the floor to see whom I had brought with me and as soon as he determined that I was alone, he pushed out a chair and said "Sat and hov a paint wimme" which translated into "Sit and have a pint with me" so I plopped down beside him and proceeded to spend an hour and a half being schooled on everything from office politics to finding clients to the attributes of Guinness beer over Labatt 50 but what I will never forget is the forty-five minutes on gold and on the yield and P/E characteristics of the South African junior gold producers.

At the time, gold was trading at around USD $175 per ounce, having corrected from $200 to $110 in the 1975- 1976 sell-off. Due partly to the "gold" content but more due to their being located in a country that had an Apartheid domestic policy, these juniors were avoided and detested by the mainstream investing world. Jammie explained that Vaal's Reef, then trading at CA$0.90, had earnings of CA$0.15 per share but paid a dividend of CA$0.10 per share which meant it was trading at six times earnings while sporting a dividend yield of 11%. Other more speculative issues were at higher multiples, but a few of them sported yields in excess of 15%.

Jammie explained that he was loading the client's portfolios with "dis Soat Offrikan trosh" (translated to "this South African trash") because gold was going to $500 an ounce, and that would take these juniors to North American levels of P/E (10) and yield (5%).

Jammie explained that he was loading the client's portfolios with "dis Soat Offrikan trosh" (translated to "this South African trash") because gold was going to $500 an ounce, and that would take these juniors to North American levels of P/E (10) and yield (5%).

After about a dozen pints (each?), I shook hands with him and stumbled off to find my way either back to the office or to another pub (I cannot recall), but that was the best "lunch" (liquid or otherwise) that I have ever had in my 45-year career.

Needless to say, gold prices finally responded to the inflationary fiscal policies of the Carter Administration and expansive monetary policies under Arthur Burns as Fed Chairman and soared by 1980 to $850 per ounce. Between our lunch in 1977 and 1980, Jammie had been promoted to "Senior Advisor, Vice-President because what began as a $10 million book of business had grown to over $150 million as that little Vaal's Reef CA$0.90 stock (in 1977) was now reporting earnings of CA$1.20 per share and a P/E of 20 ($24 per share) while increasing the dividend to CA$0.90. So, what started out as a CA$0.90 stock with an 11% yield was now paying a CA$0.90 dividend and traded at a 20 multiple. Jammie's clients made life-altering fortunes, and I recall the day that he announced that he was "Re-TEARIN fram dis muss" (translated into "retiring from this mess") and proceeded to take massive profits on all his gold stocks with bullion moving through $800 per ounce.

The sidebar to this wonderful story was this: As he began dumping the gold portfolios, the other salesmen in the office were absolutely salivating over his client base and "assets under management" because even the sons and nephews of the Canadian "rich and famous" did not have books of business even a half of what Jammie had built.

Then I recall the day the branch manager and Jammie got into a shouting match as the manager had learned that all of the proceeds of the client sales were leaving the firm and the accounts closed. As Jammie slammed down into his office chair, face beet red with a smile on his face, he looked up at me and said, "dare nat getton me cla-ents moonie!!!" (translated into "There not getting my clients' money!!") Two days later, client assets duly sold and funds distributed, Jammie retired to the

Caribbean somewhere, and I never heard from nor saw him again.

Gold Mining Stocks Are Cheap!

There is no study of technical or fundamental analysis that adequately describes that lesson I learned in the 1970s from a self-educated, beer-drinking Irishman who did all his own research and never listened to anything related to "bank or investment company" research papers. He bought gold when no one cared. He bought it when it comprised less than .5% of portfolio allocations in 1977 and sold it when those allocations hit 5% in 1980. When the ducks were sleeping quietly in 1977, he was a buyer; when they were quacking hysterically in 1980, he was a seller — and a HUGE seller. It was a life lesson I will never forget.

Here in 2024, conditions most certainly rhyme with conditions in 1977. There are many areas that differ, the largest of which was that the U.S. was the world's largest creditor nation in 1977 but is now the world's largest debtor nation, running national debt at over $34 trillion, representing $118,000 per ounce based upon the stated Treasury holdings of 8,311 metric tonnes.

Gold and gold mining stocks are cheap. I could write fifty paragraphs of reasons that I like gold here in 2024, but the story I related of that wonderful little Irishman still tickles me to no end some forty-five years later. The problem that gold aficionados have faced since 2009 is that the entire gold mining space, as represented by the Philadelphia Exchange Gold/Silver Index. (XAU:US), is just too minuscule to be considered "investible" by these leviathan funds that manage hundreds of billions of dollars.

I read somewhere that while the combined market cap of all the companies comprising the XAU index is around $250 billion, the market cap of Home Depot Inc. (HD:US) is $348 billion! To wit, while some would view that as a distinct disadvantage, speculators such as I might ponder the impact if just a few of these funds stick a paw into the proverbial water as a valuation play.

Now, they refer to the VanEck gold Miners ETF (GDX:US) as the "Senior Gold Miners RTF," but what may look "senior" in the gold space looks like a pink sheet penny stock when compared to stocks in the S&P 500 or the NASDAQ 100.

The smallest market cap in the Dow 30 Industrials is Walgreens Boot Alliance (WBA:US) at $23 billion; the company in the gold mining space with the largest market cap is Newmont Corp. (NEM:NYSE) at $33 billion.

As to valuation against the big tech stocks, Nvidia Corp. (NVDA:US) had revenue of $27 billion and is capped at $1.2 trillion (with a "t"), while NEM had revenue of $11.5 billion and is capped at USD $33.6 billion. Revenue for Nvidia is 2.3 times that of Newmont; the Market cap for Nvidia is 35 times that of Newmont.

To repeat: gold mining stocks are cheap. ABSURDLY CHEAP.

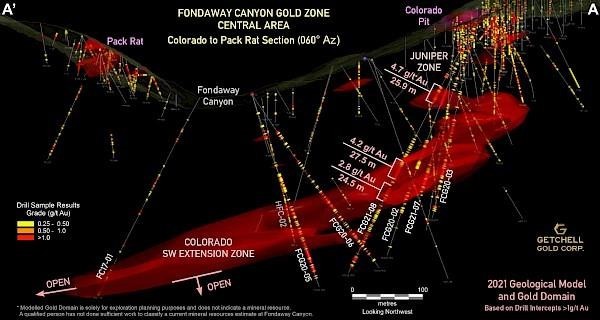

Getchell Gold

My subscribers are loaded to the gunnels with a junior developer called Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) which is a perfect proxy for gold in 2024. In the 2002-2011 period, gold in Nevada was valued at around $100 per ounce for an in-ground resource.

Some higher-grade deposits were valued higher ($200/ounce plus) and some lower-grade deposits were valued lower ($50 per ounce) but $100 has always been a benchmark for the biggest gold-producing state in the country.

GTCH has a 2,059,900-ounce deposit (indicated and inferred) in Nevada, with two new high-grade zones discovered in 2020-2022.

Thanks to a concoction of misinformation and smear, GTCH was trading at a valuation of under $5.00 per ounce up until they announced the successful raise of over CA$3.5 million, allowing them to make the final payment on their Fondaway Canyon project. In the same manner, in which young "Jammie the Irishman" ignored conventional wisdom and accumulated Vaal's Reef, I have been ignoring all of the innuendo and focusing on the in-ground value for Getchell. Having recently completed debenture financing, the company is now in good shape to advance the project. As I wrote to a subscriber this morning:

"With the asset now in the jar, the stock should be valued at $50 per ounce (U.S.) minimum until they are able to move the resource needle north of 3mm ounces. Valued today at around $7.71 per ounce, a move to $50/ounce implies a move to $0 .58 or CA$0.77 per GTCH share. Each of your 200,000 warrants off the debenture deal will carry a value of CA$0.67, implying a profit of CA$134,000. At the end of the term, in addition to the capital gain, your original $20,000 investment will be repaid to you with annual interest of 11%."

The project is wide open to depth and along strike in all directions which means that the resource can be increased with more drilling. I think that there remains an excellent chance for this to become a Tier One gold asset, which is a minimum of 5 million ounces in an optimal jurisdiction with access to all of the necessary infrastructure attributes so vital in attracting funding and/or suitors.

Getchell Gold is a BUY.

As this is being written, gold prices are again on the ascent toward record highs above $2,100. Because I use money flow as the primary driver for gold, it is the SPDR Gold Shares ETF (GLD:US) that I use as my proxy for gold bullion prices. That is because the big international funds use it for its liquidity and accessibility and therefore, all of the algobots that trade around the clock use it as well. The all-time high for the GLD was on August 6, 2020, at $194.44 per share. At $192.82 today (December 27, 2023), it is tantalizingly close to an all-time high and technical breakout from a price cap that has lasted for over four years.

Since the Fed has signaled that the monetary spigots are back in the "open" position, gold is set to move to the $2,500-3,000 level as allocations once again move from under .5% to over 5% exactly as happened between 1977 and 1980.

However, we have all heard that familiar narrative during the GFC in 2008 and again after the pandemic stimulus efforts in 2020, and yet gold refused to react, and gold miners continue to be soundly rejected by the "generalist" portfolio managers. It begs the question: "What event (or events) will serve as the catalyst for change in investor perception?

Forgive the repetitive nature of my annual forecast issue, but I believe that it will come as a "one-two punch" type of effect or, to more accurately apply the metaphor, a "left-jab-right-cross" effect where the jab is a series of failed bond auctions coupled with U.S. dollar weakness followed by a haymaker of a right cross where the U.S.S. Nimitz pulls into Gibraltar for a refit and they refuse the credit card.

At the heart of all of these interventionalist shenanigans is what the Neocons consider to be "U.S. National Security." Because gold is viewed as "anti-dollar," there will continue to be interventions and interference until the point where, in order to protect the U.S. currency and thereby assist in making U.S. treasury auctions friendlier, the U.S. Treasury is forced to underpin those bonds with collateral other than the power of taxation. The only other form of collateral is 8,133 metric tonnes of gold, which represented ∞286.7 million ounces and could be assigned as collateral for $34 trillion of national debt. If the U.S. priced gold to collateralize 10% of its national debt, it would revalue the USD gold price at $11,859 per ounce.

Never happen?

Think again. The official U.S. Government gold price has changed only four times from 1792 to the present. Starting at $19.75 per troy ounce in 1792, the "official U.S. gold price" was raised to $20.67 in 1834 and $35 in 1934. In 1972, the price was raised to $38 and then to $42.22 in 1973, where it has remained "on the books" despite being allowed to float freely in 1968.

Repricing gold is effectively devaluing the U.S. dollar so if one wants to devalue the debt, they could do so by using gold as the delivery mechanism. The mere concept of a debt default is anathema to U.S. foreign policy and a surefire end to the dollar's "reserve currency" status.

Devaluation rather than default achieves essentially the same objective but allows the façade of "dollar supreme" to continue.

The repricing of gold as a means of underpinning the upwardly-spiraling debt level is the only rational way for the Americans to continue to fund the military.

When one considers that for the first time in U.S. history, the annual interest on the national debt now exceeds the entire budget for the Department of Defense, it will not take long before that military credit card gets rejected the next time an aircraft carrier needs a tank of diesel fuel for its fighters strafing some foreign entity that tried to pay for oil in currency other than dollars.

Bonds and the U.S. Dollar

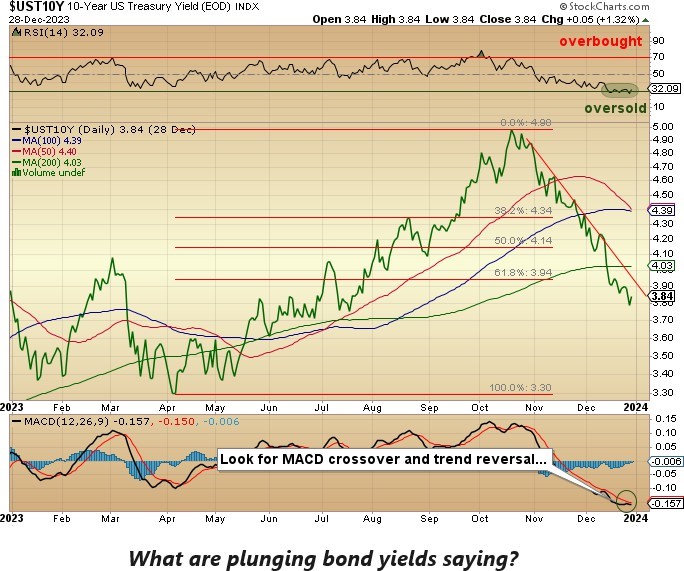

It has been said that the bond market is infinitely better at predicting economic activity than the stock market because of its sheer size and breadth. Further to that, in normal times, bond and stock prices are inversely correlated because weakening stock prices are associated with weakening corporate earnings, which invites easier monetary policy, which brings about lower bond yields with higher bond prices.

Since the end of October, both stock and bond prices have rocketed higher as the 10-year treasury yield has collapsed from over 5% to under 3.8% in one of the most violent, non-event-driven bond market rallies in history. Crashes in 1987, 1997-98, 2008, and 2020 were accompanied by similar rallies, but they were all associated with financial events approaching "crisis" mode.

One has to wonder what it is that the bond market is seeing on the economic horizon that sent prices off on an explosive ascent in Q4/2023. If bonds are pricing in a severe economic downturn, then the commensurate move in stocks has been the best-selling opportunity since the summer of '87 or New Year's 2020.

However, the problem with running analogs these days is that computers run 80% of the larger portfolios and are oblivious to anything that might be derived from human emotion. Those algorithms are robotic order-followers that do not draw any conclusions from plunging bond yields or difficult bond auctions where the Treasury is forced to buy half the issue in order to keep yields in line.

It is my opinion if forced to choose between stocks or bonds as predictors of future economic events; I will take bonds any and every day of the week. As we move into 2024, I am "cautious," verging upon "frightened."

The stock and bond market rallies have been accompanied by a corresponding tick-by-tick drop in the U.S. dollar index, a great portion of which has been caused by the rally in the Japanese yen. The BoJ is trying to "normalize" its yield curve, which involves allowing long-term yields to rise, which puts enormous upward pressure on the yen.

Since the world is short the yen by way of Japanese loans, there is a possibility that we could see a financial "event" emanating from the Japanese financial system that forces the yen into a parabolic rise against every other currency on the planet. While the largest weighting in the basket of currencies is the Euro (57.6%), the yen has the next highest (13.6%) weighting with the other currencies (British pound, Swedish krona, Canadian dollar, Swiss franc) comprising the rest of the basket.

Normalization of the Japanese yield curve, which implies the abandonment of "yield curve control ("YCC") would certainly add a bearish bias to the dollar index, and that would certainly have an impact on U.S. dollar-denominated commodity prices. Even at the London Metals Exchange, all metal quotes are in U.S. dollars, so the direction of the currency against all major metals, such as copper, gold, iron ore, et al., will certainly have an impact upon input costs otherwise explained in the Producer Price Index which in turn affect the CPI. Everything is intertwined in a manner designed to maintain the U.S. dollar's "Reserve Currency Status," which is the foundation of national security for the U.S.

Near-term, the U.S. dollar index is fast approaching oversold status, with MACD moving toward a bullish MACD cross-over and "buy signal." There is a strong likelihood that a bounce will occur in January, taking it up to fill the gap created on the downside between 102.25 and 102.75 before resuming the downtrend. I will be watching with great fascination to see whether bond yields follow or lead the movement in the dollar index and if stocks continue to take their cue from yields or the USD.

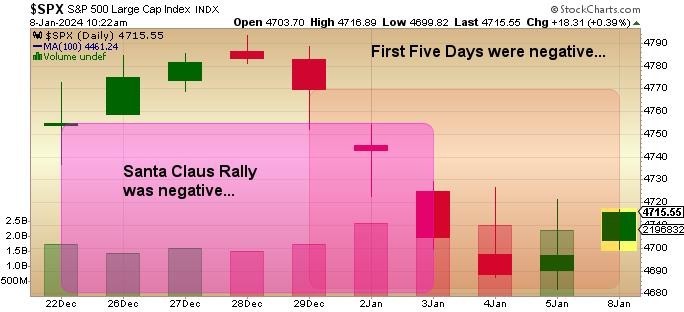

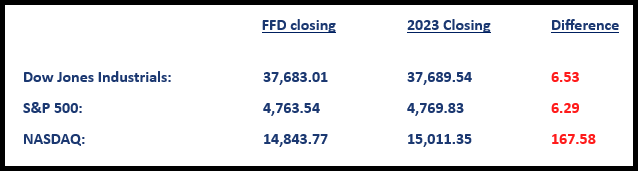

Santa Claus Rally / First Five Days Indicators

The January Barometer (JB) has an uncanny track record for predicting stock prices with an 83.6% accuracy ratio. The Santa Claus Rally ("SCR") lasts from the last day before Christmas until the close on Day Two of the New Year. The FFD (or "First Five Days") Indicator has an 83.0% accuracy ratio as well. It should be noted that in fifteen of the last eighteen presidential election years, the S&P followed the results of the FFD. When the "January Trifecta" (SCR, FFD, and JB) posts gains across the board, there is a 90.3% probability of an "up" market for the year.

This is why I refrain from making forecasts until I see the results of the SCR and FFD indicators. More often than not, the month of January follows them, so rather than trying to position myself against the odds indicated by those signals, I always wait.

Using the S&P 500 as the measuring stick for stocks, the SCR began its tracking period from the December 21 closing price at 4,746.75 and went out on the close of the second trading day for 2024 (Wednesday, January 3) at 4,707.09. Since the SCR registered a "FAIL" last week, any chance of achieving the extremely bullish "January Trifecta" has now been eliminated.

The FFD began with the closing price for the S&P500 at 4,769.83 and ended the period at 4,763.54. This indicator has also registered a "FAIL" and now joins the failed SCR in making the two "early-warning" indicators definite "sell signals," at least over the near term.

All the bulls have left for the month is to hope for their sake that January can buck the bearish trend now confirmed by the SCR and FFD. As I have written repeatedly, the SCR and FFD are only indications of probable outcomes and in no way suggest that there is total certainty to their predictive qualities. However, if January closes below 4,747.75, fighting a 90.3% accuracy ratio is going to be a very difficult endeavor.

From the standpoint of tactics, if one assumes that the January Barometer will be a "FAIL," then it matters not how the fundamentals line up for copper and gold, one must assume that stocks will be fighting the major trend of a downturn in the economy and a 90.3% probability of a bear market.

Mind you, what we will all be hearing from the Wall Street spin doctors and the White House is that all the declines at year's end and into early 2024 were normal bouts of profit-taking after two incredible months of stock price recovery. Phrases like "normal correction," "Goldilocks economy," and "massive liquidity" will be trotted out as rationale for a continuation of the P/E multiple expansion of the last quarter of 2023. With earnings essentially flat for the last quarter, the 15% rise in the S&P was all multiple expansion rather than growth-driven, and in the past, advances based on hope and faith (of a Fed pivot leading to declines in borrowing costs) always fails.

As we move into 2024, a P/E of 20 for the S&P 500 is equal to a 5% earnings yield, so with some fixed income yields at 5%, why should investors take on equity risk when they can avoid risk with fixed income? Most of the anticipated 2024 growth is already factored into stocks by way of the P/E multiple, so with the recent January 5 ISM coming in with a massive plunge, even the normally vibrant services sector is now under siege.

Remember, “Goldilocks” Was Created in a Fairy-Tale

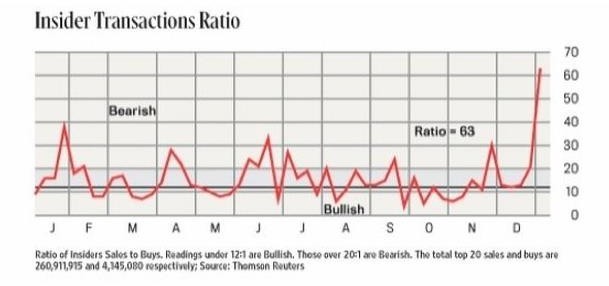

Another troublesome attribute of the current market is the level of insider selling, which is now solidly in bearish territory.

Also of note was the huge sale of stock reported last week in which Mark Zuckerberg, the Meta chief executive, sold shares on every trading day between Nov. 1 and the end of the year, unloading nearly 1.28 million shares for about $428 million, according to a Tuesday regulatory filing.

As I look out to next November, I am fearful that the societal divisions now plaguing the U.S. are going to widen, casting a Watergate-type pall over investor sentiment and stock prices. In the 1970s, the Nixon-sanctioned break-in at the Watergate Hotel in Washington led to a two-year-long scandal from 1972 to 1974 that also included the brutal 1973-1974 bear market, arguably the worst bear market of the past fifty years. I fear that campaign shenanigans are going to further alienate the left from the right in a manner that places an ethnic divide between Democrats and Republicans. This in 2024 will mirror the 1970's malaise that led to the

destruction of the "Nifty Fifty" — a group of stock market favorites that were seen as the leadership group — and will apply to 2023's "Magnificent Seven" companies that until Q4/2023 comprise 70% of the stock market gains for the year. In fact, the "Mag 7" has had a particularly brutal start to the year, with AI leader Nvidia (NVDA:US) down .86% YTD and Apple Inc. (AAPL:US) down 5.9% for the first week of trading.

The key to portfolio performance for this investor lies in gold and its ability to decouple from the influences of the paper merchants — the bullion banks — that control the U.S.-denominated price for bullion by way of the U.S. futures market. If gold can break out through $2,100 by the end of January, the Gold Miners will be swept up as allocations made by the gargantuan generalist funds that, until now, have stayed largely away from the precious metals increase.

As the expression goes, "money moves to where it is best treated," and gold was certainly one of the best performers in 2023 and has been since the pandemic lows of 2020. I think that the arrival of an economic downturn will force investors out of growth and into value, where the gold mining sector presents a compelling fundamental case for ownership. If that occurs, sentiment will shift toward the intermediates and juniors and eventually include massive money flows to the junior gold developers and explorers, exactly as we have seen with lithium and uranium since 2020.

Also, the key to performance will be the ability of the copper deficit to carry a greater price impact than the effect of a downturn in global economic activity. If demand falls 10% in recessionary conditions while supply due to mine closures falls 30%, the price variable will move higher. As opposed to the "demand-pull" advance of prior copper bull markets, this will be a "cost-push" effect where new sources of supply — new mines — will be sub-economic to build unless copper prices exceed $15,000 per tonne or $6.80 per pound. Construction costs will "push" copper prices higher to accompany the global supply deficit, creating a bonafide bull market in "all things copper."

Provided here is the link to the recent interview with Ivanhoe Mines' Founder and executive co-chairman Robert Friedland, where he discusses the copper outlook for 2024. It is absolutely compelling.

Wishing everyone a happy and prosperous 2024. . .

| Want to be the first to know about interesting Critical Metals, Cobalt / Lithium / Manganese, Gold, Uranium, Silver and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [Norseman Silver Inc.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, [Volt Lithium Corp.] has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Norseman Silver Inc., Volt Lithium, Getchell Gold, and Cameco Corp. ].

- [Michael Ballanger]: I, or members of my immediate household or family, own securities of: [Norseman Silver Inc., Getchell Gold, and Volt Lithium].My company has a financial relationship with [Norseman Silver Inc.]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.