Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) does not plan to waste any time in the new year after making a deal to consolidate an entire copper-gold porphyry system in British Columbia's Golden Triangle.

The company has completed a 51,000-meter drilling campaign at its Kitsault Valley project in 2023 and plans to report on assays from 70 holes in the coming year. Last month, DV announced it had entered into an option agreement with Libero Copper and Gold Corp. (LBC:TSX.V; LBCMF:OTCQB) to earn 100% interest in the southern portion of Libero's Big Bulk property.

After a "phenomenal" year of results in 2023, President and Chief Executive Officer Shawn Khunkhun told Proactive's Steve Darling in a recent interview that he sees the potential "for a billion-dollar company."

"We've got a number of deposits," Khunkhun said. "We want to show that they are not individual, that they may be related. We're trying to connect the deposits. If we can do that, I think it's the watershed moment for Dolly Varden."

Khunkhun said the company had been looking for such an opportunity to consolidate in the area for some time. The Big Bulk porphyry "is potentially the feeder to all of the high-grade and mineralization at Dolly Varden."

He compared the possibility of a combined system to another major project in British Columbia, Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) massive KSM project, which Khunkhun called the "largest undeveloped gold project on the planet."

Details of Projects, Deal

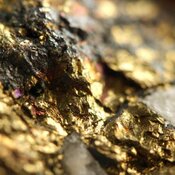

The Kitsault Valley project includes the Dolly Varden silver property and the Homestake Ridge gold-silver property. The combined 163-square-kilometer project hosts an indicated resource of 34.7 million ounces silver (Moz Ag) and 166,000 ounces gold (Au) and inferred resources of 29.3 Moz Ag and 817,000 ounces.

Big Bulk encompasses seven mineral claims spanning 3,000 hectares somewhat east-southeast of DV's current holdings.

Stuart McDougall with Research Capital Corp. has rated Dolly Varden a Speculative Buy for investors with a target share price of CA$1.35 per share.

"Importantly, the (Big Bulk) property already holds existing land use agreements and exploration permits, streamlining Dolly Varden Silver's exploration efforts," the company noted in a release on Tuesday.

Under the assignment agreement with Libero, Dolly Varden has agreed to issue shares to Libero at a deemed value of 78 cents per share (being the closing price of the common shares on the TSX Venture Exchange on December 15, 2023) for an aggregate consideration of CA$214,500.

In connection with the acquisition, Dolly Varden also entered into an amending agreement that Dolly Varden may earn-in a 100% undivided interest in Big Bulk, completing payments totaling CA$1.45 million over five years. The option agreement also gives Dolly Varden the option to accelerate the payments.

The Catalyst: Big Future for Silver?

While silver opened the year at US$23.93 per ounce on Tuesday, some analysts are very bullish on its future in 2024. Investing Haven predicted a target price of US$34.70 this year and said the price could go as high as US$48 in mid-2024 or mid-2025.

"Silver will move higher in 2024 because the top in Yields is confirmed," Investing Haven wrote. "The U.S. Dollar did already confirm its inability to move much higher. Both are supportive developments for precious metals."

According to Investing News Network, Chief Executive Officer Keith Neumeyer of First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) predicted as recently as last March that prices for the metal could reach triple digits eventually.

A Haywood Securities Report by Geordie Mark rated the stock a Buy with a share target of CA$2.00. The report referenced the company's drill results and its future plans for follow-up on the Moose Lamb fault.

The most conductive element in nature, silver is used to coat electrical contacts in computers, phones, cars, and appliances. It's also an important element in solar and fuel cell technology.

The World Silver Survey 2023, published by the Silver Institute, said there was a 237.7 Moz deficit between supply and demand for the precious metal in 2022. This deficit is likely to be repeated in 2023, the institute said.

"Global silver mine production is expected to return to growth in 2023 and rise by 2.4% y/y to 842.1 Moz (26,193 tons)," according to the report. "This will be largely driven by new silver projects coming online and ramping up."

The authors pointed to MAG Silver Corp. (MAG:TSX; MAG:NYSE American) and its joint venture with Fresnillo Plc (FRES:LSE) in Mexico, Juanicipio, which just reached nameplate capacity and is expected to hit full production soon.

Co. With 'Elite' Resource Has 'Impressive Backing'

Stuart McDougall with Research Capital Corp. has rated Dolly Varden a Speculative Buy for investors with a target share price of CA$1.35 per share.

He cited the results of the drilling on Kitsol, which returned grades of as much as 496 grams per tonne of silver, and indications that this mineralization could extend south.

Additionally, Rick Mills of Ahead of the Herd highlighted the company's "impressive backing."

A Haywood Securities Report by Geordie Mark rated the stock a Buy with a share target of CA$2.00. The report referenced the company's drill results and its future plans for follow-up on the Moose Lamb fault.

A major catalyst for Dolly Varden Silver is its reputation for uncovering high-grade mineralization. According to Chris Temple of The National Investor, the company is "one of the elite high-grade silver and gold resources in North America." Additionally, Rick Mills of Ahead of the Herd highlighted the company's "impressive backing."

Dolly Varden said last year, major Hecla Mining Co. (HL:NYSE) upped its stake in the company by CA$10 million to bring its ownership to 15.7% of DV.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX)

Reuters provided a breakdown of the company's ownership and share structure, where management and insiders own 0.10% of the company. According to Reuters, Director Darren P. Devine owns 0.07% of the company with 0.20 million shares, Director James Anthony Sabala owns 0.02% of the company with 0.05 million shares, and Director Robert John McLeod owns 0.01% of the company with 0.04 million shares.

Fury Gold Mines Ltd. (FURY-T) owns 22.04% of the company with 59.50 million shares and represents a strategic investor, stated Reuters, as does Hecla Mining Co. (HL:NYSE), which owns 10.02% of the company with 27.04 million shares.

Reuters reports that institutions own approximately 22.65% of the company. According to Reuters, 2176423 Ontario, Ltd., owns 9.49% of the company with 25.63 million shares, Fidelity Management & Research Company LLC owns 6.30% of the company with 17.00 million shares, Sprott Asset Management LP owns 2.01% of the company with 5.44 million shares, ETF Managers Group, LLC, owns 1.96% of the company with 5.29 million shares, Mirae Asset Global Investments (USA) LLC owns 1.40% of the company with 3.77 million shares, US Global Investors, Inc., owns 1.02% of the company with 2.75 million shares, DWS Investment GmbH owns 0.28% of the company with 0.75 million shares, and Charteris Treasury Portfolio Managers Limited owns 0.19% of the company with 0.50 million shares.

There are 270 million shares outstanding with 157.53 million free float traded shares, reports Reuters, while the company has a market cap of CA$240.36 million and trades in a 52-week range of CA$0.58 and CA$1.24.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dolly Varden Silver Corp., Seabridge Gold Inc, and Mag Silver Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden Silver Corp. and Libero Copper & Gold Corp.,

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.