Canada-based Freeport Resources Inc. (FRI:TSX.V;OTCQB:FEERF;FSE: 4XH) recently announced that it had successfully renewed its license for the Yandera project, one of the world's largest undeveloped copper deposits, located approximately 95 kilometers southwest of the city of Madang in the Bismark Mountain Range in Papua New Guinea (PNG).

The Yandera Copper Project is located in the highly prolific PNG Orogenic Belt, the same geological arc as some of the world's largest gold and copper deposits, including Grasberg, Frieda River, Porgera, Lihir, Wafi-Golpu and Kainantu. The Yandera orebody is well-defined and understood, hosting a large copper resource of approximately 1 billion tonnes of ore.

The 2017 Pre-Feasibility Study by Worley Parsons delineated Yandera as one of the largest undeveloped copper resources in the world. Yandera is a project of strategic national interest in PNG and has the potential to become one of the country's most significant copper mines. The project's proximity to Asia, the world's largest consumer of copper metal, positions the Yandera Copper Project as an attractive new source of long-term copper supply.

The Catalyst: Yandera License Extension

On December 11, Freeport Resources announced that Papua New Guinea's Minister for Mining, the Honorable Sir Ano Pala, had approved the renewal of the Yandera Copper Project's Exploration License 1335 ("EL") through November 19, 2023, following the regulatory processes prescribed by the Papua New Guinea Mining Act.

The renewal application for the two-year period ending November 19, 2025, was submitted in August of this year and is currently under review. In the past, these renewals were often approved six to nine months after expiry, but the new mining regime in PNG has worked very hard to clear these backlogs, and the company hopes to have this most up-to-date renewal very soon.

"We are pleased to have successfully completed the exploration license renewal process and would like to thank the Mining Advisory Council and the Government of PNG for their dedication to advancing large-scale resource projects such as Yandera Copper," announced Dr. Nathan Chutas, Senior Vice-President of Operations for Freeport Resources.

"The renewal of Yandera Copper Project's Exploration License demonstrates the commitment of the Government of PNG to build strong, working relationships with mineral exploration and development companies, such as Freeport Resources, to drive economic growth through the responsible development of Papua New Guinea's vast natural resources," continued Dr. Chutas.

The company is also planning a wider exploration program of porphyry copper targets within the largely underexplored 245.5 square kilometer land package.

"This is a major milestone for the Company. More than US$200 million has been expended on the project since 2005, culminating in a comprehensive 2017 Pre-Feasibility Study delineating one of the world's largest undeveloped copper resources. With the license renewal now in hand, we are anxious to commence work on the Definitive Feasibility Study and accelerate ongoing discussions with potential strategic partners for development of the mine."

The license in question, EL 1335, covers the 245.5 square kilometer tenement comprising Freeport Resources' wholly-owned Yandera Copper Project. Work completed and studies funded to date include approximately 154,600 meters of exploration drilling, the vast majority of which has focused on the Yandera Central deposit, as well as scoping studies, engineering studies, environmental studies, a Pre-Feasibility Study, and infrastructure-related studies.

The renewal of EL 1335 allows Freeport Resources to commence work on a Definitive Feasibility Study to advance the Yandera Copper Project toward a Final Investment Decision. Concurrent with the Definitive Feasibility Study program, Freeport Resources will accelerate ongoing discussions with international strategic investors and prospective development partners.

Freeport Resources' Definitive Feasibility Study will build on earlier work undertaken with local and regional communities to determine opportunities to achieve mutually beneficial partnerships and sustainable long-term social benefits related to job creation, indigenous advancement, health and wellness, environment, education, and community development.

The company is also planning a wider exploration program of porphyry copper targets within the largely underexplored 245.5 square kilometer land package.

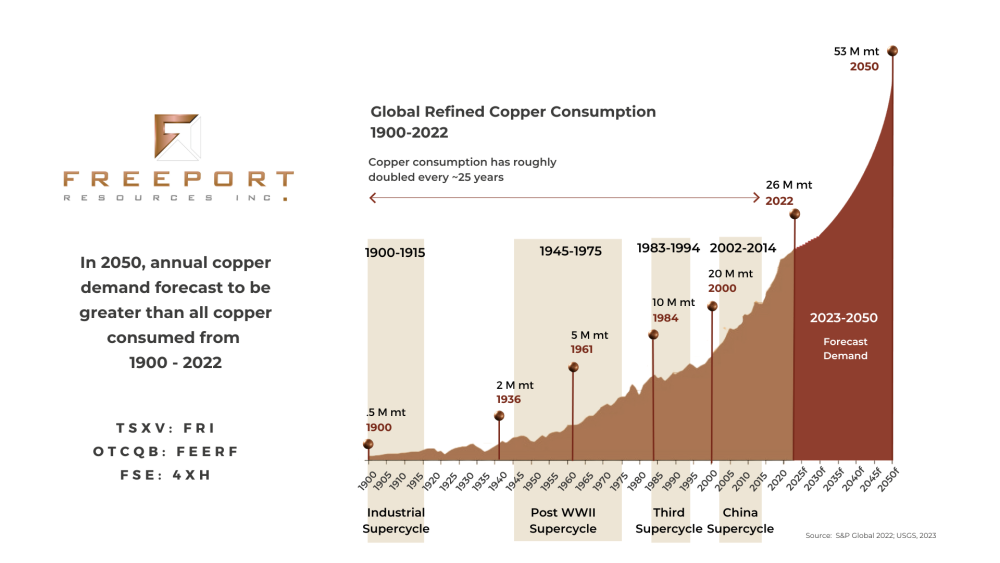

Why This Industry? Copper Demand Continues

Demand for copper is forecast to undergo unprecedented structural change driven by the global energy transition, with mined copper supply forecast to enter a deficit position starting as early as 2025.

An article by Cecilia Jamasmie, Senior Editor of Mining.com, lays out the coming crunch in copper supply. "Chile's state-owned mining company Codelco, the world's biggest copper producer, warned . . . that global shortages of the metal may reach eight million tonnes by 2032, as soaring demand continues to offset new projects numbers," she writes.

Demand for copper is forecast to undergo unprecedented structural change driven by the global energy transition, with mined copper supply forecast to enter a deficit position starting as early as 2025.

"Maximo Pacheco, chairman of the board of Codelco, said at an industry conference that while a surplus is expected in the short term due to new projects in Chile, Peru, the D.R.C., and China's Tibet region, medium to long-term demand will eclipse supply further down the line."

Jamasmie quotes Pacheco as saying that since "some copper deposits are in the process of stopping production and that other projects are in the process of starting operations, it is estimated that the deficit will be almost eight million tonnes in ten years."

Furthermore, a recent Goldman Sachs Equities Report projects a similar shortfall. "Global copper supply disruptions are expected to finish the year at 1.6mt, a historically high level and 500kt above GS initial forecast," the report explains.

"This is mainly explained by a series of mining issues in two key producing regions in LatAm, Chile and Peru. In addition to operational challenges and community protests, production has been impacted by declining grade quality, water disruption-related issues, and slow project ramp-up."

"GS anticipates unexpected disruptions to trend toward more normalized levels in 2023, but we also now project a lower supply growth rate at 3.6% (vs. 6% before). This reflects a number of downgrades across copper operations over the past quarter, as producers increasingly signal the factors that have generated underperformance this year are set to remain as headwinds into next year."

"On the demand side, GS Global Commodities team highlights that marginal reduction in non-green demand (both in China and DMs) is offset by ongoing renewables demand strengthened by an expected 2.7% global refined demand growth for 2023."

"Investors have been concerned about both copper supply growth and demand weakness into 2023 before a structural deficit materializes into the end of the decade. But the GS global commodities team believes the combination of weaker than expected supply, resilient demand and record low inventories is likely to result in a 178kt deficit already in 2023."

Yandera Copper Project's proximity to Asia marks it as an attractive new source of long-term copper supply for the continent, where many countries are rapidly transitioning to green energy solutions (and developing the appetite for copper that industry stokes.)

The transition to clean energy requires massive increases in copper supply. Higher copper prices will be required to incentivize the production of more copper from existing and new mines.

Recent advances in copper catalyst technologies have opened an entirely new, low-cost processing route that could potentially be applied to Yandera and other large yet lower-grade sulfide copper deposits.

These technologies, which allow for the treatment of lower-grade sulfide ores as oxides via a standard SX/EW circuit, are currently employed and being tested at various copper projects in both North and South America by Jetti Resources and Rio Tinto's Nuton Venture.

The technology is a potential game-changer for lower-grade copper sulfide deposits, so Frontier Resources is currently evaluating it for use at the Yandera project. If such methods prove to be viable, this could greatly enhance Yandera's feasibility by significantly reducing the capital and operational expenditures required to transition the project to production.

Why This Company? Large Claim, Proximity to the Asian Market

According to Freeport, the Yandera Copper Project's proximity to Asia marks it as an attractive new source of long-term copper supply for the continent, where many countries are rapidly transitioning to green energy solutions (and developing the appetite for copper that industry stokes.)

Freeport's Yandera Copper Project was previously held by the Sentient Private Equity Fund, a US$2.7 billion specialist mining PE fund. Sentient spent approximately US$200+ million in engineering and feasibility studies but was forced to sell the site when its portfolio had to be liquidated.

The project is held under a 2-year renewable exploration license, which has now been renewed, as it was held nine consecutive times previously.

Why Now? Exploration License Paves the Way to Profit

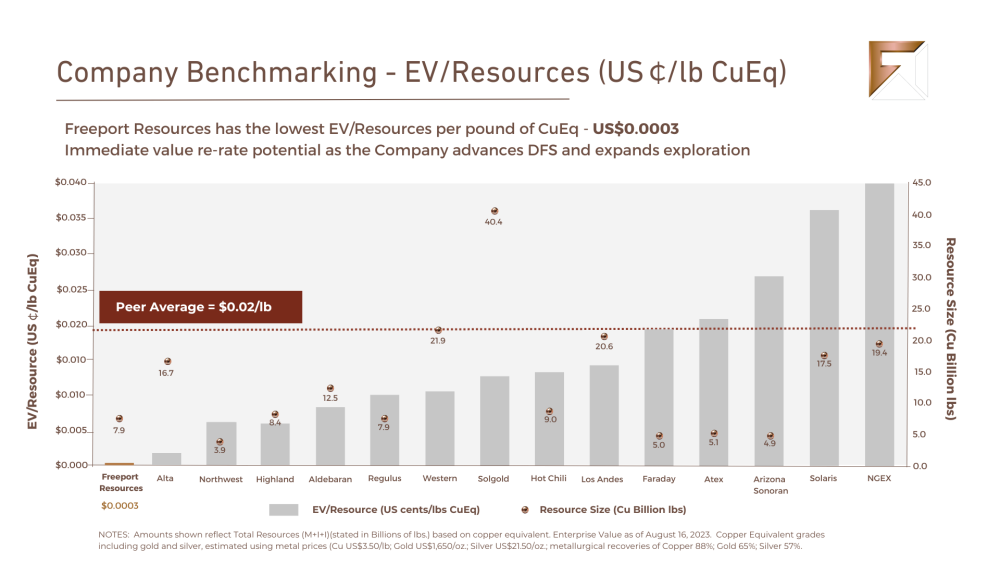

Before license renewal, the company had a market capitalization of only CA$4 million. Now, with the renewal license in hand, shares will likely undergo a significant re-rating.

Additionally, if the new catalyst technologies currently being examined are found suitable for deployment at the Yandera project, they could smooth and expedite its transition to production.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Freeport Resources Inc. (FRI:TSX.V;OTCQB:FEERF;FSE: 4XH )

Analyst Clive Maund published an opinion on March 1 that "Freeport Resources is looking like an Attractive Speculative Play."

Ownership and Share Structure

Freeport Resources has a market cap of less than CA$4 million. After its most recent financing round, the company has 157 million shares outstanding, as well as 69 million warrants and 10.2 million options. The warrants are all at much higher strike prices (CA$0.10 to CA$0.40) than the current market price of CA$0.025.

Management, Directors, and Advisors own some 20% of the outstanding shares, with institutional investors Canaccord, Haywood, and Echelon owning another 20-30%. There are not currently any strategic investors, although management is in discussion with potential strategic partners.

The company is well-capitalized with a low monthly cash burn and no incipient drilling costs, as the Yandera deposit has already been extensively explored and drilled.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [Freeport Resources Inc.] has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Freeport Resources Inc.].

- [Owen Ferguson] wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.