With the drill bit, Snowline Gold Corp. (SGD:CSE; SNWGF:OTCQB) hit its best near-surface interval to date in the Valley target at its Rogue gold project in Canada's Yukon, a news release indicated.

"[The] Rogue intrusive gold project in the Yukon is perhaps the greatest new discovery of 2021-2023," wrote Jay Taylor, editor of the Gold, Energy & Tech Stocks newsletter. "Most of the work to date has come on the Valley target where astoundingly high-grade intersections, like the 2/24/23 announcement of a 558.7 meter (558.7m) intersection that graded 1.3 grams per ton gold (1.3 g/t Au), [have] become rather commonplace."

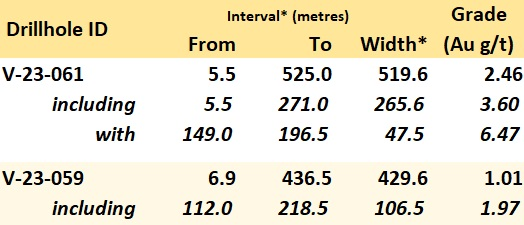

The just-announced record interval was 2.46 g/t Au over 519.6m, including 3.6 g/t Au over 265.6m, returned from hole V-23-061, the release indicated. The hole was drilled between surface and 250m down. Beginning at 149m downhole is a zone of sustained higher grades that averages 6.47 g/t Au over 47.5m. The even distribution of grades within this 250m vertical distance emphasizes the strength of the near-surface mineralization.

In the release, Snowline highlighted two additional holes, V-23-059 and V-23-060, because they exhibited continuity and breadth in the southeastern extension of Valley's mineralized system. V-23-059 demonstrated 1.01 g/t Au over 429.6 m from surface, including 1.91 g/t Au over 133m. V-23-060 returned 1.02 g/t Au over 109.5m.

"The consistency of mineralization reduces the risk and should make grade control exceptionally easy when production begins," Taylor added.

Valley mineralization remains open in several directions.

These new drill data follow a series of high-grade results from Valley Snowline reported in the past several months. The most recent, "two more fantastic gold intercepts," as described by Taylor, were 1.45 g/t Au over 372.9m (hole 23-056) and 1.34 g/t Au over 359.4m (hole 23-055), the company announced in a November 9 release.

Taylor of Gold, Energy & Tech Stocks wrote in the November 30 issue that Snowline "is an amazing story."

The mining company, headquartered in Vancouver, British Columbia, aims to find world-class gold deposits in the Yukon and possibly develop a new gold district there. Snowline owns eight projects, having methodically chosen and acquired each property. All are located in the underexplored Selwyn Basin, the geology of which is said to be analogous to that of the prolific Great Basin in the U.S. state of Nevada. The explorer's land package totals about 330,000 hectares (330,000 ha).

Rogue, spanning 94,000 ha, is Snowline's flagship asset. At Rogue, the gold company made a potential Tier 1 gold discovery in its first season.

Snowline also owns and uses a database of geotechnical results of 64,000 soil, 9,600 rock and 6,500 silt samples from the region that were analyzed.

As for the gold sector itself, it recently broke out, reported McAlinden Research Partners. On Dec. 3, 2023, spot gold prices hit $2,150 an ounce, an all-time high that took the precious metal's year-to-date rally to 16.5%.

The Catalyst

Following an active summer 2023 of drilling, assays remain pending for 16 holes placed in three targets. These include one metallurgical hole in Valley. Also to come are results from Snowline's surface exploration program.

"With gold starting to break out now, those holes could have a very positive impact on this company's market valuation. Stay tuned," Taylor wrote.

Investors also may expect additional regional consolidation in the short term from Snowline, which is well-financed.

"An Amazing Story"

Taylor of Gold, Energy & Tech Stocks wrote in the November 30 issue that Snowline "is an amazing story."

He noted that Quinton Hennigh, renowned economic geologist, had purported in October 2023 that the Rogue deposit, expected by analysts to reach about 10,000,000 ounces, will wind up being about 30−40% larger than their forecast.

Technical Analyst Clive Maund agreed with Taylor, describing Snowline in September 2023 as "one of the best gold stock investments around at this time."

Technical Analyst Clive Maund agreed with Taylor, describing Snowline in September 2023 as "one of the best gold stock investments around at this time."

Then, the stock's movements indicated an "upleg" was to come, and Maund recommended the gold company as a Buy.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Snowline Gold Corp. (SGD:CSE; SNWGF:OTCQB)

With continuing high-grade drill results coming out of the Valley target at its Rogue project and more data from it to come, all against a backdrop of high gold prices, Snowline is a company to, at least, watch and at most, take a position in, according to industry experts.

Ownership and Share Structure

Snowline has 144.6 million (144.6M) basic shares outstanding, 8.3M of which are in options and 8.7M in warrants, as detailed in its November 2023 Investor Presentation. Fully diluted outstanding shares total 161.6M.

As for the breakdown of the company's share ownership, Reuters reports that 8.17% is held by management and insiders. Insider Ana Cox Alvarez del Villar de Gubbins has the most out of this category at 7.68%, with 11.12 million shares.

19% is with strategic investor, 18526 Yukon Inc., with 27.50 million shares.

15.86% is owned by institutions. Crescat Capital LLC has 7.23%, with 10.47 million shares, and 1832 Asset Management LP has 5.51%, with 7.97 million.

The rest is retail.

Snowline's market cap is CA$673.8 million, and its stock price is about CA$4.85 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Snowline Gold Corp.].

- [Doresa Banning] wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.