This weekend, every blogger, newsletter writer, tweeter, and you-tuber is at their computers, hammering out linguistic or visionary "victory laps" over their ownership of gold and silver and the uncontested conquest of the bullion bank behemoths that have controlled them for years. They want and deserve total vindication and absolution from the sins of the idolatry of two metals that have adorned safe palaces and central bank vaults for centuries. Over this weekend, champagne corks will be popped, and balloons will float to the sky in celebration of the all-time high print in gold prices, eclipsing at the very least the highs of August 2020 in the futures arena with argument by purists that the spot market close of $2,078.90 is the only one that counts.

As a market historian with 45 years of service as my training ground, I would first point out that the Spaniards were and are a hearty lot; they roamed the Spanish Main for decades in a manner that made the Vikings look like choirboys. They raped and pillaged and plundered and rendered an entire civilization of Aztecs into servitude while they absconded with golden riches that to this day would be deemed unfathomable. They were such magnificent sailors that entire galleons of golden objects — goblets and plates and chandeliers and helmets, as well as jewelry of all shapes and sizes — were transported from Mexico and Central and South America to the ports in Barcelona and Valencia in order to win favor with the kings and queens of Spain, all of whom paid substantial homage to their courageous capitanos with villas and estates that still stand to this day. Gold has been a stalwart of the Spanish portfolio for centuries, and there will always stay.

With the move in gold futures to all-time monthly closing highs this week, the Spaniard Hernan Cortez must be smiling down at us all, along with James Blanchard, Howard Ruff, and Harry Schultz. Sipping a White Russian right next to them is Canadian Ian McAvity while Murray Pezim and Bruce MacDonald are singing a duet, chopping off the heads of champagne bottles with the Hy's kitchen butcher knife. Thousands upon thousands of poor souls who died in poverty over the past few decades thanks to "bankster shenanigans" are a marching chorus line transversing the fields and forests behind them, pounding out a rhythmic mantra of support for the long-suppressed golden horde.

It has been said that "there is NO fever like GOLD fever," but I would dispute that and say that "there is no addiction like SILVER addiction," and even after watching this absurdity of cheerleading by the Bitcoin community, it is obvious that a major change is coming to the role of the American currency. You see, every uptick in gold and silver and Bitcoin, and copper and uranium and lithium is a downtick in the functional utility of the U.S. dollar.

Citizens with passion, fuming over the increasing burden brought on by massive increases in the cost of living, are now taking steps to avoid the erosion in their savings accounts. They were forced into the stock market in the post-GFC era because of threats to savings; they were forced into Bitcoin because the government bailed out the banks in 2008 by paying no respect to their domestic currency; they are now being forced into gold and silver because stocks cannot withstand the onslaught of earnings downgrades and P/E shrinkage.

In early October, I tweeted out that we would see "New ATH by New Year's Day," and it was all based upon the volume features of the first run of the SPDR Gold Shares ETF (GLD:NYSE) to the $184.00 level which equated to roughly the $2,000 level in spot gold. I will not elaborate, but as I have written about since the 1980s, "Volume precedes price," and those volume features were telling me in spades that the constant increase in volume during up and down thrusts of the GLD:NYSE ETF represented a "bataille royale" in the trading pits of London and New York. The problem, however, was that the banks that have been persistently increasing their selling through the veiled counterfeiting of actual gold on the futures exchanges can never be trusted to either partially or completely disappear. They are always out there, ever ready to seize the moment where the retail crowd, led on by the newsletter and podcasters and YouTubers constantly drum-beating their way to prominence by calling for "ALL-TIME HIGHS" with breathless enthusiasm and mindless repetition, are lured to the cliff's edge of absolute devotion.

With an RSI for the GLD:NYSE at 73.28, one might be inclined to sell a few contracts of the ones I bought last week at $9.75 as they clipped merrily along today at $16.00 per contract. RSI readings above 70 are usually dangerous for gold, but not to be outdone; the RSI for the Dow Industrials was above 80 going into the final bell.

On October 5, I sent out a graphic of the CNBC Fear-Greed Index showing a plunge of the needle into the <EXTREME FEAR> zone with a reading of "21" in direct contrast to the current "67" reading we now have. As the "No Landing" crowd piles into overvalued stocks that are spiraling into the ionosphere of nose-bleed eternity, what the world is experiencing is a "panic-buying" mania of the highest and most- obscene order.

What you and I are watching is exactly what I was writing about back in September when the Twitterverse was talking about a market crash — the complete inverse of the panic selling and "career-risk" behavior of late October has now been replaced with the same terror only buy-side terror saddled with even greater "career-risk," knee-jerk leveraging in a maniacal effort to rid portfolios of cash in a desperate effort to secure bonus-generating alpha going into year-end.

Last week, I made a note of the need for a two-day close above the $184.36 level, which was the apex of that resistance zone in the $184-186.33 price band. We got the first close on Monday at $186.77 with the following Tuesday at $189.26 before closing out the week at $192.01, which was a 2023 high close and is now within a few points of the $194.44 all-time high last seen on August 6, 2020.

There were two other runs at all-time highs that matter, and both were "event-driven." The Russian invasion of Ukraine took the GLD:NYSE to a peak price of $193.30 on March 8, 2022, and the regional banking crisis prompted the Fed to bail out the offside banking community with the BTLF (Bank Term Lending Facility) with a print of $191.36 on May 6, 2023.

This move to new highs has me somewhat concerned because while the MSM thinks it was all a "Jay Powell event," gold usually looks way beyond such trivial nonsense as a Fed speaker, even if it is the Chairman. I think that the announcement "UAE Drops U.S. Dollar for all Settlements" was of far greater significance than anything JayPo said. With all U.S. military personnel to be removed from Saudi Arabian Soil by New Year's Day 2004, the "petrodollar" is now dead.

I scaled into the GLD March $180 calls over seven sessions starting two weeks ago each day, hopeful of a corrective move, but the only real downtick came on Tuesday-Wednesday the 21st and 22nd of November, but every time I waited, I was paying high prices.

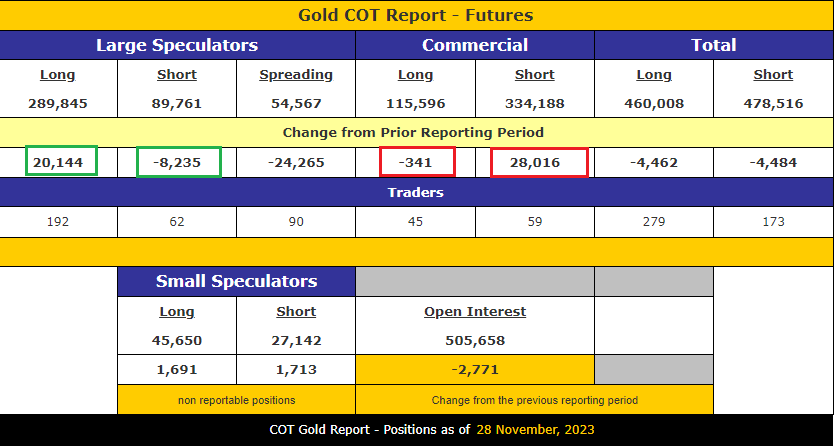

I finally added the final tranche on Monday and wound up with what at the time seemed to be a very risky average price of $9.75 per contract and a $189.75 breakeven price by March for an ETF that traded at a mere $168 in early October. Recency bias had me cringing in fear that, once again, the spiteful hammer of the bullion bank behemoths would come thundering down on me as it has so many times before over countless decades of trying to outwit them. With the COT numbers from last Tuesday showing that the prior week, they had been shorting a hefty net 28,357 contracts during the prior Tuesday-to-Tuesday period, they are considerably offside on that trade. While they are backed by the U.S. Treasury and considered "un-litigable" in the eyes of the CFTC and DoJ, they still would be showing a pretty big hole in their P&L statement.

The high-low spread for the week in Feb Gold futures was $2,007.50-2,070.80, making the average short sale for these bullion bullies at $2,039.15. With Feb Gold settling the week at $2,091.70, that means they are out by 28,357 contracts times $52.55/ounce times 100-ounce contracts or $149,026,035 on the COT week ended November 28. If that were simply one trading desk, they would be out of business no different than Randolph and Mortimer Duke in the great flick "Trading Places." ("Turn those machines bank on-n-n-n-n-n-n-n…")

I have only one thought: What if they were covering last week? The aggregate short position of the masters of mayhem is 218,592 contracts, representing a notional 21,859,200 ounces of gold worth $45 billion. In the world of normality, that would be one hell of a margin call, but alas, these are the bullion bank behemoths, and there are no margin calls in their world — which is why I am demonstrably nervous going into the weekend because you just KNOW that nobody on any of their trading desks is going home to the Hamptons this weekend.

They will be all hours on Sunday night coordinating with their London and Hong Kong henchmen to try to derail this monstrous freight train coming down the tracks and heading straight for them.

We shall see. . .

Stocks

I am flat the SPDR S&P 500 ETF (SPY:NYSE) and Invesco QQQ ETF (QQQ:NASDAQ) positions, having exited the week before last and more than happy to have pocketed the biggest trading pass of the year, having nailed the lows in both bonds iShares 20+ Year Treasury Bond ETF (TLT:US) and stocks (SPY:NYSE,QQQ:NASDAQ) and while I am still long nicely-profitable positions in Cameco Corp. (CCO:TSX; CCJ:NYSE) having done something I never do — buy a blow-out earnings report and pay at or near 52-week highs for a starter position.

I have loved uranium since 2016, and while it was dead money for a number of years, I still own shares from a 2016 private placement in Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX), and with the U3O8 stocks all on fire these days, a test of the 2021 highs above CA$4.00 might be on the horizon in 2024.

I also have a modest holding as a "bottom-fishing" exercise in the Energy Select Sector SPDR Fund (XLE:NYSEARC) through the January $80 calls. With an RSI in the 48 range and oil completely out of favor again with the "WOKE" investment crowd, I do not mind owning this group which were the darlings of the 2022 market but are the juvenile delinquents of the 2023 market, especially now in Q4/2023.

My bet is that they bottom in the next several tax-loss sessions and have a big rebound in January.

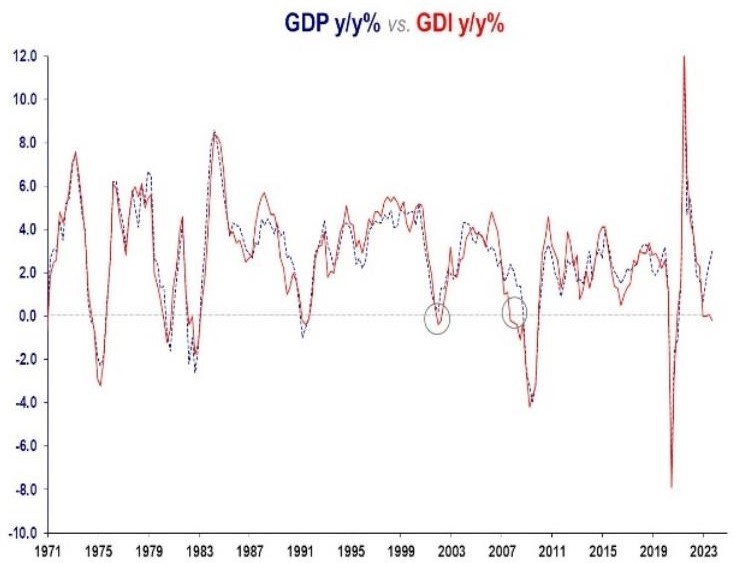

What I am now about to print is flying in the face of all the bullish seasonality narratives that are only surfacing now as stocks are flying off the shelves versus when you were hearing it from this publication back at the late October lows. That "November to Remember" has the CNBC crowd about as giddy as I have ever seen them. They are once again patting themselves on the back for going with the "No Landing" narrative and making sure that every single commentator in the last month was a living, breathing bull, all singing dutifully from "The Fed is done." hymn sheet. I, for one, do not care whether the Fed raises or lowers rates because they are now going to bear the wrath of the stock-buying public when we get into Q1, and the enormous discrepancy between GDP (gross domestic product) and GDI (gross domestic income) starts to converge.

Either GDI must catch up to GDP, or GDP must catch down to GDI – it cannot stay "as is." With every single one of the LEIs pointing to an economic slowdown and credit card debt exploding to the upside here in H2/2023, GDI is highly unlikely to catch up to GDP, but if GDP starts to head rapidly toward GDI, that means corporate earnings are sliding bigtime.

If corporate earnings begin to evaporate, then the "E" in the "P/E" ratio is going to be shrinking just as rapidly. That means that stocks are now in the "death throes rally" that preceded other crashes, such as in 2002 and 2008. I know that sounds a tad extreme, given how bullish I was a couple of months ago.

This chart — of the old and venerable Dow Jones Industrial Index – is sporting a technical picture that — well — I have never seen one like it for the usually boring old DJIA.

Starting from the top, RSI is up in the rafters at an 81.51 reading, higher than where it was at the August 1 top at 36,679. The Dow is a paltry 566 points from that high and 689 points from an all-time high dating back to January 4th, 2022. It is now 7.2% above its 50-dma, which is a rarity for the Dow, and it is up 12.7% since the late October bottom, which has to be some kind of record for this old warhorse index. I mean, after all, this is not exactly the NASDAQ!

The MACD indicator triggered a bullish crossover on November 1 but is stretching the upper boundaries of the chart having gone parabolic vertical in the last few days. Money flow indicators are now right where they were at that August top, suggesting that money is about to flow out of the Dow Jones Index soon.

The ETF that best tracks the Dow Jones Industrials is the SPDR DJIA ETF (DIA:NYSE) so I decided late Friday to open a modest position in the January $360 puts at around $4.00. The first part of the month tends to be weaker as tax-loss selling and year-end portfolio restructuring begin, but I am respectful of seasonality and institutional positioning, so I will start modestly and scale in slowly until I see that first big swoon that starts the pullback after which I will be looking to get very aggressive.

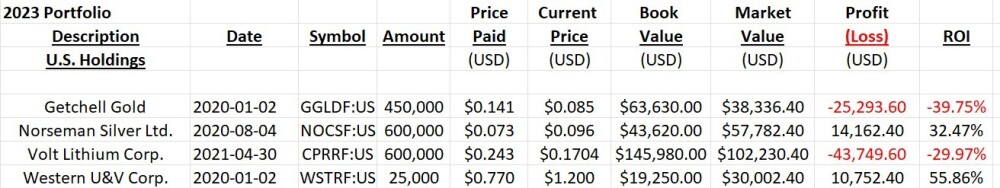

GGM Portfolio Account

Finally, there is some daylight in the portfolio, with two of my four junior resource holdings now at profitable levels. Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB) closed at CA$0.13/US$0.096 on the week, and Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) closed at CA$1.62/US$1.20 on Friday leaving only Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) and Volt Lithium Corp. (VLT:TSV;VLTLF:US).

Volt is still the best story of all these names in terms of proximity to cash flow, but the evolving new story at Norseman and their movement into the copper-gold-molybdenum project (Caballos) in Chile is definitely exciting.

Mind you, once Getchell gets the money to secure Fondaway, I expect it to be back on top.

GGMA Trading Account

If all I had done was trade the stock indices, bonds, and gold for 2023, this would be one of my best years since the 1990's. 2020 was a superb year as well, based upon my correctly identifying the bottoms in gold in March and oil in April, which resulted in some pretty nice results.

I am sitting on a pile of cash (US$111,450) which is earmarked for the Getchell unit.

This move in gold looks terrific, but with the RSI for the GLD:NYSE at 73.28 and with the March $180 calls up 58.46% in a week, I am probably going to be lightening the position by mid-next- week.

Stay tuned. . .

| Want to be the first to know about interesting Cobalt / Lithium / Manganese, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Norseman Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Norseman Silver Ltd., Getchell Gold Corp., Volt Lithium, Western Uranium and Vanadium Corp., Norseman Silver, and Cameco Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.