When I first decided to launch the newsletter in January 2020, I was faced with the task of finding a major theme not only for the yearly 2020 Forecast Issue but also a theme for the letter itself. I toyed with the concept of a totally gold-and-silver-centric letter that raged and fumed and harangued about the evils of bullion bank shenanigans and governmental interference. I considered the idea of having a "gold-and-silver stocks only" publication that would give investors actionable ideas every week. Then I remembered a passage from Ayn Rand's Atlas Shrugged in which Chilean copper magnate Francisco d'Anconia is talking to American steel boss Henry Rearden and says:

"Whenever destroyers appear among men, they start by destroying money, for money is men's protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it. Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it becomes, marked: 'Account overdrawn.'

The U.S. Dollar

You will forgive the length of that soliloquy, but that 1,000-page masterpiece is full of multi-page orations, and it was those that shaped my intentions for the GGMA Advisory. I entitled the introductory issue "2020 — New Decade, Old Deceptions" and went on to explain why the only way gold was going to find its proper value in U.S. dollars was if and when the U.S. decided to re-price it. Dozens of my fellow scribes that cover the precious metals are constantly telling us how physical offtake will eventually cripple the paper market scam machine and send the bullion banks into a short-covering frenzy, with gold and silver soaring and stocks and bonds crashing.

That leaves one asset held by central bank treasuries that can provide for the added risk of holding U.S. paper in an increasingly volatile world of fixed income — gold.

That line of thinking has proven false. A year later, in 2021, I launched another forecast issue entitled: "2021 — Financial Navigation in Uncharted Waters" and again referred to the growing debt bomb created by global responses to the pandemic and commercial shutdown.

In 2022, the title was "Market Fantasy Meets Debt Reality," and this year, it was "2023 — Sovereign debt; Silver; Navigating the Post-Bubble Train Wreck," where once again in both years, I determined that sovereign debt explosions the world over would result in a sudden need for collateral — that increased taxation during a global economic contraction would never work leaving the only tangible collateral being central bank holdings of gold.

Well, ladies and gentlemen, that is exactly where we are in the twilight of the year 2023.

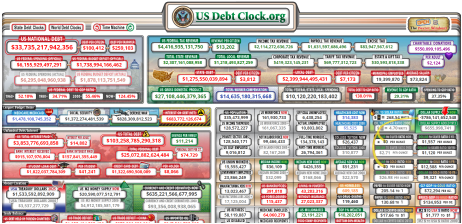

This gargantuan debt spree enjoyed by the "looters" around the world has allowed the disciples of paper wealth to debase currencies in every country on the planet, led, of course, by the largest debtor nation in that group, the United States. While not surprising that the global policeman has annual expenses stretched to Jupiter in order to support a truly devastating war machine of unfathomable destructive power and influence, they have spent "money they have yet to earn" (Thank you, Thomas Jefferson) for just too long and just too brazenly and are now faced with the early stages of a debtor revolt as the bond auctions are starting to experience "pushback" at the meager yields offered in light of the newly-perceived risk.

In everyday life, borrowers who overstep their capacity to pay end up getting a collateral call, where the lender demands added security for money advanced. The lender has to pledge something other than a "promise to pay" as assurance that their obligation will be met. In global finance, however, there is no entity out there that has the authority or the willingness to tell the U.S. Treasury that they are withholding bond purchases until the government posts an additional collateral bond.

Sadly, the government has only two sources of "added collateral," and they are either taxation or gold.

To say that I am astounded at how long it has taken for bond buyers (lenders) the world over to recognize the obvious — that the U.S. government is essentially broke — would be an understatement, but despite the rally in bond and stock prices since the end of October, that kicked can is now an anvil.

Stated in a different context, many of the gold advisory services out there say that it is either "Reflate or Default" as the duality of alternatives facing the powers that be.

Others would have it that a choice exists between a collapsing economy and stock market or a collapsing U.S. dollar that is the swing point for the U.S. bond markets. If they raise rates to justify the added risk, they sewer the banks and their lending power. If they elect to print money to cover the deficit, they will crater the currency.

That leaves one asset held by central bank treasuries that can provide for the added risk of holding U.S. paper in an increasingly volatile world of fixed income — gold.

To say that I am astounded at how long it has taken for bond buyers (lenders) the world over to recognize the obvious — that the U.S. government is essentially broke — would be an understatement, but despite the rally in bond and stock prices since the end of October, that kicked can is now an anvil.

Gold

I will post two charts today: the first is the trading vehicle that I use — GLD:NYSE — and whether or not one believes that they actually own any gold, the big institutions use it because it serves as a tradable proxy for physical gold; the second is the "Continuous Contract" which usually refers to the near-month gold futures contract quoted on the COMEX.

SPDR Gold Shares ETF (GLD:NYSE) moved down into that triple convergence zone I used as a target two weeks ago when the rally failed at $184-186 resistance.

One week ago, I wrote: "The level on the GLD:NYSE (now $179.51) at which to start warming up the "BUY" button is where the 50-dma, the 100-dma, and the 200-dma are starting to converge, which is between $178.38 and $179.68." The following Monday, GLD:NYSE traded very briefly down to $179.11, so it fulfilled the corrective move off the short-term top at $186.36 on October 27 and went out on Friday just below the beginning of that stubborn resistance in the $184-186.33 range.

It should be noted that I did not move quickly enough to replace the trading positions, so now I am marooned on a desert island and forced to claw back the position, which I now think stands a good chance of seeing all-time highs by New Year's Day.

I advised subscribers that I am going to try to scale back into the GLD March $180 calls starting on Monday. Hopefully, I get a few days of backing and filling before it attempts a breach of that big resistance zone.

The second chart of the "Continuous Contract" shows the amplitude of the moves coming out of the oversold RSI lows in October 2022 (22%) and late February/early March 2023 (15.1%).

If you apply the 15.1% increase from the last advance to this current advance, it extrapolates out to over $2,100 per ounce, and if I get that before the Holidays, I will sorely want to have bought back my GLD:NYSE trading positions long before that happens.

As I wrote earlier in this missive, the U.S. bond market is screaming "Own gold!" at the top of its lungs as the debt clock ticks away…

Bonds

I own the iShares 20+ Year Treasury Bond ETF (TLT:US) from just under $83, which was pretty much the low that it hit in mid-October as hedge funds the world over piled on to the "short-long bonds" trade that became the "Flaveur du Jour" for the kiddies the world over.

I posted a chart back then showing just how massively short they were and suggested that the biggest potential short squeeze of 2023 (and possibly the decade) is the long bond space, with the perfect candidate being the TLT:US (the ETF for the U.S. 20-year Treasury bond). From a fundamental perspective, there is no way that I want to own this vehicle but from a trading perspective, I do not mind renting it as a means of going against this positional aberration that is going to blow up more than a few portfolios before the end of December.

Weakening economic numbers are beginning to spook the big shorts, so with the 10-year yield closing out the week at 4.44%, down from over 5% three weeks ago, I think there is potential for a move to the August low of around 4.07%, which takes the TLT:US to around the high back then of $96.12 which will take my December $83 calls (bought at $3.38) to around $13 which is almost a quadruple in the final quarter of the year.

Stocks

I am developing a new contrarian indicator to go along with the "Jim Cramer Reversal" and "CNBC Fear-Greed" indicators and am now using the "CNBC Smug Smile" indicator as my new "Technical Tool for the Cynical Trader."

How this new one works is that I count the number of times the Talking Heads are laughing or smiling during the morning showing of "Squawk Box," and if there is too much hilarity going on, it is a sure indication that their Comcast options are in-the-money and advancing and not crashing as they were back in October.

I noticed a great many glum CNBC faces last March during the Regional Bank Crisis before the Fed bailed out the banks (again!) after they went offside on their bond portfolios, but that disappeared by mid-August when CCZ:S hit a 2023 high for the year. Those dour faces turned to smiling, celebratory omens of a looming reversal, and that is precisely what occurred.

This week, there was a great deal of smug, smarmy, "I-told-you-so" revisionism as the S&P went out within 2% of the 52-week high after literally the entire world calling for a Peter Schiff fancied market crash back in September. Those Chicken Little calls amidst glum CNBC faces back in late October have now been replaced with a new narrative that has gone from "hard landing" to "soft landing" to the current "flying forever!" one that is consistent with market tops.

Now, seasonality makes it impossible to go completely flat and certainly not (God forbid) short the S&P 500 here, but I pared back my long SPDR S&P 500 ETF (SPY:NYSE) call positions because a) it is fast approaching overbought status with the RSI going out at 69.61 and b) the December $425 calls bought at $6.89 traded up to $29.12 which is a 322% return since October 31.

The old expression used by my floor trader cronies before they were replaced by robots and cell phones was " When the ducks are quackin', FEED 'EM!" so feed them I did by dumping half-positions at or near the highs.

As was the case in the bond market, the hedgies were net short the world in October and went into November all still chirping about the "war in Europe" with greater chirping about rising anti-Semitism and the "Israeli genocide of Palestinians" as ample reasons to remain short.

What they forgot is that year-end bonuses are way more important to the Wall Street crowd than a few dead Palestinians, so the second that the wave of selling turned into the tsunami of buying, out the window went outraged, and in flew the little green man called "Greed" and the next thing you know, the front page headline of the WSJ and the NYT was "Stocks Charging" while Hamas and Ukraine were quickly delegated to page nine behind the robbed convenience store in Dog's Head, Arkansas.

I will remain long the 50% position in the SPY:NYSE calls until I get a MACD "sell signal" OR if the RSI moves into the plus-75 range in the next few trading sessions. It went out at 69.61 for the week, and before we all clink champagne glasses over a great call, remember that the last two times that RSI moved into the 70s, the SPY:NYSE had sell-offs, a minor one in June and then the top in July.

With performance-chasing portfolio managers still underweight equities, albeit considerably less so now, there is still a very large contingent of the fuzzy-cheeked bull market, post-GFC kiddies that still refuse to believe that the big, bad Fed that abandoned them in 2022 will punish the bears

before year-end. I think they are close to capitulating, which will be the final short-covering thrust that is the precursor for the 2024 bear market that arrives with the "nose-dive landing" as the new narrative for the U.S. economy.

Juniors

One look at the chart of the poster child for the lithium boom — Albemarle Corp. (ALB:NYSE) — and you are immediately hit with the specter of a popped bubble and if you then look at the poster child for hard-rock Canadian lithium miners in Patriot Battery Metals Inc. (PMET:CA), you can quickly ascertain the reason that my top resource pick — Volt Lithium Corp. (VLT:TSV;VLTLF:US) — has been struggling.

I can go down the list of the quality junior resource deals out there, but with portfolio managers, the world over (particularly in Canada) desperate to generate some alpha — any alpha — in any way possible, the one thing they cannot do — lest they take on career risk — is buy the junior Canadian resource stocks. Volt Lithium Corp. (VLT:TSV;VLTLF:US)

Anyone left in this business over the age of 60 has seen this all before and has become resilient to the emotional extremes of the sector.

The problem remains that most of the "old guys" who made fortunes financing the juniors are now too old or too retired to participate, while the youngsters who filled their shoes at AGF or Fidelity have rarely (if ever) made any money in the junior resource space.

Now, I can promise you that it will change once the new commodity supercycle gets its restart in 2024, but for now, with bonus cheques appearing painfully elusive going into the end of the year, we will all be waiting for a starter pistol to go off, but I fear that will be "at some point" in Q1 2024.

In the meantime, making sizeable returns in the junior space will require pinpoint execution and that means that companies like Volt Lithium Corp., a lithium "briner" developing a novel method of extraction for oil field brine pools, will be front-and-centre.

The stock is up over 500% since the August 2022 lows but down 56% from the May peak at CA$.55, yet still ahead 118.18% YTD. I will not go into the pro-forma earnings estimates, but suffice it to say, if CEO Alex Wiley executes in line with expectations and if lithium prices can recover to the May highs, this will be a Winner for the Ages.

Again, the risk in all junior securities lies in execution, but for uranium, lithium, and copper, there is no argument that can convince me that we are going to avoid severe shortages in all three and that is a tailwind that cannot be stopped.

I believe that these three metals will be the Three Horseman of the Commodities Apocalypse in 2024, with copper the only one of the three yet to move into the "mania" phase.

Happy Thanksgiving to all my American friends!

| Want to be the first to know about interesting Gold, Uranium, Cobalt / Lithium / Manganese, Critical Metals, Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Volt Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: Volt Lithium Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.