Argonaut Gold TSX:AR Recent Price - $0.46 Entry Price - $0.39 Opinion – Strong Buy on short squeeze

Today, Argonaut Gold Inc. (AR:TSX) reported financial and operating results for the three and nine months ended September 30, 2023, as well as a progress update for the Magino mine.

"Since the beginning of the fourth quarter, Magino's throughput has been averaging 9,200 tonnes per day, in-line with nameplate capacity. As we continue to ramp up, we are focused on driving mining productivity, mill optimization, and further advancing the plant expansion that has the potential to increase throughput to annual production above 200,000 ounces per year for the life of mine," said Marc Leduc, Chief Operating Officer of Argonaut Gold.

Financial Highlights

- Revenues of $104.8 million was 39% higher than $75.3 million from the third quarter of 2022, due to initial production at the Magino mine and higher production at the Florida Canyon mine, partially offset by lower planned production from the company's three Mexican mines - El Castillo, La Colorada, and San Agustin.

- Revenues include $22.0 million of pre-commercial production ounces sold from the Magino mine. Subsequent to the end of the third quarter, the Magino mine achieved commercial production on November 1, 2023.

- Gross profit of $17.1 million was 146% higher than $7.0 million from the third quarter of 2022, due to higher revenues from the Magino mine and Florida Canyon mine.

- Generated cash flow from operating activities before changes in working capital and other items totaling $21.1M, an increase of 55% from 2022 comparative period due to higher gross profit.

- Net loss of $0.5 million, or $0.00 per share, compared to net loss of $1.3 million, or $0.00 per share, a decrease largely due to higher gross profit, partially offset by increases in foreign exchange losses and unrealized losses on derivative instruments.

- Adjusted net income1 of $9.9 million, or $0.01 per basic share, compared to an adjusted net income1 of $0.4 million, or $0.00 per basic share, an increase of $9.6 million primarily due to an increased gross profit of $10.2 million.

- Cash and cash equivalents of $44.9 million and net debt of $179.1 million, as of Sept. 30, 2023.

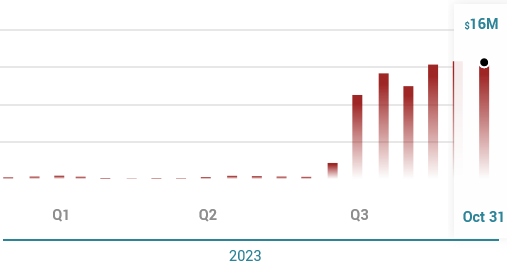

I previously commented on the huge short position on the U.S. side, and it is up to new highs of almost 43 million shares with the October 31 short report and 4.6 million on the Canadian side. Marketbeat's short report estimates 162 days to cover, and so does the short squeeze, but this is based on low volume on the OTC as the stock mostly trades in Canada at around 4 million shares per day.

Volume has been a bit higher in November, probably more shorts?

This is a very significant short position, and I believe shorts jumped on the stock because they thought Argonaut would default on their loan facility or they would have to do an equity financing that shorts could use to cover, so these points in today's Q3 release are very important.

On Sept. 29, 2023, the company obtained a waiver on certain financial covenants on its $250- million financing package (collectively referred to as the loan facilities) for the continuing development and construction of the Magino mine. A subsequent waiver was obtained on Oct. 31, 2023, which now requires the company to maintain a minimum cash balance of $10 million at all times until Nov. 30, 2023, and additional financing to be raised by the same date. It was anticipated the company would not be in compliance with certain financial covenants and accordingly obtained the waivers to prevent a default event, which could trigger the loan facilities becoming immediately due and payable.

On November 2, 2023, the Company announced raising the additional financing with the sale to Franco-Nevada Corporation and certain of its subsidiaries ("Franco-Nevada") of an additional 1.0% net smelter return ("NSR") royalty on its Magino mine and its non-core royalty holdings in Canada and Mexico for an aggregate price of $29.5-million. Upon the closing of this transaction, Franco-Nevada will hold an aggregate 3.0-per-cent NSR royalty on the Magino mine.

The Magino mine has had a slower-than-projected startup with some solvable problems that pressured the balance sheet. It is not unusual for a new mine to have some hiccups and/or technical issues at startup. The important thing is Argonaut has got through this with no loan defaults and financing with no share dilution. I believe shorts will have to cover!

On the chart, it looks like the stock has put in a double bottom leading up to jitters ahead of the Q3 report today. I think all is well, and there is huge potential for Argonaut as they continue to ramp up their Magino mine.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Argonaut Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.