Israel's war against Hamas entered its second phase in recent days. This stage of the Israeli Defense Forces' (IDF) planned three-stage military operation to counter Hamas includes a ground invasion of the Gaza Strip that could last several months, according to Defense Minister Yoav Gallant. The first phase of the war, which Gallant first detailed over a week ago, was "a military campaign takes place with fire " — referring to the massive missile bombardment of key Hamas positions throughout the expected combat zone.

That set the stage for the IDF to expand its previously limited incursions into Gaza and begin clearing "pockets of resistance" and, potentially, recover hostages recently taken by Hamas. Thus far, only four of the 240 hostages captured in Hamas's "Al-Aqsa Flood" terror attack on Israel, beginning on October 7, have been released by Hamas.

The IDF has opened up fronts in three directions throughout the northernmost portion of Gaza — a densely-populated rectangular strip of land on the Southwestern coast of Israel, just 41km long. The most significant IDF advance is cutting west across the Gaza Strip just south of the Karni border crossing, a less populated area of the territory, and now reaching the Salah Al-Din highway — the major transport artery that spans the entirety of Gaza vertically. Advances on this front have surpassed 3.1km, almost half of the 6.8km required to reach the sea, and essentially cut the northern third of the Gaza Strip off from the remaining southern portion. This seems to be the most likely course of action the IDF will take.

Mapping from various open-source intelligence (OSINT) outlets suggests that the IDF forces are on the offensive in the northeastern and northwestern portions of Gaza as well, taking positions near the Erez border crossing and along the coast near As-Siafa, respectively.

These advances have thus far taken the path of least resistance, focusing on open territory with few fortifications and civilian populations to navigate. Setting up bases of operations in these areas will effectively set up a perimeter for more difficult pushes into denser population centers like Al-Atatra and Beit Hanoun. Further Israeli gains on the fronts they've opened up may slowly close in on and encircle Gaza City. This is the largest Palestinian city in Gaza or the West Bank.

For context, the current scale of the IDF's Gaza operation looks likely to cover an area of approximately 120km2, just half the size of Milwaukee. However, up to 40,000 Hamas militants navigating complex underground tunnel systems, as well as hostile civilians who have refused evacuation, will be encapsulated in this small area of operations. Per an AP report, Yehia Sinwar, Hamas' political leader, claimed in 2021 that the militant group had 500km of tunnels.

Video evidence shows that Israeli missiles have been able to puncture these caverns and bunkers deep in the heart of Gaza, with explosions emanating from underground — apparently resulting from the destruction of Hamas's hidden weapon and ammunition stores. In support of their ground assault, the IDF has continued its bombing campaign, claiming to have struck approximately 300 targets over the past 24 hours, including anti-tank missile and rocket launch posts below shafts, as well as underground military compounds.

The major risk to Israel is not necessarily the capabilities of Hamas, which has no formal military structure and is relatively small when compared to a swelling IDF — now composed of 500,000 to 600,000 active troops following a mass mobilization of reservists. Rather, the potential spreading of the conflict to include larger enemies of the Israeli state is a much broader concern. To Israel's north, on its border with Lebanon, Israel has been exchanging fire with the militant group Hezbollah for weeks amid threats that the group, which maintains close ties to Iran, could join the conflict in support of Hamas. On Tuesday morning, Hezbollah claimed to have targeted and neutralized an Israeli Merkava tank.

Not only is Hezbollah a much larger fighting force than Hamas, they have experience fighting the IDF in a full-scale conflict (the 2006 Lebanon War) and a much larger cache of drones and other weaponry. Hezbollah's drone fleet is largely populated by augmented Shahid UAVs designed in Iran. Israel's Gallant claims an air base on Lebanese soil, just 20km from the Israeli border, is effectively being operated by Iran and is used to attack Israel. Iranian-backing of Hezbollah, which has facilitated the training and arming of the group by the Islamic Revolutionary Guard Corps (IRGC), as well as other militant groups throughout the Middle East, threatens to provoke not only Israel but the U.S. as well.

As MRP previously highlighted, the U.S. quickly sent two aircraft carrier strike groups, headed by the U.S.S. Gerald R. Ford and U.S.S. Dwight D. Eisenhower, into the eastern Mediterranean following October 7. The Pentagon has also ordered additional warplanes to bolster A-10, F-15, and F-16 squadrons at US bases throughout the Middle East.

In addition to the tens of thousands of sailors on board the aircraft carriers and other ships in their retinue, U.S. command has selected roughly 2,000 troops from multiple branches of the armed forces to prepare for potential rapid deployment to support Israel. 900 will now deploy to U.S. bases in the Middle East to bolster the American presence on the ground, following a series of at least 23 rocket and drone-based attacks against U.S. military installments in Syria and Iraq by Iran-linked militia groups. No American troops have been killed by these recent strikes, but several have been injured and the White House has confirmed that they believe Iran is "actively facilitating" some of these activities.

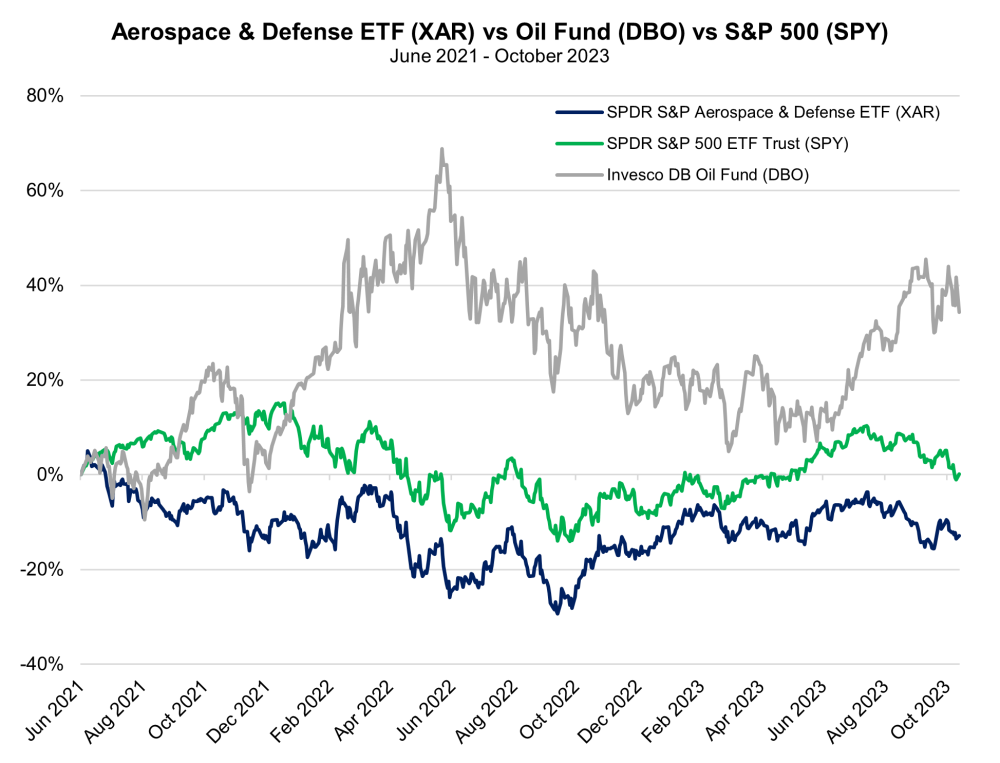

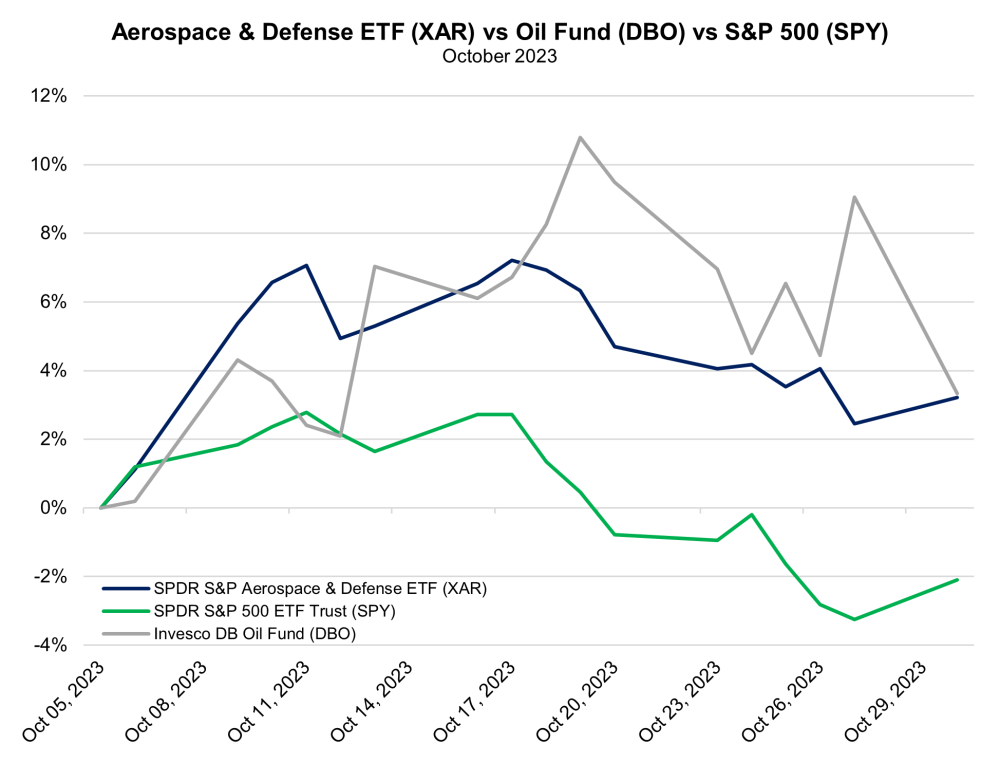

As MRP noted at the outset of this latest flare-up of the long-standing conflict between Israel and Hamas, the critical economic factor at its center could end up being crude oil. Though Iran maintains that it had nothing to do with Hamas's coordinated attack on Israel earlier this month, the country's eventual implication in this conflict cannot yet be totally ruled out. Not only does Iran produce more than 3 million barrels per day (bpd) of crude, it occupies a critical geographic and economic chokepoint on the Strait of Hormuz, a shipping route for 20% – 30% of global oil supplies.

An analysis by the World Bank suggests that several different scenarios, ranging from a small disruption to a large one, could cut 500,000 to 8 million barrels per day from oil markets. The removal of these supplies could pump crude oil prices to anywhere from $93 to $157 per barrel, depending on the scope of the simmering conflict. International benchmark Brent Crude was trading near $87.50 per barrel just before noon.

Charts

Sign up for our FREE newsletter

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.