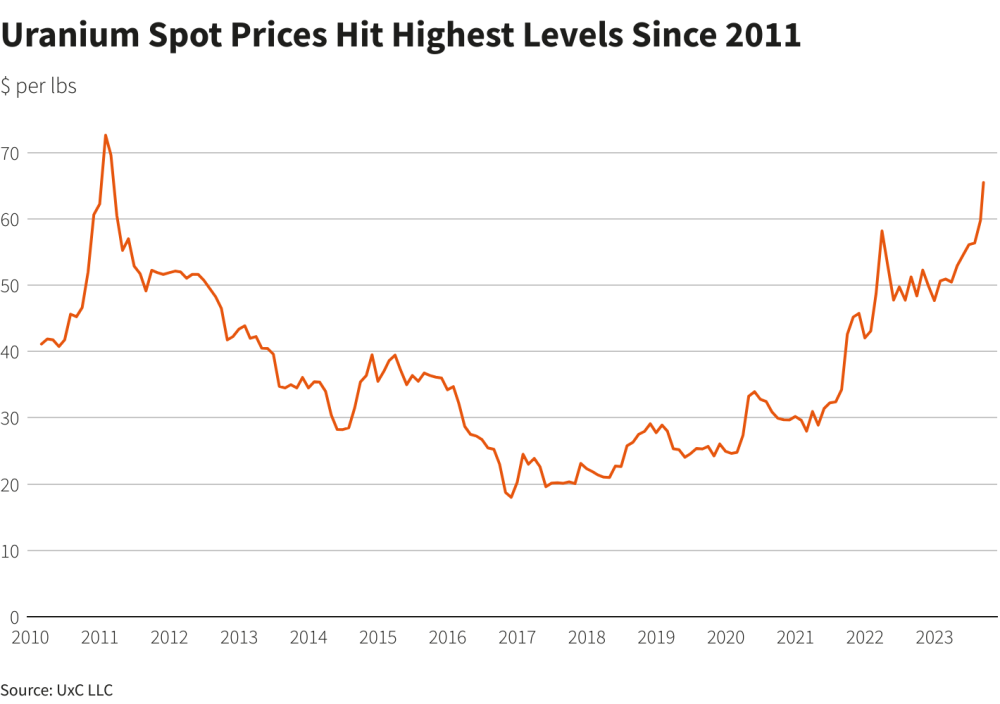

Several prominent hedge fund managers have begun substantially ramping up their investments in uranium stocks. They are betting on significant price appreciation as nuclear energy experiences a major global resurgence.

According to Bloomberg, managers, including Matthew Langsford of Terra Capital, Arthur Hyde of Segra Capital, Barry Norris of Argonaut Capital, and Renaud Saleur of Anaconda Invest, are building large positions in uranium mining companies.

Cameco Corp.

The hedge funds are particularly focused on acquiring shares of top uranium producers such as Cameco Corp. (CCO:TSX; CCJ:NYSE), Ur-Energy Inc. (URG:NYSE.MKT; URE:TSX), and NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT).

*insert info on cameco corp and ownership and share structure*

Nuclear Essential To Reaching Net Zero Emissions

Long after the Fukushima nuclear disaster turned many countries against nuclear power, it has reestablished itself as an essential part of the transition to a low-carbon future.

Nuclear energy does not directly emit carbon dioxide. The World Nuclear Association estimates that global nuclear capacity must double by 2050 to help meet net zero emissions targets. This is driven by a surging market in Europe, Asia, and Africa for new reactors, in addition to extending old plants' lifespans.

China also continues expanding its nuclear fleet.

Increasing Focus on Energy Independence

Reuters reported that "Uranium prices are likely to extend a blistering rally and end the year more than 50% higher as mounting worries over climate change accelerate a global shift to cleaner sources of energy, including nuclear power."

With this, hedge funds see enormous potential in uranium miners to help Western countries achieve independence from Russia and China, which control significant parts of the global nuclear fuel supply chain.

Establishing new domestic mines, conversion, and enrichment facilities is key to that independence.

Environmental Concerns Remain

However, nuclear power remains controversial due to concerns over reactor safety and radioactive waste disposal.

High costs also inhibit wider adoption. But nuclear's appeal has risen as Europe attempts to end its reliance on Russian natural gas following Russia's invasion of Ukraine.

With Russia controlling around 8% of recoverable uranium, the West needs to make an even bigger energy supply shift.

Processing and Fuel Cycle Lengthy

Uranium goes through multiple complex processing steps before being ready for use in reactors. After mining and milling, it is converted to a gas, enriched, made into fuel rods, and loaded into reactors where fission occurs. The entire fuel cycle can take years and relies on international supply chains.

Hedge funds believe political pressures will drive Western nations to develop domestic fuel cycle capabilities. They agree on uranium's positive macro outlook but diverge on stock picks. While most are bullish on large producers, some believe smaller miners offer greater upside.

Skyharbour

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) has been making moves this year as it continues working on its uranium projects. Skyharbour has amassed an extensive portfolio of uranium exploration projects located in the uranium-rich Athabasca Basin region of Canada. With twenty-four total projects, ten of which are drill-ready, the company controls over 518,000 hectares of mineral claims.

A key asset for Skyharbour is the Moore Uranium Project, acquired from Denison Mines, a major strategic shareholder. The Moore project is situated near Denison's Wheeler River project and Cameco's McArthur River mine in the eastern part of the Athabasca Basin. Moore is considered an advanced uranium exploration property, with high-grade uranium mineralization identified at the Maverick Zone. Previous drilling at Maverick yielded exceptional uranium intercepts, including 6.0% U3O8 over 5.9 meters and 20.8% U3O8 over 1.5 meters at a depth of 265 meters vertically.

*insert ownership and share structure*

Tisdale Energy

*insert info and ownership and share structure*

Uranium Energy

*insert info and ownership and share structure*

All in all, experts are betting big that a supply ramp-up of this magnitude will be a game changer for nuclear energy and uranium prices.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tisdale Clean Energy Corp. and Uranium Energy Corp.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.