Earlier this month, the U.S. Army moved forward on a plan to develop gear to arm small commercial drones for combat. According to Defense One, two undisclosed companies will demonstrate payload mechanisms for dropping a selection of munitions that troops would have readily available, such as 40mm or 60mm grenades, within eight to twelve months' time.

New types of augmented first-person view (FPV) drones could supplement the U.S. army's current repertoire of loitering munitions, providing much cheaper options than what is currently used. As an example, an advanced drone like the Switchblade 300, manufactured by AeroVironment, can cost $6,000 per unit, while improvised FPV drones being utilized on both sides of the Russo-Ukrainian war can deal similar damage to targets at a cost of just $200 - $400.

In generating our in-depth coverage of the war in Ukraine and its implications for investors, MRP has viewed video footage from the battlefield dominated by clips of small kamikaze drones flying directly into armored vehicles, artillery launchers, and other expensive equipment, as well as dropping grenades into trenches and neutralizing the defensive advantage these fortifications can provide. These drones punch well above what their cost would suggest, damaging or completely destroying multimillion-dollar tanks.

We've more recently seen this strategy picked up by the Palestinian militant group Hamas, utilizing commercial-style copter drones to target Israeli Merkava tanks with mortar rounds. During the initial wave of Hamas's sneak attack against Israel on October 7, one of these drones dropped a PG-7VR tandem HEAT RPG onto the turret of a Merkava Mk 4, damaging the tank beyond repair.

The scope of Hamas's drone-based combat capabilities is unknown but is likely limited. Lebanon's Hezbollah militant group, which is allied with Hamas but considered much larger and more well-armed, was estimated to have access to approximately 2,000 drones in 2021, according to Israeli think tank Alma. These would not only include quad-copter-style commercial drones but augmented Shahid drones built by Iran, which have become popular weapons in the Russian military as well. Last August, the Washington Post reported that Russia is targeting the domestic production of 6,000 Shahed variant drones (called Geran-2 by Russia) by summer 2025, compounding at least 400 drones it had previously purchased from Tehran.

The North Atlantic Treaty Organization (NATO) is now in the process of adopting its first-ever counter-drone doctrine, expected to be established by the end of the year. Not only will the U.S. military need to develop a novel strategy to weaponize FPV drone-based munitions systems, it will need to formulate strategies to counter them as well. Whether that means shooting down high-tech, long-range Shahed drones or disabling the use of improvised quadcopters, all efforts will undoubtedly require billions of Dollars in funding from the Pentagon.

As part of the U.S. Army's low, slow, small-unmanned aircraft Integrated Defeat System, called LIDS for short, Raytheon Technologies was awarded a $237 million contract in April to support U.S. Army Central Command with Ku-band Radio Frequency Sensors (KuRFS) and Coyote effectors to detect and neutralize unmanned aircraft. That funding was in addition to an initial contract awarded in October 2022, worth $207 million, to equip two U.S. Army divisions with the anti-drone systems.

Leonardo DRS has also been awarded several hundred million dollars in contracts to develop counter-drone technologies since 2017, and has said that the Army wants to equip nine divisions with five sets of mobile LIDS each, beginning the fielding systems next year. The Army's Joint Counter-small Unmanned Aircraft Systems Office (JCO) is in charge of developing the military's response to class-one, -two, and -three drones, ranging from 250 grams to over 1,000 pounds, and has begun the testing of Northrop Grumman's Agnostic Gun Truck (AGT). However, Defense One notes that the AGT is an experimental design not in serial production for Northrop Grumman and has faced delays due to procurement issues.

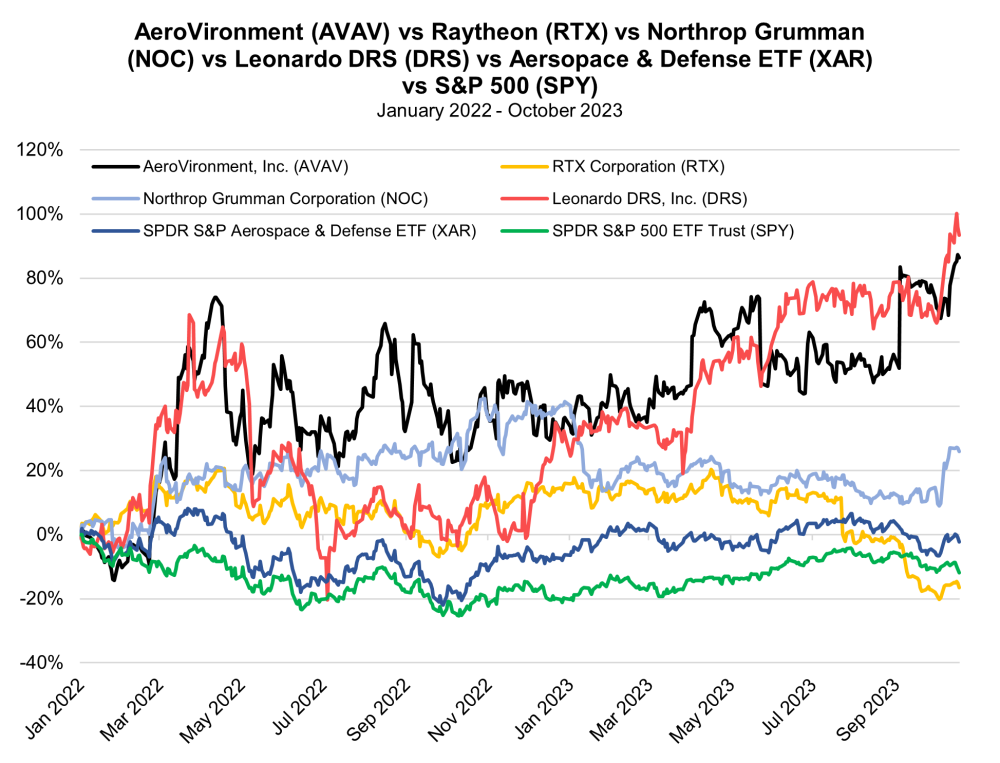

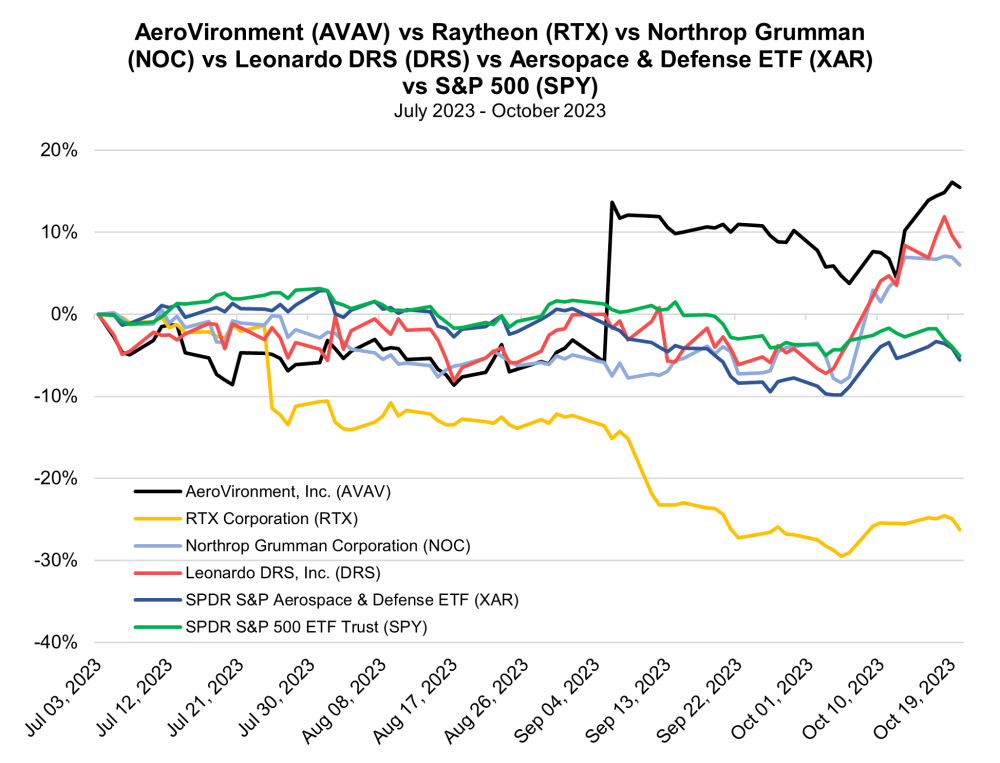

Charts

| Want to be the first to know about interesting Special Situations and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.