For the second time in three months, China is imposing export controls on a resource vital to the new green economy — this time on graphite, an element needed for batteries in electric vehicles (EVs).

China is the is top producer and exporter of the mineral and refines 90% of the world's graphite for all EV battery anodes, or the negatively charged portion of the battery.

Some graphite stocks posted big gains after the news broke Friday, including Graphite One Inc. (GPH:TSX.V), NextSource Materials Inc. (NEXT:TSX;NSRCF:OTCQB), and South Star Battery Metals Corp. (STS:TSX.V; STSBF:OTCBB) Another stock to watch is Xcite Resources Inc. (XRI:CSE)

Performing particularly well were South Star, which surged 24% on huge volume; and NextSource, which shot up 28% on huge volume, noted technical analyst Clive Maund.

"NEXT closed well off its highs, but the chart looks very bullish and so the only reason that it closed well off its highs was due to trapped earlier buyers who weren’t aware of the news dumping onto the higher price," Maund wrote. "So, it is expected to forge ahead and is also rated an immediate buy."

Maund said, "the gain in Graphite One was more modest at 7.7%, but it was on the strongest volume since July and so it is expected to 'join the party.'"

The Catalyst: Price Outside China Could 'Explode'

China's graphite restrictions are similar to ones instituted Aug. 1 for the chip-making metals gallium and germanium. In a preview of what could happen in the graphite market, Reuters reported that exports of gallium and germanium have been "choked off," pushing up prices for the rest of the world.

"This bold and unexpected move by China in graphite has taken us by surprise, arriving far sooner than anyone could have predicted," Kien Huynh, chief commercial officer at Alkemy Capital Investments, which is focused on developing projects in the energy transition metals sector, told Reuters.

The move to restrict graphite exports was "conducive to ensuring the security and stability of the global supply chain and industrial chain, and conducive to better safeguarding national security and interests," Chinese officials said.

As the tit-for-tat between Beijing and Washington continues, the U.S. government last week announced more restrictions on access to semiconductors for Chinese companies, including stopping the sales of advanced artificial intelligence chips and blacklisting Chinese chip designers.

Asset manager Chen Lin wrote in his newsletter What is Chen Buying? What is Chen Selling? that the Chinese decision was going to be a boon to other graphite markets.

"The graphite price outside China will explode," Chen wrote Friday.

China's move also underscores a need for the U.S. to ease permit review processes for new mines, the mining industry noted.

"It's well past time for the U.S. to lean into our vast mineral resources and build the secure, responsible mineral supply chains we so urgently need," said Rich Nolan, head of the National Mining Association.

Analysts: More Investment Needed to Close Deficit

While made of the same element as diamonds, carbon, graphite is very soft, relatively nonreactive, and has high electrical and thermal conductivity properties. It's made of stacked sheets of carbon atoms and occurs naturally in igneous and metamorphic rocks.

It has a greasy feel because its flexible flakes easily slide over one another, making it a good "dry" lubricant.

It's also used when a material is needed that will not melt or disintegrate — it's used to make the crucibles for the steel industry and in some nuclear reactors to slow down fast-moving electrons. In addition to batteries, it's also used for pencil lead and in brake linings for heavy vehicles.

According to a report by Fortune Business Insights, the global market size for graphite is projected to grow from US$14.83 billion in 2021 to US$25.7 billion in 2028 at a compound annual growth rate (CAGR) of 8.2%.

"We maintain the view that natural graphite prices will be rising sharply in the coming years reflecting surging demand from the EV sector, as well as rising power costs and increasingly stringent ESG (Environmental-Social-Governance) regulations," Fastmarkets noted. "This will push the market into a significant deficit without required investment in the graphite space."

Fastmarkets analysts noted that they "expect to see premium pricing structures emerge in ex-China markets to reflect higher costs associated with ESG friendly supply, but also to encourage the much-needed investment in the sector to prompt the development of localized and diversified supply. Without additional investment, the market will fall into a significant deficit beyond 2030."

According to Mordor Intelligence, "the increasing application of graphite in green technologies is likely to create lucrative growth opportunities for the global market soon."

The U.S. Geological Survey's list of 35 critical minerals for the new electric economy includes both graphite, and another vital battery metal, lithium.

"China has a stranglehold on both metals, meaning it can use them as a cudgel in trade talks with the United States, or it could freeze shipments of them during a war," noted Rick Mills, author of the newsletter Ahead of the Herd. "Indeed, when it comes to raw materials for the electric vehicle industry, China is undisputedly the most dominant force on the planet. Almost every metal used in EV batteries today likely comes from there, either mined or processed."

Graphite One Inc.

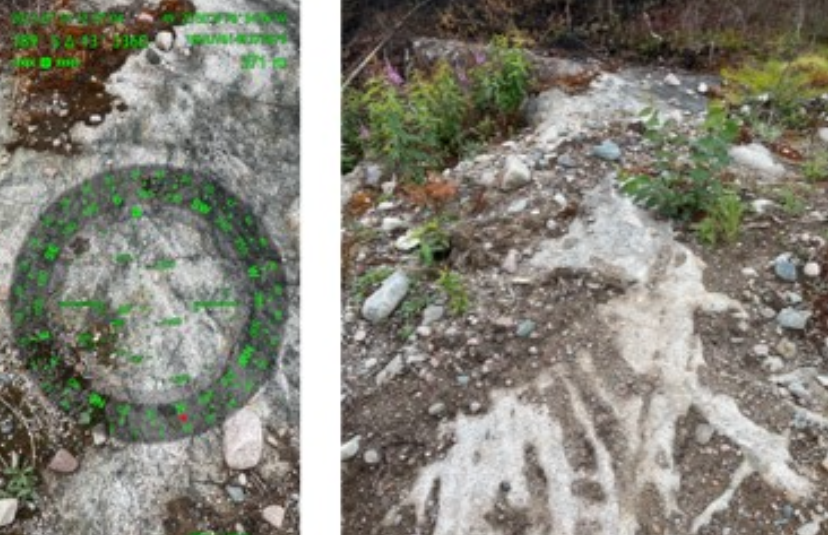

Maund noted that production of graphite in the U.S. is currently non-existent, but Graphite One is working to bring a "sizeable deposit" to production. Its Graphite One project on Alaska's Seward Peninsula about 60 kilometers north of Nome holds "America's highest-grade large-flake graphite deposit," the company said.

The project's mineral processing plant would reduce more than 1 million tonnes of graphite (Cg) mineralization to 60,000 tonnes of graphite concentrate at 95% Cg annually, Graphite One said. More than 41,000 tonnes of battery grade CSG would be delivered per year for use in EVs, lithium-ion batteries, and energy storage systems.

"Its performance — up to now — has been unimpressive, as although there have been some tradable wild swings, it is still well down on its price in 2007," Maund wrote of the company. "In mid-2020, it broke out of a huge bullish Falling Wedge pattern that had formed over many years and proceeded to advance until late 2021 before rolling over again and dropping. This advance included a couple of big spikes which are a characteristic of this stock that could work to our advantage if it does another of them soon."

The company just completed a 57-hole, 8,736-meter drilling program at Graphite One, including assays of 9.63 meters of 13.19% Cg and 9 meters of 14.89% Cg.

A National Instrument 43-101-compliant feasibility study on the project is anticipated in the fourth quarter of 2024.

According to Reuters, about 0.08% of the company is owned by institutions and about 27% is owned by strategic investors. The rest is retail.

Top shareowners include Taiga Mining Co. Inc. with about 26%, Executive Chair Douglas Hampton Smith with 0.21%, Purpose Investments Inc. with 0.08%, Director Patrick R. Smith with 0.04%, and Kevin Greenfield with 0.04%, Reuters reported.

Its market cap is about CA$133 million with 131.9 million shares outstanding. It trades in a 52-week range of CA$1.97 and CA$0.95.

NextSource Materials Inc.

NextSource's price per share went up 28% from CA$1.21 to CA$1.55 when the China news was announced.

This week, the company announced it had made its first bulk container shipment of SuperFlake® graphite from its Molo Mine in Madagascar to be processed for testing in EV supply chains in South Korea and Japan. NextSource said it expects to receive the first test results starting in December.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

NextSource Materials Inc. (NEXT:TSX;NSRCF:OTCQB)

The Toronto-based battery materials company said the mine has begun production, with Phase 1 operations being ramped up to reach nameplate production capacity of 17,000 tonnes per annum (tpa) graphite concentrate.

The company said it is also progressing with the environmental impact assessment permitting process for its first battery anode facility (BAF) plant in Mauritius.

The plant will have "the capacity to house an initial production line of 3,600 tpa with space to expand capacity through the construction of additional production lines as demand increases," the company said.

About 3% of the company is owned by institutions, according to Reuters. About 64% is owned by strategic entities, including Vision Blue Resources Ltd., which owns nearly 58%. Other top shareholders include 1832 Asset Management L.P. with 2.57%, Director and Chief Operating Officer Robin Philip Borley with 0.96%, and Director Brett Alexander Whalen with 0.82%.

NextSource's market cap is CA$193.88 million with 125.27 million shares outstanding. It trades in a 52-week range of CA$3.24 and CA$1.20.

South Star Battery Metals Inc.

South Star went up 22% last Friday to CA$0.71 after China announced the export controls.

The Canadian battery metals developer is focused on acquisition and development of projects in the Americas. Its Santa Cruz project is in Brazil, which the company said is the second-largest graphite-producing region in the world with more 80 years of mining.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

South Star Battery Metals Corp. (STS:TSX.V; STSBF:OTCBB)

A largescale pilot plant there had good recoveries of 95% to 99% Cg, South Star said. The 12-month construction and commissioning of the site are underway, with Phase 1 commercial production projected for this quarter.

The company said its second project in development is "strategically located in Alabama in the center of a developing electric vehicle, aerospace, and defense hub in the southeastern United States."

The BamaStar project is a historic mine that was active during World Wars I and II. A National Instrument 43-101 technical report with the maiden resource estimate for the site has been filed. South Star said testing achieved grades of about 94% to 97% Cg with about 86% recoveries.

About 33% of South Star is held by institutional investors, 10% is held by insiders and management, and the rest, 57%, is retail, according to the company.

Top investors include Fitpart Fund Administration Services with 21.4%, Ace Capital Gestora De Recursos Ltd. with 18.85%, Green Bow Capital LLC with 6.34%, Daniel William Wilton with 3.55%, and Marc Paul Francois Leduc with 0.98%, Reuters reported.

Its market cap is CA$38.89 million with 34.48 million shares outstanding. It trades in a 52-week range of CA$0.82 and CA$0.375.

Xcite Resources Inc.

Another company to watch is Xcite Resources, a mineral exploration company focused on its Turgeon Lake property in Quebec. The property is at an early age of exploration and has about 39 claims covering more than 2,200 hectares.

About 24% of the company is owned by strategic investors, Reuters reported. Top shareholders included Carl Desjardins with 11.07%, Jean-Francois Meilleur with 11.07%, Christopher R. Cooper with 0.96%, and Etienne Gouin-proulx with 0.96%.

Its market cap is CA$1.09 million with 15.58 million shares outstanding. It trades in a 52-week range of CA$0.17 and CA$0.07.

Sign up for our FREE newsletter