After major rallies in gold or stocks or Bitcoin or anything, for that matter, the Twitterverse is always littered with thousands of tweets by individuals taking credit for calling the exact bottom. Well, for gold, here is the chart I posted on October 3, the day before VanEck Gold Miners ETF (GDX:NYSEARCA:) bottomed into an RSI of 26.79 and a price of US$25.62. Thirteen days later, and at 11:29 this morning, it hit US$30.16.

It was a superb call but one that has been very rare in this bear market year.

As the saying goes: "You have to be good to be lucky (and vice-versa)…"

SPDR Gold Shares ETF (GLD:NYSE) was bought at US$172.50 on Canadian Thanksgiving Monday with the GLD December US$170 calls bought on a scale-in order during the week of October 9-12.

I backed away from the Friday gap and instead filled the final 20% into the Monday pullback resulting in an average price of CA$7.78 per contract. This morning, the GLD:US exploded up into overhead resistance with a print up to US$185.23 but I established a target price of US$184.00 and told subscribers that only a move through that level — the July highs — would take the RSI into "overbought" conditions, which it did, on a move to 71.52 before backing off.

The Twitterverse was inundated with words like "shenanigans," "slammies," and "manipulations," but the reality was that gold was simply overbought this morning, and because of that, I put out "Sell" on the remaining 50% at US$16.00 which when added to the US$14.75 I got yesterday, gave me an average sell price of US$15.375 versus the average cost of US$7.78 resulting in a 97.6% return in under two weeks.

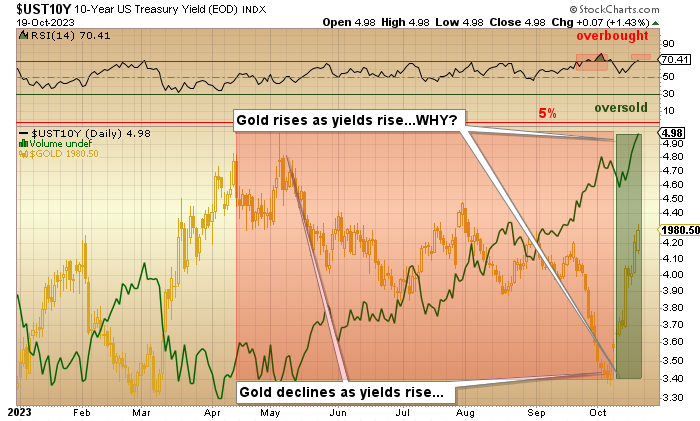

I put out a note this morning that showed this chart:

You will notice that gold moves in an inverse direction to interest rates, and that is not really much of a surprise to anyone who follows the gold market. You can see how gold went into a prolonged decline at the exact point where the 10-year yield started its ascent from the 3.30% level back in April, but in and around the start of October, that negative correlation ended, and gold and yields have been rising in tandem ever since.

Now, everybody with a keyboard and a Twitter membership has been explaining in torrid detail the reasons for gold's explosive move, but if there is one thing about gold that the "younguns" do not seem to grasp, it is that gold, unlike everything else on the planet, has an uncanny predictive ability. The reasons it goes up or down are usually only revealed later and are never the reasons given on Kitco or anywhere else in the mainstream media, for that matter.

Gold moved up US$60 per ounce on Friday, October 6, giving rise to speculation that someone was "front-running" knowledge of the impeding Hamas invasion. When gold bottomed in mid-March 2020, neither the global central bankers nor the elected leaders had said anything about trillion-dollar bailouts or helicopter cash drops to households around the world.

Gold sniffed it out and it was only months later, after it had rallied from US$1,450 to US$2,089 that the world learned of the sheer magnitude of the monetary and fiscal stimulus packages that were thrown with reckless abandon at what turned out to be a nasty little flu bug and not the second coming of Ebola or the Bubonic Plague.

Something has changed in the gold market, and I am the first to admit that I know not of its origin. All I know is that when gold moves in a manner that is unorthodox, all I can do is apply my rudimentary knowledge of technical analysis coupled with ample doses of prayer, rabbit's feet, four-leaf clovers, and Haitian Death Chants and hope to hell that I am on the right side.

Gold goes wherever it wants to go. If we are lucky, we find out the reason weeks or months later.

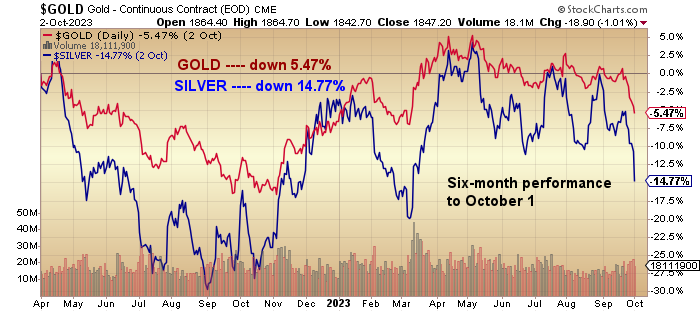

Notice how silver was lagging gold through the last six months, down 14.77% to gold's 5.47% decline.

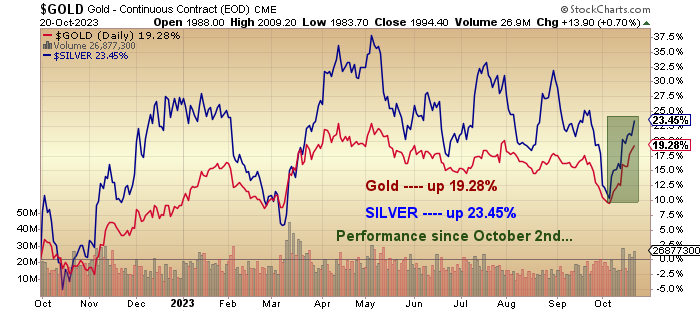

Suddenly and with little warning, silver started to outperform gold, and as one of my most reliable indications of the health (or frailty) of any bull market in the precious metals, the silver market is now officially ahead of gold for the October monthly performance.

If this continues into month-end and on into November, I expect to see gold at new all-time highs and silver well into the US$30s. I am not yet adding to my silver miners, having added Norseman Silver Ltd. (NOC:TSX.V; NOCSF:OTCQB) earlier in the month, but they are now officially on my radar screen, starting with Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) as a possible option play.

Stocks

I own a modest position in the SPDR S&P 500 ETF (SPY:NYSE) and told everyone this week that while I am betting on a year-end rally to take the SPY:US to between US$452 and US$457, my abort button is programmed to activate the moment the U.S. 10-year prints 5.25%.

It went out at 4.917% after trading up to 4.999% this morning. If this spike in long rates does not soon abate, I cannot see stocks mounting an advance into year-end and fear a 2018-type decline instead, which would not be fun.

The week ended with me enjoying something that has been annoyingly elusive in 2023. It is called a "capital gain". If it were not for some fortuitous trades in the SPDR S&P 500 ETF (SPY:NYSE) and GLD:US markets this year, I would be lamenting a pitiable performance in many of the junior miners I own.

To be absolutely clear, I do not need to hear that I should not worry "because everyone else has been demolished, too," as a panacea for my junior gold and silver portfolio. The next time I hear that insincere babble, I am reaching for my Louisville Slugger that stays at all times beside my Hockey-Night-in-Canada chair with the vibrating backrest.

Forewarned is forearmed…

| Do you want the latest investment ideas delivered to your inbox? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Norseman Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Norseman Silver Ltd. and Pan American Silver Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.